Approaches to Lab Instrumentation Maintenance and Asset Management

Laboratory instrumentation is becoming increasingly sophisticated. With this sophistication, the maintenance and repair of instruments has become increasingly more crucial and complex, requiring the services of knowledgeable professionals. Equipment servicing is a growing source of revenues for both OEMs and third-party maintenance providers.

Users, on the other hand, must balance service costs and equipment downtimes which can potentially curtail productivity. To reduce potential downtimes, there has been a notable shift from reactive service (such as performing maintenance when something goes wrong) to proactive service (such as regularly scheduled maintenance and instrument-based preventative maintenance software).

In general, there are three main models that organizations use for servicing equipment: they can rely upon the OEM to provide maintenance and repair, in-house staff with maintenance knowledge (either members of the research staff or a dedicated maintenance staff member) or they may contract with an asset management company. Asset management companies are generally third-party service providers that are capable of servicing multiple instrument brands. Offering service contracts and even on-site maintenance staff, these companies tout faster response times, shorter downtimes, and potentially lower costs than OEMs for instrument maintenance and repair. Asset management services are growing in popularity. Recognizing a growing opportunity, some well-known instrument companies that have traditionally been regarded as OEMs have established themselves as asset management providers, including Agilent Technologies, PerkinElmer and Thermo Fisher Scientific.

To gauge how maintenance needs of drug discovery labs are currently being addressed, 246 users of laboratory equipment were surveyed in October, for a report on analytical instrument use in drug discovery. This report, which will be available in late November from SDi, includes detailed market data, analysis and end-user perspectives for key technologies used in drug discovery and pre-clinical research. Given the primary topic of the survey, the majority of respondents were from the pharmaceutical and biotechnology industries.

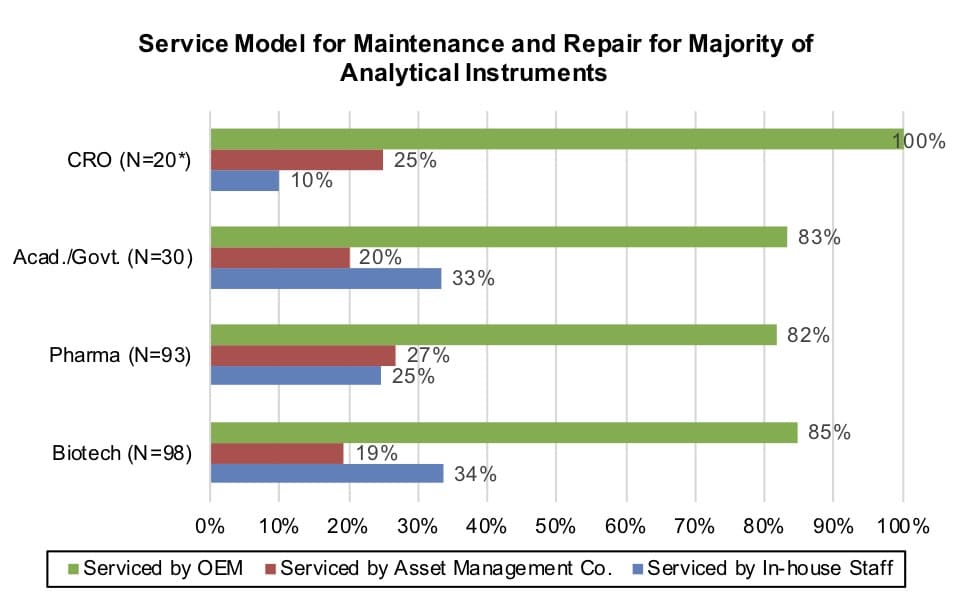

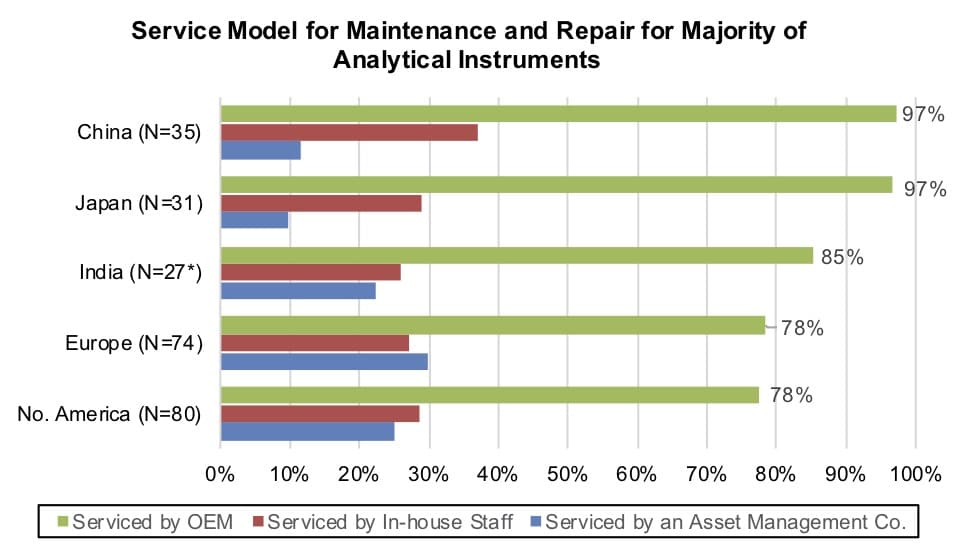

Respondents were asked which service model(s) for maintenance and repair their laboratories typically use for the majority of their analytical instruments. The vast majority, regardless of region or industry, reported that their instruments are most frequently serviced by the OEMs. But beyond maintenance by OEMs, there were differences in servicing patterns for in-house staff and asset management companies. Users in the biotech industry and public sector (ie, academia and government) were more likely to rely on in-house staff for servicing, while users in the pharmaceutical industry and from CROs reported more frequently using asset management companies (see graph below). Regional differences were also apparent (see graph below). Users in Japan and China were the least likely to utilize asset management companies, likely due to less availability in these regions. In other areas, respondents utilized in-house staff and asset management companies at comparable levels.

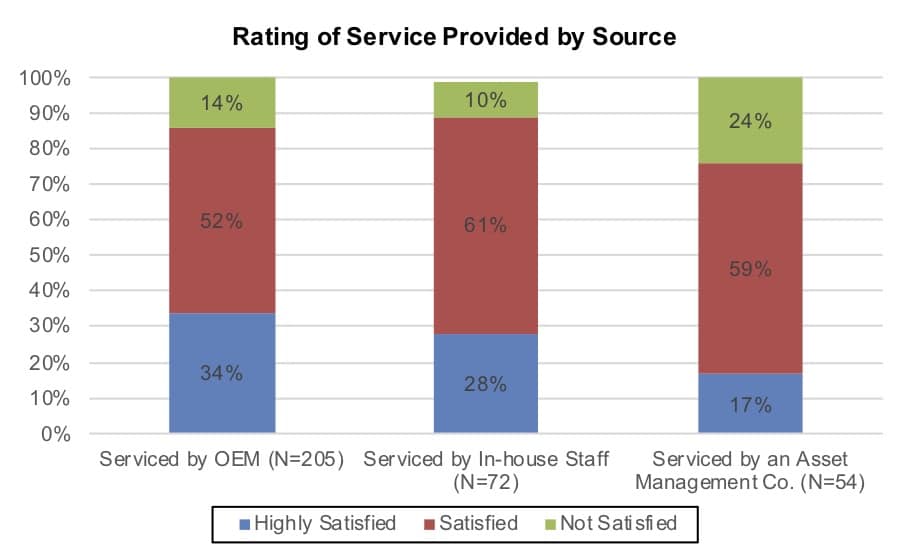

Respondents were asked to rate their satisfaction with the various service models that they use (see graph below). In general, respondents were satisfied with each service model. The highest-rated instrument maintenance model was provided by in-house staff, with 89% of respondents being highly satisfied or satisfied, and only 10% reporting being not satisfied. OEMs also received similarly favorable ratings, with 86% of survey respondents reporting favorable opinions. Seventy-six percent of respondents reported favorable opinions of service by asset management companies.

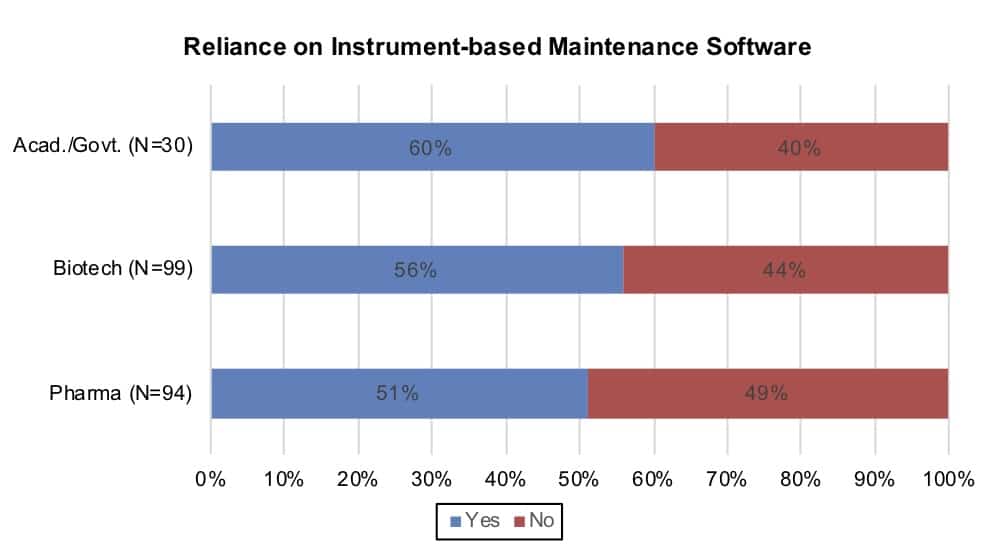

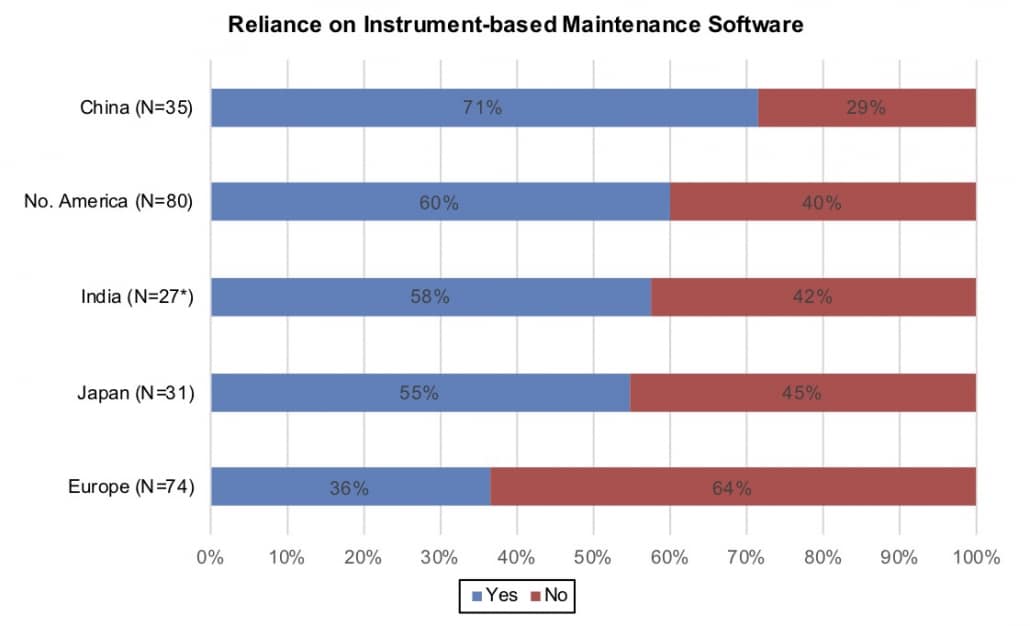

With the advancement of on-board software, many instrument manufacturers are including preventative maintenance software features that provide early warning for required service. Respondents were asked whether, for the majority of their analytical instruments, they rely on these features. Responses were influenced by whether users had instruments with this software available. Fifty-five percent of respondents reported relying on instrument-based preventative maintenance software. At 60%, respondents from academia and government were the most likely to rely on the software, while pharmaceutical industry users, at 51%, were the least likely (see graph below). Interestingly, there were very pronounced regional differences in how reliant users were on the software (see graph below) as 71% of respondents in China reported relying on preventative maintenance software, in contrast to only 30% of European respondents.

As instruments become more technically complex and automation more commonplace, users will grow more reliant upon outsourced professional maintenance services. Maintenance, whether reactive or proactive, is a fundamental part of laboratory operations.