Contract Testing Labs Recover Revenues

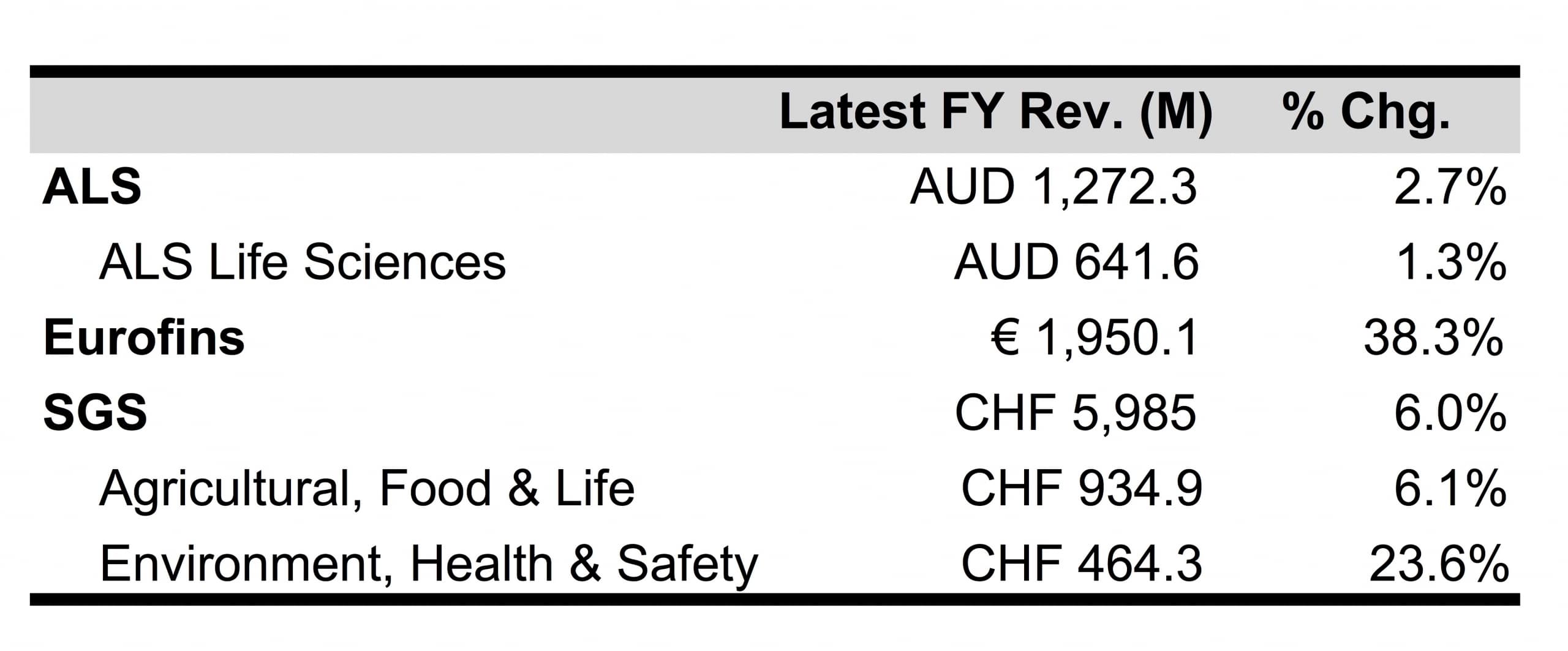

After a difficult 2015 due to weaknesses in oil, gas and mineral markets, three publicly held contract testing lab companies bounced back in 2016. Through acquisitions, divestments, investments in startups, collaborations and division restructuring, contract testing labs ALS, Eurofins and SGS all saw increases in revenue last year, especially in environmental, food and agriculture testing segments.

Contract testing labs have a worldwide presence and broad testing capabilities, making them a significant customer base for analytical instrumentation and lab product companies. Whether it be acquisitions and consolidations or company reorganizations and structural changes, the activities of contract testing labs have a noteworthy impact on the purchase, use and application of analytical instruments and lab products.

Eurofins

Luxembourg-based contract testing firm Eurofins provides testing for numerous industries, including the agriculture, biopharmaceutical, clinical diagnostic, environment, food and genomic markets, with 310 labs in 39 countries and a diverse portfolio of over 130,000 analytical methods. In FY16, the company brought in revenues of €2,536.6 million ($2,897.1 million = €0.87 = $1), a 30.1% increase, of which over 9% was organic, the company’s highest organic growth since the 2008 recession. Adjusted net profits jumped 35.2% to €227.5 million ($259.8 million), and adjusted EBIT increased 35.5% to €357.6 million ($408.4 million).

Capital expenditures for FY16 were €194.1 million ($221.7 milion), an 18.5% increase, although capital expenditure as a percentage of sales decreased 70 basis points to 7.7%, reflecting the company’s goal of managing capital expenditures closer to 6% of sales by 2020. Capital expenditures include an additional 46,000 m² (495,139.88 ft²) in state-of-the-art lab expansions, the establishment of 22 new startup labs and the development and implementation of IT services.

By region, North America sales topped revenues, with the company earning €803.6 million ($917.8 million) in the region, a 24.9% increase. North America comprises the largest market for Eurofins, representing 32% of revenues. France, the second largest market, soared 69.3% to €625.9 ($714.8), accounting for 25% of revenues. Eurofins’ third largest market, Germany, grew 11.6% to €279.4 million ($319.1 million) and represented 11% of total revenues. Eurofins is continuing to expand company operations in emerging markets and in Asia Pacific, the latter which accounted for €342.1 million ($390.7 million) of revenues, a 27.1% increase.

Acquisitions and Startups

Revenue growth was largely driven by acquisitions, as Eurofins purchased 27 companies with total annualized revenues of over €220 million ($251.3 million). Notable acquisitions include Netherlands-based Sinensis Life Sciences, a pharmaceutical testing and cGMP QC services company; French environmental clinical testing and hospital hygiene company Biotech-Germande; ams Laboratories and Advantar, both analytical and cGMP QC service companies in Australia and the US, respectively; PerkinElmer Labs/NTD, a reference lab in the US for first and second trimester prenatal screening; EAC Corporation, part of Asahi Industries of Japan, a water and dioxin testing firm; Megalab, a Spanish clinical diagnostic lab; and ASL Análises Ambientais, an environmental testing service provider in Brazil.

As part of its 2014 multiyear startup lab investment program, Eurofins launched 22 startup labs in FY16. Startups, including businesses in the process of restructuring or reorganizing, delivered €282.3 million ($322/4 million), down 11.2%, accounting for 11.1% of total revenues. Including the new labs from FY16’s startup investments, the startup program generated 101% growth in revenue in FY16, causing the company to accelerate its startup initiative, aiming to open 76 startup labs by the end of 2017. This would total 110 labs launched by Eurofins between 2007 and 2017.

Infrastructure

Between 2005 and 2016, Eurofins added or upgraded over 380,000 m² (4,090,286 ft²) in lab infrastructure. The company plans to add 17,200 m² (185139 ft²) to its lab campus in Lancaster, UK, which is already the world’s largest independent single-site lab, by the end of 2018, with plans to complete 1,600 m² (17,222 ft²) by the end of this year.

In Asia Pacific, the company plans to expand lab space in China, Australia and Singapore by the end of 2017. Eurofins also aims to consolidate small sites into larger industrialized sites or move certain businesses to larger campuses to maximize efficiency. In Hamburg, Benelux and Sweden, site consolidation is expected to reach completion by 2019.

SGS

Swiss contract testing lab SGS has over 2,000 offices and labs globally, and provides core services for inspection, testing, certification and verification. In 2016, total company revenues increased 6.0% in constant currency to CHF 6.0 billion ($6.5 billion = CHF 0.92 = $1), which includes 2.5% organic growth and 3.5% in acquisition contributions. Adjusted operating income margin dropped 5 basis points to CHF 15.4 million ($16.6 million). SGS provides services for numerous industries, including life science, agriculture and food, energy, chemical, mining, and oil and gas.

Environment, Health and Safety

The Environment, Health and Safety (EHS) division showed the fastest revenue growth at SGS in 2016, increasing 23.6%, 6.9% organically, to account for CHF 464.3 million ($501.2 million). Growth was mostly driven by the increase in environmental testing services in North America, as well as a spike in health and safety contracts, especially in Europe. Trends in the Brazilian, Chinese and Taiwanese dioxins market also contributed to growth in the division.

Sales for high-volume and high-margin laboratory contracts were particularly strong in Europe, especially in Italy, Germany and Benelux countries, and were driven by health and safety contracts in the hospitality and real estate sectors. Demand for testing services was propelled by China and Taiwan due to an increase in the establishment of environmental laws. South America had growth in the high single digits, particularly because of the growing dioxins market in Brazil, as well as 2015 acquisitions, which performed as the company expected. A decrease in business opportunities in the oil and mining sectors hindered SGS’ growth in Australia.

SGS made two significant acquisitions in the EHS division: Canadian trace analysis company AXYS Analytical Services and the acquisition of assets of environmental testing firm Accutest Laboratories. These acquisitions enhanced the company’s service portfolio in North America, largely driving growth in the region. Adjusted operating margin for EHS decreased one percentage point to 11.8% due to a temporary margin dilutive effect from the Accutest acquisition.

Agriculture, Food and Life

As part of SGS’ structural reorganization changes, effective January 2016, the Life Sciences Services and Food Testing segments were incorporated into Agricultural Services. The company’s Agriculture, Food and Life (AFL) services revenue increased 6.1%, 4.5% organically, to CHF 934.9 million ($1.0 billion), with the Life, Food and Trade division offsetting the slow growing agricultural market that was adversely affecting demand for contract research services.

The division made six acquisitions or strategic partnerships in 2016, including the purchase of Portugal food DNA sequencing company Biopremier, and Moroccan food and hospitality testing firm Laagrima, as well acquiring a 75% share in Brazilian precision farming company Uniego Agricultura de Precisâo, and the assets and license of official USDA inspection agency John R. McCrea Agency. North America drove certification services, while demand for testing services sales increased in Asia.

Due to weather and less-than-ideal crop quality in Europe, growth in commodity services decreased in the first half of 2016, especially during historical peak periods. Weather was also a factor in diminished Seed and Crop activities in Southern Africa.

Adjusted operating margin for AFL decreased 3.7% to 15.7% due to challenges in the agriculture market and SGS’ recent acquisition investments.

ALS

ALS provides testing services for 18 industries, including agriculture, environmental, pharmaceutical, water and food. The Australia-based company has 370 sites in 65 countries, and has 4 major segments: Life Sciences, Industrial, Commodities (containing Minerals and Coal), and Oil and Gas (formerly Energy). In February, just before the end of FY17, ALS announced the appointment of Raj Naran as the company’s next CEO and managing director, succeeding Greg Kilmister, who is expected to retire this month.

In FY17, revenues increased 2.7% to AUD 1,272.3 million ($977.5 million = AUD 1.30 = $1). Underlying net profits also grew 4.0% to AUD 112.7 million ($86.6 million), partially due to acquisitions and restructuring costs of $11.0 million, a 52.8% increase. The company invested AUD 106 million ($81.4 million) into 11 acquisitions in the food, tribology, and environmental and water segments, although the vast majority of these acquisitions were completed in the latter half of FY17 and do not have much of an impact on reported FY17 results.

All ALS business segments had positive growth in FY17, except lab services for Oil and Gas, which dropped 40.3% to AUD 10.8 million ($8.3 million), accounting for 1% of sales. During FY17, ALS divested the majority of its Oil and Gas assets due to a reduction in exploration and production in the sector, but retained the lab services segment. Life Sciences contributed AUD 641.6 million ($493.0 million) to revenues, a 1.3% increase, while commodities was the fastest growing segment at 6.3%, representing AUD 427.2 million ($328.2 million). Industrial accounted for $192.7 million ($148.1 million), a 3.8% increase.

ALS Life Sciences

The Life Sciences division focuses on analytical testing and sampling services for the environmental, food, pharmaceutical and consumer product markets, and although the division’s revenue increased 1.3% in FY17, the growth was below company expectations as it was virtually the same as FY16 (see IBO 7/15/16). The Environmental segment brought in revenue of AUD $522 million ($401.1 million), an 11% increase, with growth in all regions except North and South America. The segment’s margin improved 10.4%, 3.5% and 2.4% in Asia, Australia and Europe, respectively. The company continued to underperform in Canada and South America due to weak resource industries (i.e., mining, oil and gas) and internal management concerns, although the company indicated that organizational changes and new business initiatives outside of resource industries will help margin improvement during the next year.

The Food and Pharmaceutical division had significant growth in all regions and has a current pro forma run rate of AUD 154 million ($118.3 million), including acquisitions. FY17 food testing acquisitions included European firms ALcontrol UK and BioCity, which is the food microbiology lab of the 2 Sisters Food Group in the UK. The acquisition of South American microbiology and quality control lab EMICAL in Colombia and biological and chemical testing firm TECAM in Brazil were also completed in FY17, as part of ALS’ food testing lab expansion strategy in the region. The company plans to complete more food testing acquisitions in this sector as part of its business strategy, with the aim of procuring revenues of $200 million in FY18.