Danaher to Become Major Player in Bioprocessing Market

Danaher announced this week that it will purchase GE’s $3.2 billion BioPharma business (see Executive Briefing). Danaher will pay $21.4 billion, or $20 billion after tax benefits. Danaher’s largest acquisition to date, the purchase is in many ways a culmination of Danaher’s commitment to the bioprocessing market. The acquisition will add GE BioPharma’s approximately $2.7 billion bioprocessing business to Danaher’s existing Pall bioprocessing business, which has estimated sales of approximately $1 billion, according to a 2018 Danaher investor presentation.

With a bioprocessing business that will be an estimated $2.8 business (excluding cell and gene therapy products), Danaher’s footprint in the market will resemble Merck KGaA, Sartorius and Thermo Fisher Scientific. In 2018, Sartorius Bioprocessing Solutions recorded €1.2 billion ($1.4 billion at €0.85 = $1) in revenues. In the first nine months of 2018, Merck Life Science’s Process Solutions business generated €1.8 billion ($2.1 billion) in sales. Annual revenues for Thermo Fisher’s Bioproduction business totaled $1.3 billion (through the first quarter of 2018), according to a 2018 investor presentation.

GE BioPharma will join Danaher’s $6.5 billion Life Sciences business segment. As Danaher President and CEO Thomas P. Joyce, Jr. stated on a call with investors following the announcement, “We will have nearly doubled our exposure in the biologics end-market, which will represent approximately 50% of our Life Sciences revenue of $10 billion.” Danaher has emphasized the strategic priority of biopharma manufacturing tools to the company due to the rapidly growing market for biologic drugs and the high percentage of consumables sales, which are also specified into product manufacturing, providing a captive user base. Seventy-five percent of GE BioPharma’s revenues are recurring.

New Opportunities

Danaher expects GE BioPharma’s core revenues to grow 6%–7% annually, according to the call, generally the same as its recent performance, which was characterized on the call as high single digits over the past three years. The BioProcess portfolio of GE BioPharma’s business is made up of product offerings for both upstream and downstream bioprocessing. With expected 2019 revenue of $1.1 billion and an organic revenue growth rate of 5%–6%, GE BioPharma’s upstream offerings include cell culture and media, bioreactors and fiber cartridges for microfiltration.

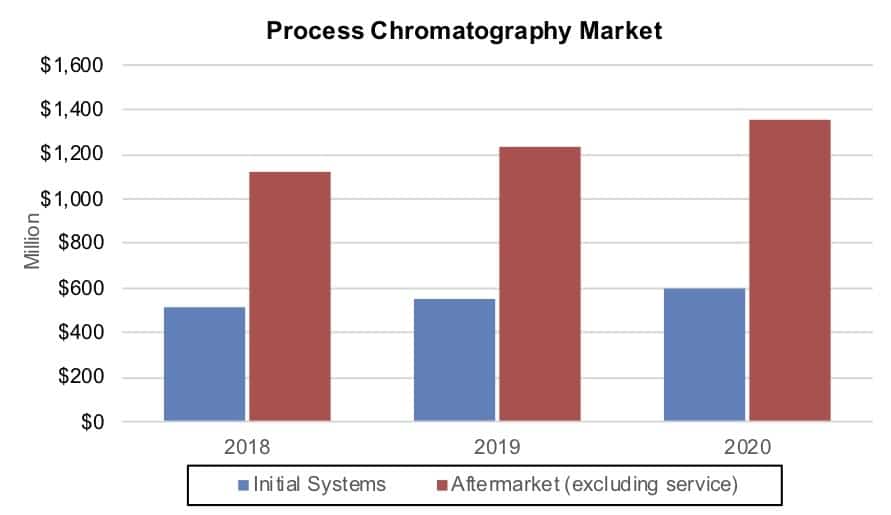

GE Biopharma’s downstream business is estimated to record 2019 revenues of $1.7 billion, according to the call, and currently has an organic revenue growth rate of %–8%%. Downstream solutions include pilot and process LC systems, columns and resins, cell culture media, software and service. On the call, Danaher highlighted BioPharma’s process chromatography business, which considerably expands Pall’s LC business as well as compliments Pall’s filtration business. “This combination will help increase our visibility to monoclonal antibody, vaccine and gene therapy projects in development, representing a growth acceleration opportunity in the future,” noted Mr. Joyce.

According to SDi’s recent market report, “Bioprocessing Technologies 2018,” GE holds the largest market share in the process chromatography market (defined as systems, aftermarket and service). Competitors in this market include Merck KGaA and Novasep. “From a share position standpoint, we feel very good about not only the stability of the share position of the business on a downstream basis, but the opportunities, again over a longer period of time, as we continue to advance our tools around funnel management and market visibility to enhance that share position, again, over time,” commented Mr. Joyce.

The purchase also establishes Danaher’s position in the cell culture media market for biotech manufacturing, where competitors include Thermo Fisher and Merck KGaA. SDi estimates that bioprocessing cell culture media and supplements demand topped $2.5 billion last year. This development follows other recent changes in the cell culture business for bioprocess manufacturing, such as Thermo Fisher’s purchase of Becton, Dickinson’s $100 million Advanced Bioprocessing business last year (see IBO 9/15/18), which includes cell culture products, and Sartorius’ decision to transition to supplying some of its own cell culture products, ending an exclusive agreement with Lonza (see IBO 1/31/19).

The BioProcess unit also offers single-use systems, including bags and tubing, connectors, process liquids, the FlexFactory configurable platform and application services. Pall’s single-use portfolio offers similar product type,s and the purchase will help provide end-to-end solutions for single-use bioprocessing, according Mr. Joyce. Both Danaher and GE have noted in the past the rapid growth of its single-use systems businesses. A recent Danaher presentation reported that Pall’s single-use business totals approximately $300 million.

In addition to the BioProcess business, Danaher also gains two other GE BioPharma business segments, whose sales total $400 million, according to the call. GE BioPharma’s cell and gene therapy portfolio includes cell banking and cell processing products, such as a cell separation system, a cell expansion system and cell culture media. The acquisition also includes GE BioPharma’s research and pharmaceutical development portfolio, offering consumables such as sample preparation kits, genomics consumables and lab filtration, as well as system for electrophoresis, high-content imaging and SPR, among other products. This addition is expected to complement Danaher’s existing offerings for biologics development and genomics workflows. The two businesses have organic growth rates in the low to mid-single digit core, led by cell therapy product sales, as stated on the call.

Financial Returns

The $21.4 billion acquisition is valued at 17x 2019 estimated EBITDA. The deal will be financed by cash, new debt and credit facilities, as well as an equity offering. Danaher has already filed a share offering for $1.35 billion of shares of common stock and $1.35 billion of shares of Series A Mandatory Convertible Preferred Stock. Proceeds are anticipated to be $1.31 billion and $1.45 billion, respectively, excluding the underwriters’ option to exercise shares. At the end of 2018, Danaher’s consolidated debt totaled $9.7 billion. Following the announcement, Moody’s noted that upon completion of the deal, Danaher’s pro forma debt to EBITDA will be 4x.

Annual costs savings for Danaher in the first-three full years are estimated at over $100 million, with a high-single digit return on invested capital expected in the fifth year following the purchase. But as a carve out from GE Healthcare, Danaher is primarily focused on setting up GE BioPharma as a standalone business, rather than immediate cost and sales synergies, according to Mr. Joyce. “The carve out components are really focused largely on the G&A side, IT, finance, HR, legal, etc.,” he explained. “Keep in mind, the core direct components of this business we get [are a] tremendous R&D team, a fantastic commercial sales and marketing team, and so we’ll be focused on other areas to take cost out on a non-customer facing basis.” GE BioPharma’s carve out will lead to a simplified structure and greater focus, emphasized Mr. Joyce. He expects most sales and channel synergies with the Pall bioprocessing business to play out over the long term.

In connection with the deal, Danaher also announced changes to its plans for its Dental business spin-off (see IBO 7/31/18). The spin-off will now be completed via an IPO, with Danaher stating that this change gives it greater balance sheet flexibility. Although the final number of Dental shares to be offered is not yet finalized, on the call, the company estimated an initial offering of 19.9% of shares. The spin-off remains scheduled for the latter half of this year.