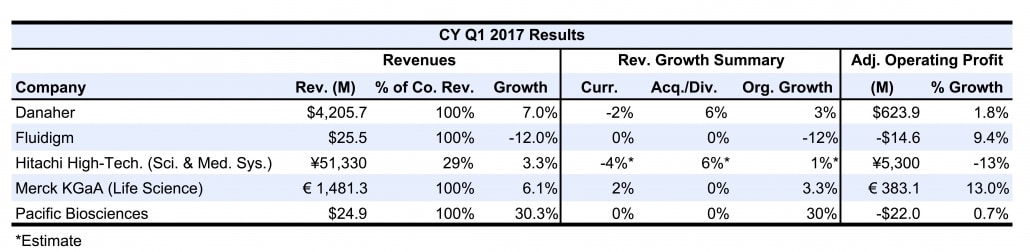

First Quarter 2017 Results: Danaher, Fluidigm, Hitachi, Merck KGaA, Pacific Biosciences

Danaher Reports Steady Q1 Growth

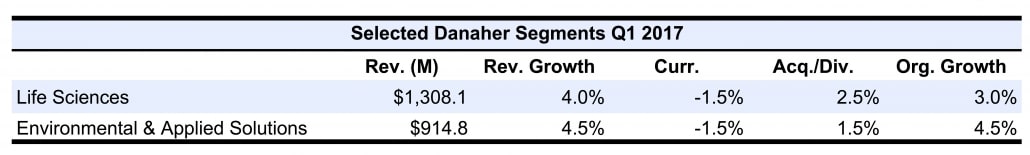

First quarter sales for Danaher’s Life Sciences segment expanded 4.0%, 3% organically, to account for 31% of company revenues. Segment growth was driven by strong biopharmaceutical demand, especially in China. For the segment as a whole, equipment and consumables sales grew roughly 2.5% each. Consumables sales growth was reduced 50–75 basis points due to one fewer selling day.

SCIEX sales grew in the low single digits organically, as strength in China and Western Europe was partially offset by lower sales in North America, weak demand from clinical customers and one fewer selling day. By end-market, biopharmaceutical sales for the SCIEX business grew double digits, while applied sales were roughly flat despite strong food and environmental demand in China. On a standalone basis, sales for the acquired Phenomenex business (see IBO 10/15/16) climbed in the mid-single digits organically despite a strong comparison.

Sales for the Beckman Coulter Life Sciences (BCLS) business grew in the low single digits organically, led by continued strength in the Flow Cytometry and Particle Counting businesses, especially in China. However, BCLS growth was partially offset by lower demand for centrifugation products and slower demand in developed regions due to timing of projects.

Leica Microsystems sales grew in the high single digits organically, including growth across all product lines and geographic regions. With the exception of industrial markets, which experienced steady improvements, microscopy sales were higher in all other customer markets. Furthermore, microscopy sales were boosted by several new project wins within the confocal and surgical businesses in North America and Western Europe.

Pall sales advanced in the low-single digits organically, including mid-single digit growth for the Pall Life Sciences business due to strong demand for single-use technologies from biopharmaceutical customers. Meanwhile, Pall Industrial sales declined slightly because of a strong comparison.

Operating margin for the Life Sciences segment jumped 210 basis points to 16.2% as a result of cost control and restructuring measures, acquisitions and productivity improvements.

For Danaher’s Environmental & Applied Solutions segment, first quarter reported and organic sales expanded 4.5% each to account for 22% of revenues. Growth was driven by strong instrument sales and higher pricing, which contributed 0.5% to segment revenue growth. Organic sales for the water quality business and Hach grew in the mid-single digits each. Hach sales were strong in China, and grew in both North America and Western Europe due to improved orders in the previous quarters. Conversely, Hach sales declined in both Latin America and the Middle East. Sales growth in the other businesses, including Product Identification, ultraviolet water disinfection and chemical treatment solutions, also contributed to segment growth. Environmental & Applied Solutions operating margin was flat at 22.7%

Fluidigm Stabilizes Cash Outflow in Spite of Depressed Sales

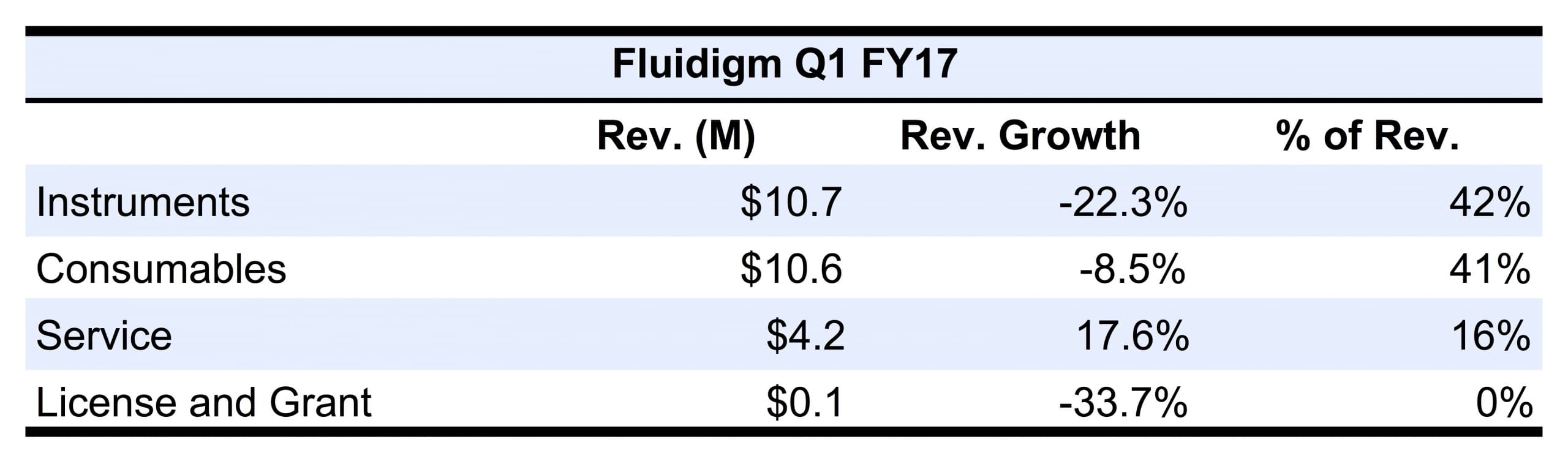

First quarter sales for Fluidigm contracted 12.0% to $25.5 million due to a projected decline in single-cell genomics sales. This regression was attributed to continued competitive challenges, and weakness in Asia Pacific and Europe. However, sequentially, company sales improved a modest 1.8%, representing a second consecutive quarter of sequential growth.

Overall, instrument sales fell 22.3% to account for 42% of revenues, primarily due to lower C1 sales, which slumped more than 70%. This was moderately offset by higher mass cytometry system sales. Despite improved demand for mass cytometry reagents, consumables sales contracted 8.5% to make up 41% of revenues. Propelled by post-warranty contracts, service revenue climbed 17.6% to represent 16% of revenues. License revenue, which declined, was negligible.

Based on markets, genomics product sales tumbled 37.7% to $11.4 million. Mass cytometry product revenue jumped 39.4% to $9.9 million, including double digit-sales growth for both instruments and consumables. This growth was driven by demand for the new Imaging Mass Cytometer and strength in the biopharmaceutical markets. While the company will provide ongoing development and service efforts for C1 customers and the roughly 365 active systems, resources will be shifted to the faster growing NGS library preparation and qPCR markets.

Geographically, sales declined double digits in all major regions, falling 18.1%, 17.0% and 10.2% in Europe, Asia Pacific and the US, which accounted for 30%, 20% and 46% of revenues, respectively. Conversely, sales in Other regions more than doubled to account for 4% of revenues.

Adjusted Product gross margin fell 630 basis points to 62.2% due to lower production volume and product mix. Adjusted operating loss narrowed 9.4% to $14.6 million as a result of cost saving measures. The company reduced its cash outflow from $11.8 million in the fourth quarter of 2016 to $9.2 million in the first quarter, resulting in a cash balance of $50.3 million. Second quarter sales are projected to declined 15%–22% to $22–$24 million.

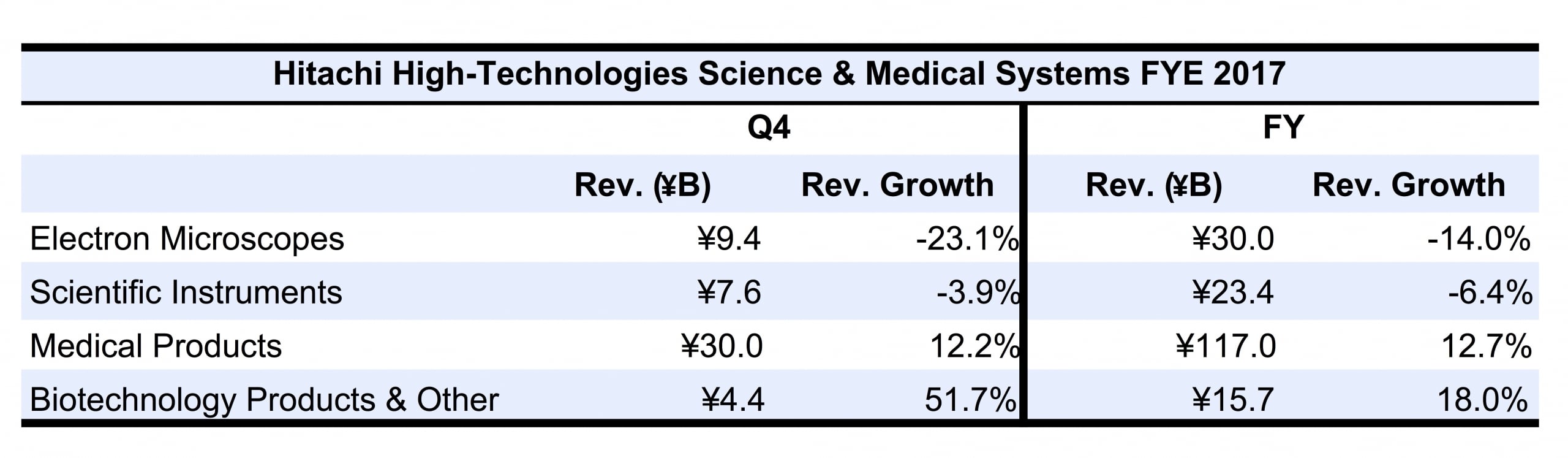

Hitachi High-Tech. Reports Mixed Fiscal Q4 Results

For the fiscal fourth quarter ending March 31, Hitachi High-Technologies’ Science and Medical Systems (SMS) sales grew 3.2% to ¥51.3 billion ($451.3 million at ¥113.67 = $1) to account for 28% of company revenues. Excluding currency headwinds and acquisitions, SMS sales advanced roughly in the low single digits. Sales were particularly strong in the Biotechnology and Medical Products business, especially for clinical analyzers, as well as new gene and bacterial testing products. Higher sales of LC and MS products further contributed to growth. However, sales of electron microscopes were sharply lower due to weak academic and government spending in both Japan and Europe, as well as a strong year-over-year comparison. SMS operating margin contracted approximately 200 basis points to 10.3% because of currency, product mix and increased investments.

For the fiscal year, SMS sales advanced 5.1% to ¥186.1 billion ($1.7 billion at ¥108.76 = $1) to make up 29% of revenues. Organic sales grew at a similar mid-single digit range, led by large orders for clinical analyzers and strength in China. Segment operating margin slipped 50 basis points to 14.5%.

For fiscal 2017, the company projected SMS sales to grow 2% to ¥190.5 billion ($1.8 billion at ¥105.00 = $1). Fiscal full-year sales of Scientific Instruments and Electron Microscopes are expected to grow 12% and 26%, respectively. Biotechnology Products and Others sales are estimated to climb 17%, while Medical Products sales are anticipated to fall 8%.

Merck KGaA Reports Modest Q1 Growth

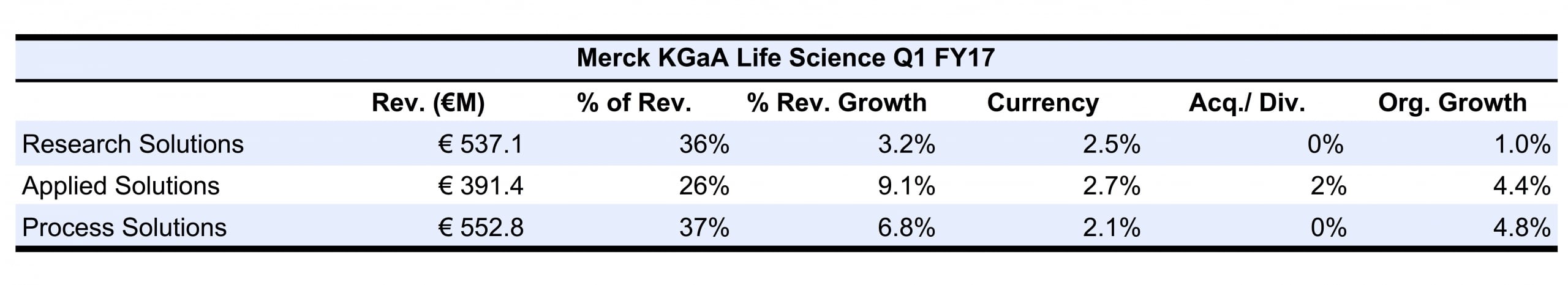

First quarter sales for Merck KGaA’s Life Science (LS) division grew 6.1%, 3.3% organically, to €1.48 billion ($1.58 billion at €0.94 = $1) to make up 38% of company revenues. Currency and the acquisition of BioControl Systems (see IBO 1/15/17), net of divestments, added 2.4% and 0.4% to sales growth, respectively.

Applied Solutions sales improved 4.4%, led by strong demand for food and beverage testing, as well as healthy growth in the lab water business. Sales for the Research Solution business advanced 1.0%, as growth in China and other higher-growth regions was partially offset by weakness in the US.

Process Solutions sales climbed 4.8% due to strength in upstream processing, especially for biopharmaceutical ingredients and single-use products. However, sales growth was hampered by a strong comparison and a slow start to the year.

Geographically, LS sales in Asia Pacific climbed 8.2%, with broad-based growth across most businesses, especially for upstream bioprocessing products and services in South Korea.

Sales in the Middle East & Africa region advanced 8.6% due to strength in both the Process and Research Solutions business. Latin American sales expanded 6.4% due to strength in the Biomonitoring and Advanced Analytical businesses. European sales grew 2.3%, led by strength in the Lab Separation and Workflow Tools businesses. North America sales improved 0.6%, as higher sales of analytical instrumental products from Applied customers were offset by lower demand within the Research Solutions business.

LS adjusted gross margin jumped 900 basis points to 59.0% due to sharply lower cost of sales, as the company accounted for increased inventories in the previous year following the completed acquisition of Sigma-Aldrich (see IBO 11/30/15). Adjusted operating margin advanced 160 basis points to 25.9%. The company maintained its 2017 outlook for LS organic sales to grow above the market rate.

Pacific Biosciences Cuts Outlook

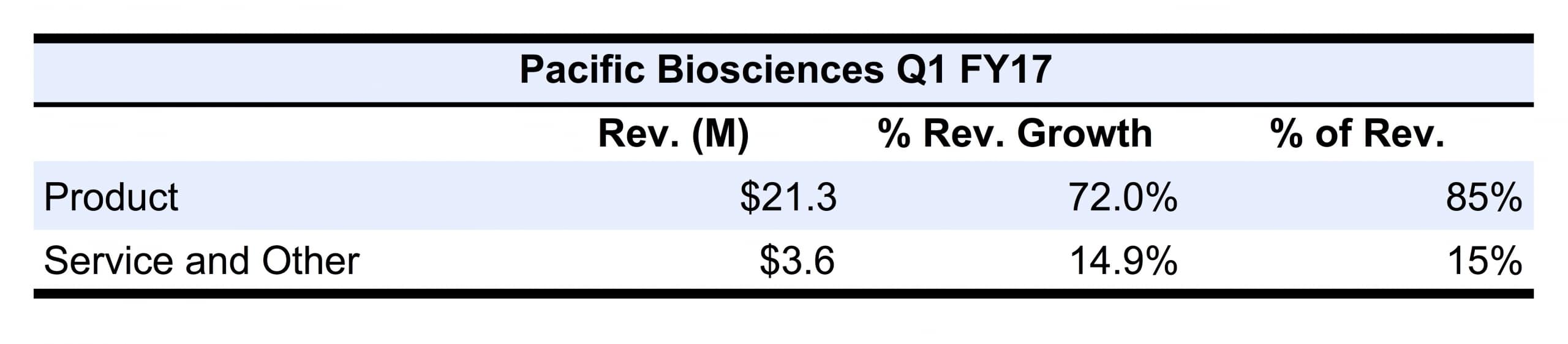

Excluding Roche’s contractual revenues of $3.6 million in the previous year, first quarter product and service sales for Pacific Biosciences climbed 60.4% to $21.3 million.

Instrument sales jumped 63% to $12.6 million, led by increased placements of Sequel systems, especially in China. The company placed a number of systems in China to both new and existing customers over the last two quarters, including 15 Sequel systems to just two Chinese customers during the same period. The company also highlighted increased demand from plant and animal sequencing markets. Overall, total installed instrumentation base reached more than 300 systems.

Consumable revenue advanced 88% to $8.7 million due to an expanded installed base of PacBio systems, which reached more than 300 units. The company also noted increased demand for SMRT Cell kits for plant and animal sequencing applications. Service and other revenue expanded 15% to $3.6 million.

Adjusted product and service gross margin advanced 307 basis points to 41.1% due to instrument mix and increased placements. Adjusted operating narrowed 0.7% to $22.0 million.

Despite positive sales momentum in the quarter, the company offered a cautious outlook for instrumentation sales due to delayed government funding in the US. As such, the company lowered its 2017 product and service revenue growth range from 40%–60% to 35%–45% to $105–$115 million. Second quarter sales are projected to be substantially higher on a year-over-year bases, but to decline sequentially.