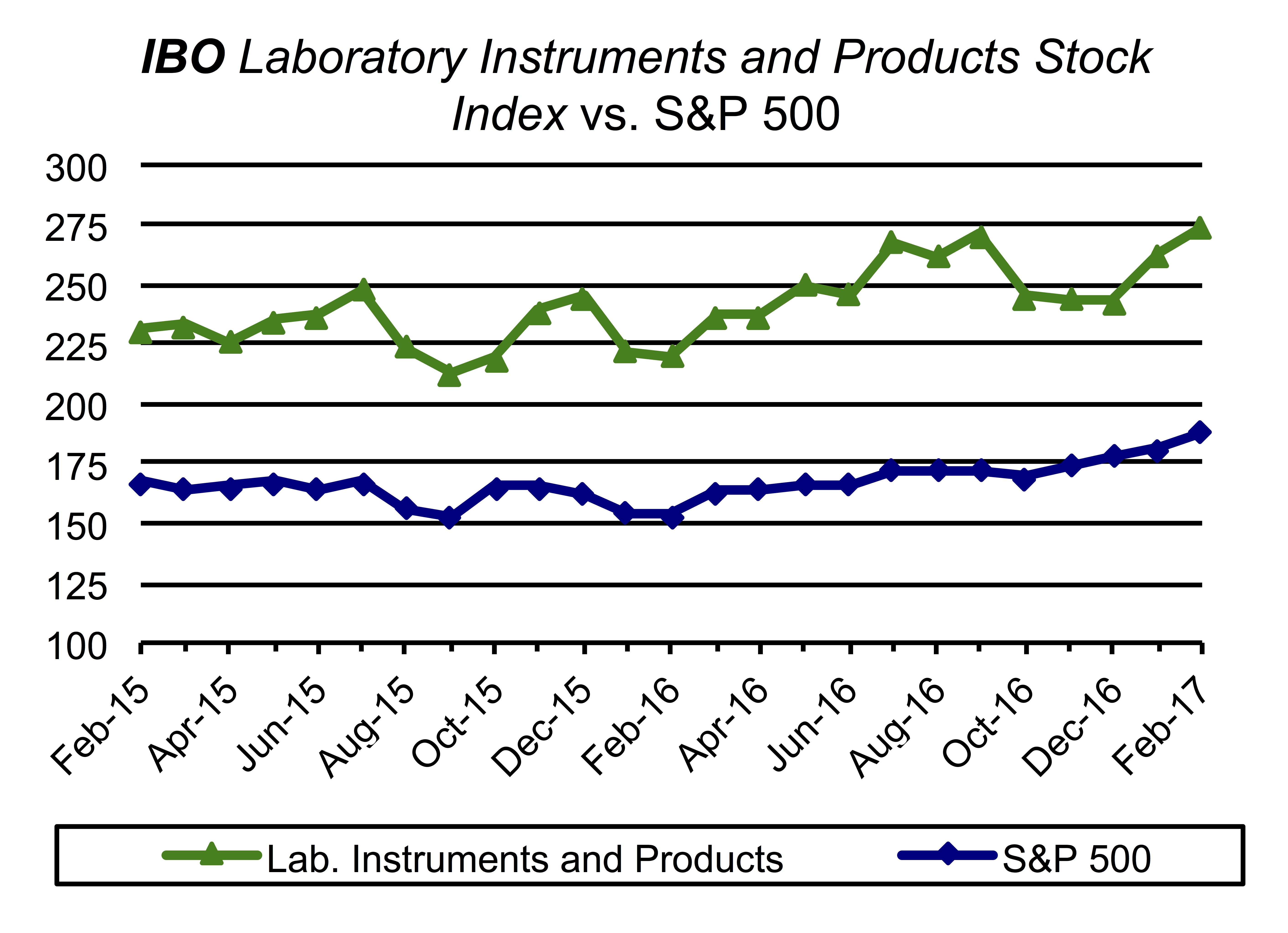

IBO Indexes Piggyback Market Strength

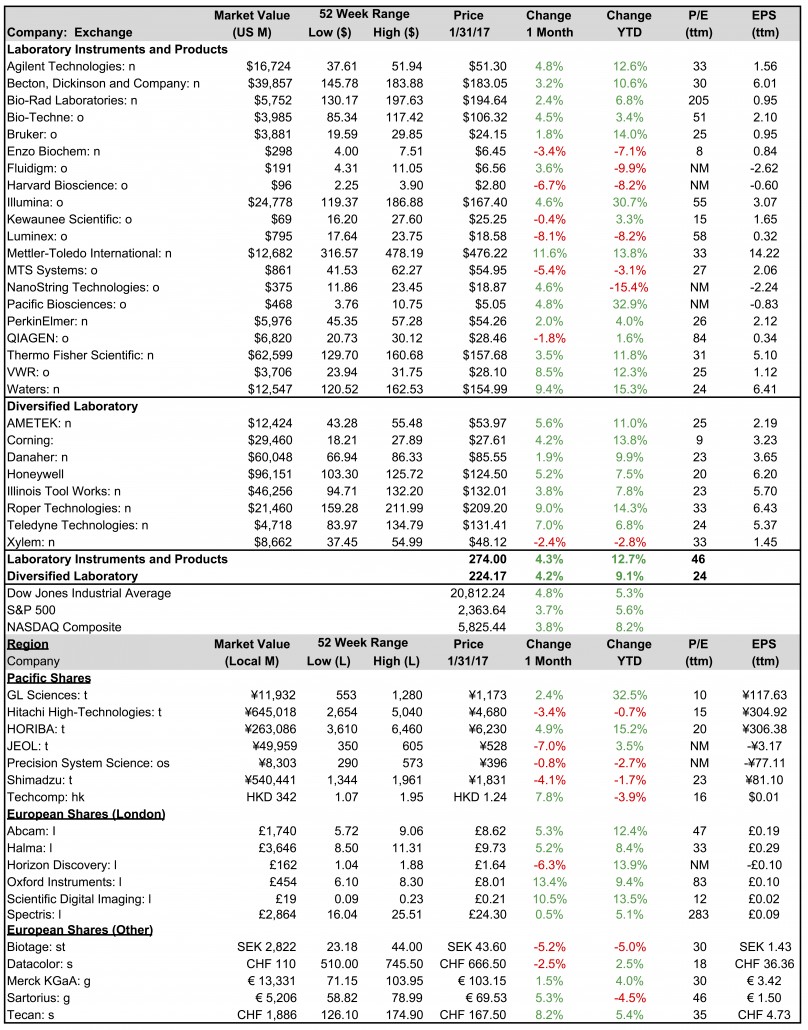

US equity markets continued to soar in February trading at historic highs due to unremitting euphoria for President Trump’s stimulus spending and tax reforms. Markets remained fixated on the administration’s pro-growth policies, ignoring certain risks including soaring equity valuations, a hawkish US Federal Reserve and enduring debt crisis in certain European countries. Nevertheless, deregulation policies specifically spurred investments in US financial equities, as the total market capitalization for the five largest US banks soared $69 billion for the month and $267 billion since the election in November 2016. For the month, the Dow, S&P 500 and NASDAQ advanced 4.8%, 3.7% and 3.8%, respectively. Year to date, the Dow, S&P 500 and NASDAQ are up 5.3%, 5.6% and 8.2%, respectively.

Laboratory Instrumentation

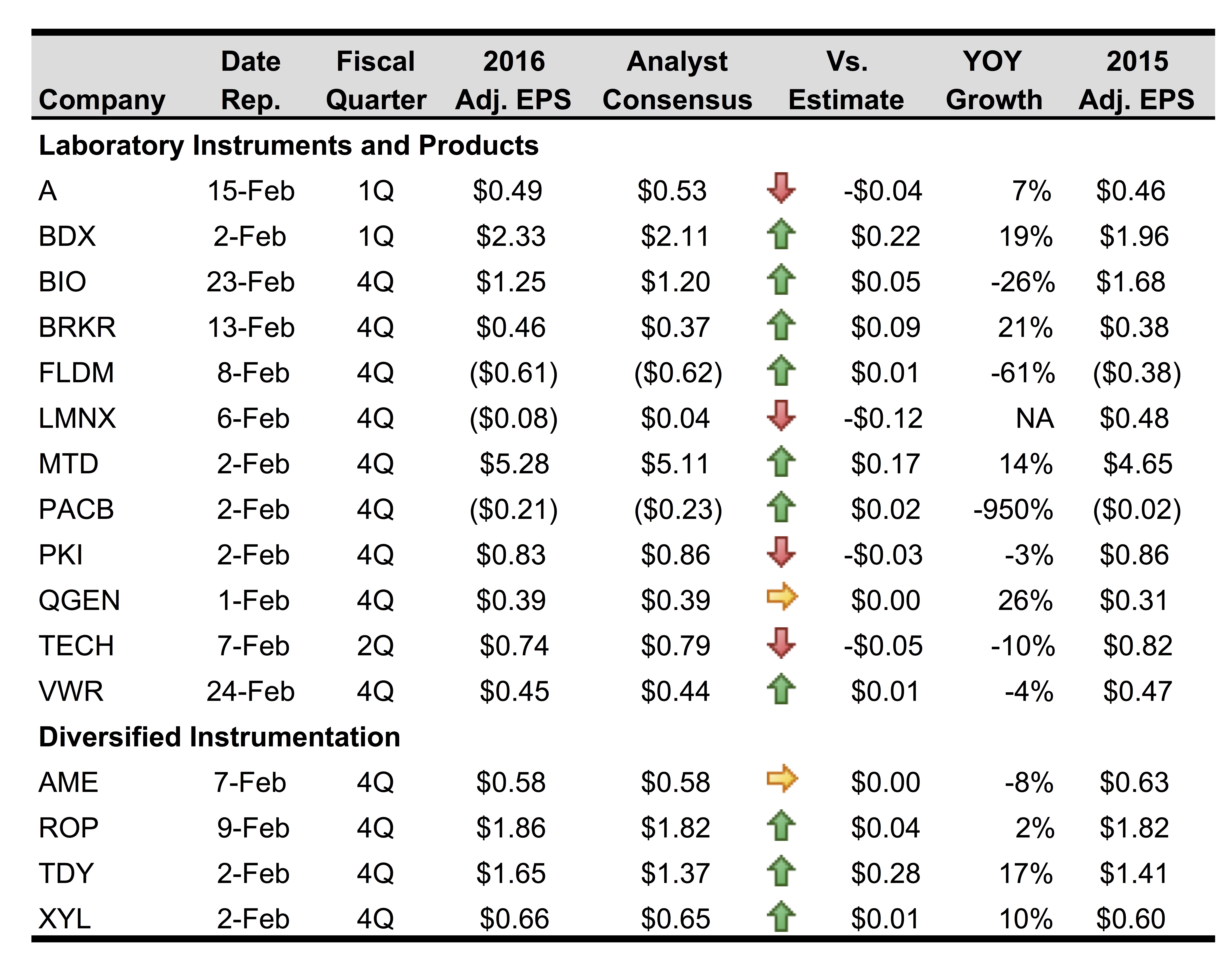

The Index advanced 4.3% in February to 274.00 and is up 12.7% year to date. Most companies in the Index traded higher for the month, led by Mettler-Toledo, which climbed 11.6%. The company again delivered efficient fourth quarter 2016 financial results, as adjusted EPS climbed 14% to $5.28. For 2017, adjusted EPS is expected to grow 12%–13% to $16.55–$16.75, including first quarter adjusted EPS of $3.05–$3.10.

Similarly benefiting from strong financial results, Agilent Technologies and Becton, Dickson (BD) rose 4.8% and 3.2% for the month, respectively. On February 15, Agilent reported that fiscal first quarter adjusted EPS expanded 7% due to solid food and biopharmaceutical demand, as well as efficiency improvements. The company maintained its fiscal year 2017 adjusted EPS outlook of $2.10–$2.16 and projected fiscal second quarter EPS of $0.47–$0.49.

BD reported on February 2 that fiscal first quarter adjusted EPS advanced 19% to $2.33, easily topping expectations. The company raised its currency-neutral fiscal 2017 EPS growth by 100 basis points to 13%–14%. However, factoring in currency, adjusted fiscal year EPS was lowered from $9.45–$9.55 to $9.35–$9.45 for growth of 9%–10%.

Bio-Rad Laboratories and Bruker also posted stronger-than-expected fourth quarter 2016 adjusted EPS results despite lower organic revenue growth. On February 13, Bruker reported that quarterly adjusted EPS jumped 21% to $0.46 due to completed restructuring measures, share repurchases and improved pricing. However, the company expects 2017 adjusted EPS to fall 10% to $1.05–$1.09 due to dilution from acquisitions. Shares expanded 1.8%.

Bio-Rad (see Reported Financial Results) beat adjusted EPS expectations on February 23 as it highlighted continued sales strength for its Droplet Digital PCR system and process media products. The company projected 2017 sales to grow 4% organically. Shares improved 2.4% for the month.

Although Fluidigm and Pacific Biosciences each reported a much wider fourth quarter adjusted EPS loss compared to a year ago, results were marginally ahead of analysts’ expectations. Despite weak sales growth, Fluidigm reported on February 2 that sales and operating expenses improved sequentially. The company expects improved operating margin beginning in the second quarter due to headcount reductions and other efficiency developments. The company advanced 3.6% for the month.

Like Fluidigm, Bio-Techne, PerkinElmer and VWR posted mixed quarterly financial results yet share prices increased for the month. On February 24, VWR slightly beat fourth quarter adjusted EPS expectations, but missed sales consensus due to weak instrumentation demand and decelerated growth in biopharmaceutical markets. The company projected 2017 sales to grow 3%–4% excluding currency and maintained its full-year adjusted EPS of range of $1.79–$1.87. Shares climbed 8.4% for the month.

Bio-Techne, which advanced 2.4% for the month, reported on February 7 that fiscal second quarter adjusted EPS were negatively impacted by timing of orders in the Diagnostics segment. However, the company maintained its fiscal 2017 organic sales growth.

On February 2, PerkinElmer missed both sales and adjusted EPS expectations as a result of constrained spending by industrial and environmental customers. Nevertheless, the company’s newborn screening business remained robust. The company projected 2017 adjusted EPS of $2.75–$2.85, including first quarter EPS of $0.52–$0.54. Shares improved 2.0% for the month.

Despite strong market momentum, several companies in the Index succumbed to selling pressure due to weak financial results. Luminex recorded the sharpest decline in the Index for the month, as shares fell 8.1% due to disappointing fourth quarter 2016 earnings results on February 6. However, the company maintained its 2017 sales range of $295–$305 million.

QIAGEN, which slipped 1.8% for the month, met fourth quarter 2016 adjusted EPS expectations on February 1, but missed sales consensus due to weak demand from academic customers. The company reaffirmed its 2017 currency-neutral adjusted EPS of $1.25–$1.27. First quarter adjusted EPS are expected to be $0.25–$0.22 excluding currency.

On February 28, Kewaunee Scientific (see Reported Financial Results) reported a sharp EPS decline for the fiscal third quarter ending January 31. Earnings for the company slumped 58% to $0.13 primarily due to timing of orders for two large projects, but also slower sales growth from international customers. Shares were only marginally lower for the month.

In ratings news, on February 27, Evercore ISI upgraded Illumina from “Hold” to “Buy.”

Diversified Instrumentation

The Index grew 4.2% for the month to 224.17 and is up 9.1% year to date. All companies advanced for the month except Xylem, which declined 2.4%. The company missed fourth quarter sales expectations on February 2 due to anemic industrial demand. However, adjusted EPS for the company, climbing 10%, narrowly exceeding expectations. The company also projected positive organic revenue growth in 2017, along with adjusted EPS of $2.20–$2.35 for growth of 12% including acquisitions.

Roper Technologies and Teledyne Technologies recorded the strongest gains for the month, as shares advanced 9.0% and 7.0%, respectively, due to stronger-than-expected fourth quarter adjusted EPS on February 9 and February 2, respectively. Both companies also projected strong 2017 adjusted EPS growth due to acquisitions and improved organic sales growth. Roper projected 2017 adjusted EPS of $8.82–$9.22, and Teledyne estimated EPS of $5.40–$5.50. On February 23, Argus upgraded Roper from “Hold” to “Buy.”

AMETEK, which improved 5.6% for the month, met fourth quarter adjusted EPS expectations on February 7 and projected 2017 adjusted EPS of $2.34–$2.46.

Danaher was upgraded by Credit Suisse from “Neutral” to “Outperform” on February 1, and by Citigroup from “Neutral” to “Buy” on February 24. Conversely, on February 1, Sanford C. Bernstein downgraded Corning from “Outperform” to “Market Perform.”

International

Most major international equity markets traded higher in February with the exception of

Thailand’s SET and Philippines’ PSEi, which slipped 1.1% and 0.2%, respectively. The largest stock market index gains were recorded by India’s Sensex 30 and Switzerland’s SMI, which expanded 3.9% and 3.1%, respectively. In addition, the UK’s FTSE grew 2.3%.

Despite a gain for Japan’s Nikkei 225, which improved 0.4%, prices for most Pacific Rim companies in the IBO Stock Table traded lower. JEOL (see Reported Financial Results) recorded the sharpest decline, falling 7.0%. On February 10, the company reported that fiscal third quarter EPS ending December 31, 2016, slumped 61% to ¥3.59 ($0.03), due to weakness within the Science and Measurement Equipment business.

For the same fiscal quarter, Shimadzu reported that EPS grew 10.6% to ¥18.65 ($0.17). The company maintained its previous EPS outlook of ¥81.40 ($0.78). Shares fell 4.1% for the month.

Techcomp recorded the strongest gain for the month among Pacific Rim companies in the IBO Stock Table, rising 7.8% absence of any earnings news. HORIBA, which rose 4.9% for the month, reported on February 14 that fourth quarter 2016 EPS grew 25% to ¥134.26 ($1.53). For 2017, EPS are expected to be roughly flat at ¥306.00 ($2.77).

Prices for the UK-based companies in the IBO Stock Table advanced with the exception of Horizon Discovery, which fell 6.3%. Oxford Instruments and Scientific Digital Imaging recorded the strongest gains, climbing 13.4% and 10.5%, respectively.

Spectris, which improved a modest 0.5% for the month, reported on February 14 that adjusted full-year 2016 EPS climbed 12% to 127.5 pence ($1.72), primarily due to cost savings measures.

Prices for other European companies in the Stock Table were mixed in February. Tecan advanced the most for the month, rising 8.2%. Conversely, Biotage fell 5.2% as the company reported on February 9 that fourth quarter 2016 EPS declined 16% to SEK 0.27 ($0.03) due to slower sales growth.