IBO Lab Stock Index Trends Down in 2016

Major US markets experienced heightened volatility in 2016 prompted by growth concerns in China to begin the year, monetary policy changes and unexpected political events, including Brexit and Donald Trump’s presidential victory. A majority of analysts predicted a market collapse with a Trump win and futures tanked roughly one thousand points on election night. However, the negative sentiment quickly shifted as the Dow Jones Industrial Average added 7.8% following the election and traded just below the 20,000 mark before the year end. Consumer confidence quickly spiked due to anticipated fiscal stimulus, reduced taxes and rolled back regulations.

As such, the Dow, S&P 500 and NASDAQ ended the year up 13.4%, 9.5% and 7.5%, respectively. Furthermore, crude oil prices jumped 43.6% and gold advanced 8.7%. The US dollar Index also increased, rising 3.5%, but could negatively impact exports. As already revealed, the US trade deficit widened towards the end of the year.

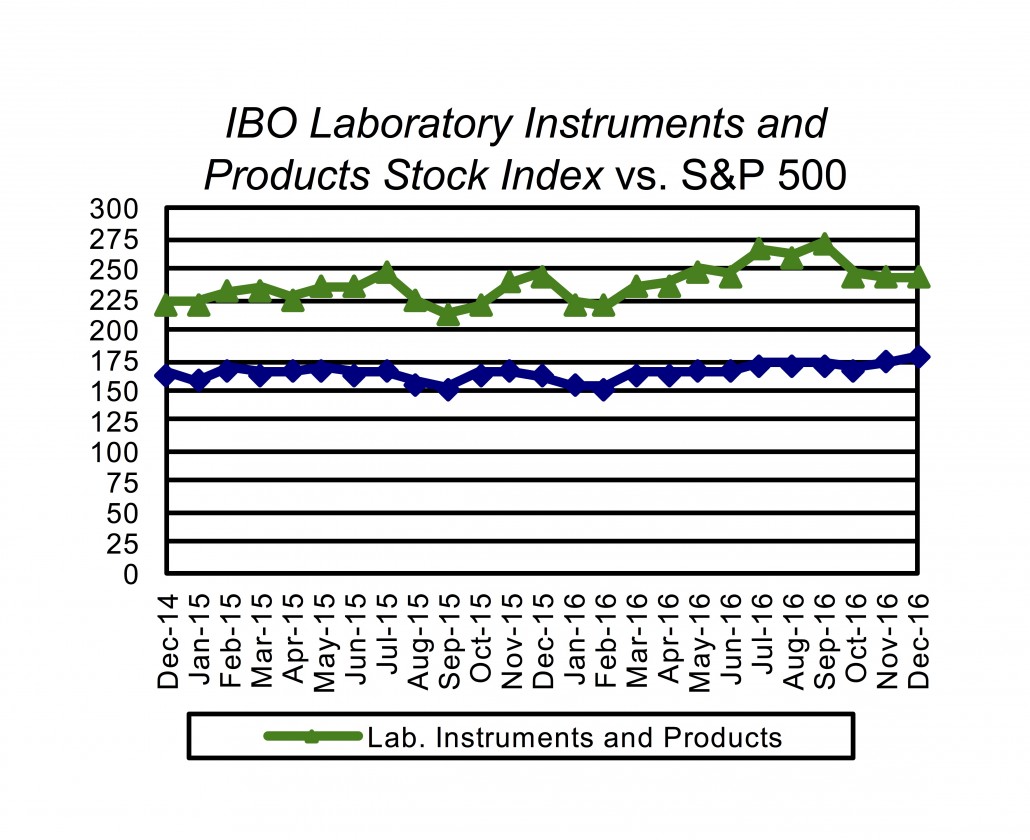

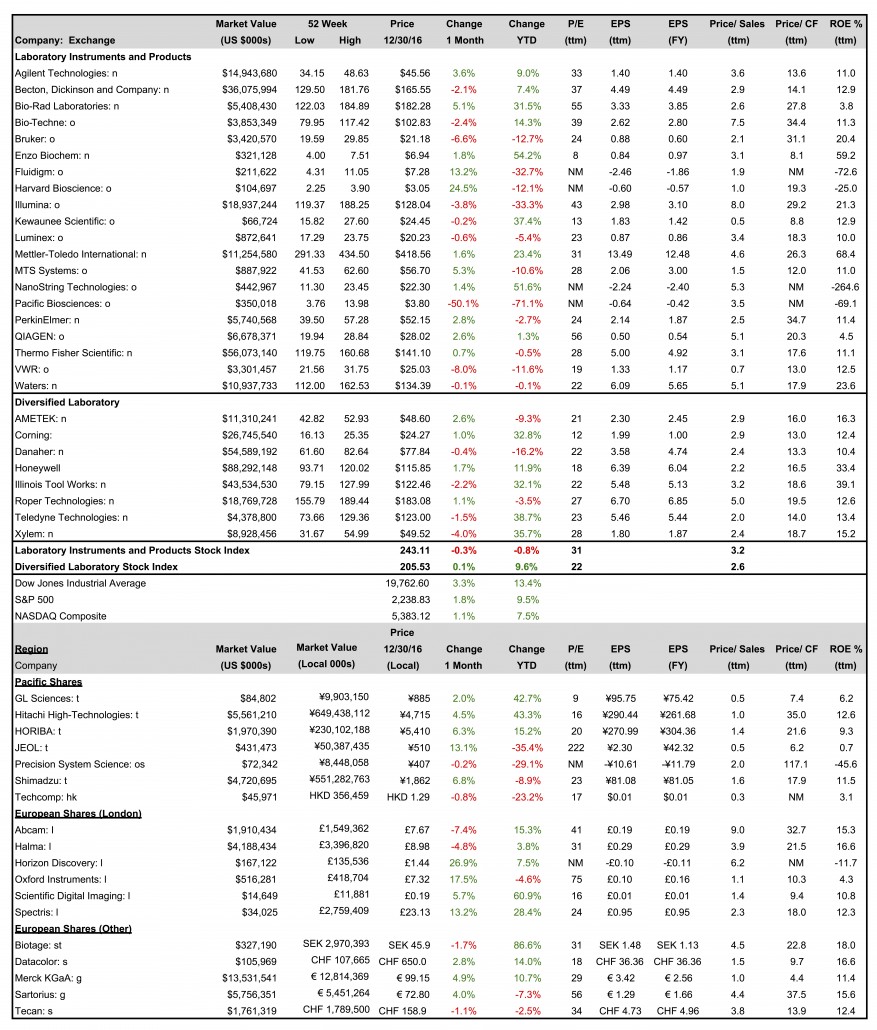

IBO’s Laboratory Instruments and Products Stock Index return deviated from the major US Indexes, contracting 0.8% for the year, its first negative return since 2011. Overzealous valuations coupled with missed revenue guidance and conservative financial outlooks caused a number of companies in the Index to sell off during the year. In contrast, IBO’s Diversified Laboratory Stock Index nearly mirrored the S&P 500, climbing 9.6% due to share repurchases and cost cutting measures.

Laboratory Instruments and Products

The Laboratory Instruments and Products Stock Index, which enjoyed a four-year run of double-digit gains, posted a modest decline in 2016. Prices for a number of companies in the Index were negatively impacted by slower-than-projected revenue growth and reduced sales outlooks, primarily due to waning demand among academic and government markets in developed regions, as well as continued weakness from industrial customers. Furthermore, several firms experienced specific operational challenges. Valuations were also a concern given the strong price escalations for a majority of companies over the last several years, coupled with slower adjusted EPS growth. For the Index, 2016 adjusted EPS growth is projected to be roughly flat, compared to double-digit gains registered in each of the previous two years.

In spite of the negative Index return for the year, a number of companies recorded strong price momentum due to improved profitability, new product introductions, healthy sales growth and share buybacks. Acquisitions further limited the Index decline as Thermo Fisher Scientific acquired both Affymetrix (see IBO 1/15/16) and FEI (see IBO 5/31/16) for notable premiums. The two companies recorded year-to-date price increases of 39% and 35%, respectively, prior to removal from the Index. Nevertheless, 11 of the remaining 20 companies in the Index ended in negative territory in 2016, including seven with double-digit declines.

The year’s biggest decliners were NGS firms Illumina and Pacific Biosciences, which slumped 33.3% and 71.1%, respectively. The two companies, which were trading at elevated prices to earnings valuations, experienced operational challenges and reduced 2016 sales outlooks. Illumina missed company sales expectations two out of the first three quarters of the year, as demand for high-throughput systems slowed at a stronger-than-projected pace. Furthermore, the company’s bottom line was negatively impacted by increased investments in its genetic testing service venture Helix and liquid biopsy business Grail. Given the increased financial commitments to these start-ups and slower order growth for high-throughput instrumentation, the company’s 2016 sales growth outlook was cut from an initial estimate of 16% to 7%, and adjusted EPS growth was trimmed from roughly 8% to flat for the year.

Despite Illumina’s misguided financial forecast, the company’s long term growth outlook remains robust, especially within clinical applications. However, sales and earnings growth in 2017, while expected to improve, will continue to experience dilution from its joint ventures as well as potential cannibalization of its HiSeq systems by its the lower-priced NextSeq.

Pacific Biosciences experienced notable challenges as well, especially towards the end of 2016. While the company reported increased adoption of its new Sequel instrumentation, orders for the system slowed sequentially in the second and third quarters, falling below company projections. Supply issues of SMRT Cells clearly impacted demand, but competition also remains a concern for the company. Given the slower order growth, the company lowered its 2016 product and service sales growth outlook from 70% to a range of 55%–65%.

Moreover, Pacific Biosciences was further pressured after Roche terminated its IVD development agreement with the company (see IBO 12/15/16). While the voided agreement provides Pacific Biosciences unrestricted commercialization opportunity of its Sequel system into the clinical market, it remains uncertain if the company can offset projected revenue contributions from Roche or sustain its current cash burn rate. As a result of the sharp price decline, shares are currently trading 76% below its IPO price of $16 in October 2010. However, at current price levels, the company may be a viable acquisition target in 2017.

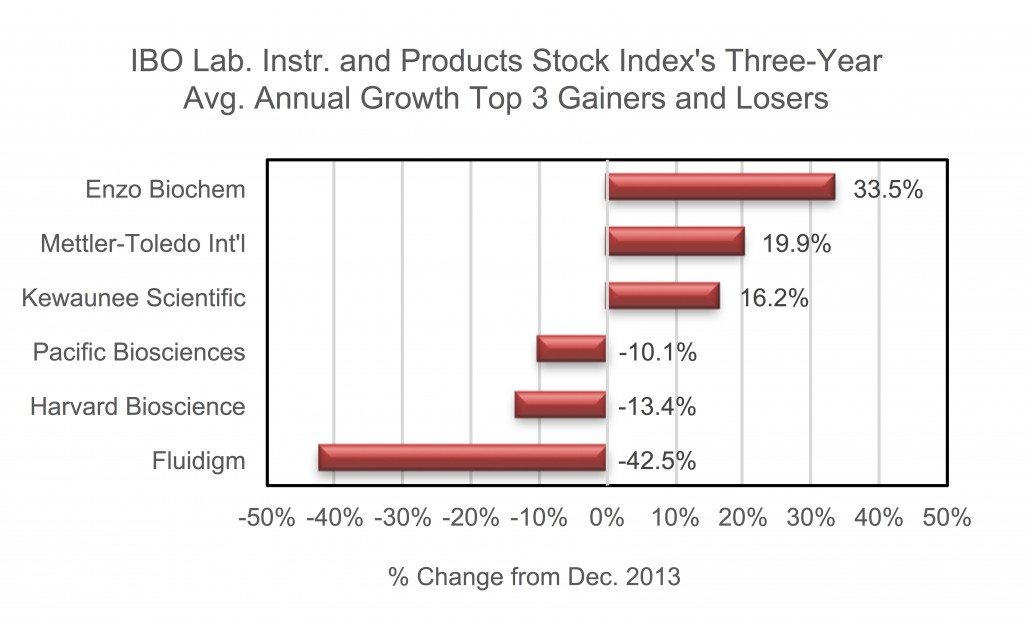

Similar to Pacific Biosciences, Fluidigm ended 2016 well below its IPO listing price in February 2011 (see IBO 2/28/11). The company, which traded at a record low and dropped 32.7% in 2016, has declined by double digits in each of the past three years. The company misguided sales projections for 2016 as a result of growing competition for single-cell genomics platforms, poor order and sales execution, in addition to timing issues. Furthermore, the company suspended its 2016 guidance due to an ongoing business review.

Several other companies, including Bruker, Harvard Bioscience, MTS Systems and VWR, also recorded double-digit declines for the year due to missed sales projections. VWR, which fell 11.6% in 2016, was perhaps unjustly rebuked after the company reported slightly lower-than-projected third quarter sales, primarily due to macroeconomic challenges in Europe. Despite slower projected earnings growth compared to the previous year, adjusted EPS is estimated to climb roughly 13% in 2016. The company also reported strong operating cash flow for the first nine months of 2016.

Conversely, Bruker’s sell off was justified due to slower sales growth and valuation concerns. Due to the company’s heavy instrument revenue mix and headwinds from European academic and industrial markets, sales expectations fell below company guidance in each the second and third quarters. The company initially forecasted 2016 sales to grow 3%, but lowered its outlook to -3% following two consecutive weak quarters. Despite the revenue shortfall, the company reported a positive earnings surprise in the third quarter due to restructuring initiatives and favorable NMR pricing. However, margin expansion will prove to be more difficult in 2017 given the company’s slow revenue growth and operational challenges.

Anxieties over valuations also disrupted the strong price momentum for both Thermo Fisher Scientific and Waters in 2016. Following double-digit gains in each of the previous four years, shares for the two companies slipped 0.5% and 0.1%, respectively, in 2016. However, both firms reported mostly strong financial results, including projected 2016 adjusted EPS growth of roughly 11%, driven by strong biopharmaceutical demand, robust growth in China, cost control measures and share repurchases. Unfortunately, Waters reported a slight third quarter revenue miss due to lower academic and government sales. Thermo Fisher avoided this negative trend but, like Waters, noted weakness in industrial markets.

There were a number of strong performers in the Laboratory Instruments and Products Stock Index as well. Two smaller companies, Enzo Biochem and NanoString Technologies, recorded the highest returns for the year, climbing 54.2% and 51.6%, respectively. Enzo Biochem benefited from a $35 million patent infringement case against Life Technologies (see IBO 5/31/16) as well as growing demand for its high margin diagnostic services.

Shares of NanoString advanced following strong second and third quarter sales results due to greater adoption of its nCounter SPRINT Profiler system, especially by new customers. In addition, the company posted strong demand from academic and biopharmaceutical markets, and expanded its companion diagnostic partnerships.

Another small company, Kewaunee Scientific, recorded robust momentum in 2016, as shares jumped 37.4% following strong earnings results and a new international laboratory project award valued at roughly $18.5 million.

A number of larger firms, such as Agilent Technologies, Becton Dickinson, Bio-Rad Technologies and Mettler-Toledo, similarly recorded healthy price gains in 2016. Mettler-Toledo recorded its fifth consecutive year of double-digit returns, as shares climbed 23.4% in 2016.

Bio-Rad experienced a steady climb in 2016, rising 31.5%. Despite missed adjusted EPS results in the first and second quarters, sales remained strong for its Digital PCR and process chromatography products. The company also continued to benefit from significant holdings in Sartorius.

Both Agilent Technologies and Becton, Dickson, which advanced 9.0% and 7.4% for the year, respectively, delivered fiscal earnings ahead of analysts’ consensus. Agilent exceeded analysts’ adjusted EPS expectations in each of its fiscal four quarters due to various cost saving and efficiency measures. The company further outsourced noncore manufacturing to lower cost regions, reduced its operational facilities and benefited from the discontinuation of its unprofitable NMR business. Sales were also strong for the fiscal year, led by biopharmaceutical, food and diagnostics markets.

Becton, Dickinson continued to execute significant margin expansion due to cost synergies and acquisitions. Earnings also benefited from improved tax rates and healthy sales growth. The company projected stronger sales growth for fiscal 2017, driven by new products in its core medical business, increased presence in informatics, as well as strong demand in certain life science businesses, including molecular diagnostics, cell analysis and sample preparation for NGS.

International

Major international equity markets traded mostly higher in 2016. Within the Asia Pacific markets, the strongest gains were recorded in smaller economies, as the Thailand SET, Indonesia Jakarta and Taiwan TAIEX Indexes climbed 19.8%, 15.3% and 11.0%, respectively. In addition, India’s Sensex 30 advanced 1.9%, while both Japan’s Nikkei 225 and Hong Kong’s Hang Seng improved 0.4%. In contrast, China’s Shanghai Composite declined 12.3% for the year, as the yuan valuation decelerated against the US dollar and the country limited leveraged stock purchases by insurance companies.

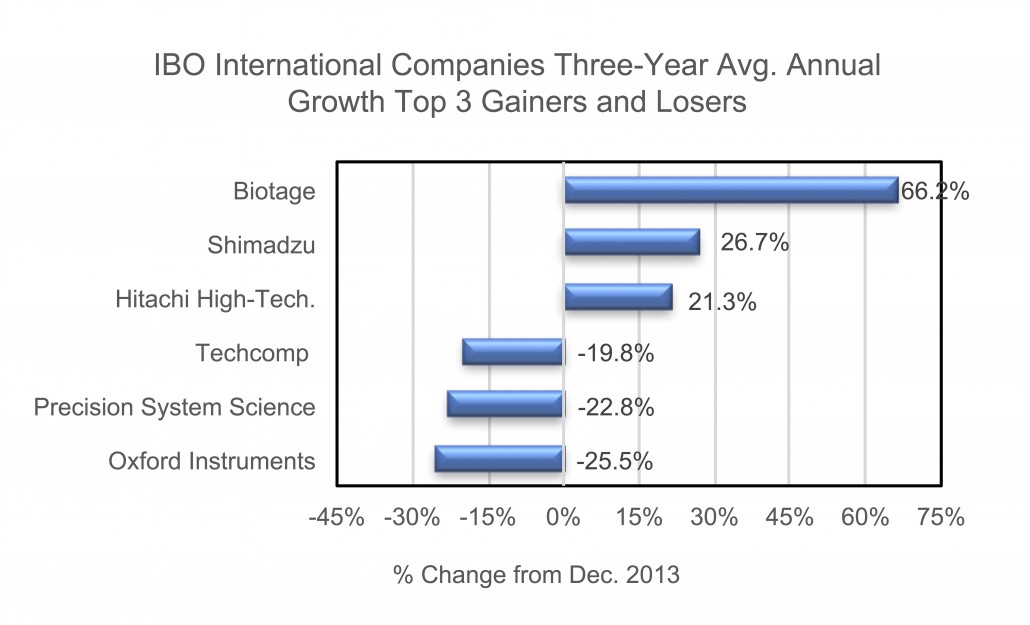

Despite a favorable export environment for Japanese equities due to the deprecation of the yen against the dollar, more than half of the Pacific Rim companies in the IBO Stock Table traded lower in 2016. JEOL recorded the sharpest decline, falling 35.4%, while Hitachi High-Technologies jumped 43.3%.

European equity markets were mostly mixed in 2016. The UK’s FTSE and Germany’s DAX gained 14.4% and 6.9%, respectively, despite Brexit concerns and terrorist attacks. However, Italy’s MIB and Switzerland’s SMI contracted 10.2% and 6.8%, respectively.

Most UK-based companies in the IBO Stock Table advanced in 2016, with the exception of Oxford Instruments, which fell 4.6%. Scientific Digital Imaging and Spectris recorded the strong gains, climbing 60.9% and 28.4%, respectively.

Prices for the other European companies in the IBO Stock Table were mixed in 2016 as Biotage soared 86.6% due to strong demand in China. Meanwhile, Sartorius declined 7.3% as the company reported slower growth in the Americas and Asia Pacific.

December

US equity markets posted healthy return in December, as the Dow, S&P 500 and NASDAQ improved 3.3%, 1.8% and 1.1%, respectively.

Laboratory Instruments and Products

In December, the Index slipped 0.3 % despite a majority of companies trading higher. Pacific Biosciences weighed on the Index, falling 50.1% following the Roche announcement.

Both Bruker and VWR also posted notable price declines for the month, contracting 6.6% and 8.0%, respectively. Conversely, Harvard Bioscience and Fluidigm advanced 24.5% and 13.2%, respectively.

On December 6, Kewaunee Scientific reported that GAAP EPS for the fiscal second quarter 2017 more than doubled to $0.54 due to strong International sales growth, which included the completion of several multiyear laboratory projects in India and Kuwait. However, shares were marginally lower for the month.

Enzo Biochem, which improved 1.8% for the month, reported on December 8 fiscal 2017 first quarter sales slightly ahead of analysts’ expectations and a narrower-than-projected adjusted EPS loss, driven by strong demand for diagnostic services.

There were several analysts’ rating revisions this month. On December 10, Morgan Stanley lowered its price target on Illumina from $115 to $100 per share. On December 14, JPMorgan Chase downgraded Bruker from “Overweight” to “Neutral,” and set a price target of $20 per share.

Diversified Instrumentation

The Index improved 0.1% in December, with half the companies in positive territory and the other half trading lower. AMETEK recorded the strongest gain, climbing 2.6%, while Xylem fell 4.0%.

International

Asia Pacific equity indexes traded mostly higher in December, as Japan’s Nikkei 225 and Australia’s All Ordinaries improved 4.4% and 3.9%, respectively. Meanwhile, China’s Shanghai Composite and Hong Kong’s Hang Seng sank 4.5% and 3.5%, respectively.

Prices for most of the Pacific Region companies in the IBO Stock Table improved this month, led by JEOL, which jumped 13.1%. Conversely, Precision System Science and Techcomp slipped 0.2% and 0.8% in December, respectively.

European equity markets all traded higher in December, including a 13.6% and 7.9% gain in Italy’s FTSE MIB and Germany’s DAX, respectively. London’s FTSE 100 returned a gain of 5.3%.

Most UK-based companies in the IBO Stock Table traded higher, led by Horizon Discovery, which scaled 26.9%. Abcam and Halm recorded the only declines, subsiding 7.4% and 4.8%, respectively. Halma was upgraded by HSBC from “Hold” to “Buy” on December 5, and by Numis Securities from “Add” to “Buy” on December 6.

Prices for the other European companies in the IBO Stock Table also varied. Merck KGaA advanced 4.9%, while Biotage eased 1.7%.