IBO Sales Indexes Show Growth: Industrial Markets Continue Their Comeback

For the second quarter of 2017, sales growth remained solid for publicly held instrument and lab products businesses as a result of continued strength in the biopharmaceutical and applied markets. Second quarter performances were better than companies expected, primarily backed by demand for LC and MS products, and services. Revenue for life science products continued to increase due to a rise in pharmaceutical and academic demand. Sales for analytical instruments advanced as well, driven by an improved industrial market and a strong biopharmaceutical performance. Geographically, strong demand in China lifted sales for the Asia Pacific region, while Europe and Americas sales rallied due to strong industrial and environmental sales.

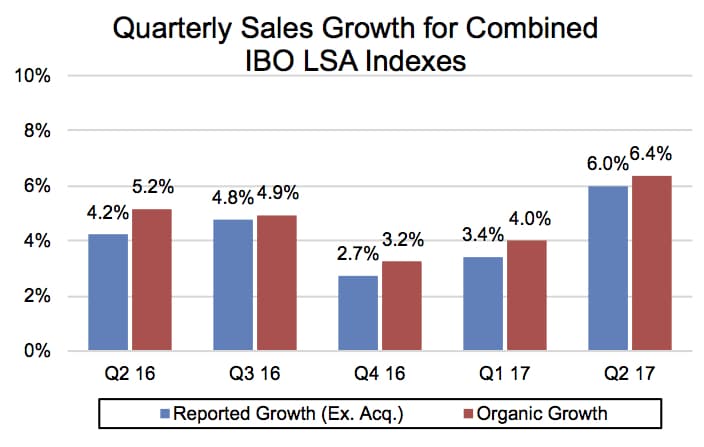

Combined calendar year second quarter sales for the 22 companies or business units in the IBO Life Science and Analytical Instrument Indexes (LSA Indexes) grew 6.0% on a reported basis. Compared to the first quarter, sales growth increased 2.6 percentage points from 3.4%, whereas growth increased from a year ago by 1.8 percentage points. Organic growth for the LSA Indexes, which excludes acquisitions and currency and is based on constant exchange rates for non-US companies when converted into US dollars, increased 6.4%, compared to 4.0% in the first quarter and 5.2% in the previous year.

Biopharmaceutical Markets

Sales in biopharmaceutical markets for companies in the LSA Indexes grew nearly 7%. These sales for the majority of the companies in the Index grew in the low- to mid-single digits, with only a few businesses’ revenues growing at double-digit rates. Agilent Technologies, Biotage, Bio-Techne Biotechnology and Protein Platform (Bio-Techne), and Shimadzu Analytical & Measuring Instruments (AMI) were the strongest performers, driven by Asian and European markets. QIAGEN experienced solid growth in the mid-single digits, primarily due to strong growth in consumables-related revenue. However, biopharmaceutical sales were less robust for PerkinElmer, for which sales were flat.

Academic and Government Markets

Academic and government sales for companies in the LSA Indexes remained steady, growing moderately at around 2%. Sales for the majority of the companies in the Index grew in the low single digits, as Waters and Bio-Techne’s revenues for this sector both increased in the high single digits, driven by strong demand in the US market. However, a few companies, Bruker Scientific Instruments (BSI), Merck KGaA Life Science, PerkinElmer, performed below expectations, with sector revenues decreasing by low single digits due to softer-than-expected demand in Europe and Asia Pacific. Agilent performed moderately, with flat growth rates for this end-market. Overall, academic sales for the Index advanced from the previous quarter.

Industrial Markets

For industrial end-markets, companies in the LSA Indexes experienced a solid increase in sales, growing more than 4%. Growth for the quarter was driven by steady aftermarket and service revenues, along with a strengthened chemical & energy segment for Agilent. Sales growth remained steady, maintaining strength from the first quarter. Continuing from the first quarter into the second was the strengthening recovery of the chemical and energy segment, for which Agilent experienced a turnaround in segment growth of around a 7%–8% increase in sales. Additionally, Agilent’s sales in industrial markets grew in the high single digits primarily due to solid gains in the chemical and refining market, which accounts for 60% of its chemical & energy segment’s sales. Overall, industrial sales for most of the companies in the Index finished in positive territory, increasing in the mid-single digits. Bruker, however, continued its skid, with its industrial sales decreasing in the low single digits.

Applied Markets

Applied sales for the companies in the LSA Indexes increased over 8%, driven by strength overseas, particularly in China and emerging markets. All company sales for this market in the Index finished in positive territory, as most advanced by mid- to high-single digits. QIAGEN, with applied sales advancing double digits for the quarter, experienced strong sales growth from its human ID forensic solutions. Additionally, sales in applied markets for most geographic regions for the company performed strongly, with Asia Pacific and Japan in double-digit growth territory. Overall, applied sales for the Index remained solid and continues to increase from the first quarter from the first quarter and a year ago.

Food sales for companies in the LSA Indexes advanced over 6%, with all companies in positive territory except for PerkinElmer, for which the sales decreased by low single digits. PerkinElmer, however, performed well in the environmental market, with sales increasing mid-single digits. Similarly, Thermo Fisher Scientific Analytical Instruments and Waters both experienced mid-single digit growth in food-related sales, driven by sales in Europe. Overall, environmental sales for the LSA Indexes grew roughly 6% as well due to robust demand in China and Europe.

Geographic Markets

Geographically, Asia Pacific remained the strongest region, as sales climbed more than 10%, including double digit-growth for BSI, Bio-Techne, Shimadzu AMI and Waters. Within the Asia Pacific, sales in China were again strong, advancing over 12% for the companies in the LSA Indexes, primarily due to solid demand for life science, biopharmaceutical and environmental products. Companies within the double-digit sales growth range in China included BSI, PerkinElmer and Shimadzu AMI. Sales in Japan were also notably strong, increasing over 9%, with Biotage, HORIBA and Shimadzu AMI leading with double-digit sales growth.

European sales for the LSA Indexes’ companies increased by over 3%, led by strong biopharmaceutical, diagnostics and academia sales. Along with the strong overall market growth, extra selling days during the quarter also led to an increase in European sales, for which Agilent, Biotage and Bio-Techne saw solid double-digit sales growth.

LSA Index sales in the Americas climbed nearly 3%, with most companies performing in the mid-single digits. Sales in this region for Shimadzu AMI and Waters, however, decreased, and double-digit growth was limited, as only Biotage revenue advanced more than 20% in the region.

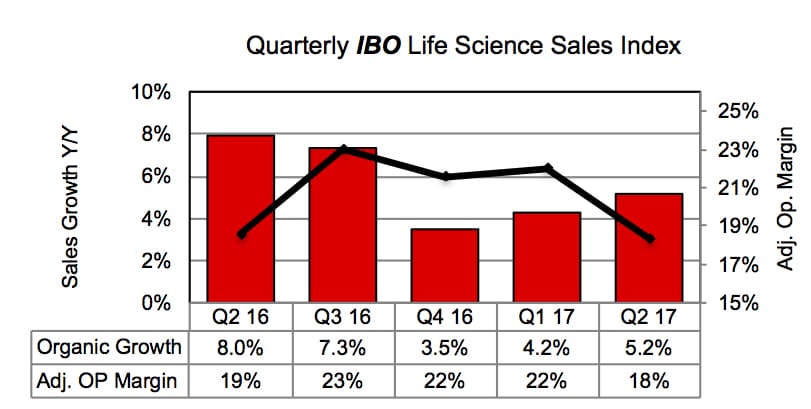

Life Science Sales Index

Second quarter IBO Life Science Index sales grew 4.9% on a reported basis to $5,062.8 million. Organically, sales grew 5.2%, driven by strong demand in the biopharmaceutical and applied markets. Against the first quarter, sales were up 1.2 percentage points on a reported basis. Organically, sales advanced by 100 basis points against the first quarter. However, compared to last year, both organic and reported sales growth decreased. Index adjusted operating profit advanced 10.2% to reach $929.1 million, whereas adjusted operating margin contracted 20 basis points to 18.4%.

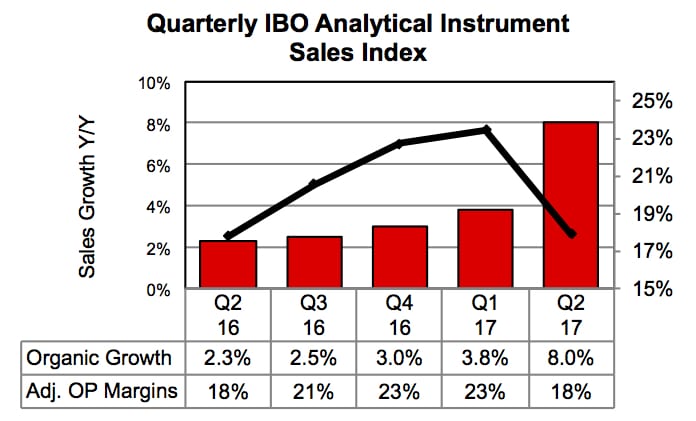

Analytical Instrument Sales Index

Second quarter sales for the IBO Analytical Instrument Index jumped 7.5 % on a reported basis to $4,167.9 million. Organically, sales grew 8.0% due to strong growth in Europe and a recovering industrial market. Additionally, stabilized academic and strengthened biopharmaceutical markets lifted sales. Compared to the first quarter, reported sales growth increased 2.3 percentage points, while organic sales growth increased by 3.3 percentage points. Against the second quarter of last year, both reported and organic sales growth were up, rising 6.2 and 5.7 percentage points, respectively, due to robust sales for Agilent, Thermo Fisher and Shimadzu AMI. Adjusted operating profit advanced 20.4% to $746.4 million, while adjusted operating margin increased by 10 basis points to 17.9%.