IBO Sales Indexes Strengthen in 2017

IBO’s Life Science and Analytical Instrument Indexes (LSA Indexes) follow the quarterly sales and operating profit margins of 23 major publicly held instrument and laboratory product companies or businesses. All sales figures are calculated on an organic basis, excluding acquisitions, divestments and currency effects, and are based on constant exchange rates for foreign companies when converted into US dollars.

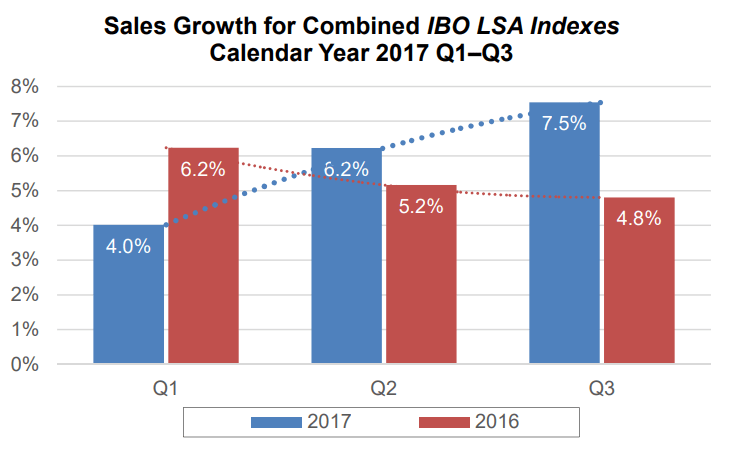

In the first nine months of 2017, organic sales growth for companies or businesses in the LSA Indexes continued to be robust, increasing 5.9% to surpass the previous year’s organic sales growth of 5.4%. Organic sales were strongly driven by both companies in the Analytical Instrument Index as well as the Life Science Index. In contrast to the organic sales growth for the first three quarters in 2016, the organic sales growth for the same period of 2017 established an upwards trend, with the first quarter showing the slowest growth.

In the first quarter of 2017, organic sales growth climbed just 4.0% due to a tough comparison to the previous year’s 6.2% growth. However, organic sales growth began to accelerate in the second quarter of 2017, increasing to 6.2%, then leaping even higher to 7.5% the following quarter. The pick-up in sales growth in the second quarter 2017 was primarily driven by strong performances by a mix of Life Science Index and Analytical Instrument Index companies, such as Agilent Technologies, Illumina, QIAGEN and Shimadzu. Organic sales growth jumped in the third quarter 2017, rising 1.3 percentage points to 7.5% due to significant quarterly growth from companies in the Analytical Instrument Index. Companies in the Life Science Index delivered positive organic sales growth as well, driven by solid performances from Illumina and Thermo Fisher Scientific.

Life Science Index

Sales for IBO’s Life Science Index in the first nine months of 2017 climbed 6.2% organically, versus 7.8% in the previous period. Organic revenue growth for the Index was driven by strong sales from Bio-Techne, Illumina and Thermo Fisher’s Life Sciences Solutions segment. QIAGEN also performed solidly for the first nine months, further adding to Index growth. Significant product sales contributions for the Index during the first nine month of 2017 included mass cytometry and NGS-related products, as well as consumables and services. As for end-markets, academic and government, diagnostic and clinical, and applied end-markets led Index sales growth. Adjusted operating margin for the Index in the first nine months of 2017 rose slightly, up 70 basis points to 22.4%, driven by lower SG&A expenses along with curtailed R&D costs.

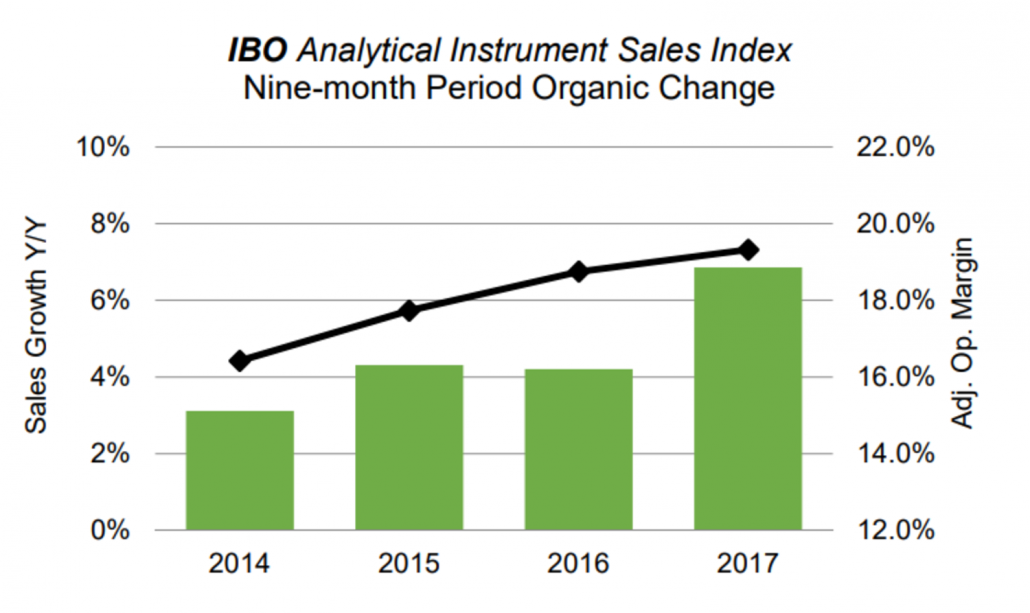

Analytical Instrument Index

IBO’s Analytical Instrument Index delivered 6.9% organic sales growth in the first nine months of 2017. Compared to 2016, organic sales growth rose 2.7 percentage points, largely driven by significant sales contributions from Agilent, Shimadzu and Thermo Fisher’s Analytical Instruments segment. By end-market, the biopharmaceutical, environmental and food end-markets also provided growth. Academic and government spending picked up its pace from the second quarter 2017 as well. Adjusted operating margin for the Index in the first nine months of 2017 climbed 60 basis points to 19.3%, representing a fifth quarterly consecutive increase.