IBO Stock Indexes: Lab Instrumentation Stock Index Up Double Digits in November

US Federal Reserve Chairwoman Janet Yellen announced her resignation on Monday, November 27, and it is expected to be effective as of February 2018. But her resignation is expected to have little impact, as Fed policymakers are still on track to raise interest rates in December, the third time this year. Estimates released this month show US GDP increased 3.3% for the third quarter, up 20 basis points sequentially. The better-than-expected GDP rate was primarily driven by increased exports, private inventory investments and nonresidential fixed investments.

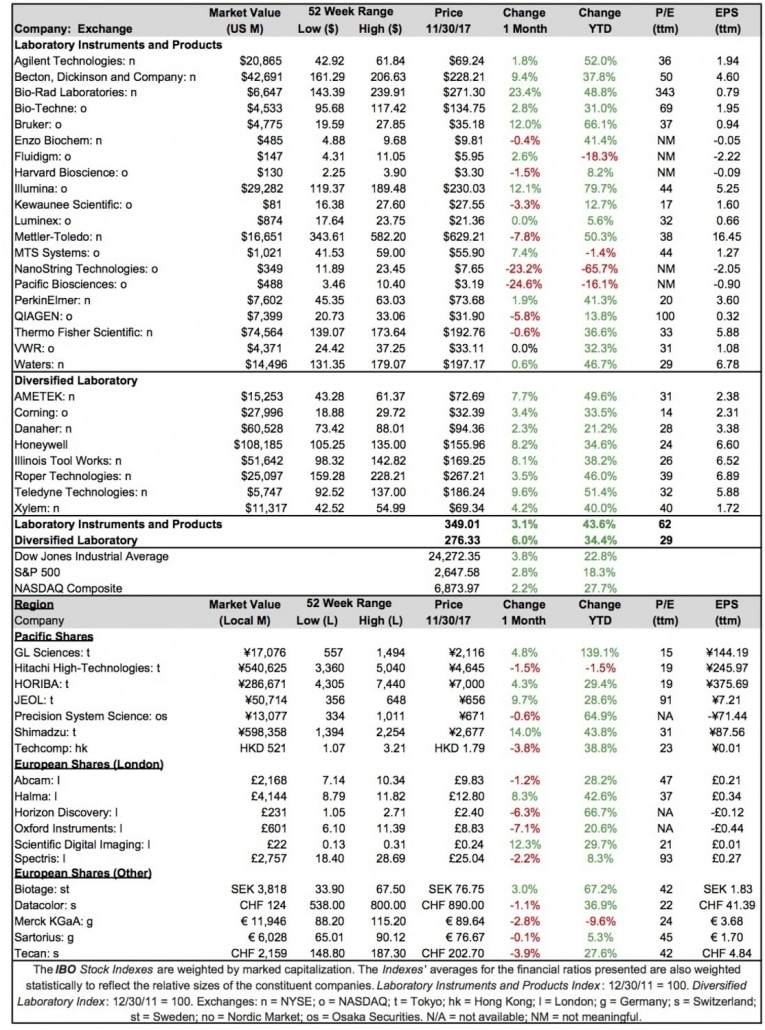

The Dow Jones Industrial Average (DJIA) climbed 3.8% in November to close at 24,272.35, and also represented an 895.11-point sequential increase. Year to date, the DJIA has increased 22.8%. The S&P 500 increased 2.8% to end at 2,647.58 for the month, representing sequential growth of 72.32 points. The NASDAQ Composite rose 2.2% to finish the month at 6,873.97.

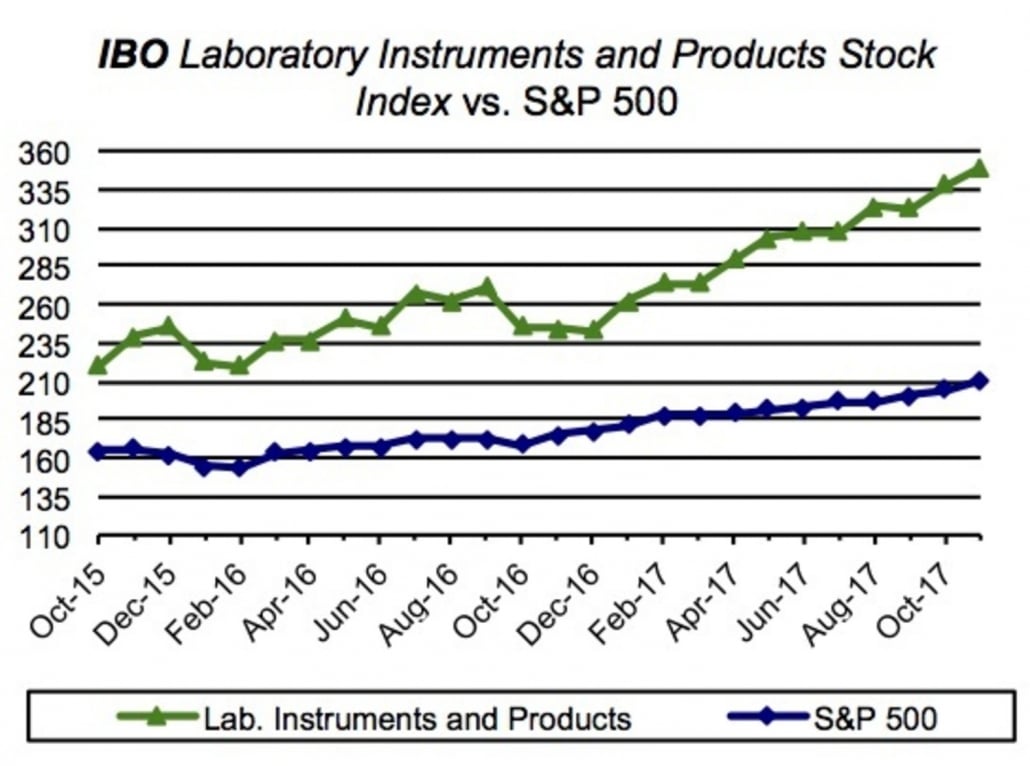

Laboratory Instrumentation Stock Index

The Laboratory Instrumentation Index advanced 3.2% to 349.01 in November. The Index’s top performer was Bio-Rad Laboratories, increasing 23.4% to close at $271.30. Conversely, Pacific Biosciences fell 24.6% to $3.19. Nanostring Technologies’ shares also fell double digits, decreasing 23.2% to close at $7.65. The stock has also also fallen the most year to date among Index stocks, having dropped 65.7%.

Year to date, Illumina’s share prices have increased the most, leaping 79.7% to end the month at $230.03. Illumina shares also experienced solid double-digit growth for the month, increasing 12.1% to $230.03.

For the month, Agilent Technologies’ share price increased slightly, up 1.8% to finish the month at $69.24. The company reported fiscal fourth quarter earnings on November 20 (see Bottom Line). Net income totaled $177.7 million, representing an EPS of $0.54. Adjusted EPS for the quarter, $0.67, beat company expectations of $0.61 and even beat analysts’ projections of $0.63. On November 21, Deutsche Bank set a price target for the stock of $75.00, along with a “buy” rating. For the fiscal first quarter, Agilent expects its adjusted EPS to be $0.55–$0.57. As for fiscal year 2018, the company projects an adjusted EPS of $2.50–$2.56. On November 15, Agilent increased its cash dividend from 13.2 cents per share to 14.9 cents.

Also reporting this month was Becton, Dickinson. The company released its fiscal year-end earnings on November 2, delivering adjusted EPS of $9.48. For the quarter, adjusted EPS beat analysts’ expectations by $0.02, reaching $2.40. The company’s share price advanced 9.4% to $228.21 for the month. On November 3, Morgan Stanley upgraded the stock’s price target from $205.00 to $245.00. As for fiscal 2018, the company expects adjusted EPS to range between $10.55 and $10.65, representing growth of around 12%.

Third quarter earnings for Bio-Rad Technologies were reported on November 7. The company delivered adjusted EPS of $0.91, surpassing analysts’ expectations of $0.33 and increasing 46.8% from the same period last year. The significant increase in earnings was supported by lower SG&A expenses. Bio-Rad also announced a new share repurchase program of up to $250 million on November 28. On November 29, Wells Fargo gave the stock an “outperform” rating, along with a $290.00 price target. Overall, share prices jumped 23.4% for the month.

Bruker also beat analysts’ forecasts. The company reported third quarter earnings on November 1, recording adjusted EPS of $0.29. Adjusted EPS beat analysts’ expectations of $0.27 but fell 9.4% from the same period last year. The company expects its full-year adjusted EPS to be $1.17–$1.20. On November 3, Citigroup upgraded the stock’s price target from $29.00 to $34.00. For the month, Bruker’s share price increased 12.0% to end at $134.75.

Other companies reported net losses this quarter. Fluidigm shares rose 2.6% for November despite reporting net losses for the quarter. On November 2, the company announced its third quarter adjusted EPS increased 34.2% to -$0.25. Nanostring Technologies also experienced negative adjusted EPS, -$0.45, for the quarter. On November 3, Robert W. Baird downgraded the stock’s price target from $14.00 to $12.00. The company expects its full-year net loss per share to be between $1.86 and $1.99, an upgrade from the previously projected loss of $2.03–$2.20.

Larger companies remained on track. On November 2, Mettler-Toledo reported third quarter adjusted EPS of $4.36, an increase of 12.1%. The company’s strong adjusted EPS growth was driven by solid sales growth in its Lab and Industrial businesses as well as increased productivity. On November 3, Morgan Stanley upgraded the stock’s price target from $535.00 to $545.00. Mettler-Toledo stock price, however, fell 7.8% for the month, closing at $629.21. The company expects its adjusted EPS to increase by around 18%, yielding $17.50, an upgrade from the previously projected $17.25–$17.35.

However, share prices dropped for two life science companies this month. Pacific Biosciences recorded third quarter earnings on November 1, in which net loss totaled $22.0 million, a further increase from last year’s third quarter loss of $17.5 million. Adjusted EPS remained flat at -$0.19. Share prices for the month dropped 24.6% to $3.19.

Third quarter earnings for PerkinElmer were announced on November 6. Adjusted net income for the period amounted to $554.5 million, an increase of 7.7%. Adjusted EPS increased 7.4% to $0.73, beating analysts’ expectations of $0.72. For the full year, PerkinElmer expects adjusted EPS to be between $2.87 and $2.89. On November 3, Morgan Stanley upgraded the stock’s price target from $77.00 to $78.00. Stock price grew 1.9% to $73.68 for the month and is up 41.3% year to date.

On November 6, QIAGEN reported third quarter net income of $48.5 million, an increase of 39.3%. Adjusted EPS for the quarter rose 6.7% to $0.32, which fell in line with analysts’ expectations. On November 8, Deutsche Bank reiterated its “buy” rating for the stock. However, share prices fell 5.8% for the month, closing at $31.90.

Diversified Instrumentation Stock Index

For November, the Diversified Instrumentation Index rose 6.0% to 276.33. All companies’ share prices in the grew for the month, with Teledyne Technologies increasing the most at 9.6%. Conversely, Danaher shares experienced the least amount of growth at 2.3%. Overall, Index companies’ share prices increased in the mid- to high-single digits.

AMETEK share prices rose 7.7% to $72.69 for the month. Year to date, the company’s share price has advanced 49.6%. On November 7, AMETEK reported its third quarter earnings, delivering adjusted EPS of $0.66, an increase of 17.9%. Adjusted EPS also beat analysts’ expectations of $0.62, driven by strong organic sales growth and acquisitions. As such, the company raised its full-year guidance to $2.57–$2.58 from $2.46–$2.52. For the fourth quarter, AMETEK expects adjusted EPS of $0.66–$0.67, similar to this quarter. The company also announced quarterly dividends of $0.09 for the fourth quarter

On November 2, Teledyne Technologies announced net income of $69.0 million for the third quarter, an increase of 32.7%. The company’s adjusted EPS increased 25.0% to $1.90, surpassing analysts’ expectations of $1.57. As such, Teledyne raised its full-year adjusted EPS guidance from $6.15–$6.25 to $6.66–$6.71. In line with the good news, its share price for the month advanced 9.6% to close at $186.24.

International Stock Index

Asia Pacific indexes in IBO Stock Table all finished the month in positive territory, with the exception of Malaysia’s KLCI, which fell 0.4% to 1,717.86. Asia Pacific’s top gaining index was Japan’s Nikkei 225, rising 8.1% to 22,724.96. Following it was India’s Sensex 30, which increased 6.2% to 33,149.35. Overall, Asia Pacific indexes rose by mid-single digits.

Asian Pacific companies in IBO’s Stock Table ended November mostly in positive territory. Shimadzu’s share price gained 14.0% to close the month at ¥2,677 ($23.77 at ¥112 = $1), while JEOL’s share prices also experienced strong growth, advancing 9.7% to ¥656 ($5.83). But Japan’s Hitachi High-Technologies and Precision System Science, and Hong Kong’s Techcomp fell 1.5%, 0.6% and 3.8% for the month, respectively.

European equity markets in the Index ended on positive ground as well, with France’s CAC and Germany’s XETRA DAX growing the fastest. Both indexes grew near mid-single digits, at 3.3% and 3.1%, respectively. Gaining the least was Italy’s FTSE MIB and Switzerland’s SMI, up 0.4% and 0.9%, respectively. Overall, European indexes grew in low single digits.

The majority of the European shares in the IBO Stock Table finished the month in negative territory. Among UK stocks, Oxford Instruments fell the most, decreasing 7.1% to £8.83 ($11.95 at £0.74 = $1). Conversely, Scientific Digital Imaging’s share price grew the fastest, increasing 12.3% to £0.24 ($0.32). European shares in the Index outside the UK similarly experienced decreases, with only Biotage gaining 3.0% to close the month at SEK 76.75 ($9.16 at SEK 8.38 = $1).