Laboratory Equipment: Life Science Techniques Shine

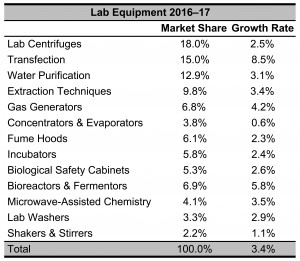

Within the laboratory equipment segment, IBO includes lab centrifuges, transfection solutions, water purification systems, extraction techniques, gas generators, concentrators and evaporators, fume hoods, incubators, biological safety cabinets, bioreactors and fermenters, microwave-assisted chemistry, lab washers, and shakers and stirrers. Even though these products do not take analytical measurements, they remain essential tools for laboratory scientists, and some even directly contribute to instrument sample preparations and techniques. In 2016, total lab equipment sales exceeded $4.2 billion. This year, this market is expected to grow 3.4%, driven by transfection, and bioreactors and fermenters.

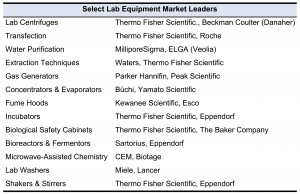

Thermo Fisher Scientific is the clear market leader for lab equipment. Holding a 19% market share, the company offers 9 out of 13 of the aforementioned types of equipment. In particular, the company is a market leader in lab centrifuges, transfection, extraction techniques, incubators, biological safety cabinets, and shakers and stirrers. The second place vendor is MilliporeSigma, with 9% of sales. Most of MilliporeSigma’s revenues come from water purification.

In terms of market share, MilliporeSigma is followed by Eppendorf, Parker Hannifin and Sartorius, each of which hold 3% of total demand. There are only three types of lab equipment projected to grow by more than 4% during the year. Transfection sales comprise 15% of the market and are expected to grow high single-digits, propelled by therapeutic applications and cell-based gene-transfer protocols. Here, transfection viral vector methods are driven by clinical lab demand, while chemical methods are driven by academic demand.

Bioreactors and fermenters are also expected to experience healthy growth, fueled by single-use systems and consumables. As much of this market is attributable to life science applications, a robust pharmaceutical and biotechnology sector is mostly responsible for the performance. Gas generators will likely experience mid-single digit growth due to solid demand from environmental testing labs and the pharmaceutical industry.

Techniques in the remaining portion of the lab equipment segment are expected to grow at a low single-digit rate this year, if not remain flat altogether. With 18% of the market, lab centrifuges will experience modest growth driven largely by the pharmaceutical and biotech sector, particularly in Asia. Water purification is mostly driven by clinical-based systems. Extraction techniques will be fueled by testing in pharmaceutical and clinical research. Although the pharmaceutical and biotech end-market will undoubtedly prove a solid source of demand for microwave-assisted chemistry, growth for this technique is also largely attributable to increased demand from environmental and food testing labs, where its speed and ease of use are helping grow the market.

The concentrators and evaporators market is generally reserved for niche process development and scale-up applications in various manufacturing industries, where demand is largely stagnant. Due mostly to their ubiquity, growth will be similarly flat for shakers and stirrers. The growth of other product segments, including fume hoods, incubators, lab washers and biological safety cabinets, is generally tied to the rate of new lab construction.