Third Quarter Financial Results: Danaher, Illumina, PerkinElmer and Thermo Fisher Scientific

Life Sciences Boost Danaher Results

Danaher reported third quarter revenues of $4,528.3 million, a 9.5% increase. Operating margin remained unchanged at 16.9%, maintained by higher core sales volume, continued productivity improvement and a weakened US dollar. Overall, currency exchange rates positively affected sales by 1.0% while acquisitions added 5.5% to sales growth. As such, company sales grew 3.0% organically for the quarter.

Danaher’s Life Sciences segment (LS) generated $1,392.6 million in revenue, signifying a 5.1% gain. Organically, segment sales advanced 3.1%. Operating profit also experienced improvement, growing 20.6% to $246.8 million. Additionally, operating margin increased by 2.3 percentage points to 17.7% due to the continued reduction of costs.

Beckman Coulter Life Sciences (BCLS) recorded organic revenue growth in the high single digits for the quarter. The business experienced strong revenue growth due to continued expansion across all major product lines and regions. BCLS’ automation revenue was boosted by continued demand for Biomek i-Series Workstations. Additionally, the business’ flow cytometry sales were lifted by improved CytoFLEX sales. Strong demand in North America, China and Western Europe also bolstered sales for flow cytometry products.

Leica Microsystems’ organic sales growth was led by positive growth in North America and Western Europe. The increased strength in the applied and medical end-markets also lifted segment sales. Overall, the business delivered mid-single digit organic revenue for the quarter.

Similarly, SCIEX MS organic revenues also rose mid-single digits, with especially strong growth in China and Western Europe. The segment’s applied end-market sales were led by food and forensic testing, while the pharmaceutical end-market sales were driven by China’s raised regulatory requirements in pharmaceutical testing.

Organic growth for Pall, however, declined due to the impacts of the recent hurricanes in Florida and Puerto Rico. Even so, Pall’s microelectronics and single-use businesses presented strong growth for the quarter, along with double-digit growth in its biopharma business. For the fourth quarter, the company expects Pall’s organic revenue to improve substantially as the business regains traction and moves past the hurricanes’ negative impacts.

For Danaher’s Environmental and Applied Solutions segment (EAS), sales grew 8.0% to $992.9 million. Currency exchange rates and acquisitions positively impacted sales by 3.0% and 2.0%, respectively. Overall, organic sales advanced 3.0% for the quarter. Operating profit for the segment fell 0.3% to $222.8 million, leaving operating margin at 22.4%. down 1.9 percentage points. EAS’ margin decline came primarily from the negative impacts of recent acquisitions and investments.

Organic revenue for EAS’ water quality business grew in low single digits for the quarter, supported by solid demand in China and Western Europe. However, sales growth was held back by weakness in Latin America. Hach’s organic revenue also increased by low single digits, driven by a healthy performance in its core municipal and industrial end-markets. Continued advancement in China also added to Hach’s steady organic growth.

For the fourth quarter, Danaher expects its organic growth to accelerate.

Illumina Lifts Full-Year Revenue Guidance

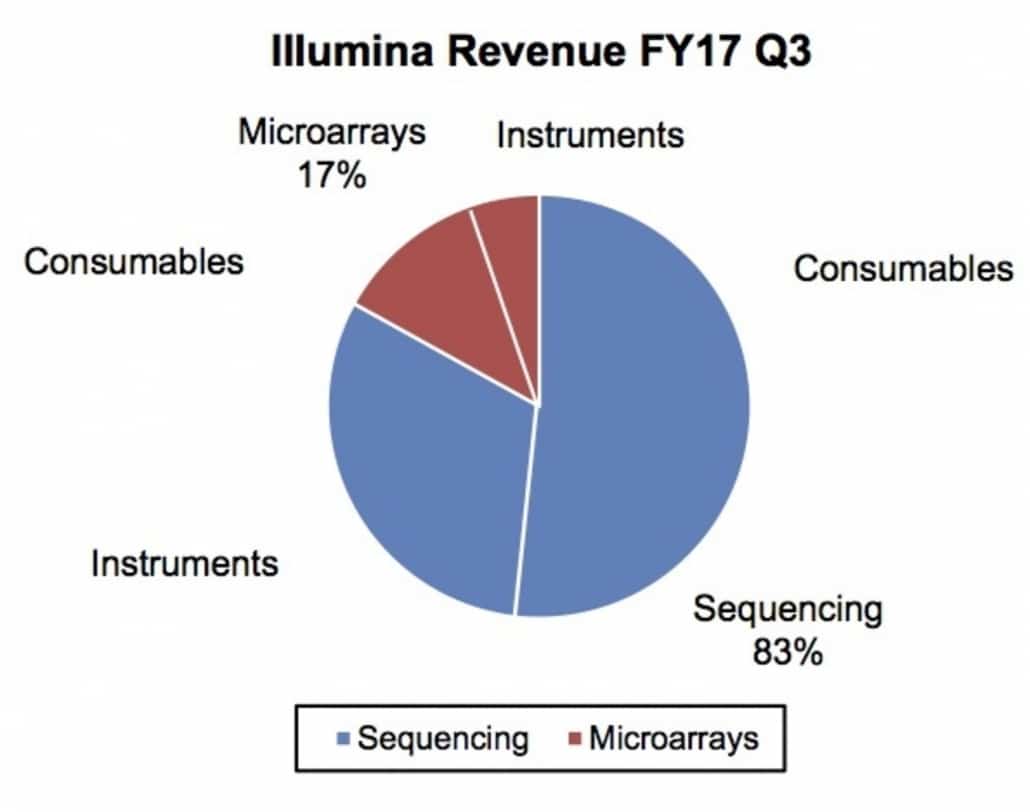

Illumina’s third quarter revenues surged 17.6% to $714.0 million, largely driven by revenue growth across both its sequencing and microarray portfolios. In particular, strong growth in sequencing consumables and instruments, along with a solid performance in microarrays, lifted the company’s sales growth. Shipments to the company’s clinical customers rose 35%, driven by liquid biopsy customers. Gross margin, however, fell 2.7 percentage points to 67.5%, primarily due to lower instrument margins from the NovaSeq.

Consumables sales increased 13.9% to $451.0 million, driven by growth in the sequencing installed base. Between the two consumables type, sequencing and microarrays, sequencing consumables sales increased more, up 14.1% to $380.0 million. Sequencing consumables’ strong increase came from growth in the company’s installed base and NextSeq utilization. Also, HiSeq consumables provided better-than-expected revenue, as sales increased sequentially, driven by large clinical commercial customers. Microarray consumables sales also grew in double digits, increasing 12.7% to $71.0 million.

The company reported that around 200 NovaSeq systems are in place as of the third quarter. In the third quarter alone, around 80 NovaSeq systems were delivered to customers. To the company’s expectations, the majority of NovaSeq orders this quarter came from existing HiSeq customers. Also, NovaSeq shipments increased sequentially, as expected, and will continue to do so as manufacturing capacity constraints have decreased. HiSeq X sales recovered slightly, on a sequential basis, due to increased sales for translational studies and growth in China. However, both HiSeq X and HiSeq consumables are expected to decline in the coming quarters as more customers switch to NovaSeq.

Diagnostic Sales Lead PerkinElmer’s Growth

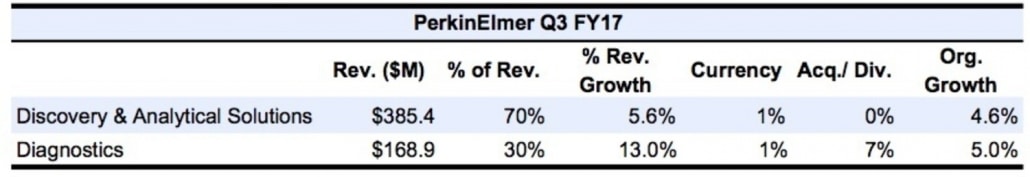

Third quarter revenues for PerkinElmer increased 7.7%, 4.6% organically, to $554.3 million(see Bottom Line). In specific, the company’s Discovery & Analytical Solutions segment (DAS) revenue increased $20.3 million, while its Diagnostics segment increased its revenue by $19.5 million.

Sales for DAS increased 5.6% to $385.4 million, representing 70% of total company sales. Currency exchange rates positively impacted sales by 1%, while acquisitions had no impact. As such, organic sales growth for the quarter was 4.6%. DAS adjusted operating income and margin for the segment was $62.2 million and 16.1%, representing a 5.2% increase and 10 basis points decrease, respectively.

Overall segment growth was driven by strong growth in the food, pharma and biotech, and environmental end-markets. Also, new product introductions, as well as an improving macro environment, added to segment growth. The segment experienced solid sales growth due to a $15.7 million increase in its OneSource laboratory service sales, as well as a $7.9 million increase in its environmental, food and industrial market sales. However, the segment continued to post declining sales of radioactive reagents in its radio-nucleotide business.

PerkinElmer’s Diagnostics segment experienced significant sales growth of 13.0% to $168.9 million for the quarter. Sales were in line with company expectations as organic revenue grew 5.0% to account for 30% of total company sales. Exchange rates and acquisitions positively impacted sales by 1% and 7%, respectively. Segment adjusted operating income for the quarter was $56.7 million, a 12.3% increase. Despite the increased operating income, adjusted operating margin fell 30 basis points to 33.5%.

The segment’s sales growth for the quarter was driven primarily by continued expansion of the newborn and infectious disease screening business. Furthermore, the segment’s clinical labs business also experienced strong growth, along with the Tulip business, predominantly operating in the Indian market. Overall segment growth was accelerated by the company’s emerging markets diagnostic offerings, along with its applied genomics solution sales. Additionally, sales growth in the advanced genomics front-end sample prep business was especially robust in the Americas.

Geographically, all major regions sustained robust organic revenue growth for PerkinElmer, as Asia led with high single-digit growth. China led the region’s increase, delivering mid-teen percentage growth. The Americas produced mid-single digit sales growth, with healthy growth across all areas. Europe had low-single digit organic sales growth, with particular strength in pharmaceuticals. Europe’s industrial end-market performance started to show signs of recovery, with the food end-market still robust.

By end-market, food sales growth was very strong, advancing over 20% for the quarter. The main drivers for the food business came from Perten, along with a particularly strong performance from recently introduced products. Pharmaceutical & biotech sales were driven by a strong performance from OneSource. Environmental and industrial end-market sales both grew low-single digits, as positive growth in Asia and the Americas was offset by falling sales in Europe. In the academic end-market, sales also rose low-single digits as it began to recover from a slow start to the year.

For the fourth quarter, the company expects revenues to be $613–$618 million, signifying a 4%–5% organic growth. With its fourth quarter guidance projected, PerkinElmer expects its full-year organic revenue growth to be on track at 4%.

Thermo Fisher Scientific’s Analytical Instruments Revenue Up Double Digits

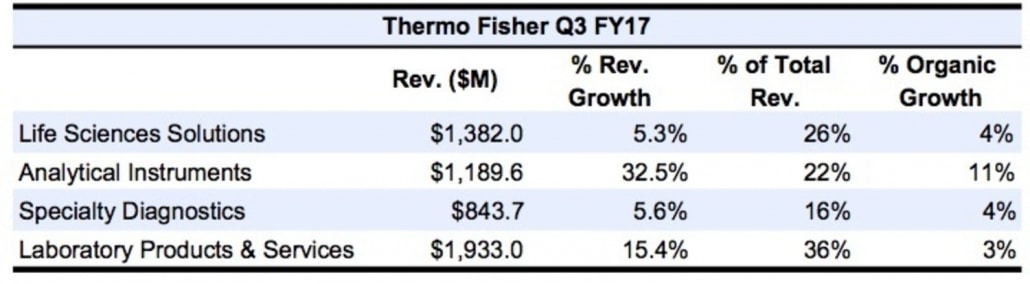

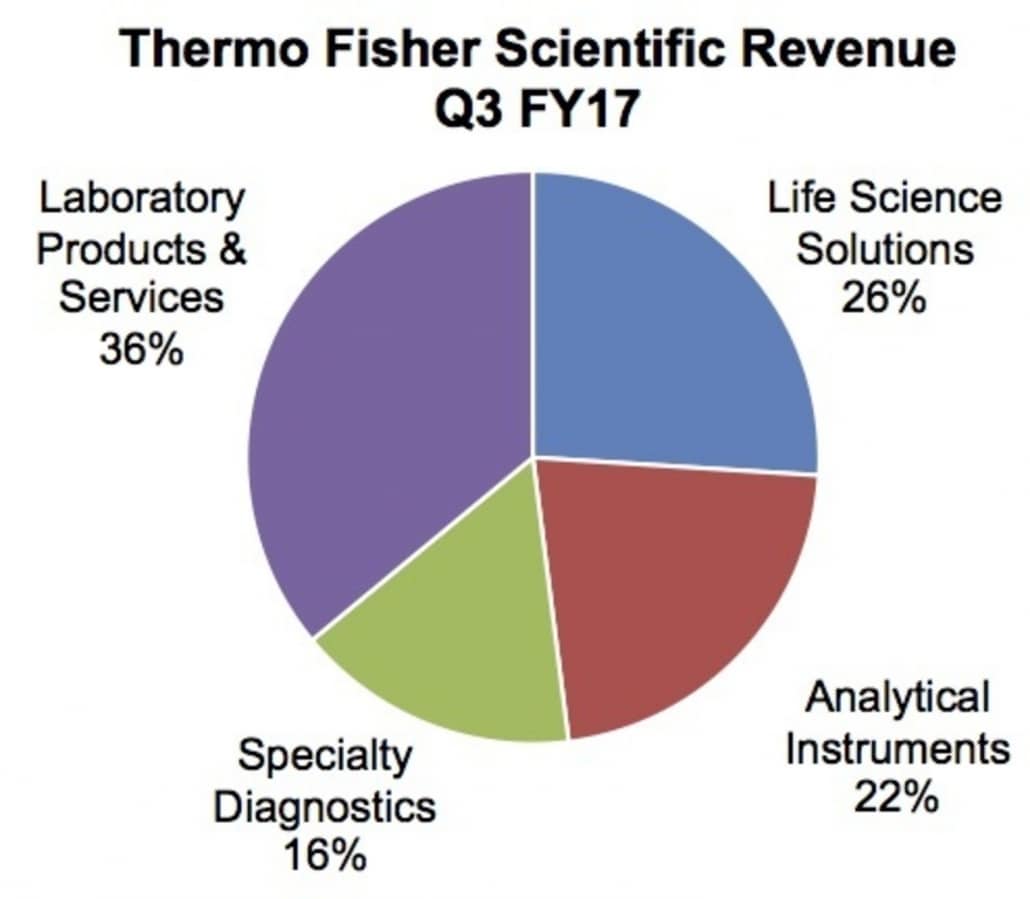

Third quarter sales for Thermo Fisher Scientific advanced 13.9% on a reported basis to $5,116.2 million. Organic sales beat company expectations, rising 5.1% due to increased demand from all end-markets, along with strong operational execution. Currency effects positively impacted sales by 1%, while acquisitions added 8% to sales. In dollars, this translates to a $44 million bump to sales due to currency effects and a $378 million addition in sales due to acquisitions. Third quarter operating income rose 17.6% to $636.0 million while operating margin also grew, up 40 basis points.

Thermo Fisher’s Life Sciences Solutions segment (LSS) experienced an increase of 5.3% in revenue, raising sales to $1,382.0 million. Segment revenue increased $70 million, with $56 million coming from existing businesses, $9 million from positive currency effects and $5 million due from acquisitions. Organically, segment sales rose 4%, primarily driven by increased demand for biosciences, genetic sciences and bioprocess production products. LSS’ third quarter adjusted operating income grew 16.8% to $453.0 million, lifting adjusted operating margin by 3.2 percentage points to 32.8%. Operational profit grew in large part due to productivity improvements, volume pull-through, and price increases.

The Analytical Instruments segment’s revenue vaulted 32.5% to $1,189.6 million largely due to acquisitions. FEI delivered double-digit sales growth in the third quarter, as the electron microscopy product line, part of the materials science business, grew alongside the segment’s chromatography and MS businesses. Additionally, the segment’s chemical analysis business continued to show growth, back on track with expectations. Organic revenue also increased in the double digits, up 11%, primarily driven by increased sales in the materials and structural analysis business. Adjusted operating margin grew 35.0% to $256.6 million, driven by the company’s PPI Business System and acquisitions. Adjusted operating margin also grew, up 40 basis points to 21.6%.

In the Specialty Diagnostics segment, sales grew a healthy 5.6% to $843.7 million. In dollar amounts, sales increased $32 million from existing businesses, $10 million from favorable currency effects, and $4 million from acquisitions. As such, organic revenue growth increased 4%, driven by strengthened sales of immunodiagnostics products and increased sales from the health care market channel. Segment adjusted operating income grew 2.1% to $218.8 million, while adjusted operating margin decreased 90 basis points to 25.9%.

Laboratory Products & Services (LPS) segment revenue advanced 15.4% to $1,933.0 million, accounting for 36% of total company revenue. LPS sales increased a total of $259 million, for which acquisitions represent $192 million of the increased sales. Organically, however, sales only grew 3%, driven by the segment’s channel business. Adjusted operating profit inched higher by 1.4% to $243.4 million. Yet adjusted operating margin fell 170 basis points to 12.6%, as a result of the weakened clinical trial business.

By end-market, pharmaceutical and biotech sales grew in the mid-single digits. Academic and government sales were also up in mid-single digits, as strong growth in China and Europe sales. In the industrial and applied end-market, sales grew in the mid-single digits due to continued strength in the Asia-Pacific. Diagnostics and healthcare sales grew by low-single digits, but flat for the year.

Geographically, the Asia Pacific region continued to produce a strong quarterly sales performance, up low-double digits, with China’s sales increasing in the high teens. South Korea and India also delivered robust growth as well. European sales grew in the mid-single digits, while sales in North America grew in the low-single digits. Additionally, sales in the US have begun to recover slowly.

For the full year, Thermo Fisher raised its revenue guidance to $20.50–$20.66 billion from the previously projected $19.71–$19.89 due to the addition of Patheon (see IBO 5/15/17), a strong quarterly performance and more favorable currency effects. The new guidance reflects a 12%–13% growth in revenue.

Healthy Gains for Waters in Third Quarter

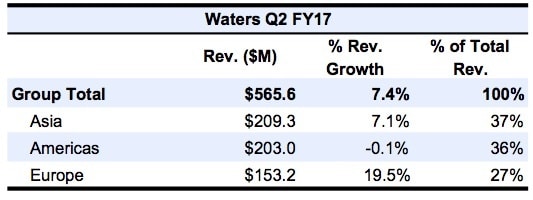

Waters delivered third quarter sales growth of 7.4%, lifting sales to $565.6 million. Currency effects positively impacted sales by 1%, while acquisitions added little to sales. Operating income increased 5.0%, primarily driven by higher sales volume and controlled spending.

By end market, pharmaceutical sales increased 7.0% on a reported basis and 5.0% on a constant currency basis. Pharmaceutical sales were mainly driven by strength in large molecule and biomedical research applications. However, revenues were negatively affected by the declining sales in the US. Industrial end-market sales grew 6.0% on a reported basis, 5.0% in constant currency, led by strong growth in material characterization. Additionally, increasing needs for food quality and safety also helped lift industrial sales for the quarter. In the governmental and academic end-market, sales rose 15.0% on a reported basis due to increased spending by academic institutions. On a currency neutral basis, governmental and academic sales increased 13.0%.

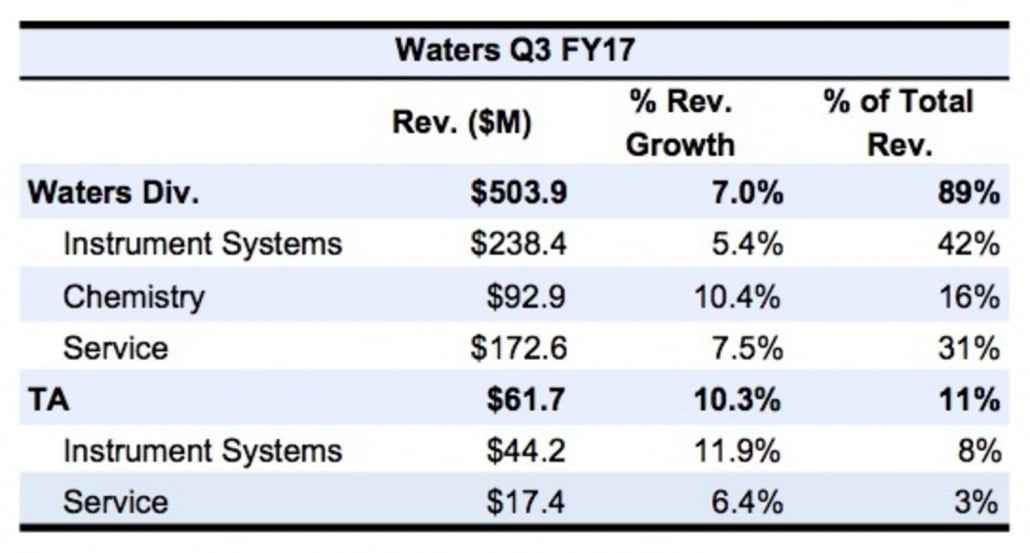

Waters Division segment sales advanced 7.0% to $503.9 million. On a constant currency basis, sales rose 6.0%, driven by Waters chemistry sales. Waters Division’s product and services revenue grew 6.2% to $411.0 million. Instrument system revenue, which increased 5.4%, 4.0% on a constant currency basis, to $238.43 million, was primarily driven by strong sales of LC instrument systems, along with other LC MS systems. Additionally, the segment’s benchtop LC tandem mass spec systems, the GVO TQXS and GVO TQX Micro, added to instrument sales growth. Recurring revenues, service sales and chemistry sales together, grew 8.0% and accounted for 50% of segment revenue. The recurring revenues’ growth was driven by HPLC and UPLC application kits. Service revenue rose 7.5% due to higher sales of service plans and service demand billings. Waters Division’s chemistry sales grew the most, increasing double digits, up 10.4% to $92.9 million. Chemistry consumable sales were higher due to continued demand for application-specific testing kits. Geographically, Waters sales in Asia increased 7.1%, 8.0% in constant currency, to $209.3 million due to strong pharmaceutical and industrial sales in China. However, sales in India were negatively impacted by lower customer demands. Sales in Europe leaped 19.5%, 13.0% in constant currency, to $153.2 million primarily driven by strong demand from pharmaceutical customers. Sales in the Americas were flat, with sales in the US increasing 1.0% for the quarter. Sales in the rest of the world fell 7.0%, negatively impacted in part by the recent natural disasters.

For Waters’ TA segment, sales grew in double digits, increasing 10.3% to $61.7 million. On a constant currency basis, segment sales rose 9.0%, driven by the company’s new Discovery line of thermal analyzers. High-temperature thermal systems also added to the segment’s strong quarterly performance. TA instrument sales advanced 11.9% to $44.2 million, while TA service sales grew 6.4% to $17.4 million. Together, overall TA sales account for 11% of total company revenues. Geographically, TA sales in Asia increased 19.0%, driven by strong sales growth in China. Sales in Japan, however, fell 1.0% due to unfavorable currency effects. In the US, TA sales increased 10.0%, while in Europe, sales rose 11.0%. However, TA sales for the rest of the world fell 32.0%.

For the fourth quarter, Waters expects reported sales to increase between 5% and 8%, given the company’s currency neutral guidance of 3%–5% sales growth along with a positive 2%–3% currency effect. For the full year, the company expects constant currency sales to be 5%–6%, unchanged from the previous guidance.