Regional Forecast: India Drives Sales Growth in Life Science Markets

Current indications are that India will have the strongest regional market for life science and analytical instrumentation and lab products in 2017, with growth forecast at 7.5%, followed closely by China at 6.8%. Both countries continue to develop rapidly with private and public investments, but the Chinese market has grown to such a size that it becomes harder to support such high growth rates as it had in the past. India’s pharmaceutical and biotechnology industry, including generics, continues to increase demand for instrumentation from research to quality control. Improving commodities prices will also help the Indian chemicals and polymer industry. Other Asia Pacific countries will also provide above average opportunities.

Despite current uncertainties regarding the new administration in the US, the US and Canada should post solid growth of 5.0%. In contrast, European growth is expected to lag behind the global average. The situation in Japan continues to slowly improve, but currency effects are expected to erode gains, holding the country to growth of 2.5%. Latin America and the Rest of World are forecast to experience positive, albeit lackluster, growth.

Macroeconomic Growth

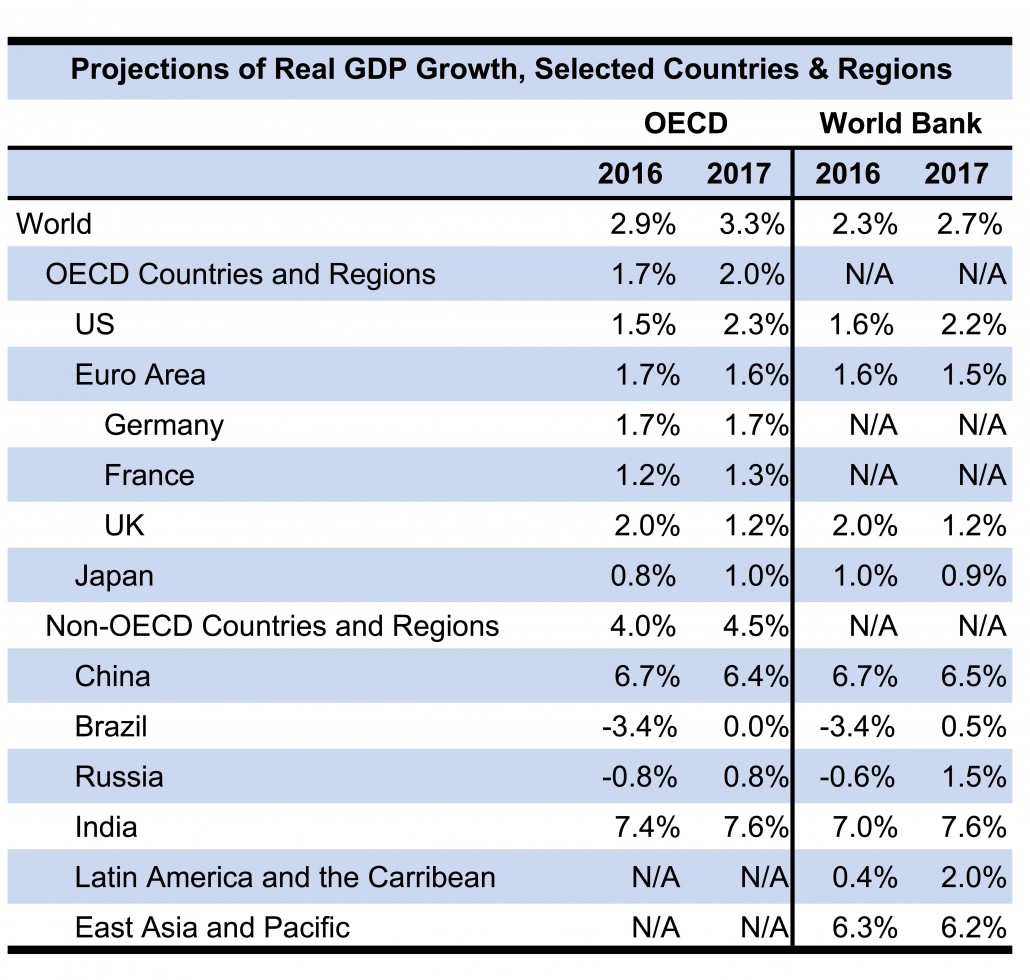

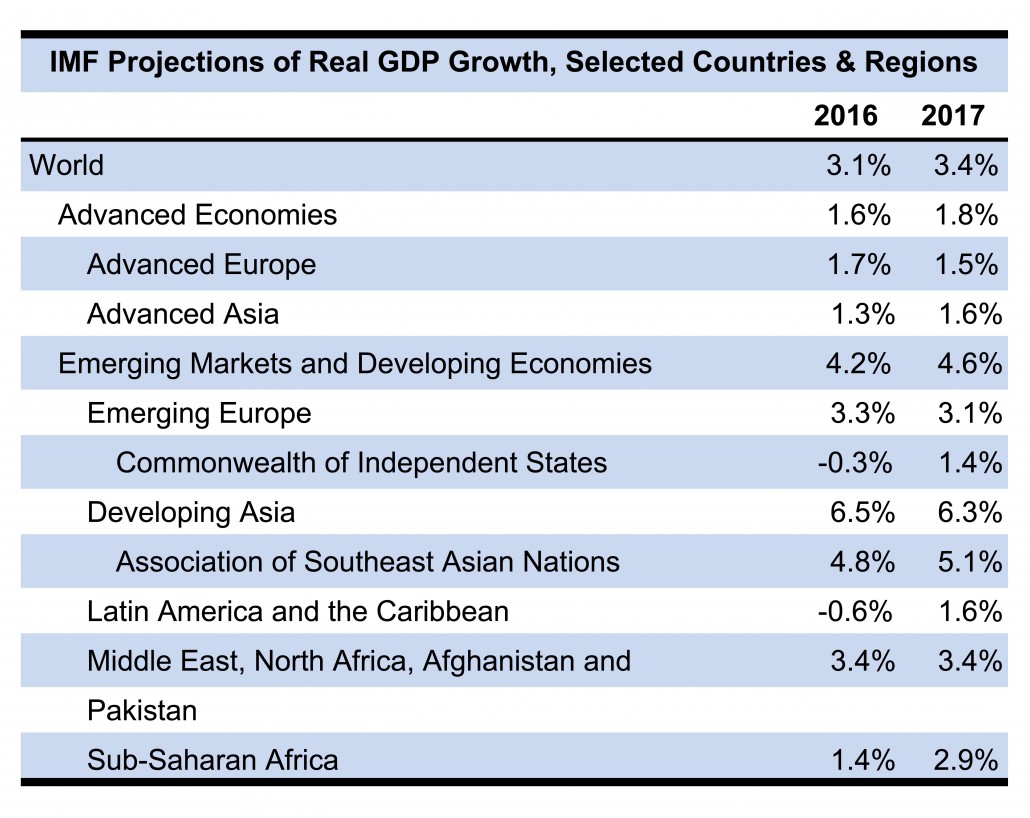

Growth in investments in emerging markets and developing economies declined to 2.9% in 2016, yet the global economic growth rate for 2017 is approximately 3.0%, according to major international economic organizations. Modest improvements in global GDP are forecast for 2017 in most countries and regions, based on projections by the International Monetary Fund (IMF), the Organization for Economic Cooperation and Development (OECD) and the World Bank (see tables).

According to the World Bank, weak investments around the globe are affecting GDP growth, although small upturns are predicted. Data indicate that growth in advanced economies (the US, Euro Area, Japan and the UK) will increase 1.8%, while growth in emerging market and developing economies (East Asia and the Pacific, Europe and Central Asia, Latin America and the Caribbean, Middle East and North Africa, South Asia and Sub-Saharan Africa) will grow 4.2%.

The OECD echoes the World Bank’s analyses in November 2016’s “Global Economic Outlook,” with data indicating that weak private investments, slowing public investments and collapsing world trade are affecting global GDP. Similarly, the IMF cites political and economic uncertainties around the globe, such as Brexit, as being the causes of weakened investments.

Duke/CFO Survey Results

In December 2016’s “Global Business Outlook,” Duke University’s Fuqua School of Business and CFO magazine surveyed approximately one thousand senior financial officers around the globe, including 367 from North America, 192 from Asia, 169 from Europe, 126 from Latin America and 99 from Africa. For the first time in almost 10 years, the survey’s Optimism Index for the next twelve months has hit its highest score of 66/100; historically, a high score on the Optimism Index has correlated to growth in employment and GDP in the coming year. In the US, economic uncertainties, regulatory requirements, access to capital, and the attraction and retention of employees are amongst the top concerns for businesses. Weighted average projections for capital spending and R&D are divided into global regions below.

European CFOs generally have a positive economic outlook, but it does not translate to a higher level of optimism, as corporate debt over the last three years has made many European companies vulnerable to more financial risk. Because of this, European capital spending and R&D expenditures are forecast to grow marginally at 2.7% and 2.1%, respectively, in 2017.

In Asia, CFOs forecast capital spending growth of 6.8% and business spending to be quite positive in the region. Executives in China, India, Singapore, Malaysia and Vietnam anticipate the largest increases in capital spending. Asian R&D expenditures are estimated to grow 5.1%. Japanese companies expect R&D spending to grow 2.5%, but capital spending to decrease 5.4%.

Latin American firms estimate capital spending to rise 3.3% and R&D spending to grow 2.7%. CFOs in Brazil predict capital spending to jump 7.9% in 2017, with R&D expenditures growing 5.2%. Capital spending is estimated to decrease 0.7% in Mexico, while R&D spending is predicted to remain flat.