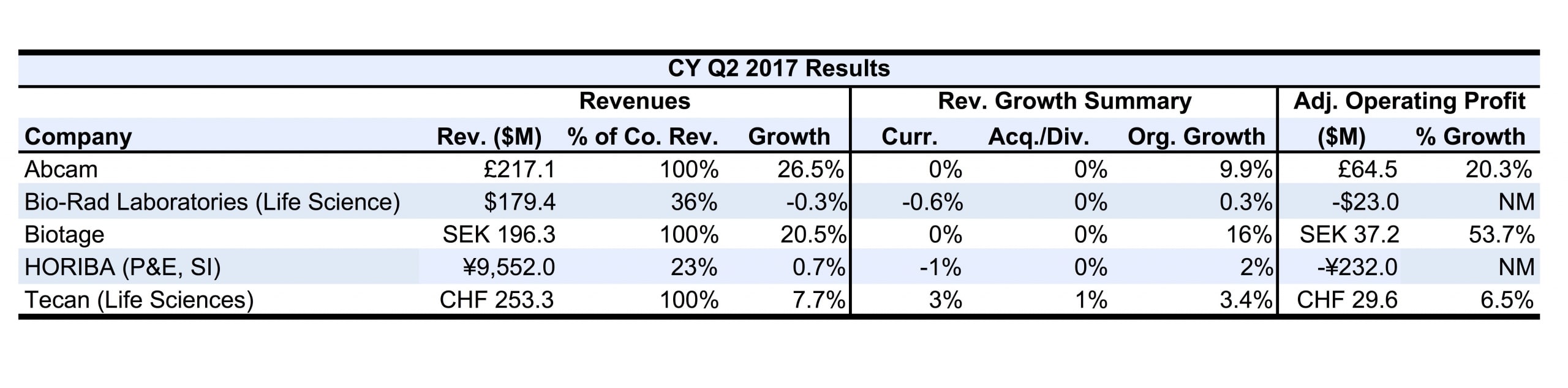

Second Quarter Results: Abcam, Bio-Rad, Biotage, HORIBA and Tecan

Fiscal Year Revenues Soar for Abcam

Abcam revenues for the fiscal year ending June 30 amounted to £217.1 million ($287.0 million at £0.76 = $1), advancing 26.5% on a reported basis and 9.9% on a currency neutral basis. Full-year currency neutral revenue growth matched expectations, meeting the company’s projected guidance of 9%–11%. Operating profit grew 14.3% to £51.9 million ($68.6 million), while its operating margin fell 2.6 percentage points to 23.9%.

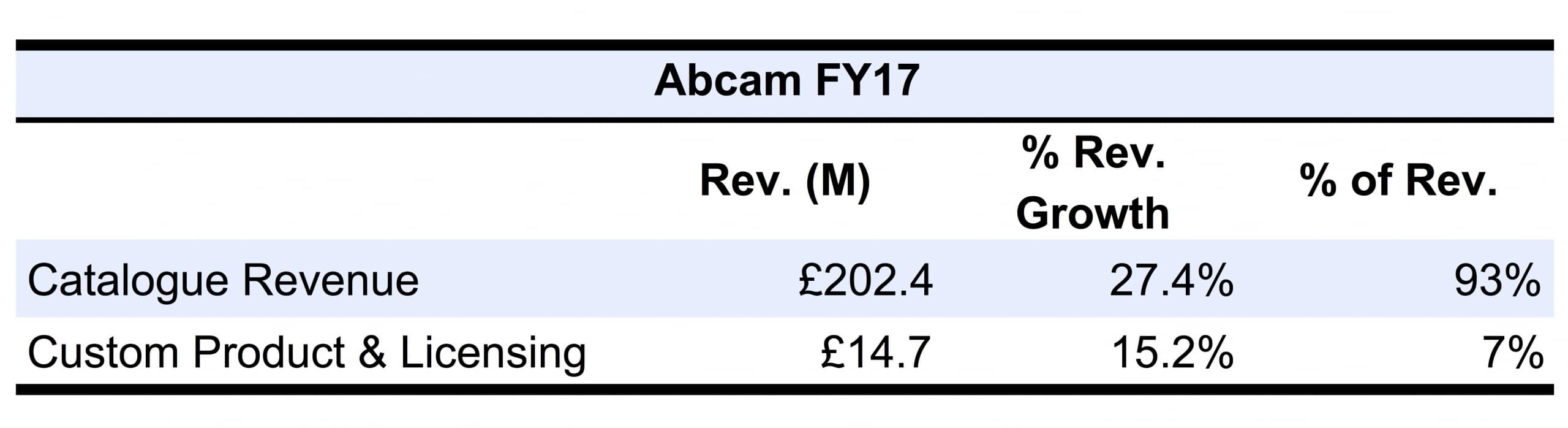

The company’s catalogue revenue increased 27.4%, 10.8% on a currency neutral basis, to £202.5 million ($267.7 million), accounting for 93% of total company revenues. Additionally, both primary and non-primary antibodies experienced double-digit revenue growth, advancing 25.9% to £159.8 million ($212.4 million) and 33.0% to £42.7 million ($56.7 million), respectively. On a currency neutral basis, their sales gained 25.2% and 15.6%, respectively.

Core primary antibody sales increased 20.7% to £118.3 million ($157.2 million), accounting for 74% of total primary antibody revenue. RabMAb primary antibody sales amounted to £41.5 million ($54.9 million), increasing 43.9% and accounted for 26% of total primary antibody revenue. RabMAb primary antibody revenue growth matched company expectations, even with the upgraded guidance of 23%–27% growth from March this year. Non-primary antibody revenue also grew at the expected rate, between 15% and 20%, led by strong sales from the company’s kits and assays. In particular, the SimpleStep ELISAs provided robust sales. Overall, kits and assays represented around 60% of total non-primary antibody sales.

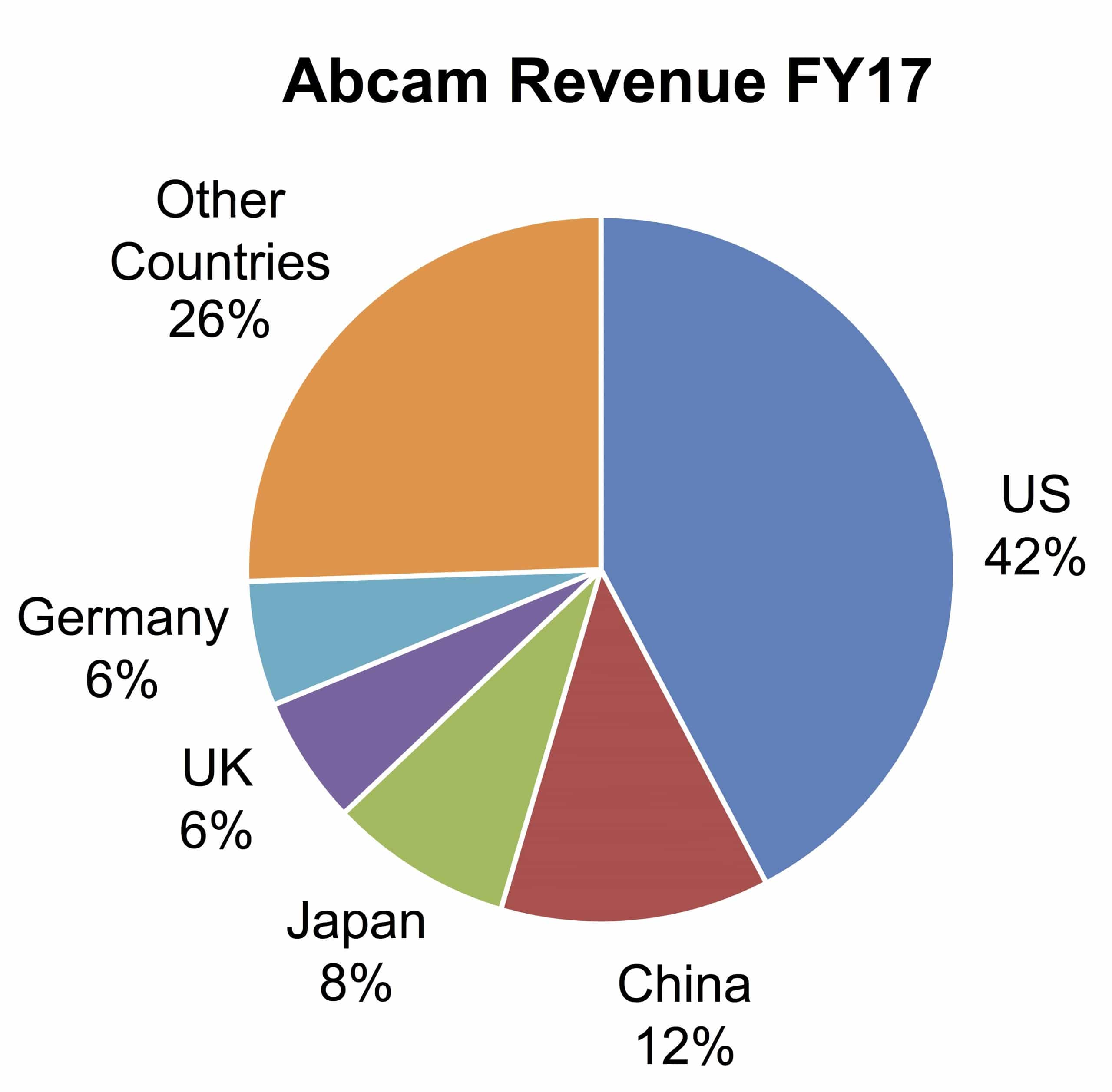

Geographically, all regions recorded double digit-growth in revenues, with Japanese sales vaulting 47.4% to £18.1 million ($23.9 million). Sales in China, the company’s second largest market, also increased considerably, growing 41.6% to £26.7 million ($35.5 million). US sales advanced 19.5% to £91.8 million ($121.4 million) and accounted for the largest portion of company revenues at 42%. Revenues for the UK and Germany were nearly identical, with the former increasing 12.9% to £12.6 million ($16.7 million) and the latter leaping 33.4% to £12.4 million ($16.4 million). As for the rest of the world, sales grew 28.3% to £55.4 million ($73.2 million).

For fiscal 2018, the company is targeting 20%–25% growth each for its recombinant antibody and immunoassay revenues. The company expects revenue growth for fiscal 2018 to be similar to that of fiscal 2017.

Bio-Rad Revenues Slip for Second Quarter

Second quarter revenue for Bio-Rad Laboratories’ Life Science segment (LS) decreased slightly by 0.3% to $179.4 million. On a currency neutral basis, revenue instead increased 0.3%, driven by strong sales of Droplet Digital PCR. Acquisitions further added to sales as recently acquired RainDance Technologies (see IBO 1/31/17) provided solid growth. However, segment sales were slightly offset by a decline in process chromatography media sales of approximately $8 million, along with unfavorable customer ordering patterns. The segment’s gross margin decreased 1.9 percentage points, driven down by lower cell biology, food science and gene expression margins. Overall, Life Science segment revenue accounted for 36% of company sales.

Geographically, only LS sales in North America and the Asia Pacific region, excluding Japan, increased, with China experiencing particularly strong sales growth. Conversely, in both Europe and Latin America, sales declined. ERP deployment in Europe primarily drove sales down for the region, negatively impacting sales by $3–$4 million.

For the full year, Bio-Rad reaffirmed its currency neutral sales growth of 4%. The company believes RainDance could also add up to 1% to sales. However, the company lowered its operating profit growth target to 6%–6.5% from 7%, due to lower-than-expected operating profit in the first half.

Biotage Produces Strong Second Quarter Revenues

Second quarter sales for Biotage advanced 20.5% to SEK 196.3 million ($24.3 million at SEK 8.07 = $1). On a currency neutral basis, sales rose 15.9%, while gross profit increased 7.3% to SEK 121.0 million ($15.0 million). Gross margin for the quarter advanced 4.5 percentage points to 61.7%, and also grew sequentially by 80 basis points. The strong growth in gross margin was largely driven by increased sales volume, along with higher production efficiency. Operating profit increased 53.7% to SEK 37.2 million ($4.6 million), as operating margin grew 4.1 percentage points to 18.95%. Overall, system and aftermarket product sales accounted for 49% and 51% of company revenues, compared to 45% and 55% in the previous year, respectively.

For the quarter, all product areas experienced healthy sales growth. Sales of peptide synthesis, evaporation systems and industrial products were especially strong. System sales for organic synthesis continued to show strength, while industrial products, including systems and consumables, also experienced healthy sales growth.

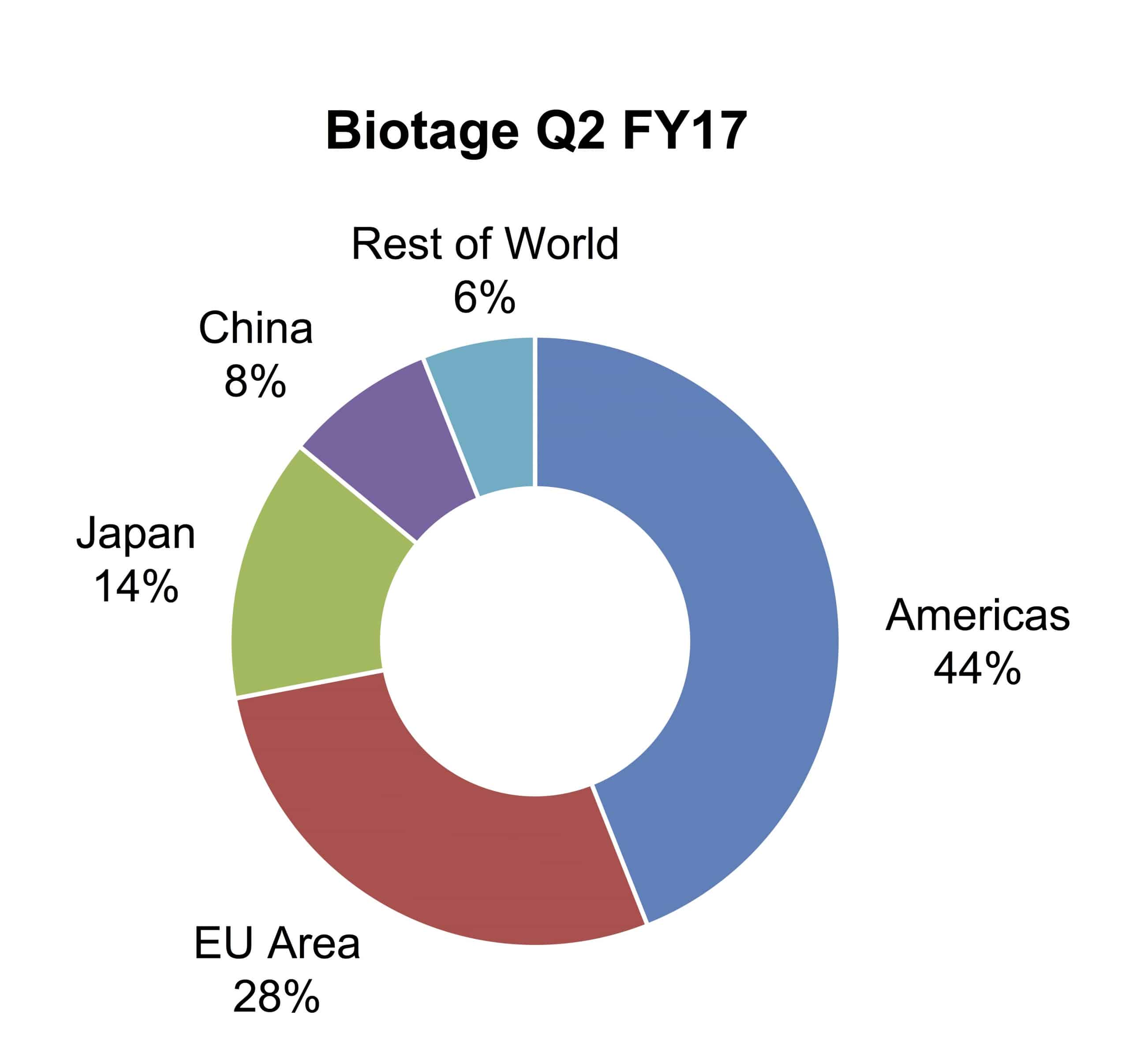

Geographically, all regions experienced double-digit sales growth. Asia performed the best, driven by strong sales in South Korea, China and Japan. China’s solid sales growth for the quarter was largely driven by systems sales. Direct sales contributed much to South Korea and China’s sales growth.

Overall, the Americas accounted for 44% of total company revenues, up 1 percentage point, to become the company’s largest market segment. The European region amounted to 28% of company sales, falling 2 percentage points, to account for the company’s second largest market segment. Conversely, Japan advanced 2 percentage points to 14% of company sales. China fell 1 percentage point to 8%, while South Korea rose 1 percentage point to 3%.

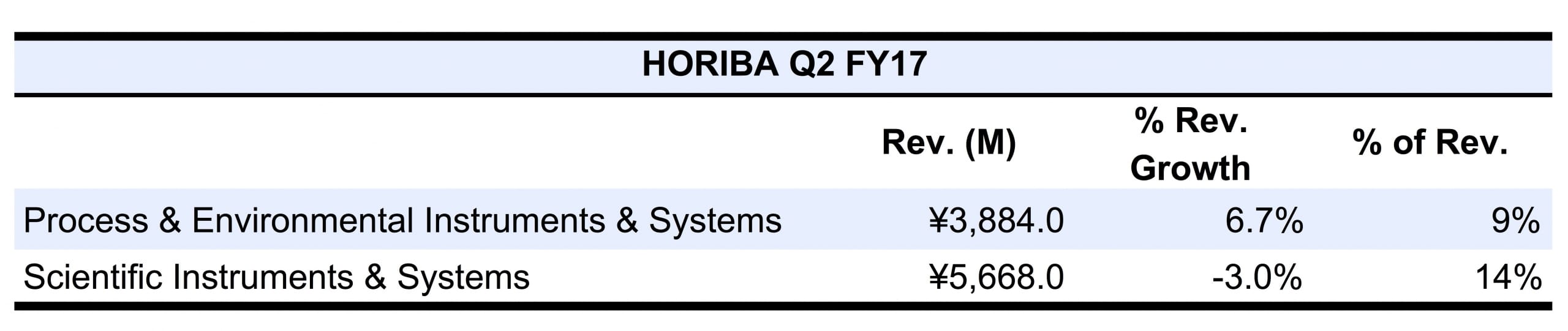

Second Quarter Sales Flat for HORIBA

Second quarter revenue for HORIBA’s Process & Environmental Instruments & Systems (P&E) segment grew 6.7% to ¥3,884.0 million ($34.5 million at ¥112.4 = $1), accounting for 9% of total company revenues. The segment’s operating income totaled ¥147.0 million ($1.3 million), decreasing 26.5%. As for the first half, segment revenues grew 3.6% to ¥8,079.0 million ($72.2 million), led by increased demand for the company’s stack gas analyzers along with increased VOC-regulation related sales in China.

For HORIBA’s P&E segment, Japan accounted for the segment’s largest market at 61%. Japanese sales rose 9.6% for the first half, reaching ¥4,910.0 million ($43.9 million). As for the rest of Asia, sales jumped 41.9% to ¥1,370.0 million ($12.2 million), led by China’s strong performance. Sales in the Americas, however, fell 37.2% to ¥923.0 million ($8.21 million), accounting for 11% of total segment revenues. European sales decreased slightly by 1.0% to ¥874.0 million ($7.8 million), also accounting for 11% of segment sales.

HORIBA’s Scientific Instruments & Systems (SI) revenue fell 3.0% to ¥5,668.0 ($50.7 million), amounting to 14% of total company sales. The segment’s operating income fell into negative territory, from last year’s profit of ¥57.0 million ($0.5 million), to -¥379.0 million (-$3.4 million). First-half results followed the same trend, as segment revenue fell 6.9% to ¥11,513.0 million ($102.9 million), along with operating profit, which declined to -¥440.0 million (-$3.9 million). The segment’s sluggish performance was primarily due to poor sales to universities in Japan, US and Europe.

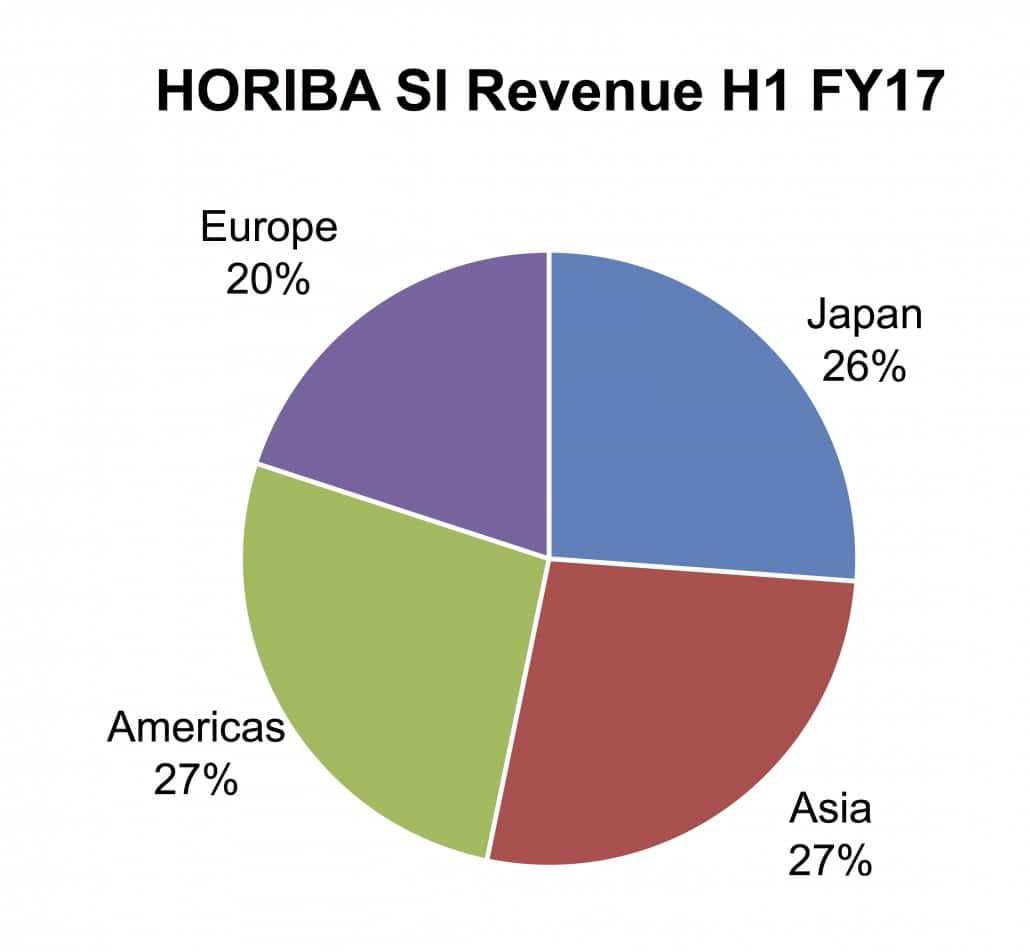

As for HORIBA’s SI segment, Americas and Asia were the two largest markets for the first half, each accounting for 27% of segment sales. However, sales growth between the two regions differed, as sales rose 4.3% and 1.2%, respectively. Each managed to reach sales of approximately ¥3.1 billion ($27.6 million). Japanese sales came in at ¥3.0 billion ($26.7 million).

For the full year, HORIBA projects P&E sales to be ¥18.0 billion ($160.1 million), unchanged from the previous guidance. Similarly, the SI sales forecast remained unchanged with an expected total of ¥25.0 billion ($222.4 million). The same follows for P&E and SI operating profit, for which projections remain unchanged at ¥1.1 billion ($9.8 million) and ¥0.5 billion ($4.5 million), respectively.

Life Science Division Lift Tecan Second Quarter Sales

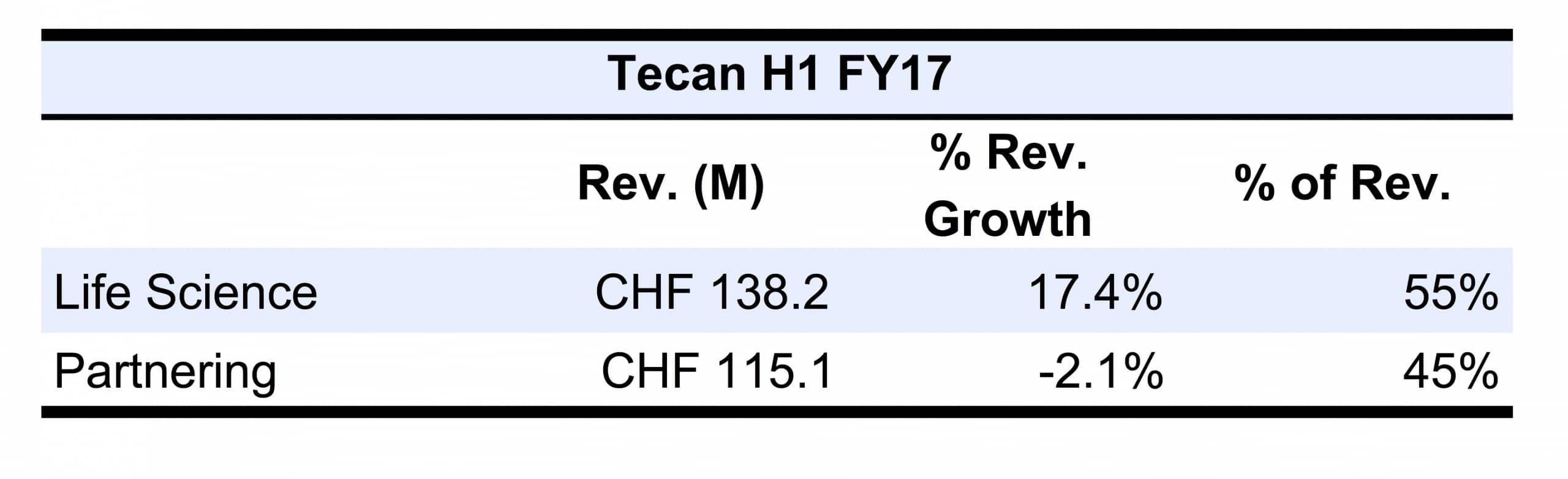

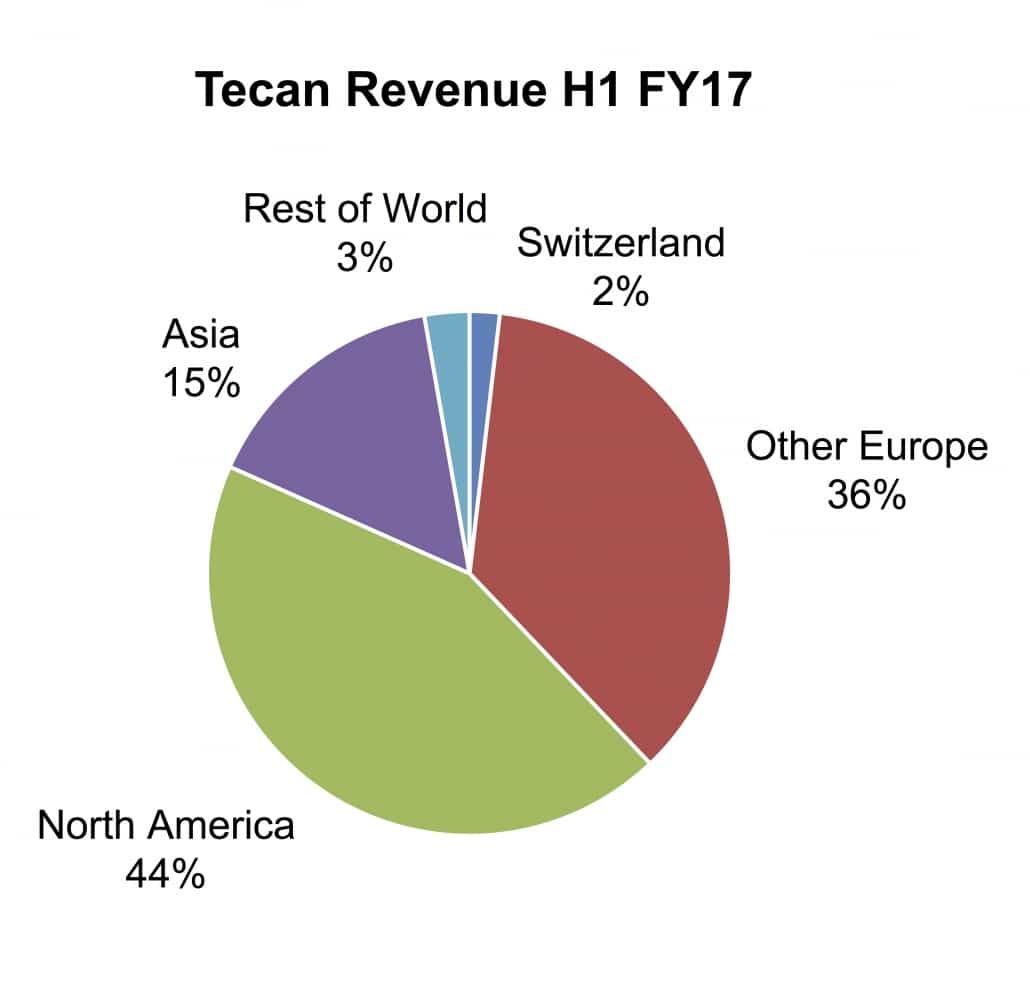

For the first half of 2017, revenues for Tecan increased 7.7%, 3.4% organically, to CHF 253.3 million ($259.74 at CHF 0.98 = $1). Order entries also grew notably, jumping 16.2%, 12.5% organically, to reach CHF 291.2 million ($299 million), exceeding sales. The company’s operating profit grew 6.6% to CHF 29.6 million ($30.4 million), lowering operating margin by 13 basis points to 11.7%.

Life Science sales advanced 17.4% to CHF 138.2 million ($141.9 million) for the first half. Organically, segment sales increased 9.5%, primarily driven by strong instrument platform and consumables sales. The segment’s operating profit vaulted 46.5% to CHF 17.8 million ($18.3 million) mainly from the large sales increase, along with higher efficiency gains. Operating margin improved to 12.4%, a 2.5 percentage point increase.

Tecan’s Partnering segment sales, however, fell 2.1% to CHF 115.1 million ($118.2 million) due to phased-out instrument platforms, which benefited last year’s first-half sales. Acquired precision-pump company Pulssar Technologies added a minimal contribution to segment revenue. Organically, revenue fell 2.6%, while operating profit also declined, sliding 9.1% to CHF 19.0 million ($19.5 million). Similarly, the segment’s operating margin dipped 1.3 percentage points to 16.4%, driven down by lower sales volume.

Recurring sales of services and consumables advanced 25.5% to CHF 113.2 million ($116.2 million), driven by strong organic growth and SPEware consumables. For the first-half, recurring sales accounted for 45% of total company sales, a 6 percentage point increase, the company’s all-time high. Service sales, which included spare parts, amounted to 23% of total company sales. As for consumables, sales accounted for around 22% of company sales.