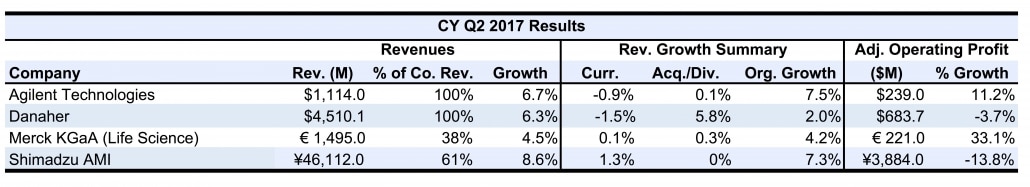

Second Quarter Results: Agilent, Danaher, Merck KGaA and Shimadzu

Agilent Raises Full-Year Forecast

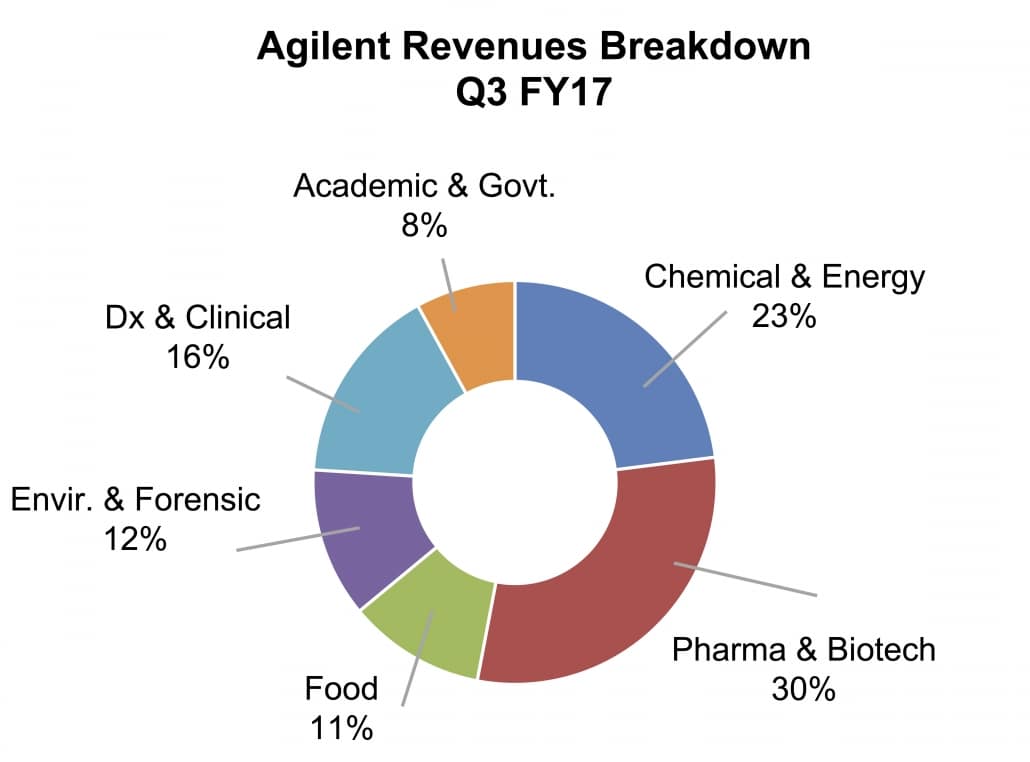

Agilent Technologies continued its solid growth, with fiscal third quarter sales increasing 6.7%, 7.5% organically, to $1.11 billion. The company’s operating profit reached $236 million, an 11.3% increase, whereas its operating margin increased by 90 basis points to 21.2%. The company noted its strong third quarter performance was due to its Chemical & Energy and Pharmaceutical end-markets, for which sales to both increased by 10%.

In the Analytical Laboratory end-market, revenues grew 8% organically, while the Academia & Government end-market sales experienced a 3% increase, driven by a strong quarter in Europe and double-digit growth in the cell analysis, spectroscopy and services markets. Revenue for the Food business expanded 2% due to sound market growth and strong European performance. Environmental & Forensics sales grew a substantial 7%, driven by the Americas and Asia Pacific markets. In the Diagnostics and Clinical end-markets, revenue grew 6% organically, led by strength in Europe, pathology and companion diagnostics.

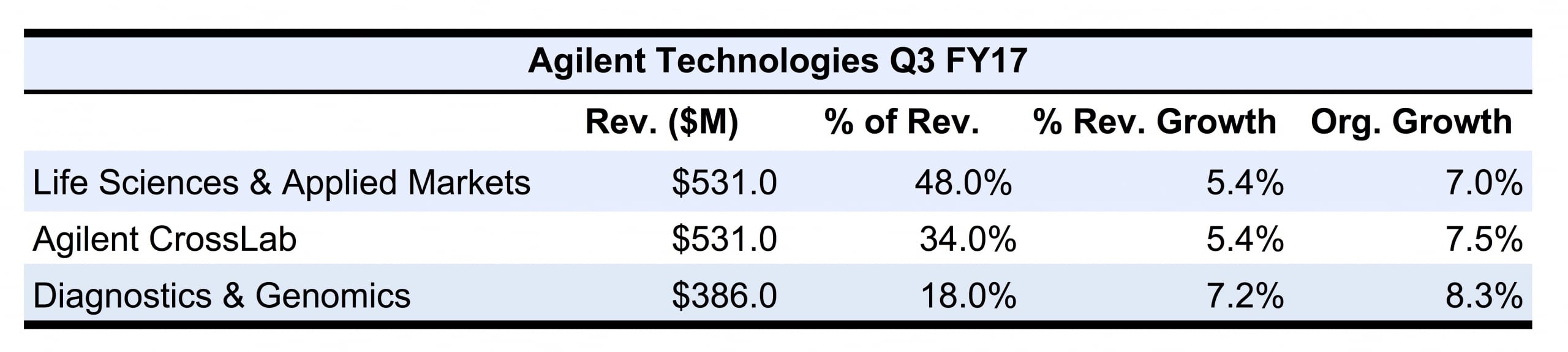

By segment, Life Sciences and Applied Markets Group (LSAG) sales advanced 5.4% to $531 million, led by the Chemical & Energy, Environmental and Pharmaceutical end-markets. Organically, LSAG sales grew 7.0%, as Europe and China both saw double-digit organic growth. Operating margin for the segment jumped 220 basis points to 21.3%.

Sales for the Agilent CrossLab Group (ACG) grew 7.2%, 7.5% organically, reaching $386 million. The segment continued its strong sales performance, led by the Pharmaceutical, and Academia & Government end-markets. Additionally, both services and consumables continued their healthy sales growth across all end-markets and regions. Operating margin increased by 70 basis points to hit 23.4%.

Agilent’s Diagnostics and Genomics Group (DGG) recorded 9.4% growth in sales, reaching $197 million. Organically, sales for the segment increased 8.3%, as currency effects negatively impacted sales growth. The segment’s robust growth came largely from the Pharmaceutical, and Diagnostics & Clinical end-markets. DGG’s solid performance extended across all markets and regions, led by strong demand for pathology products and companion diagnostics services, as well as double-digit sales growth in Nucleic Acid Solutions. In particular, Asia and Europe both produced double-digit organic sales growth, leading regional gains. DGG’s operating margin followed company expectations, decreasing 190 basis points to 16.9%.

For the company as a whole, Americas revenue grew 4%, reaching $378 million to account for 34% of the company’s total sales. Sales growth in Europe was better than expected, increasing 12% to $326 million. The Asia Pacific region experienced moderate sales growth, rising 5% to account for 37% of total company revenues. Within Asia Pacific, sales for Japan decreased 4%, while China continued its strong growth, leading the region’s sales with a 9% increase. Sales for the rest of Asia Pacific increased 1%.

For the fiscal fourth quarter, Agilent expects revenues to be $1.15–$1.17 billion, a 3.6%–5.4% increase, with organic revenue up 3.5%. As for fiscal year 2017, Agilent projects revenue to be between $4.435 billion and $4.455 billion, an upgrade over its previous $4.36–$4.38 billion projection. The company expects 6% organic growth in sales, and an adjusted operating margin of 21.8%, a 110 basis points increase.

Danaher Life Science Sales Exceed Expectations

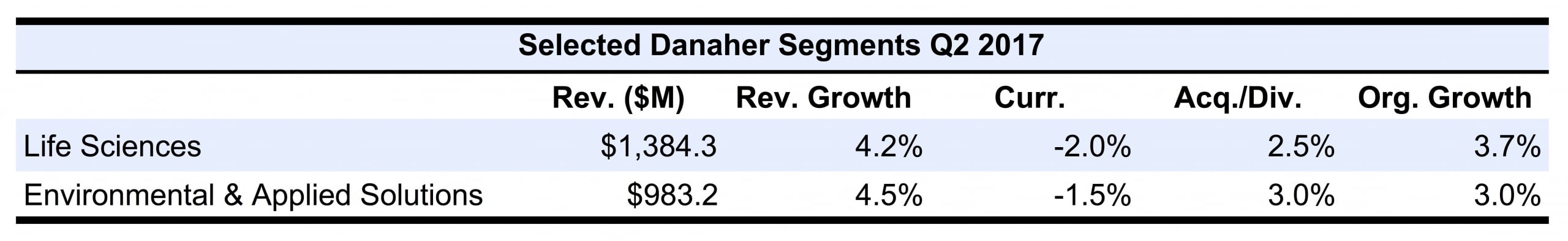

Danaher reported sales growth of 6.3%, 1.8% organically, to $4.5 billion. Exchange rates negatively impacted sales growth by 1.5%, while acquisitions added 6% to sales growth.

For Danaher’s Life Sciences segment (LS), revenue grew 4.2% to $1.38 billion. Organically, segment sales increased 3.5%, faster than expectations. LS operating profit grew 15.3% to $221.6 million, resulting in a 16.0% operating margin. LS operating margin increased 150 basis points, while organic operating margin grew 120 basis points. The continued operating margin expansion was mostly driven by consistent execution across the LS platform.

SCIEX sales organically increased by mid-single digits, due to strong performances in the pharmaceutical and food testing end-markets. In the academic market, demand was steady. MS sales grew primarily due to strong sales growth in China and in Western Europe. MS sales showed strength across various markets, including food, pharmaceutical and academia.

Similarly, Beckman Coulter Life Sciences (BCLS) sales grew mid-single digits as well, driven by the centrifugation and automation product lines. Additionally, several key automation projects contributed to strong results in North America. Overall, BCLS maintained a positive performance across all major product lines. China, in particular, continued its strong performance as a result of increased investments in biopharmaceutical and life science research.

Leica Microsystems’ organic sales grew slightly, in the low single-digits, primarily due to a strong performance across high-growth markets. However, sales in developed markets were less robust.

Organic growth for Pall increased in the low single-digits. For Pall Life Science, growth was particularly strong in the biopharmacuetical market, with sales increasing by double-digits for single-use technologies. For Pall Industrial, sales grew moderately, driven by microelectronics and aerospace sales.

For Danaher’s Environmental & Applied Solutions segment, sales grew 4.5% to $983.2 million. Organically, revenue rose 3.0%, while organic operating profit increased by 120 basis points. The segment’s water quality business grew low single-digits. Organic revenue at Hach also increased low single-digits, primarily due to strong quarter performance in China, in addition to an expanding industrial end-market. Other businesses that contributed to the segment’s sales growth included product identification, ultraviolet water disinfection and chemical treatment solutions. Segment operating margin increased 70 basis points to 23.9%. Geographically, segment revenue growth was led by China, partially offset by Latin America.

For the remaining half of 2017, Danaher expects organic sales growth to be higher compared to the first half. For the third quarter, the company projects 3% organic growth in sales.

Process Solutions Leads Merck KGaA Life Science Growth Once Again

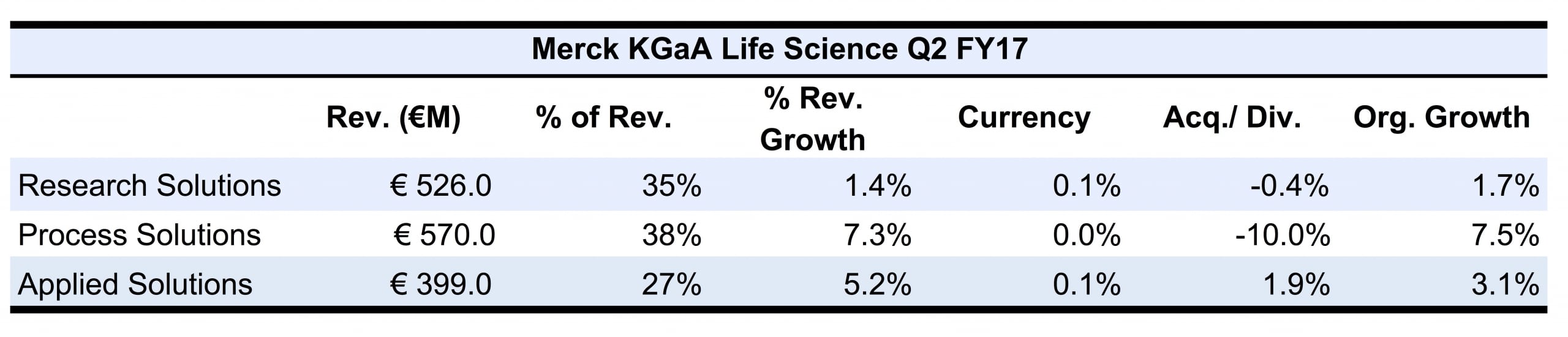

Merck KGaA’s Life Science sector (LS) sales advanced 4.6% in the second quarter to reach €1.49 billion ($1.76 billion at €0.85 = $1). Organically, segment sales grew 4.2%, as foreign currency effects and acquisitions positively impacted sales by 0.1% and 0.3%, respectively. However, divestment of business activities in Pakistan offset acquisition sales growth. Organic growth remained above market levels, driven by Process Solutions. The sector continued its strong growth due to increased demand in the biopharmaceutical industry.

Sales for the Process Solutions segment of LS grew 7.3%, 7.5% organically, to €570 million ($673 million). With the highest growth rate among LS businesses, Process Solutions represented 38% of total LS sales. The strong second quarter performance came primarily from growth across all businesses and portfolios within the segment. Specifically, ongoing strength in single-use and service activities, as well as an improved small molecule business, contributed the most to segment performance.

Applied Solutions sales increased 5.2%, 3.1% organically, to €399 million ($471 million), accounting for 27% of total LS revenue. Organic sales growth was primarily driven by bio-monitoring products in the pharmaceutical business as well as the expanding demand in the Lab Water business. Acquisitions increased sales by 1.9%, driven by a strong performance from BioControl Systems, a food safety testing company.

Research Solutions sales increased 1.4%, 1.7% organically. Segment revenue reached €526 million ($621 million) to account for 35% of total LS sales. The slight growth came from strong demand in China and steady demand in the US.

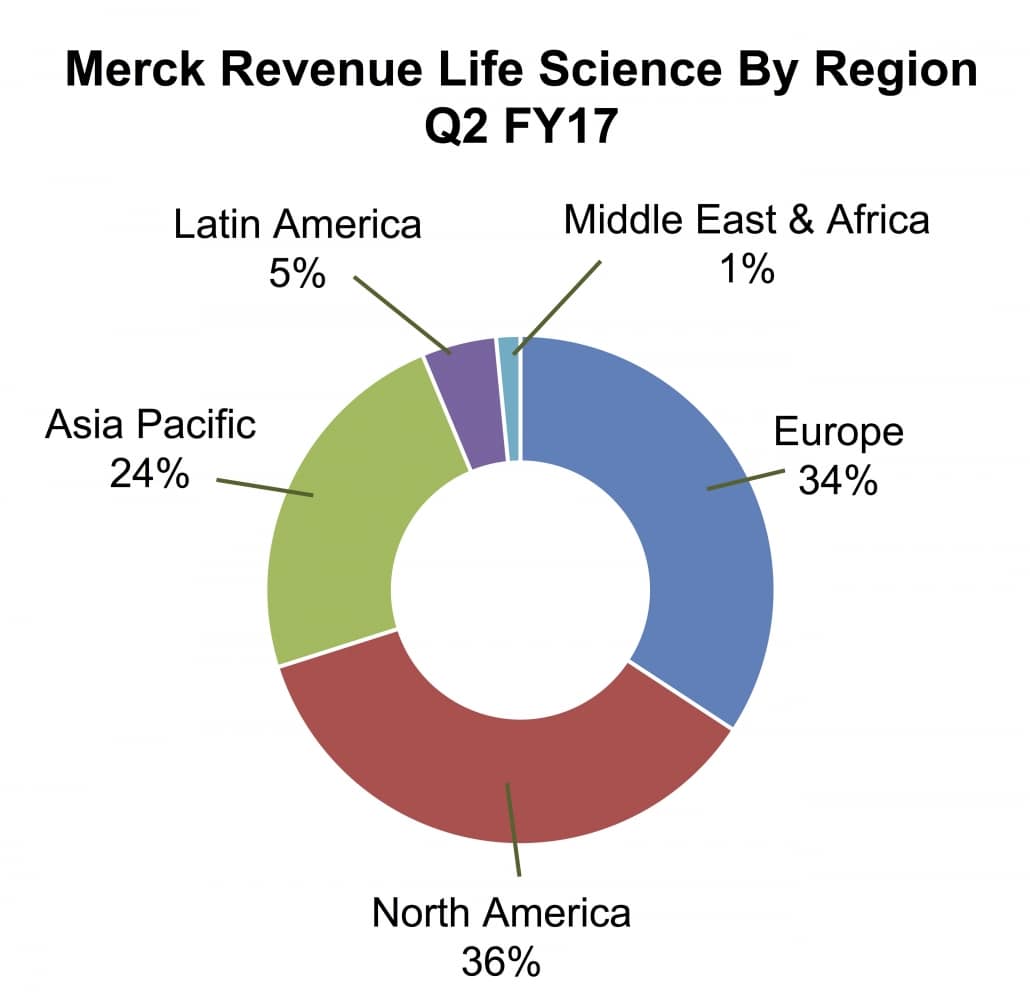

Geographically, North America accounted for 36% of LS’s total revenue. Sales in the region grew 3.6%, 2.0% organically, to reach €536 million ($633 million). The steady growth was driven by the Research Solutions segment, which recorded higher sales in the pharmaceutical market. Additionally, Lab Separation & Workflow Tools in the pharmaceutical market also added to the region’s strong sales growth. Europe, the second largest regional segment, accounting for 34% of total LS sales, experienced strong organic sales growth of 5.1% to €512 million ($605 million). Sales growth was driven by Process Solutions, for which demand for the Actives & Formulation and Services businesses increased.

In Asia Pacific, LS organic sales grew 6.8%, primarily driven by biopharma materials sales and Process Solutions sales. In particular, the Filtration & Chromatography business, part of the Process Solutions segment, performed better than expected to lift sales in Asia Pacific. Sales for the region reached €353 million ($417 million) to account for 24% of the LS sector’s total revenue.

LS sales in Latin America advanced 5.3% organically to €71 million ($84 million), driven by the Upstream & Systems business and the Process Solutions segment. Sales in the Middle East & Africa region, however, decreased 5.6% organically to €23 million ($27 million) due to weak demand in the Research Solutions and Applied Solutions segments.

For 2017, Merck expects LS revenue of €15.3 billion and €15.7 billion ($18.07 billion and $18.55 billion). Organically, sales are projected to increase by 4%, unchanged from previous guidance.

Chinese Sales Lift Shimadzu AMI

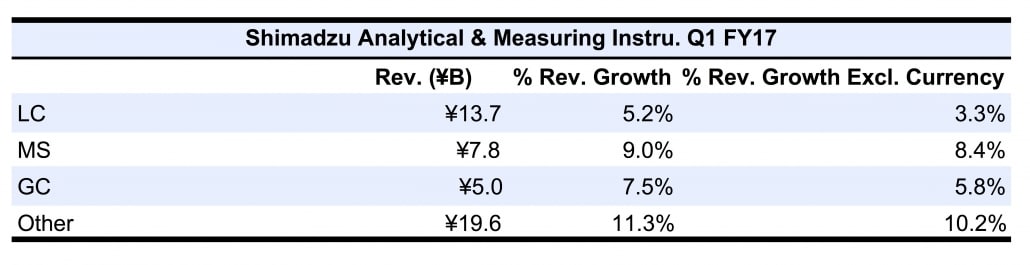

For its fiscal 2018 first quarter ending June 30, sales for Shimadzu’s Analytical and Measuring Instrument (AMI) business segment climbed 8.6% to ¥46.1 billion ($420 million at ¥109 = $1), accounting for nearly 61% of total company revenues. The segment’s operating income, however, decreased 4.0% to ¥4.7 billion ($40 million), leaving its operating margin 130 basis points lower at 10.3%. On a currency neutral basis, AMI sales grew 7.3%, while operating profit increased 3.9%.

Instrument sales in the AMI segment advanced 8.1% to reach ¥32.4 billion ($300 million). Similarly, the segment’s Aftermarket sales grew 9.8% to ¥13.8 billion ($130 million). Increased demand for instruments lifted sales for LC and MS, while GC sales were driven by surging demand in China. Instrument sales accounted for 70% of total AMI sales, while Aftermarket revenue made up the remaining 30%.

Geographically, AMI sales in Japan grew 11.1% to ¥16.8 billion ($150 million), driven by increased private sector demand for LC, MS and testing machine products. In China, AMI sales leaped 16.8%, 13.7% on a constant currency basis, to ¥12.4 billion ($110 million). LC, MS, GC and environmental testing instrument sales grew double digits in China. However, for other Asian countries, AMI sales slumped 4.8%, 7.2% on a constant currency basis, to ¥5.2 billion ($50 million), as MS sales grew but LC sales declined. Together, the three Asian regions combined for an overall 10.6% increase in AMI sales.

AMI sales in Europe continued to grow as well, increasing 8.9% to ¥4.8 billion ($40 million), driven by LC sales. MS and GC revenues remained strong and expanded in the pharmaceutical, food safety and environmental testing markets. On a constant currency basis, AMI sales in Europe grew 9.4%. Conversely, in North America, AMI sales dropped 7.4%, 8.4% on a constant currency basis, to ¥4.8 billion ($40 million). The decrease in AMI sales was due to lower demand and delays in customer-based installations.

For the fiscal year ending March 2018, Shimadzu reiterated its forecast of total company revenue of ¥355.0 billion ($3.24 billion), signifying a 5.1% increase on a constant currency basis. The company also reaffirmed its total operating income forecast of ¥38.0 billion ($350 million), representing a 7.0% increase on a constant currency basis. As for the AMI segment, Shimadzu forecasted sales growth of 4.2% to ¥218.0 billion ($200 million), with no changes from its previous forecast. Similarly, Shimadzu reconfirmed AMI operating income growth forecast of 4.7%, resulting operating income of ¥34.6 billion ($320 million).