Second Quarter Results: Illumina, PerkinElmer, Thermo Fisher Scientific, Waters

Illumina Consumables Revenue Exceeds Expectations

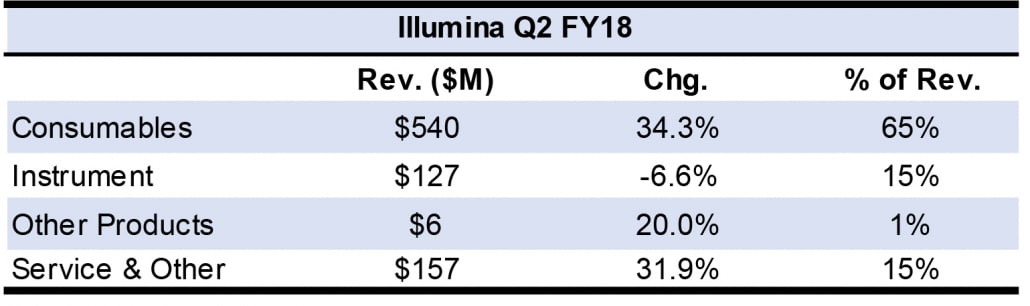

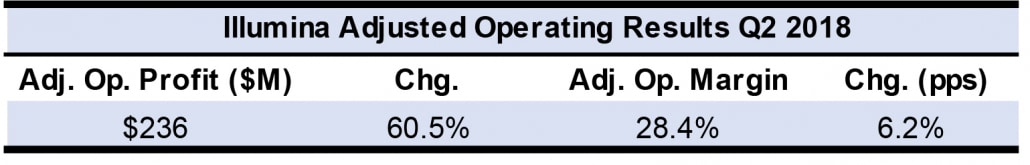

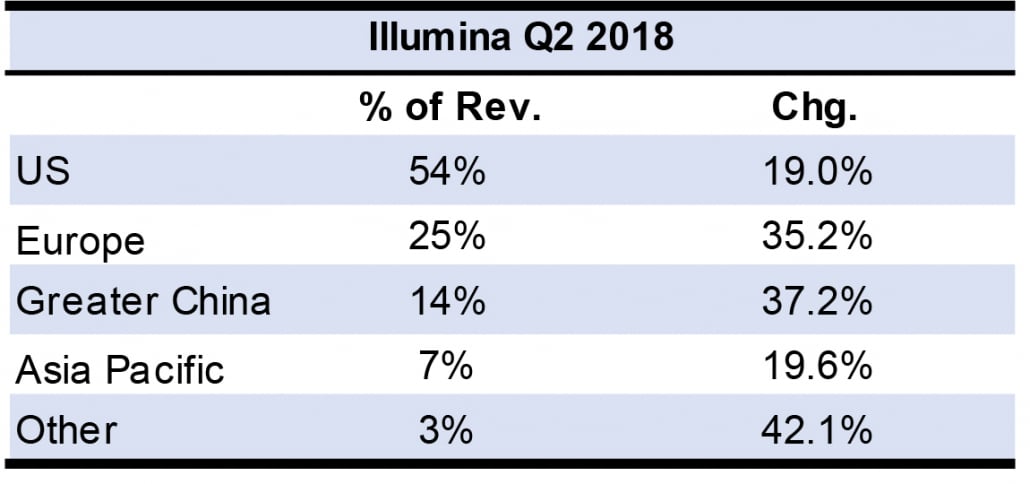

Illumina second quarter revenues grew 25.4%, including two percentage points growth from currency effects. (See IBO 7/31/18.) Illumina’s strong second quarter revenues were led by faster-than-expected sales growth for sequencing consumables.

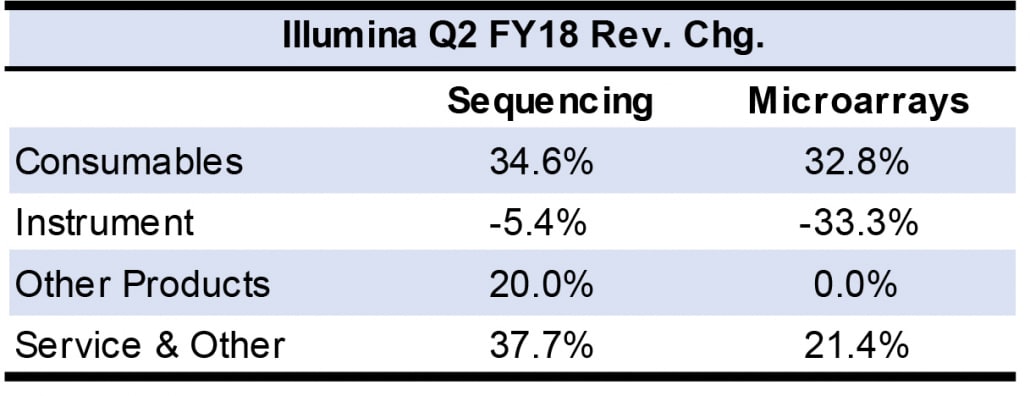

Sales of sequencing consumables grew 34.6% and were up 31% excluding early stocking by Chinese customers in response to tariffs. Sales of consumables for high-throughput sequencers (NovaSeq, HiSeq) grew over 35%, while sales for mid-throughput sequencers (NextSeq) consumables rose over 50%. Sales of low-throughput sequencers (MiniSeq, MiSeq, iSeq) consumables also increased, totaling over 10% of sequencing consumables revenue. In addition, impacting consumables sales, library preparation revenue rose 25% to make up close to 15% of the sequencing consumables business.

Although sequencer revenue declined year over year, sales were up 8% sequentially. More than 200 separate labs now have NovaSeqs installed. The company expects to ship 330–350 NovaSeqs in 2018. Half of low-throughput sequencer sales were to new-to-sequencing customers. As for sequencing services revenue, it was approximately evenly divided between maintenance contracts and sequencing services.

The company raised its revenue growth rate guidance for the year from 15%–16% to 20%, in part due to demand for NovaSeq consumables. Second quarter revenues are expected to be flat or up modestly.

PerkinElmer Reports Strong Organic Growth

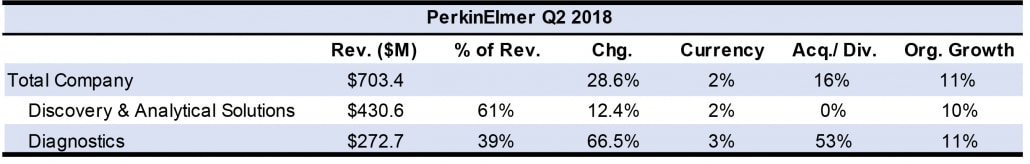

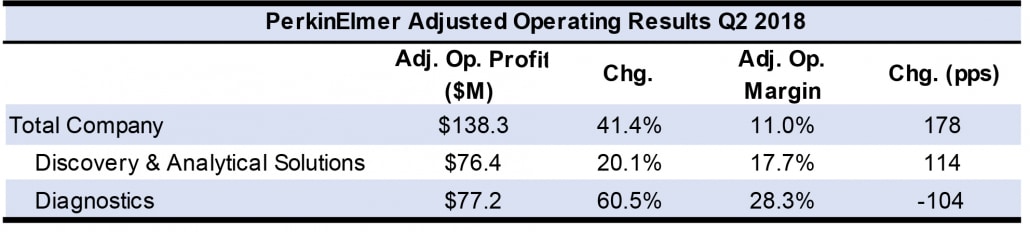

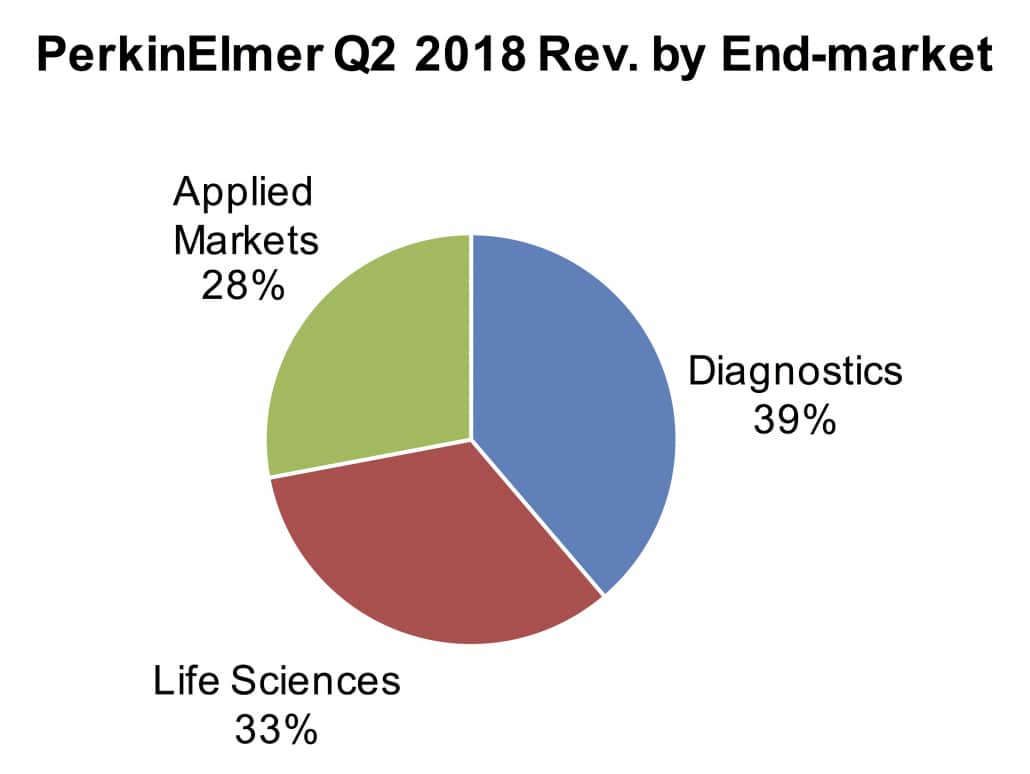

PerkinElmer’s second quarter sales grew double-digit organically for the company as a whole company and each of its two divisions (see Bottom Line). Product and Service revenues rose 39.6% and 8.2% to make up 70% and 30% of sales, respectively. All figures below are given on an organic basis.

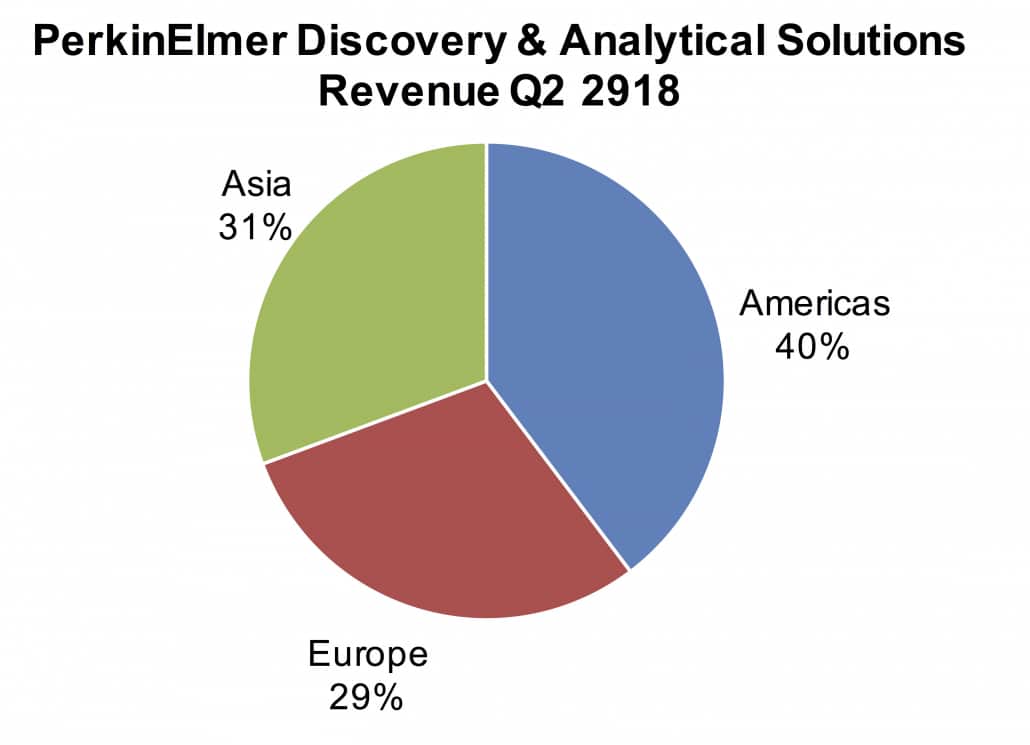

Geographically, Asian and European sales each grew double digits. American sales rose high single digits. China and India both recorded double-digit sales growth.

Discovery & Analytical Solutions sales were led by imaging, high-content screening, analytical instruments, informatics and service sales. Sales to the life science end-market were up double digit, while sales to applied end-market rose high single digits. Sales to applied markets were driven by the industrial and Asian food testing end-markets, with sales for each up high in the single digits.

In the Diagnostic segment, reproductive health sales grew high single digits. Sales for genomics and immunodiagnostics each grew double digits. The genomics business is expected to post $50 million in revenues by 2020. Sales for Tulip Diagnostics rose in high teens.

The company raised its full-year organic revenues growth guidance from 5% to 6%, including 7% growth for core Diagnostic sales. EUROIMMUN is expected to add 1% to annual growth. Second quarter sales are anticipated to rise 10% organically, or 29% including 16% growth from acquisitions.

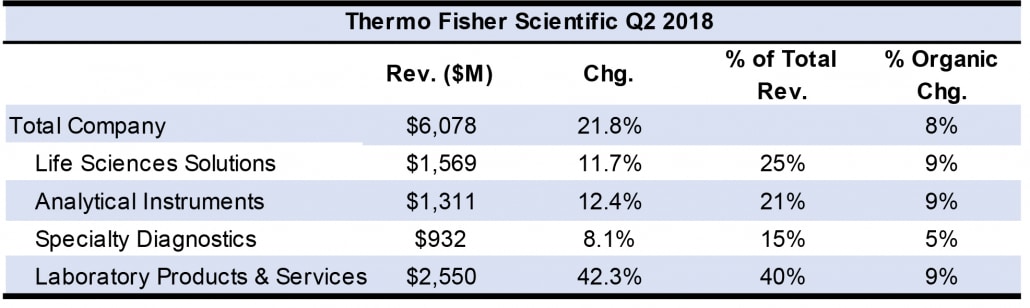

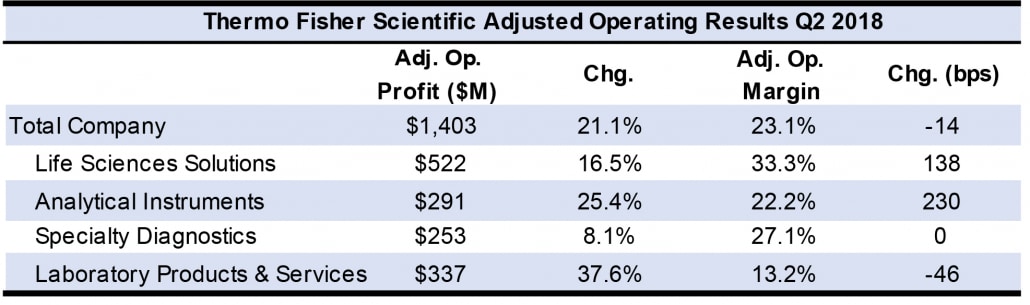

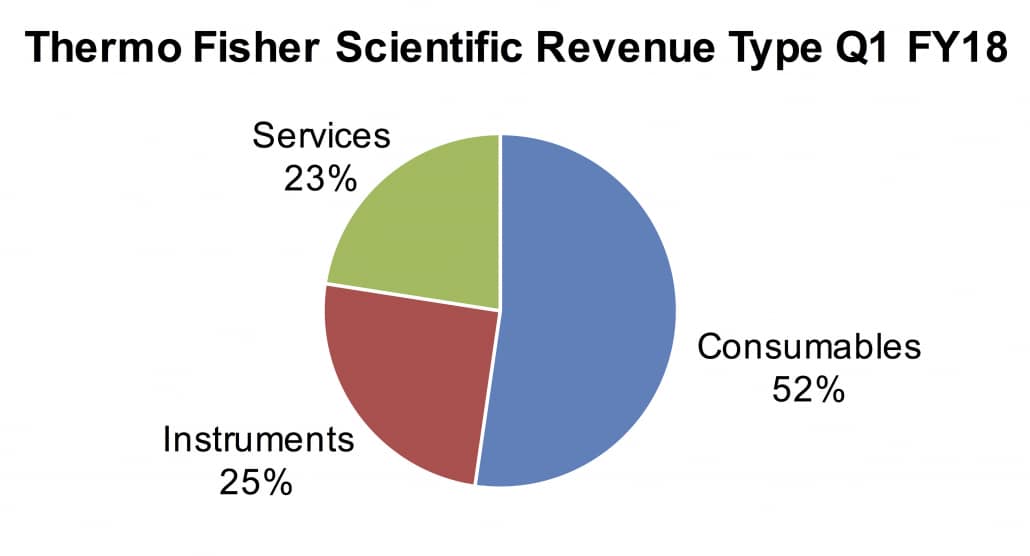

Broad-based Growth for Thermo Fisher Scientific

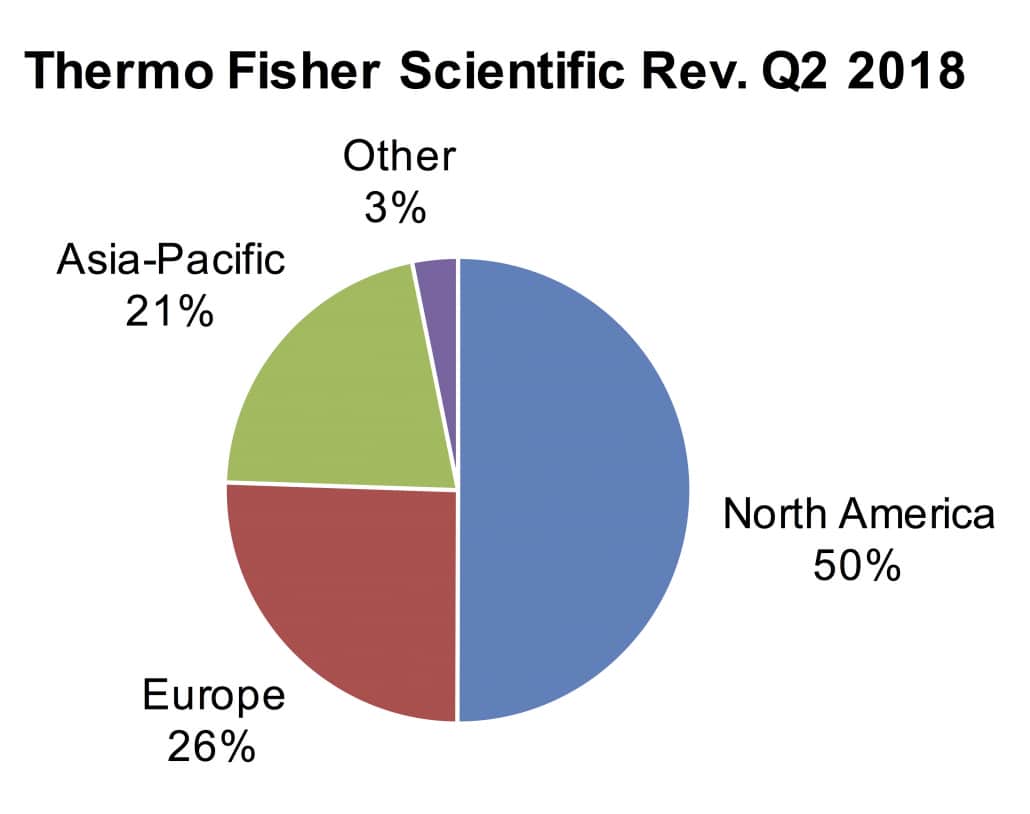

Reported double-digit second quarter revenue growth for Thermo Fisher Scientific included 12% acquisitions net of divestitures and a 2% benefit from currency. (See IBO 7/31/18.) The company reported broad-based growth, including strength in its chromatography, MS, clinical trial services and the bioprocess businesses.

Asia-Pacific and Rest of World led regional growth, with sales for each increasing in the low teens. Within Asia-Pacific sales, Chinese sales rose more than 26% to $648 million. European sales rose high-single digits, while North American revenue climbed mid-single digits. Within North America, US sales grew 17.3% to $2.9 billion.

Sales to the biotech and pharmaceutical end-markets increased in the mid-teens, while academic and government revenue rose high single digits. Sales to the industrial and applied end-market as well as diagnostics and healthcare both grew mid-single digits.

The company narrowed its full-year revenue guidance to 13%–14% growth, including 6% organic growth. The company attributed the increase to higher organic growth, Patheon’s strong performance and greater negative impact from currency.

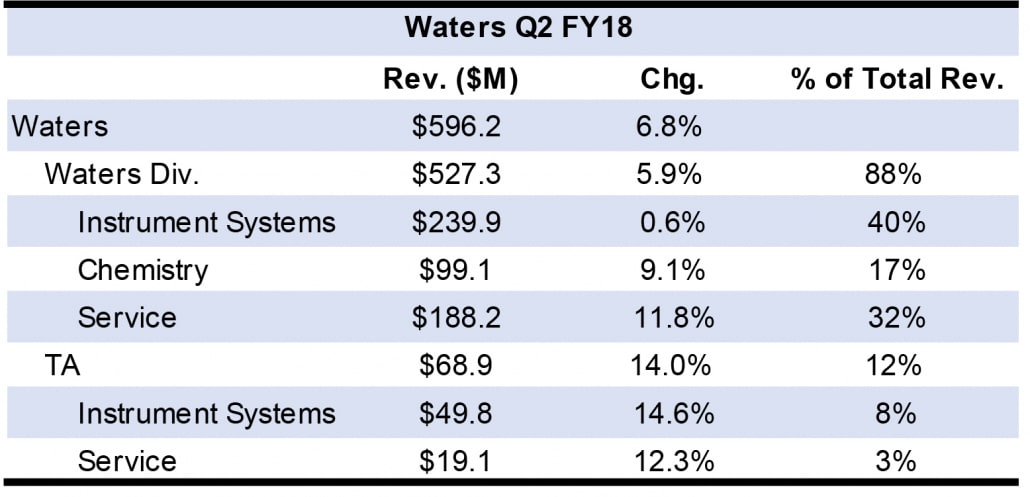

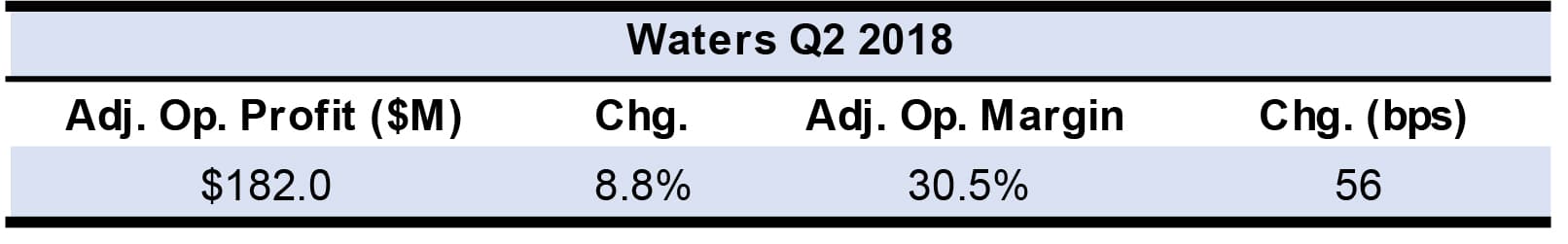

Service Revenue Up Double Digits for Waters

Waters second quarter revenues grew 5% in constant currency, as constant currency sales for the Waters Division and TA Instruments increased 4% and 12%, respectively. (See IBO 7/31/18.) All figures below are in constant currency. Service sales led growth, rising 9% in the second quarter, followed by chemistry sales, with a 6% increase and a 2% increase in instrument sales.

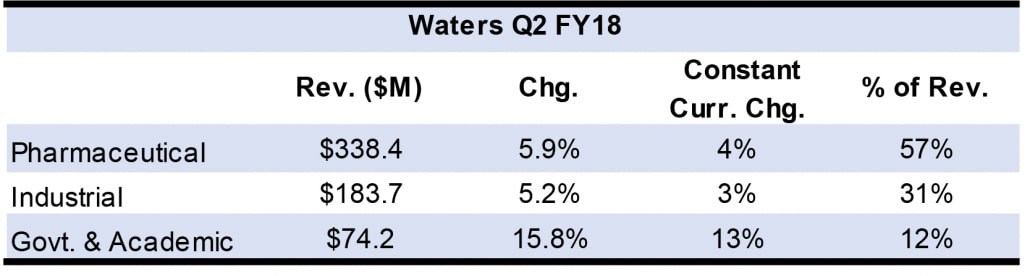

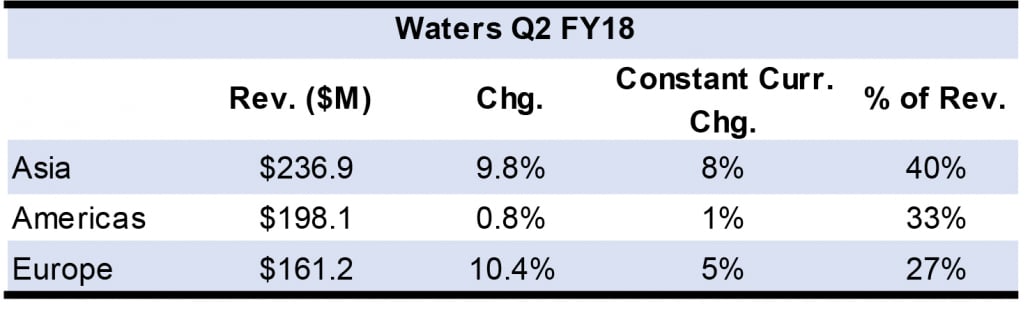

Pharmaceutical end-market growth was led by China’s double-digit sales growth. However, sales in developed markets declined moderately due to slower demand from large pharma. After a weak first quarter, pharmaceutical sales in India rose sequentially. TA Instrument and Waters Division chemicals sector sales were the standouts among industrial markets. Academic and government sales were strong, with the exception of the biomedical research sector.

On a geographic basis, Chinese demand rose 16.6% to make up 18% of total Waters sales. Although total company sales for India were flat, the company noted a sequential increase in pharmaceutical sales in the country. US sales declined 1.8%, due to slower sales of biomedical LC/MS systems to pharmaceutical and industrial markets.

By product line, MS sales were led by tandem quadrupole systems, while demand for high-resolution systems, which make up about 25% of MS sales, were softer. Stand-alone chromatography revenue was also healthy

Waters forecast third quarter organic sales to increase 4%–6%, with currency subtracting 1%–2% growth. The company maintained its annual sales guidance of 4%–6% growth excluding currency effects.