Strong Start for IBO Indexes into Q3

The US economy remained sturdy this month even after the disastrous string of hurricanes, which brought millions of dollars in damage to the nation. As such, the US GDP grew at an estimated 3.0% in the third quarter, surpassing analysts’ expectations of 2.5%. Other parts of the US economy also showed signs of improvement as the unemployment rate fell to 4.2%, the lowest since 2001. Additionally, consumer spending also improved, increasing a robust 3.3%.

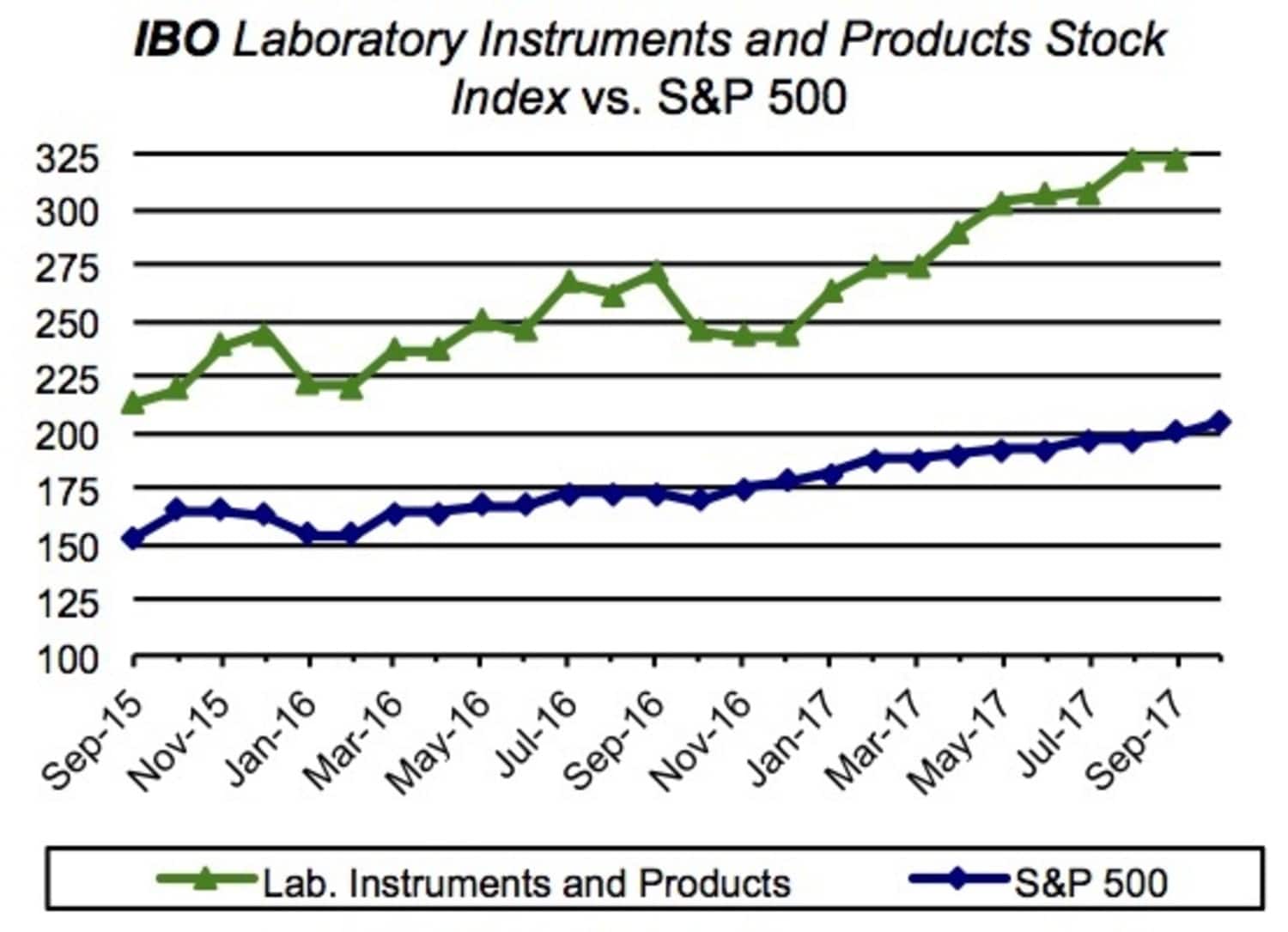

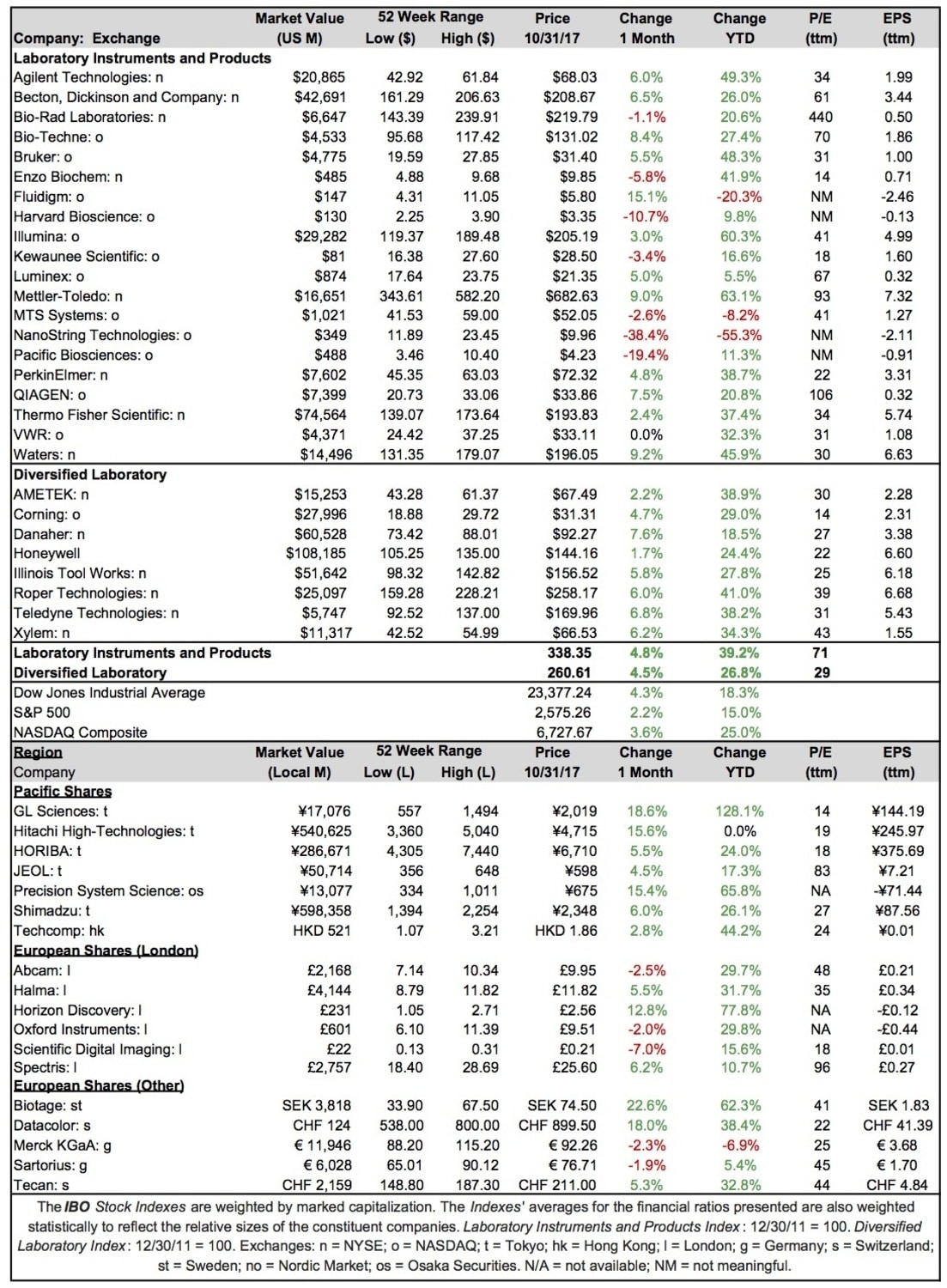

The Dow Jones Industrial Average (DJIA) rose 4.3% to 23,377.24 in October, marking a seventh consecutive monthly increase after its slight dip in March. Year to date, the Index has risen 18.3%. Following the DJIA in percentage growth was the NASDAQ Composite, advancing 3.6% to 6,727.67. Year to date, the Index is up 25.0%. The S&P 500 experienced the slowest growth amongst the three indexes, climbing just 2.2% to close at 2,575.26 for the month.

Laboratory Instrumentation Stock Index

For October, the Laboratory Instrumentation Index grew steadily, increasing 4.8% to 338.35. Year to date, the Index is up a strong 39.2%. Within the Index, Fluidigm’s share price grew the most, advancing 15.1% to close at $5.80 for the month. Conversely, Nanostring Technologies shares sunk 38.4% to end the month at $9.96, due to lower-than-expected revenues. On October 11, Nanostring reported its third quarter preliminary earnings. As such, Product and Service sales came short of the company’s projection, amounting to approximately $16.9 million versus the expected $19.5–$21.5 million (see IBO 10/15/17). Following the earnings report, on October 12, Robert W. Baird, an asset management fund, lowered the stock price target from $23.00 to $19.00.

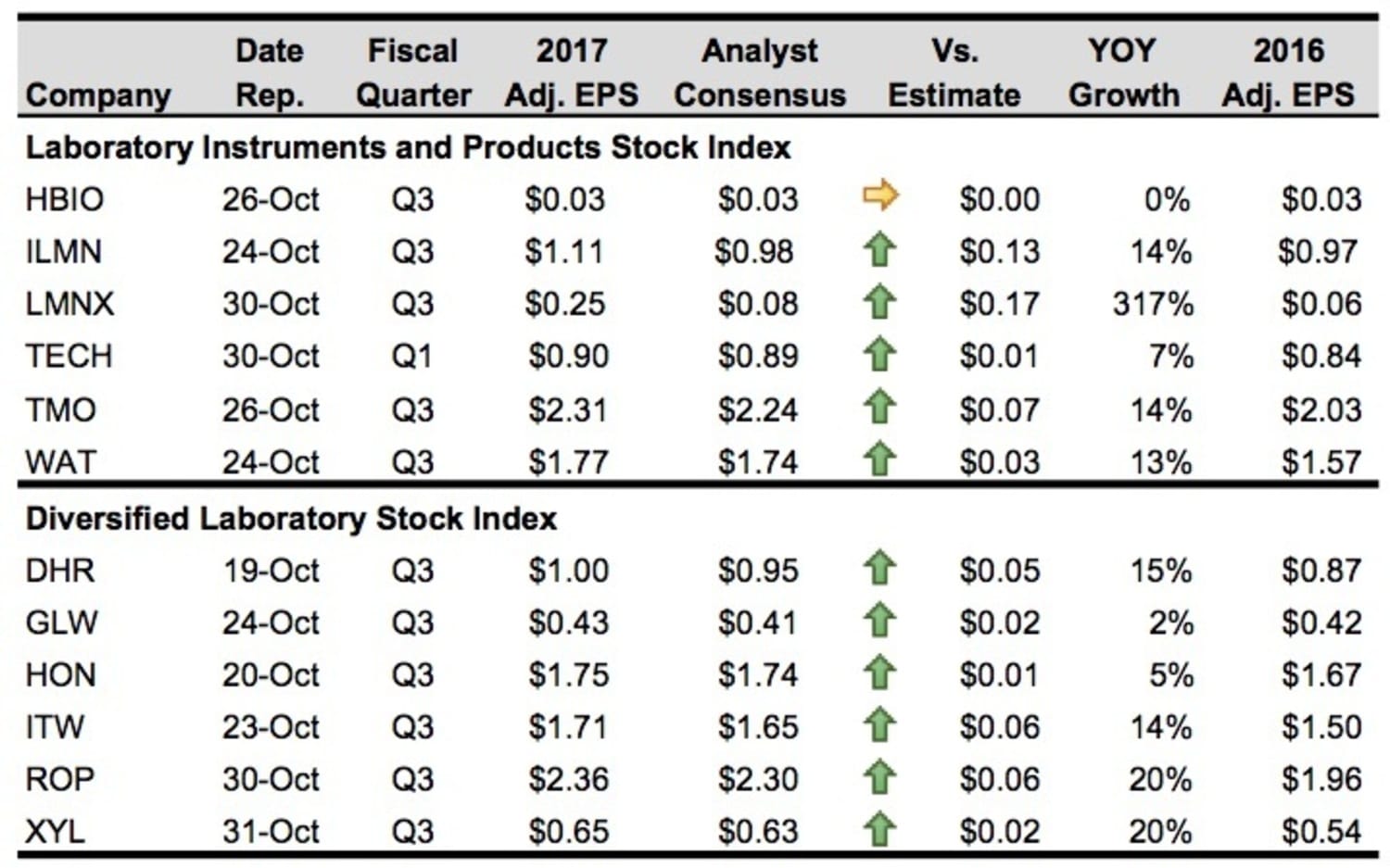

Agilent Technologies shares grew a healthy 6.0% to $68.03 for the month. On October 20, Robert W. Baird reiterated its “buy” rating, along with a price target of $70.00 for the stock. Similarly, Bio-Techne’s share price advanced 8.4% to $131.02 for the month due to strong revenue (see Bottom Line) and earnings. The company’s fiscal year 2018 first quarter results were reported on October 30, as it recorded an adjusted EPS of $0.90, an increase of 7.1%.

On October 24, Illumina reported its third quarter earnings, for which net income totaled $163 million and adjusted EPS equaled $1.11, an increase of 14%. Finishing at $205.19, the company’s share price rose 3.0% for the month and has risen 60.3% year to date. On October 23, Deutsche Bank upgraded the stock’s rating from “hold” to “buy”.

Harvard Bioscience’s share price dipped 10.7% for the month, closing at $3.35. The company’s third quarter adjusted EPS matched analysts’ expectations of $0.03 for flat year-over-year growth. However, Harvard Bioscience expects fourth quarter adjusted EPS to be approximately $0.05–$0.06.

On October 30, Luminex reported its third quarter results, showing an adjusted EPS gain of $0.25. Net income for the company totaled $17.6 million, a significant increase over last year’s $2.7 million due to an $11.1 million income tax benefit. For the month, Luminex’s share price advanced 5% to close at $21.35.

Thermo Fisher Scientific reported its third quarter earnings on October 26, delivering an adjusted EPS of $2.31, a 13.8% increase. The company’s share price climbed 2.4% to $193.83 for the month and has increased 37.4% year to date. Thermo Fisher upgraded its full-year adjusted EPS guidance due to the strong operational performance of the recently acquired company Patheon (see IBO 5/15/17). The updated full-year adjusted EPS is expected to be around $9.29–$9.38, versus the previously projected $9.15–$9.28, signifying 12%–13% earnings growth.

On October 24, Waters reported strong third quarter earnings as adjusted EPS rose 13% to $1.77, beating analysts’ estimates of $1.74. As a result, the company’s share price increased 9.2% to $196.05 for the month.

Diversified Instrumentation Stock Index

The Diversified Instrumentation Index advanced 4.5% to 260.61 in October, with all companies in the Index ending in positive territory. Year to date, the Index has advanced 26.8%. Danaher’s share price grew the most at 7.6%, closing out the month at $92.27. Conversely, Honeywell gained the least, as its share price rose only 1.7% to close at $144.16.

AMETEK received a boosted price target on October 13, with Jefferies Group setting a “buy” rating along with a price target of $77. Since the rating’s update, the company’s share price has gained $0.30, or around half a percent. Similarly, Honeywell also received a boosted price target as Credit Suisse set a target of $150.00 on October 23, an increase over the previous price of $141.00. However, since the price target change, the stock price has fallen 1.3%.

Corning’s shares increased 4.7% to close at $31.31 for the month, supported by a $29.50 price target from Jefferies Group on October 6. Year to date, the company’s share price has increased 29.0%.

On October 19, Danaher reported net earnings of $572.1 million, along with an adjusted EPS of $1.00. Year over year, the company’s adjusted EPS rose by 15%. For the fourth quarter, Danaher expects adjusted EPS to be $1.12–$1.16, amounting to a full-year expected adjusted EPS of $3.96–$4.00. In October, the company’s share price advanced 7.6% to $92.27, bolstered by Credit Suisse’s price target upgrade from $93.00 to $96.00.

Illinois Tool Works (ITW) was first given a “buy” rating by Citigroup on October 9, followed by another on October 16 from Wells Fargo. The former gave a price target of $171.00, while the latter gave a price target of $170.00, both an increase from $162.00. On October 23, the company reported an adjusted EPS of $1.71, an increase of 14%, beating analysts’ expectations of $1.65. For the fourth quarter, ITW expects its GAAP EPS to be around $1.55–$1.65 and its full-year GAAP EPS to be between $6.62 and $6.72. The company’s share price advanced 5.8% for the month, closing at $156.52.

Roper Technologies’ shares increased 6.0% to $258.17 in October, strengthened in part by a “buy” rating from Cowen and Company that was issued on October 12. Roper expects its fourth quarter adjusted EPS to be approximately $2.56–$2.62. As for its full-year adjusted EPS guidance, the company projects $9.27–$9.33, versus its previous guidance of $9.12–$9.30.

Xylem reported third quarter adjusted net income of $119 million, equaling $0.65 adjusted EPS, an increase of 20%. The company’s adjusted EPS beat analysts’ expectations of $0.63 by $0.02. For the full year, Xylem projected adjusted EPS to be $2.39–$2.41.

International Stock Index

Asia Pacific equity markets traded mostly positively, with average growth of 4.6% for the month. The APAC Indexes’ largest growth contributor was Japan’s Nikkei 225, increasing 8.1% to 22,011.61 in October. Conversely, Malaysia’s KLCI fell 0.4% to 1,747.92 and was the only APAC index to decrease.

GL Sciences’s shares vaulted 18.6% to ¥2,019.00 ($17.77 at ¥113 = $1) this month. Precision System Science and Hitachi High-Technologies’ shares both increased double digits as well, growing 15.4% and 15.6%, respectively. JEOL, along with Hong Kong’s Techcomp, both grew low single digits, at 4.5% and 2.8%, respectively. For the year, GL Sciences’ share price has increased the most among Asia Pacific companies in the IBO Stock Table, advancing 128.1%. Hitachi High-Technologies, however, has experienced a flat year-to-date increase, the lowest among Asia Pacific companies in the IBO Stock Table.

European equity markets traded modestly higher, as average Index growth was 1.5% for the month. Germany’s XETRA DAX and France’s CAC rose the most, advancing 3.1% and 3.3%, respectively.

Among European shares in the IBO Stock Table, the top performer was Sweden’s Biotage, which soared 22.6% to close at SEK 74.50 ($8.90 at SEK 8.37 = $1). Year to date, Biotage’s shares have grown 62.3%. Following closely is Germany’s Datacolor, as its share price also grew double digits, up 18.0%, closing the month at CHF 899.50 ($899.50 at CHF 1 = $1). Tecan’s shares grew modestly, up 5.3% to CHF 211.00 ($211.00). In contrast, Merck KGaA and Sartorius shares both ended the month in negative territory, sliding 2.3% and 1.9%, respectively.

The UK’s FTSE 100 advanced 1.6% to 7,493.08 for the month. Similarly, overall, UK stocks in the IBO Stock Table finished in positive territory, with the best performing stock, Horizon Discovery, growing 12.8% to £2.56 ($3.40 at £0.75 = $1). Conversely, Scientific Digital Imaging’s shares fell the most, decreasing 7.0% to £0.21 ($0.28).

Halma and Spectris’ shares both grew steadily for the month, increasing 5.5% to £11.82 ($15.70) and 6.2% to £25.60 ($34.01), respectively. But Oxford Instruments’ shares fell slightly, down 2.0% to £9.51 ($12.63). With Abcam shares also down, falling 2.5%, London shares in the IBO Stock Table were split half and half between positive and negative territory for October.