More M&A Ahead: Thermo Fisher Scientific Previews Its Future

At its 2017 Analyst Meeting on May 17, Thermo Fisher Scientific set out its plan to maintain its reign as the analytical instrument and lab products industry’s largest company. As President and CEO Marc Casper put it, “We’re the unrivaled leader in our industry and continue to get stronger.” In 2016, company sales approached $19 billion.

The presentation provided not only an update on the company’s recent financial, strategic, product and market accomplishments, but also insight into current and future priorities and investments. These priorities and investments can be expected to influence the industry as a whole due to Thermo Fisher’s size, reach and competitive position in multiple technology segments.

In the presentation, Mr. Casper noted the company’s ability to “leverage its scale and depth of capabilities to drive organic growth.” In 2016, organic revenues grew 4% and are forecast to grow at the same rate this year. From 2018 to 2020, organic revenue’s estimated CAGR is 4%–6%. This forecast is the same as that given at last year’s Analyst Day for organic sales growth for 2017–2019.

Acquisitions

However, organic growth accounted for only half of the company’s reported growth last year, and M&A will continue to play a major role, according to the presentation. Thermo Fisher expects to deploy 60%–75% of capital over the next five years for acquisitions. Senior Vice President and CFO Stephen Williamson estimated approximately $7.8 billion will be spent on acquisitions between 2018 and 2020.

In 2016, acquisitions contributed 4% to reported revenue growth, with a 5% contribution expected this year. The company has driven industry consolidation with major purchases of both competitors, as well as companies with adjacent product lines. Since 2010, the company has spent $29 billion on 50 acquisitions.

As the company explained, sales growth translates into key financial metrics. “The primary metric we use from a financial perspective is driving EPS growth,” said Mr. Casper. Accompanied by the revenue growth objectives were financial estimates of three-year (2018–2020) adjusted EPS CAGR of 12%–15% to $12.90–$13.90 per share. The projection assumes the Patheon acquisition (see IBO 5/15/17) closes by December 31, deployment of $12 billion in capital, 1.75x average year-end leverage from 2017 to 2020 and a 2020 tax rate of 13.5%. Such a performance would match the most recent five-year period (2011–2016) when adjusted EPS CAGR increased 15%. ROIC is expected to improve 100 basis points per year from 2018 to 2020 from 10% to 11.6%.

Pharma and Biotech

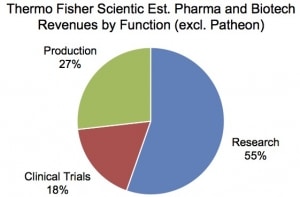

Among the themes highlighted in the Analyst Day presentation were Thermo Fisher’s success in the pharma and biotech end-market, which accounted for 31% of sales in 2016, or $5.8 billion. The company reported 9% average organic revenue growth over five years for this end-market. Mr. Casper attributed the growth to Thermo Fisher’s strong value proposition for these customers, which spans research, clinical trials and production (see graph below).

Following the acquisition of Patheon (see IBO 5/15/17), the pharma and biotech share of Thermo Fisher revenue will further increase. A disproportionate share of revenue from this end-market can be expected in the future, according to Mr. Casper. “I think biophama will continue to be a slightly larger piece over time, with the other three [end-market segments] being more balanced,” he told analysts in response to a question. “It’s just the way we’re executing the growth opportunity and how tight the offering is across the whole portfolio [that] creates accelerated growth in the biopharma end-segment.”

Digital Science

The company also highlighted continued investments in digital science, including its e-commerce business and cloud computing capabilities. Thermo Fisher’s e-commerce revenue totals over $4 billion annually, with 65 million annual visits, according to the Analyst Day presentation. “The way I think about this is that we’ve got leading physical scale—all the things I talked about earlier, our sales people, our service people, our product lines—and in combination with the leading digital scale gives us a remarkable position in the industry,” said Senior Vice President and CCO Tom Loewald.

Mark Stevenson, executive vice president and president, Life Sciences Solutions (LSS), gave an example of the advantages of the company’s e-commerce platform for commercial reach. In 2016, LSS added 18,000 SKUs to the Fisher Scientific channel (part of the Laboratory Products and Services division) as well as new accounts, particularly in Europe, in addition to the 14,000 SKUs included in 2015. “We’ve continued to see those portfolios grow three times the rate they were growing previously through adding that channel,” he commented. In total, 65% of all Fisher Scientific transactions are online.

Other examples highlighted e-commerce growth regionally and for specific businesses. In China, Mr. Stevenson noted LSS’s $150 million in online revenues. Discussing the Analytical Instruments’ chromatography business, Dan Shine, senior vice president and President, Analytical Instruments, stated, “We’ve continued to leverage our e-business and Fisher Scientific channels to accelerate consumables growth.”

Informatics and software, and specifically cloud computing, are also part the company’s vision for digital science and a current priority. “Our ambition to produce the leading cloud-enabled platform for science,” stated Mr. Loewald. Mr. Casper declared, “All of our new generation equipment and instruments will be cloud enabled.” Current and expanding cloud capabilities include remote monitoring, collaboration platforms and analytics software.

New Products

The company also provided updates on key product lines. Patrick Durbin, senior vice president and president, Specialty Diagnostics, announced that the company plans to launch an MS-based clinical analyzer next year. “We have been for many years fascinated about the opportunity to take mass spec into the clinic, and we’ve developed a proprietary walkaway mass spectrometry–based clinical analyzer,” he told analysts. “It’s really focused on providing superior clinical results compared to immunoassays in a walkaway, easier-to-use format that could end up in the hospital.”

Like MS, NGS technologies is another traditional research technology, and part of a separate Thermo Fisher division, that was discussed by Mr. Durbin in terms of its diagnostics applications. Specifically, he presented an NGS-based bone marrow transplant workflow comprised of Thermo Fisher products. The workflow consists of the Nx Type HLA assay, Ion Chef specimen preparation system for NGS, Ion Torrent S5 NGS system and the TypeStream data science solution.

NGS’s clinical applications were also highlighted by Mr. Stevenson, who noted the success of the NGS business’s focus on clinical applications. The company expects fourth quarter FDA clearance of a companion diagnostics panel non–small cell lung cancer jointly developed with Pfizer and Novartis to run on its FDA-approved Ion PGM Dx system. “Really our focus is on the oncology part of therapy selection,” he commented. “We’ve developed this gold standard chemistry, the PCR-based AmpliSeq technology, that is underlying the chemistries we’ve deployed in different formats for different applications on our NGS solutions.” Examples include the use of Thermo Fisher’s Oncomine NGS panels in an NCI basket trial, the development of immune response assays for segmented clinical trials, and use for liquid biopsies for post-treatment monitoring.