The Application of Analytical and Scientific Instruments in the Pharmaceutical/Biopharmaceutical Market in 2019

Access to healthcare has always been a persistent issue throughout the world, especially when it comes to access to medicine. With the rise in certain diseases and an aging global population, the pharmaceutical and biopharmaceutical industry is attempting to meet this demand by using various analytical and scientific instruments and techniques to perfect their drug development cycles.

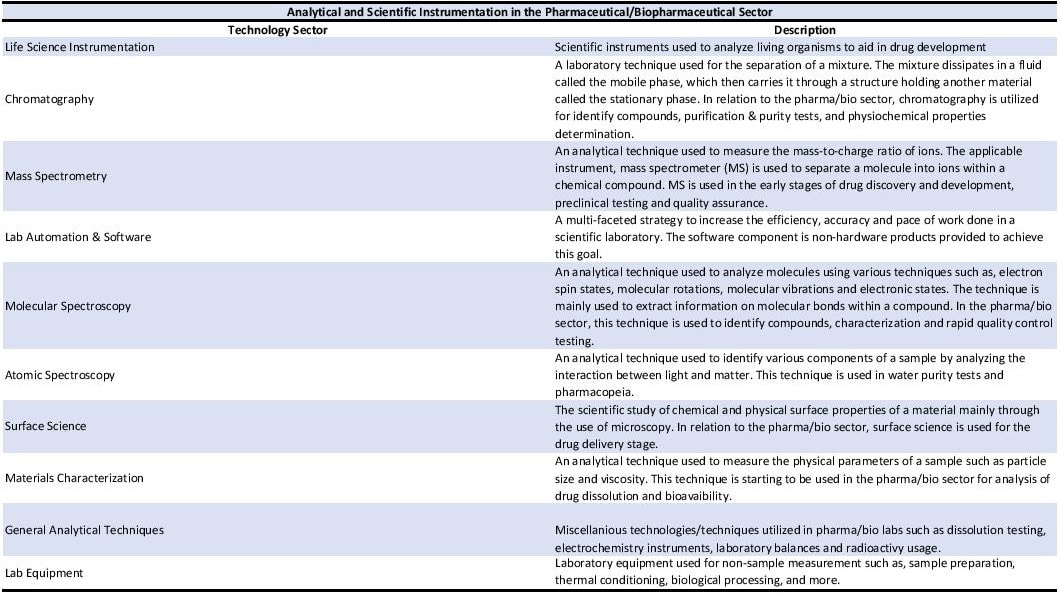

In August 2019, IBO’s publisher Strategic Directions International released the Lab Instrumentation Markets for Pharmaceuticals, Biopharmaceuticals, & CROs report, which provides a detailed overview of the current market situation for analytical and scientific instrumentation in the pharmaceutical, biopharmaceutical and CROs market. Specifically, the report outlines the market trends and regional and industrial demands for both the overall market and 64 technologies within ten technology sectors. The ten technology sectors are the following: life science instrumentation, chromatography, mass spectrometry, atomic spectroscopy, surface science, materials characterization, general analytical techniques, and lab equipment. Also, the report highlights the leading companies offering these technologies, which include Thermo Fisher Scientific, Waters, MilliporeSigma, Bruker, Malvern Panalytical (Spectris), Danaher, and others.

According to the report, in 2018, the market for analytical and scientific instrumentation usage in the pharmaceutical/biopharmaceutical market was estimated at over $19 billion and is projected to achieve high single-digit sales growth to $26 billion by 2023. Biotherapeutics R&D application is forecast to be the main growth driver because of the pharmaceutical/biopharmaceutical industry’s shift towards a precision drug development model. In comparison to small molecule R&D methods, biotherapeutics R&D has a leaner infrastructure, which results in developing drugs with fewer side effects and drugs with a small patient pool. As a result, regulatory approvals are passed at a higher rate for biotherapeutics than for small molecule-based drugs. Nevertheless, small molecule-based research is still forecast to be the leading R&D method in the pharmaceutical/biopharmaceutical industry, yet growth in demand for the method is waning. The report also highlights that companies that utilize either or both R&D methods will rely heavily on collaboration and outsourcing, which will lead to higher demand for CROs.

Geographically, in 2018, the US & Canada, and Europe were the two largest regional markets for the pharmaceutical/biopharmaceutical-related analytical and scientific instrumentation market, with China being the fastest-growing region. The report forecasts that China will lead revenue growth due to expansion in the pharmaceutical/biopharmaceutical market in the country, but predict declining sales in Europe due to various socio-political events, such as Brexit.

In 2018, sales-wise, life science instrumentation, chromatography, and lab automation & software were the highest-selling analytical and scientific technologies within the pharmaceutical/biopharmaceutical market. However, the report forecasts that out of those three, life science instrumentation would continue to be a fast-growing sector, along with mass spectrometry and materials characterization. All three sectors’ sales are predicted to rise in the high single digits through 2023.

Within the life science instrumentation sector, demand from emerging markets such as China and other Asia Pacific countries is expected to increase significantly. At the same time, the report predicts biotherapeutics R&D application will be the primary usage for the technology. Product-wise, PCR will account for the most significant portion of the market, while sequencing will be the main growth driver, due to demand for next-generation sequencing. Thermo Fisher, Illumina, and QIAGEN are the top suppliers for this technology sector.

Like the life science instrumentation sector, the mass spectrometry sector is expected to have emerging markets such as China and other Asia Pacific countries and biotherapeutics R&D application to be the sector’s primary revenue drivers. However, the mass spectrometry market differs because of the increased demand from CRO customers who use mass spectrometry technology for their analytical services to pharmaceutical/biopharmaceutical companies. Product-wise, quadrupole LC/MS is forecast to have the most robust growth, followed by MALDI-TOF technology. SCIEX (Danaher), Thermo Fisher, and Waters are the top three vendors for mass spectrometry.

Though materials characterization has a small revenue size in comparison to the other nine main technology sectors, the report forecasts the sector to be one of the fastest-growing segments due to the demand for calorimetry in the study of cell metabolism. On a geographical basis, the US, China, and India are anticipated to be the most significant growth drivers with biotherapeutics R&D being the main applied usage from customers. TA Instruments (Waters), Malvern Panalytical (Spectris), and Mettler-Toledo are the top three suppliers.

Though the report highlights the benefits that analytical and scientific instrumentation brings to the pharmaceutical and biopharmaceutical market, it also notes the drawbacks that could occur. For instance, though M&A is seen as a byproduct of sales growth for the pharmaceutical and biopharmaceutical market, it can also result in decreased competition and a smaller customer pool for analytical and scientific instrument suppliers. The report also notes a slow global economy and the uncertain impact of the UK’s exit from the EU (Brexit).