2017 M&A Activity: Private Equity Makes its Mark

Analytical instrument and laboratory product companies continued to branch out over the last year via M&A activity. As usual, Danaher and Thermo Fisher Scientific remained active in their acquistions, both within and outside the analytical instrument and lab product market. For instance, in Thermo Fisher’s case, its largest purchase, the $7.2 billion acquisition of contract development and manufacturing firm Patheon (see IBO 5/15/17), was outside the analytical instrument and lab product market. Likewise, a number of other instrument makers sought to broaden their end-markets, such as Bruker and PerkinElmer, which invested in companies dedicated to diagnostics products.

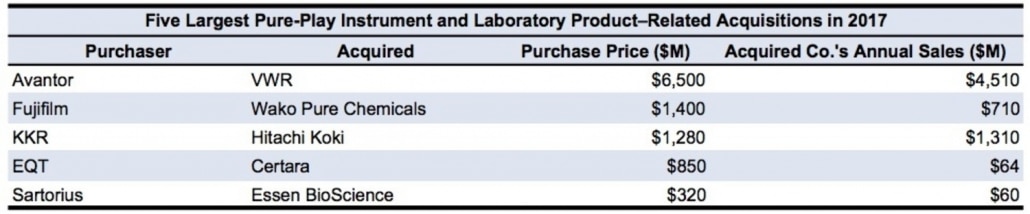

Nonetheless, M&A activity for analytical instrumentation, and especially the consumables and software products used with them, was in line with previous years. The largest deal this year was Avantor’s $6.5 billion purchase of VWR (see IBO 11/30/17). In fact, three deals topped the billion dollar mark this year (see table below). Three of the year’s largest deals involved private equity, indicative of those buyers’ interest in the laboratory sector and willingness to spend.

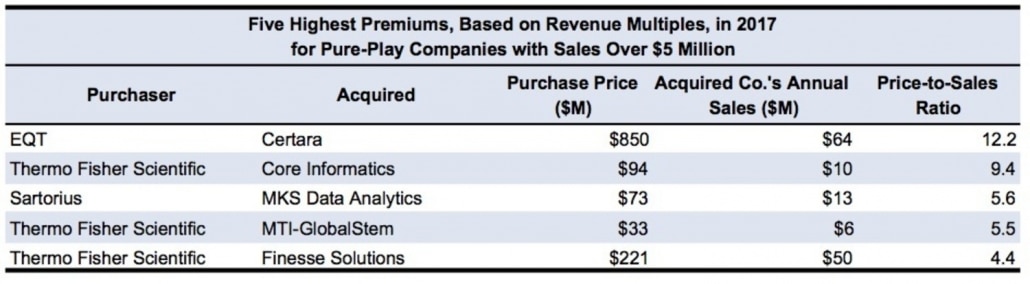

Surprisingly, two of these transactions were ranked among 2017’s five “best values” (see table below). Also on that list is Horizon Discovery’s purchase of Dharmacon (see IBO 7/31/17), a divestment by GE Healthcare that also yielded a stake in Horizon. Also leaving a market via a divestment was Oxford Instruments, which sold its atomic spectroscopy business to Hitachi High-Technologies (see IBO 4/20/17).

In this review of the year’s M&A activity, IBO focused on pure-play acquisitions by analytical instrument and lab product companies. Thus, the review excludes acquisitions in markets such as diagnostics and process analytics. The review of M&A activity is based on acquisitions news published in IBO between November 30, 2016 and December 15. Unless otherwise noted, the information is based on publicly available company financial reports and press releases.

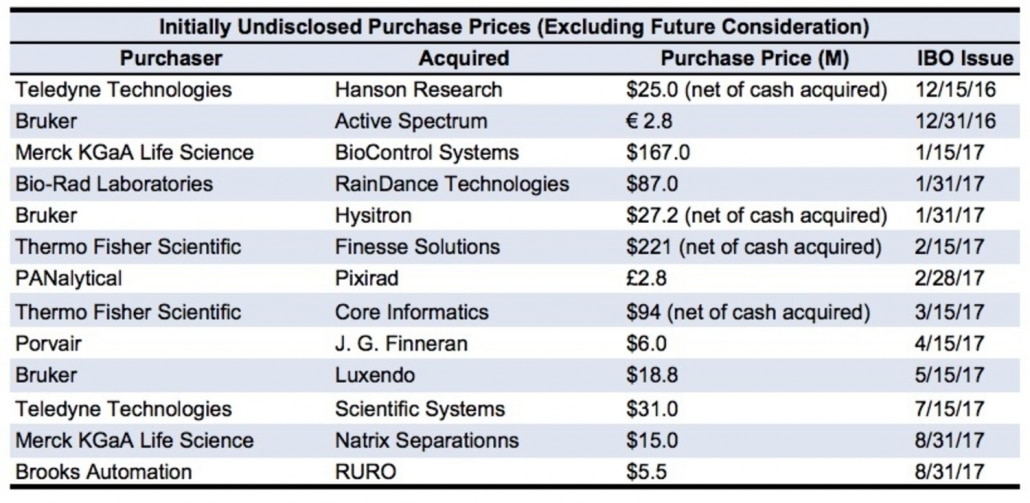

Among the most active companies this year were Bruker, which made a series of small bolt-on purchases, adding new technologies and investing in its MALDI Biotyper franchise. Other companies choosing to add to successful product lines included Agilent Technologies and Population Genetics (see IBO 7/31/17), Bio-Rad Laboratories and RainDance Technologies (see IBO 1/31/17), and Mettler-Toledo and Biotix (see IBO 11/15/17). In many cases, companies also acquired former suppliers, as with Bio-Techne and Trevigen (see IBO 9/15/17), Teledyne Technologies and Scientific Systems (see IBO 7/15/17), and Spectris (PANalytical) and Pixirad (see IBO 2/28/17).

Companies entering new technology markets via M&A included Danaher’s deal for IDBS (see IBO 10/31/17), Shimadzu with its purchase of AlsaChim (see IBO 6/30/17) and Teledyne Technologies through its acquisition of Hanson Research (see IBO 12/15/16).

Distributors Attract Buyers

The year’s largest acquisition by far was Avantor/New Mountain Capital’s purchase of laboratory product and services firm VWR (see IBO 11/30/17). Avantor highlighted the critical mass, synergies and end-to-end solutions created by combining its chemicals business with VWR’s lab products business. The size of the new company and its diverse offerings can be expected to enhance VWR’s ability to compete for large accounts and internationally with its major competitor, Thermo Fisher Scientific.

In another leveraged buyout targeting lab product distribution, private equity firm Golden Gate Capital acquired Cole-Parmer, a manufacturer and distributor of laboratory equipment, for a reported $910 million (excluding fees and expenses), according to Moody’s. Moody’s reported that Cole-Parmer has 2016 revenues of approximately $343 million. This purchase, along with the acquisition of US lab product distributor Thomas Scientific for an undisclosed amount by Carlyle Group, one of the world’s largest private equity firms (see IBO 9/30/17), suggests increased interest in lab product distribution, as well as continued growth in this market by these private equity participants through additional acquisitions.

Hot Markets: Cell Research, Software, Raman

Products for cell biology research, both instruments and aftermarket, were also the focus of acquisitions as the current market and the future promise of cell biology provides an important sales growth and strategic driver. In fact, an effort to grow a cell research business was behind one of the year’s largest purchases. This spring, Fujifilm acquired Wako Pure Chemicals for $1.4 billion (see IBO 12/31/17). Wako Pure Chemical produces cell research products, particularly customized cell culture media. Fujifilm highlighted the synergies with its other life science research businesses, which includes Cellular Dynamics. But the purchase also impacts the laboratory chemicals market in general, as Wako Pure Chemicals is among the largest suppliers in this market.

Sartorius continued its investments in cellular analysis instrumentation with the purchase of Essen BioScience (see IBO 3/15/17). Similarly, Bio-Techne added to its consumables line for cell analysis by purchasing Trevigen (see IBO 9/15/17), which not only adds the cell culture and cell assay products Bio-Techne previously distributed, but also expertise in the field and thus the ability to grow the business. Thermo Fisher purchased MTI-GlobalStem (see IBO 11/30/17), a provider of cell culture and transfection products, similarly adding to its existing offerings for cell research.

In another market addressing current research trends as well as the future products for laboratory data management, Thermo Fisher purchased Core Informatics, building its cloud and lab data management capabilities (see IBO 3/15/17). Thermo Fisher paid $221 million for the company, whose annual sales totaled $10 million (see table below).

The software sector also attracted another major lab instrument player. Danaher announced the purchase of ELN company IDBS for a reported $100 million, adding further capabilities for serving the pharmaceutical market, as well as dedicated software company (see IBO 10/31/17). The purchase marked Danaher’s entrance into the ELN and data informatics market, positioning it to offer more comprehensive lab solutions. This was also indicative of Danaher’s continued investments in its analytical instrument business.

As for entering new technology markets, several companies focused on molecular spectroscopy, focusing, not surprisingly, on the fastest growing segment. Agilent Technologies and Anton Paar each entered Raman spectroscopy market by acquiring Cobalt Light System (see IBO 7/15/17) and BaySpec’s Raman product line (see IBO 12/15/16), respectively. Metrohm expanded its Raman offerings with the purchase of Diagnostics anSERS (see IBO 11/30/17).

Companies Build NGS Capabilities

Agilent continued to enlarge its footprint in the NGS market. The company acquired the intellectual property of Population Genetics for NGS sample preparation, building upon a successful franchise by purchasing a previously licensed technology (see IBO 7/31/17). The company also acquired Multiplicom, a supplier of NGS assays for both research and diagnostics applications (see IBO 12/31/16).

Although the pace of M&A for NGS has slowed somewhat from previous years, NGS-related companies continue to be targets. The acquisitions targeted the growing sample preparation tools and analysis software markets. Takara Bio purchased Rubicon Genomics, which provides the ThruPLEX products for NGS sample prep (see IBO 12/31/16). Bio-Rad’s $87 million purchase of RainDance Technologies (see IBO 1/31/17) also addresses NGS sample prep, utilizing RainDance Technologies’ digital PCR and microfluidic technology for such applications. Spiral Genetics (see IBO 1/31/17) and OmicSoft (see IBO 1/15/17), providers of NGS analysis software, also changed hands. They were acquired by QIAGEN and Fabric Genomics, respectively, as consolidation continued in the fragments of the NGS software market.

Consumables: Always a Draw

As expected, companies invested in life science consumables companies, ever aware of the benefits of these high-margin, recurring revenue product lines. Mettler-Toledo expanded its Rainin pipettor franchise with a deal to acquire Biotix (see IBO 11/15/17). In the case of Brooks Automation, the firm expanded its biostorage business, adding a new PCR consumables product line by purchasing 4titude (see IBO 10/15/17).

Moving away from services by enlarging its consumables business was Horizon Discovery, which acquired Dharmacon for $85 million as well as sold a stake in the combined company to GE Healthcare (see IBO 7/31/17). In doing so, Horizon shored up its genetic engineering product lines, becoming less reliant on its genetic engineering services as a major percentage of revenues.

M&A in the last year was a story of a few megadeals and many smaller bolt-ons purchases, with an emphasis on life science but also healthy interest in spectroscopy and bioprocess chromatography (see IBO 8/31/17, IBO 11/30/17). It was driven not only by the industry’s biggest companies, but also by private equity buyers.