Bio-Techne: A Transformed Company

In its last issue, IBO named Bio-Techne as its 2016 company of the year (see IBO 1/15/17). In this issue, IBO takes a closer look at the firm and the elements of its growth strategy that have revitalized the company.

Founded in 1976 as R&D Systems, the Company became a public company trading on the NASDAQ stock exchange in 1983 as Techne (TECH). Today it conducts business under the Bio-Techne name and is a provider of life science reagents and instrumentation for research and clinical diagnostics, serving a broad range of applications and customer segments. Major product lines include antibodies, cytokines, immunoassays, capillary electrophoresis (CE) systems and calibrators for clinical instruments.

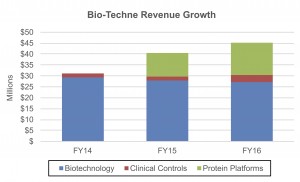

Sixty-four percent of the company’s sales are derived from its Biotechnology segment, which offers proteins, antibodies, immunoassays and biologically active small molecules. In fiscal 2016, sales for the Biotechnology segment totaled $317.3 million. The Diagnostic segment offers controls and calibrators, as well as bulk reagents, and accounts for 21% of revenues, with greater than 50% of this business conducted on an OEM basis. The company’s Protein Platform segment represents 15% of sales, and offers instrumentation for protein analysis.

When CEO Chuck Kummeth was hired in 2013 (see IBO 6/15/13), revenues were falling in part due to declines in NIH spending. In addition, as a result of underinvestment, the company’s infrastructure was insufficient for a changing competitive environment. As Mr. Kummeth told IBO, he “made the strategic decision to leverage Bio-Techne’s vast biological content and reagent expertise to expand into adjacent life science tools markets through an active M&A program.” The strategy also required other organizational changes. “Bio-Techne’s core business consists of thousands of products, with none representing more than $2 million in annual revenue and sales spanning thousands of customers. Given the company’s diverse customer and product mix, returning the core portfolio to consistent growth required significant fundamental changes in how the company approached its end-markets and the overall leadership of the business.”

“Bio-Techne made it easier for its customers to do business with the company.”

Mr. Kummeth installed a new senior leadership team, hiring 12 senior executives, and revised the compensation plan to link pay to performance. Infrastructure investments included new technology and enterprise-wide business systems. New investments were also made internationally, most notably, the expansion of the firm’s Chinese business, through new products offerings, such as the R&D Systems brand, personnel and acquisitions. The 2014 purchase of PrimeGene (see IBO 4/15/14) gave the company access to Chinese manufacturing and, consequently, the country’s middle market for lower-priced products.

Customer contact was a particular focus. “Bio-Techne made it easier for its customers to do business with the company, making investments to completely overhaul its website as well as forming a partnership with Fisher Scientific, leveraging Fisher’s channel and sales force to increase exposure with academic, industrial and governmental customers,” said Mr. Kummeth. In fiscal 2016, revenues rose 10.3%, 6% organically, to nearly $500 million, up from sales of $310.6 million in 2013, when sales declined 0.4%. Excluding currency, company sales have recorded a three-year combined annual growth rate of 18.3%.

Bio-Techne has quickly expanded through acquisitions. As Mr. Kummeth explained, “These initiatives were coupled with a disciplined M&A strategy, broadening the Biotechnology portfolio offering (Novus Biologicals [see IBO 7/15/14], Advanced Cell Diagnostics [see IBO 7/15/16]) and geographic presence (PrimeGene, Space Import Export [see IBO 7/15/16]), adding critical mass to its Diagnostics segment (Bionostics, Cliniqa [see IBO 6/15/15]) and expanding into the instrumentation business (Protein Simple [see IBO 6/30/14], CyVek [11/15/14], Zephyrus Biosciences [see IBO 3/31/16]).” Since 2013, Bio-Techne has completed nine acquisitions. The firm continues to evaluate a large pipeline of potential M&A targets. Priorities include fast growing applications, value-added products and regional expansion.

The purchase of Novus Biologicals, a supplier of antibodies and reagents, not only provided the company with new content but also enhanced online capabilities that have been utilized to increase Bio-Techne’s web presence. In particular, the company has credited a new website for its R&D Systems brand as having a significant impact on sales. Last fiscal year, website traffic increased 10% and online orders grew 15%.

Asked how the company distinguishes its website from competitors’ sites, Karen Padgett, vice president of Antibody Business Unit and Global Marketing at Bio-Techne, told IBO, “The new R&D Systems website has leveraged all of the deep scientific content created by our strong scientific teams by making it more readily available as a resource. There are also 100 scientifically curated, interactive pathways; live chat; customer reviews; and substantially more application data.” The new website is a showcase for the depth of scientific expertise behind Bio-Techne products. “We also added an entire feature on our quality systems as well as our state-of-the-art facilities in Minneapolis, Minnesota, and our largely expanded custom service offerings,” she noted.

Acquisitions also led to the formation of the company’s Protein Platforms segment. The segment includes the former Protein Simple, CyVek and Zephyrus Biosciences product lines; specifically, the Simple Western Platform, which simplifies western blotting, offering improved reproducibility and quantitative results; the SimplePlex system for multiplex ELISAs and a faster workflow; and the Single Cell Western for single-cell western blotting. In addition, the segment offers the micro-flow imaging (MFI) and CE systems for biologics development and production.

Protein Simple formed a foundation for the Protein Platforms segment, while the two start-ups added promising growth engines. Each product line utilizes the Biotechnology segment’s content, driving growth in that segment and creating solutions for end-users. “Moving upstream to include instrumentation that utilizes Bio-Techne content, consumables and reagents was a natural progression for the company,” said Bob Galvin, senior vice president, Protein Platforms. “Through three separate acquisitions, Bio-Techne quickly built its Protein Platforms division to offer a wide range of innovative protein analysis products, many of which leverage the Bio-Techne reagent portfolio,” he added.

The integration also includes sales. “The Biotechnology and Protein Platforms divisions target the same academic and biopharma customers, enabling Bio-Techne to utilize an integrated sales approach across the two divisions,” he explained. “In this integrated approach, Bio-Techne can now simultaneously showcase instrumentation to simplify and improve lab workflow, as well as the highest quality reagents to ensure quality experiments. Going forward, developing or acquiring instrumentation leveraging Bio-Techne reagents and biological content remains a key component of its growth strategy.”

Each of the segment’s four instrument platforms are novel technologies. Asked about the challenges of getting researchers to replace their traditional technologies, Mr. Gavin told IBO, “In order to adopt them, scientists require that new techniques solve real scientific problems. New technologies must allow them to perform experiments that they could not otherwise complete in order to justify transition from traditional tools.” For example, the Simple Plex reduces the number of separate steps for an ELISA from 8 to 2.

Customer engagement and education communicate the technology’s advantages. “In the marketing of new technologies like Simple Plex or Single-Cell Western, the focus will continue to be on identifying scientists who can benefit from these tools in a unique way. This is followed by a consultative sales method to work with the scientists who can benefit from acquiring the technology,” explained Mr. Gavin. Applications support is also key. “Finally, a consistent and cooperative application support team after the sale is required to ensure new customers can successfully deploy the technology in their labs. Focusing on supporting the science our customers perform will speed the adoption of innovative technologies.”

Bio-Techne plans to continue to grow through acquisitions, introduce additional value-added products, and expand into high growth markets, such as companion diagnostics and custom product development. Mr. Kummeth told IBO, “Bio-Techne continues to execute on its plan and is well on its way to achieving its initial strategic targets, including reaching the milestone of $1 billion in revenue (includes over $100 million in China), 4–6 divisions (currently 3) and over 2,500 employees (currently around 1,700).”