Continued Modest Growth Predicted for the Analytical and Scientific Instrumentation Market in Europe

Despite macroeconomic and industry-related challenges, Europe has been a steady regional market for the analytical and scientific instrument industry. IBO’s publisher, Strategic Directions International (SDi), part of Science and Medicine Group, believes market growth in Europe will occur for various reasons. For example, the EU’s scientific research funding program, Horizon Europe, has led to demand for analytical and scientific instruments and lab tool products. Other recent factors influencing the market include Brexit and the Russia-Ukraine conflict.

In November 2023, SDi published “SDi Europe 2023: The Market for Laboratory Analytical & Life Science Instrumentation,” which gives an overview of the European market for analytical and life science instrumentation and forecasts demand through 2027. The report summarizes the demand by end-market and technology. The countries included in the report are France, Germany, Italy, Russia, Spain, Switzerland, the UK and Other Europe. SDi used both primary and secondary resources for the report. Primary sources included interviews, and secondary resources entailed company financial documents, industry-related publications and website documents.

The 10 technology sectors covered in the report are atomic spectroscopy, chromatography, lab automation & informatics, lab equipment, life science instrumentation, mass spectrometry (MS), materials characterization, molecular spectroscopy, sample preparation and surface science. Furthermore, SDi gives revenues and market forecasts by application, region, sector and more for each of the 10 laboratory technologies.

In 2022, Europe’s analytical and scientific instrumentation market generated over $21.0 billion in sales and is forecast to record a low single-digit increase through 2027 CAGR. According to the report, Agilent Technologies, Danaher and Thermo Fisher Scientific are the top vendors in Europe.

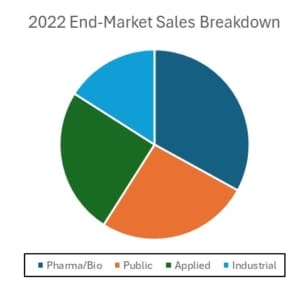

By end-market, the pharmaceutical/bio end-market is forecast to be an end-market leader due to Europe’s aging population and the emerging market for highly-targeted biotherapeutics. SDi noted that declining COVID-19-related revenues, rising interest rates and the collapse of Silicon Valley Bank were challenges for the local pharmaceutical and biotech sector and thus affected the European analytical and scientific instrumentation market.

Mass Spectrometry

By technology, mass spectrometry (MS) is predicted to be the main growth driver for European instrument sales. The MS market in Europe is anticipated to rise in the high single digits through 2027 CAGR due to proteomics research activity in the region. Within the MS market, quadrupole LC/MS technology is predicted to be the main MS sales leader because of these instruments’ capabilities and performances, which are suited for biotherapeutics development, environmental testing and proteomics research.

The top vendors in Europe for MS systems were Agilent, Danaher and Thermo Fisher, with each company specializing in a particular MS technology. For instance, Agilent is a large supplier in the GC/MS and LC/MS markets. Danaher is a leading vendor of quadrupole LC/MS systems. Lastly, Thermo Fisher has a strong presence in the Fourier Transform MS (FT/MS) and isotope ratio MS markets.