Fall 2017 Business Climate Survey: End-markets Propel Growth

The biannual IBO Business Climate Survey analyzes insight from executives at instrument and lab product companies regarding future industry and growth prospects and developments. The 2017 fall survey was conducted by email in early October and included IBO subscribers and solicited Strategic Directions International and BioInformatics, LLC customers.

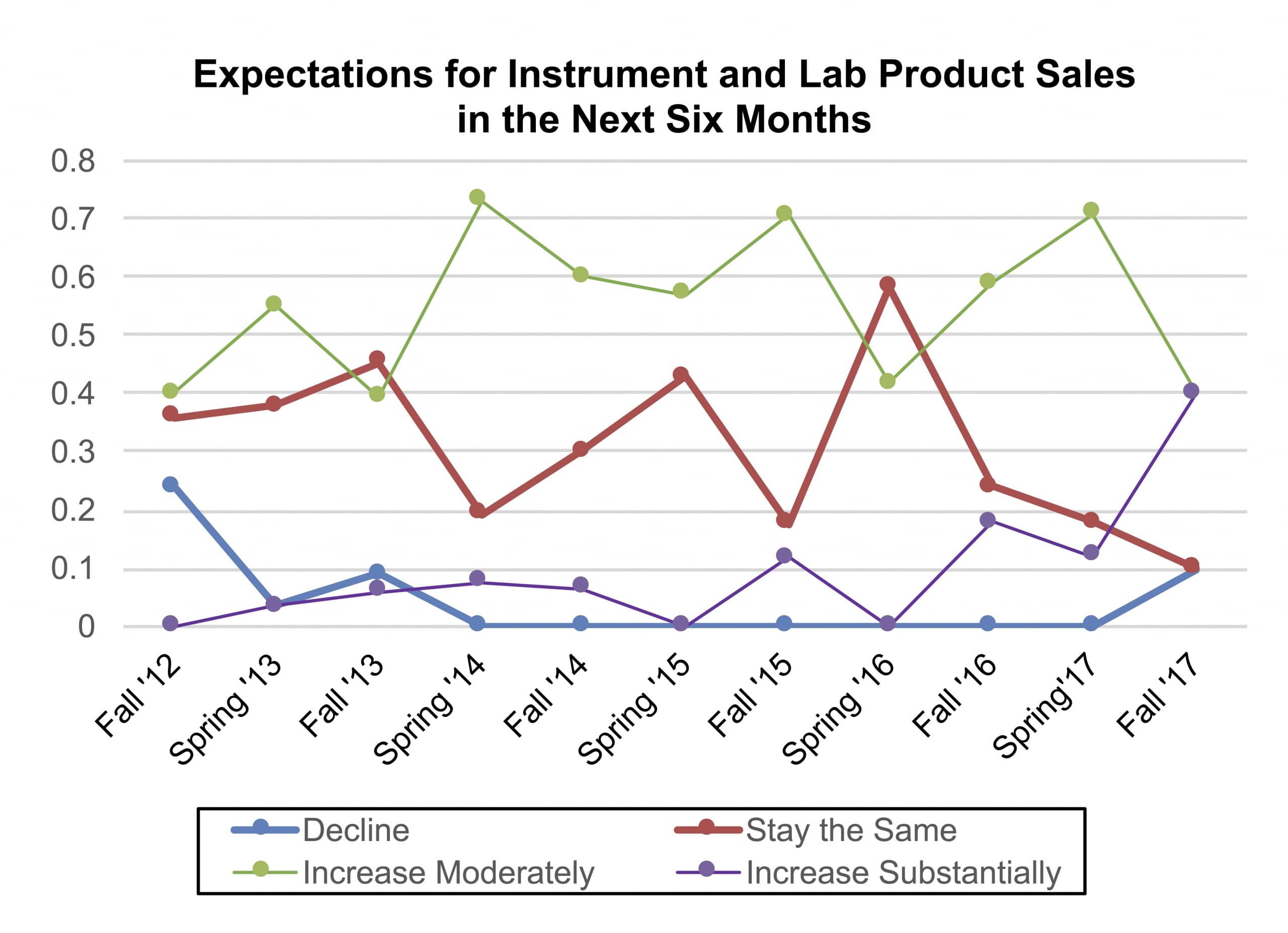

In regards to sales expectations over the next half-year period for instruments and lab products, 40% of executives indicated that they expect sales to increase moderately or increase substantially, thus a total of 80% of executives predict sales to increase over the next six months. This is a healthy jump from the spring 2017 Business Climate Survey (see IBO 5/15/17), in which 71% of respondents stated that they expected sales to increase moderately and only 12% forecast sales to increase substantially.

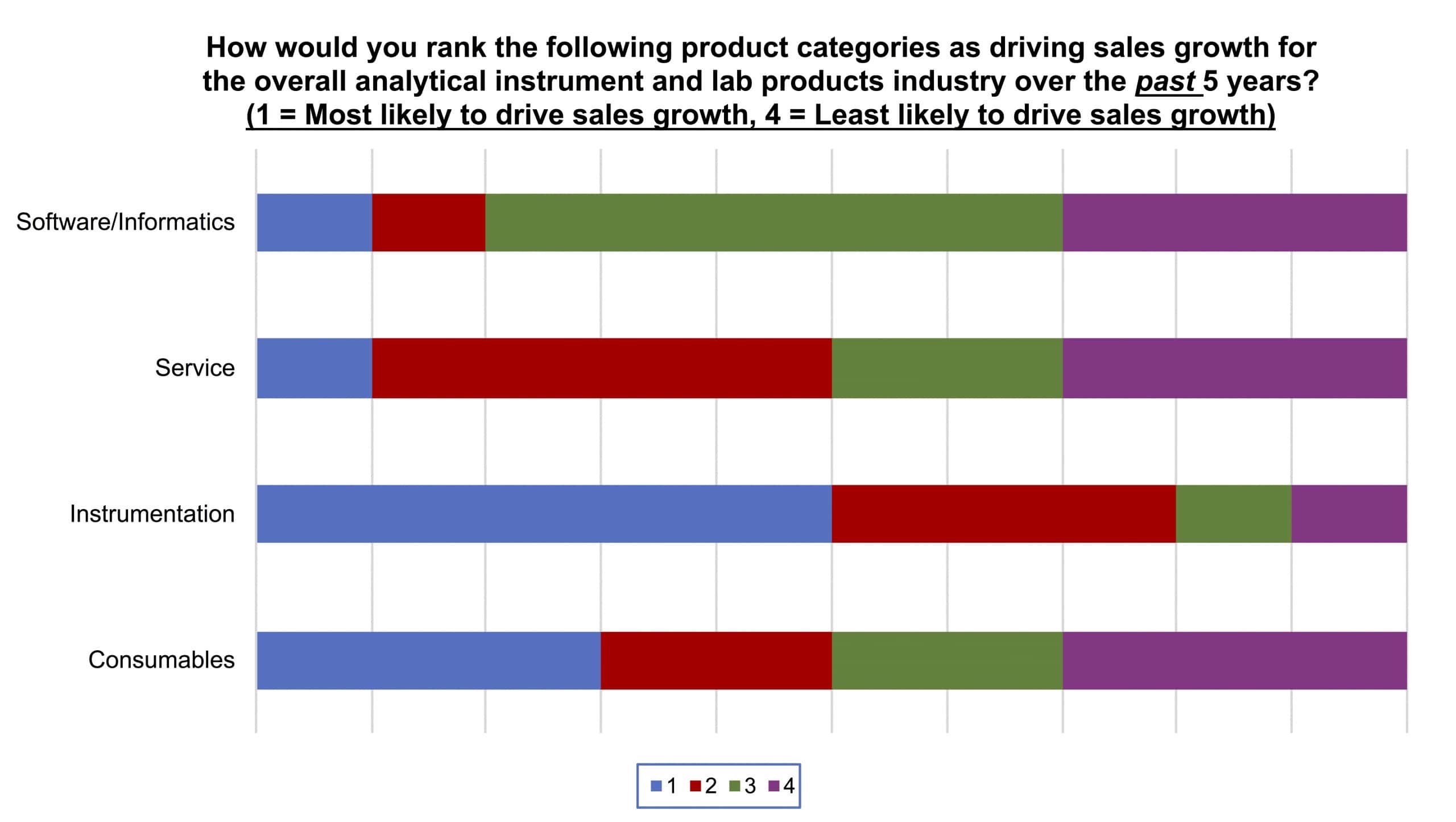

Among 4 types of product categories (see graph below), instrumentation emerged as a clear indicator of sales growth not only over the last 5 years, but it is also expected to most accelerate sales growth over the next 5 years, with 50% of respondents citing it as a major driver of sales. Thirty percent of respondents indicated consumables as most likely to have driven sales over the past 5 years.

While service was acknowledged by 50% respondents as having most likely or likely to have increased sales in the past 5 years by, fewer respondents expected it to continue driving sales over the next 5-year period, as only 30% of respondents indicated it as likely to drive sales and no respondents indicated it was most likely to drive sales.

For software and informatics, however, a reverse trend emerged, with 10% of respondents indicating it as most likely to have driven sales growth in the past 5 years, and 20% of respondents expecting it to be most likely to drive sales in the next 5 years.

Solution-based purchases (initial sale encompassing integrated instrumentation, software, consumables and service from one vendor and its partners), automation and ease-of-use features, and a higher demand for regulatory compliance and testing emerged as the industry trends with the greatest potential to lead sales growth, with 30%, 20% and 20% of respondents, respectively, ranking them as the most lucrative developments over the next five years.

Cloud-based computing was not seen as the biggest growth opportunity, with 40% of respondents ranking it at a 3, indicating that it is a stable growth opportunity. In contrast, the migration of research technologies to clinical markets is seen as the industry trend least likely to provide the most sales growth, with 40% of respondents ranking it a 5.

These trends are expected to carry over to the next decade as well, with respondents indicating that solution-based purchases would provide the biggest growth opportunity over the next 10-year period, followed by demand for regulatory compliance and testing.

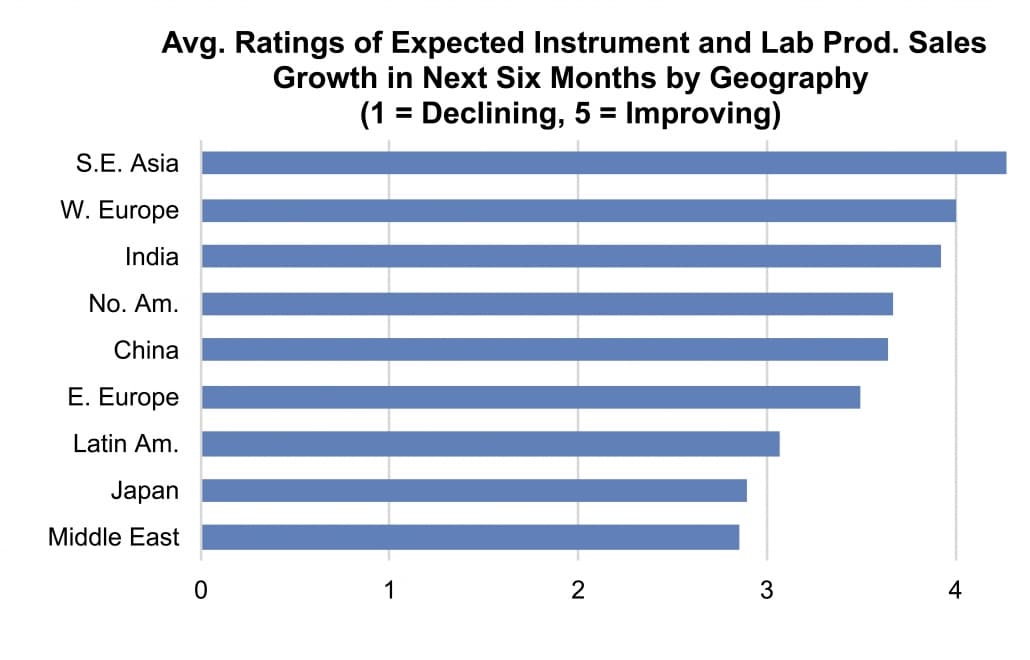

Respondents were also asked to forecast their companies’ sales growth rates for the next 6 months in 8 geographic regions (see graph below) on a scale of 1 to 5, with 1 representing a declining growth rate, 3 representing a stable growth rate and 5 representing an improving growth rate. Southeast Asia emerged as a clear leader in expectations of improving sales growth with a combined average of 4.3. The only regions to receive a combined average score of less than 3 were Japan and the Middle East, both at 2.9, indicating those regions could potentially have declining sales over the next 6 months.

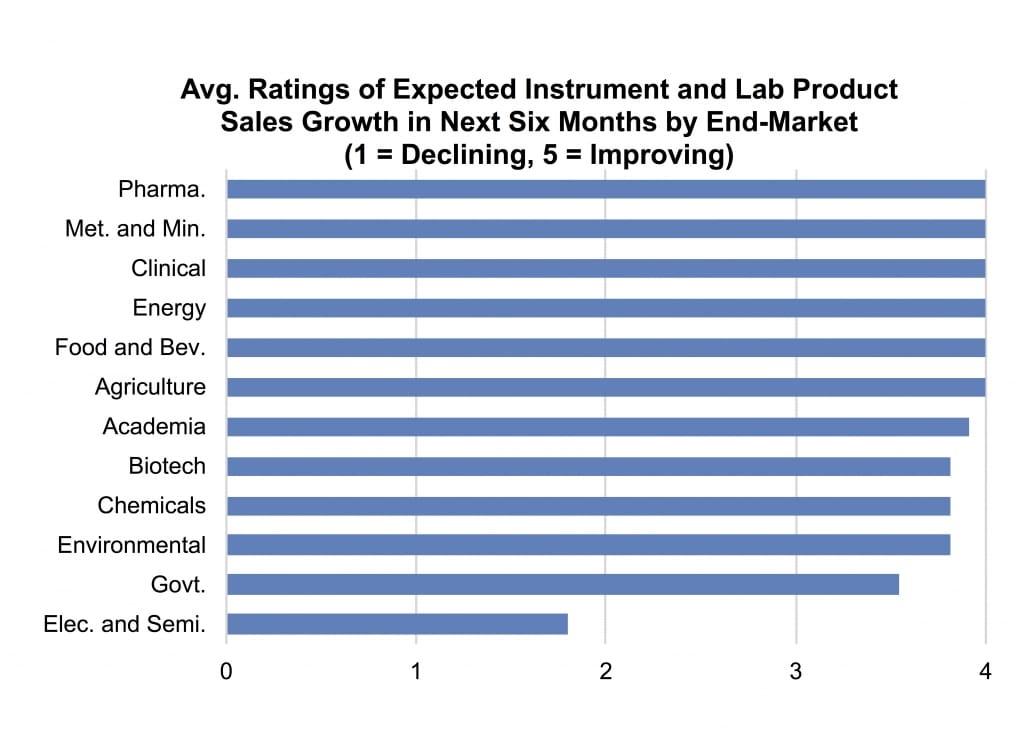

The same rating system was used to determine the respondents’ views on sales growth in 12 end-markets (see graph below). Pharmaceuticals was indicated as the prospective end-market with the highest improving sales growth rate, with a combined average of 4.4. Metals and minerals, clinical, energy, food and beverage and agriculture all had combined averages of over 4.0, while biotechnology, the highest ranked end-market in the Spring 2017 survey, fell to a combined average rating of 3.8.

Academia, chemicals and environmental hovered around a combined average of 3.8, indicating a forecast of stable sales in those end-markets. Electronics and semiconductors was the outlier of the group, receiving a combined average of 1.8, signifying that sales are not expected to improve in this market.