Spring 2017 IBO Business Climate Survey: Doubts Remain

The latest IBO Business Climate Survey shows overall optimism for instrument and lab product sales for the next six months but also indicates areas of concern, especially around certain end-markets. The survey was conducted by email the weeks of May 1 and 8. Surveys were sent to IBO subscribers, as well as other instrument and lab product company executives who opted to a take the survey in return for a complimentary issue of IBO. There were a total of 17 respondents.

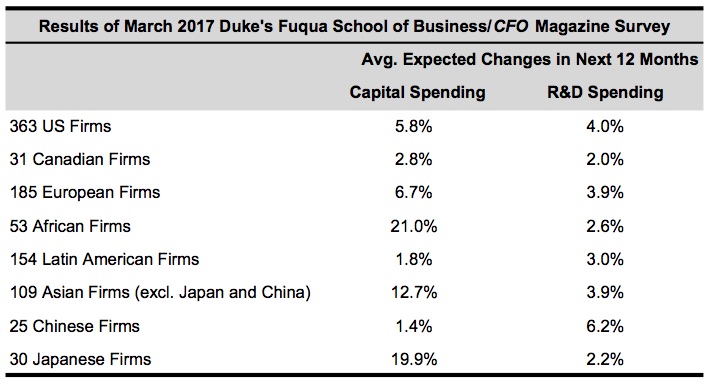

Duke and CFO Magazine’s quarterly “Global Business Outlook” Survey surveys senior financial executives and CFO subscribers at both public and private companies. The latest survey, conducted in March, showed increased optimism. Results for R&D and capital spending plans are shown in the table below.

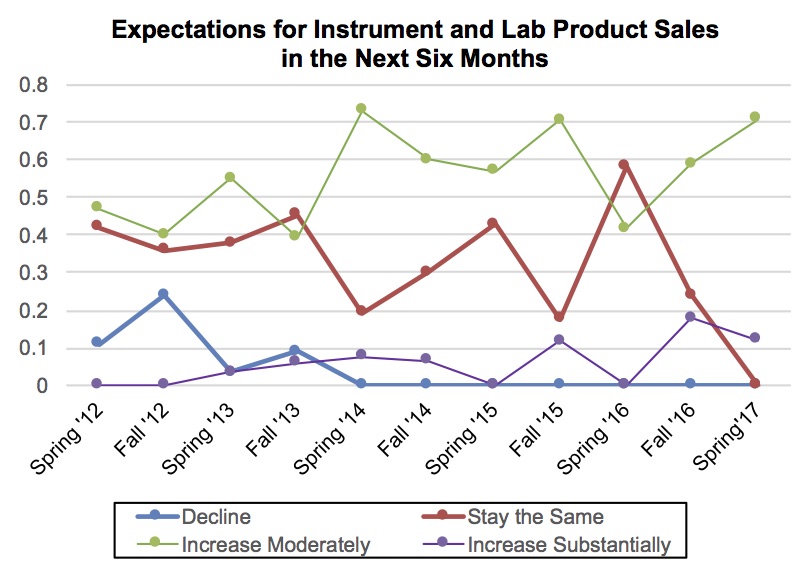

Such optimism was also evident in IBO’s survey. Over 70% of executives surveyed by IBO expect instrument and lab product sales to increase moderately in the second and third quarter. This is a healthy increase from the 59% in the fall 2017 survey (see IBO 10/31/16), perhaps owing to the completed elections in the US and France. As usual, no respondent expected sales to decline.

It is widely acknowledged that the election of Donald Trump as US president has brought increased uncertainty regarding a number of issues, especially federal spending on science, environmental regulations, and economic and political policies. To gauge the perception of his election on the industry’s outlook, survey respondents were asked to rate the effect of President Trump’s election on the instrument and lab product industry’s financial health and stability. According to the results, there is not much enthusiasm. On a scale of 1 to 5, with 1 indicating an overall negative effect and 5 indicating an overall positive effect, 65% of respondents rated the effect as a 2, while 24% rated it as a 3.

Asked to state the reasons for this effect, many respondents noted the uncertainty created by the Administration’s statements and actions regarding federal science funding and policy. Others noted the general level of uncertainty, citing possible negative economic and geopolitical ramifications. “He is causing uncertainty around the world, which will make managers more cautious and less likely to commit to capital purchases,” stated one survey participant. Some respondents commented on possible mixed effects, noting President Trump’s pro-business policies on the one hand, but the the possibility of a decrease in public research funding on the other. Others expect to benefit from the Administration’s pro-business stance. As one executive put it, “Negative effects on public funding will likely be offset by modestly stronger private sector performance. As our company relies more on the private sector, I expect the effect to be neutral.”

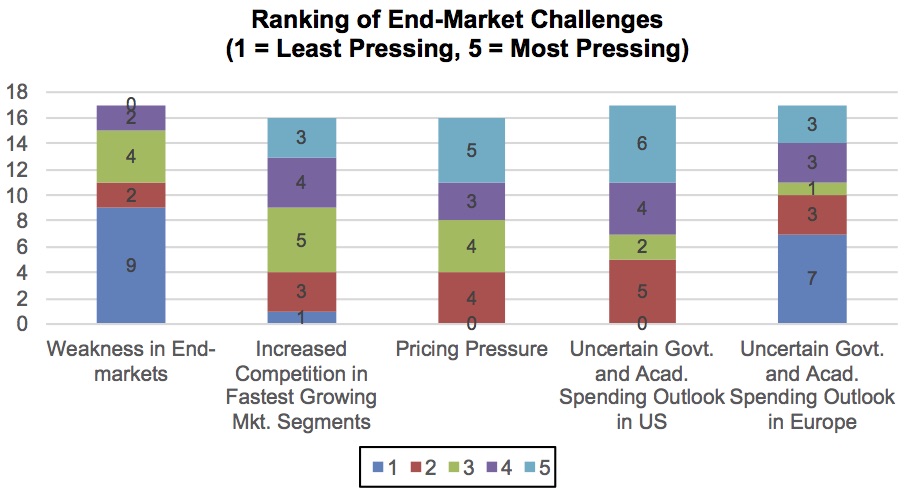

Surveyed executives were then queried about end-market challenges. They were asked to rank, on a scale of 1 to 5, with 1 being the “least pressing challenge” on the list and 5 being the “most pressing challenge” on the list, five current market challenges. As the graph below illustrates, the highest number of rankings of 5 belonged to “uncertain government and academic spending in the US,” followed closely by “pricing pressure.” Surprisingly, the highest number of respondents ranked “uncertain government and academic spending outlook in Europe” as the least pressing challenge. The good news: no respondent ranked “weakness in end-markets” as a 5, and nearly half of respondents ranked it as the least pressing.

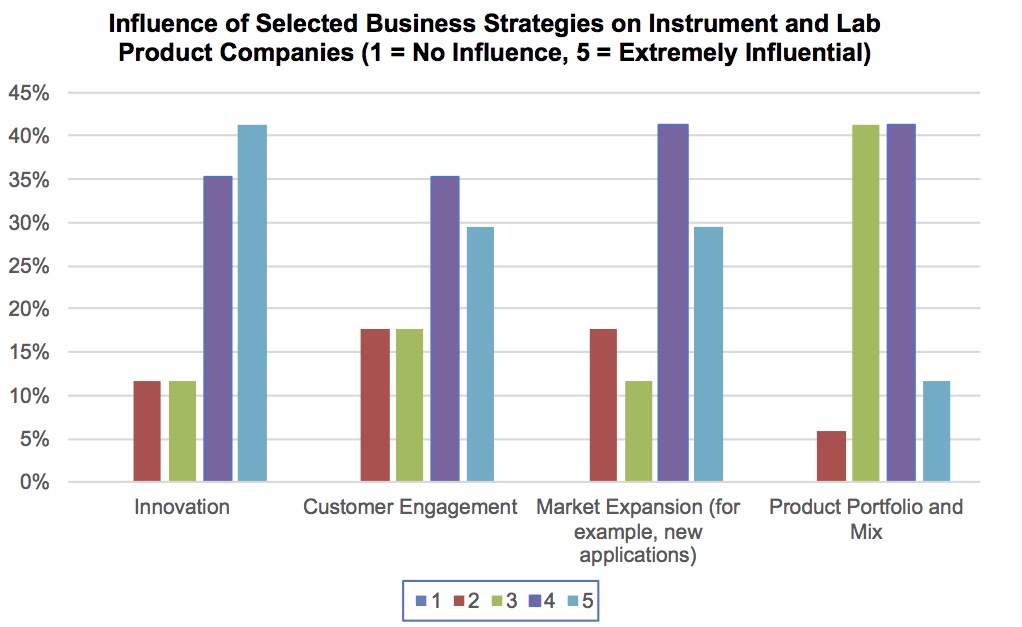

As instrument and lab product companies refine and implement strategies in response to changing market conditions, IBO sought to understand just how influential four strategies for growth—customer engagement, innovation, market expansion, and product portfolio and mix—are perceived by industry executives. IBO asked respondents to rate the strategies on a scale of 1 to 5, with 5 indicating “extremely influential” and 1 indicating “no influence.”

As the graph below indicates, “Innovation” was the only category for which the highest percentage of respondents rated a 5. For the three other strategies, the highest percentage of respondents rated them a 4. The distribution of ratings by respondents among all four strategies suggests that no one strategy can be considered a primary driver.

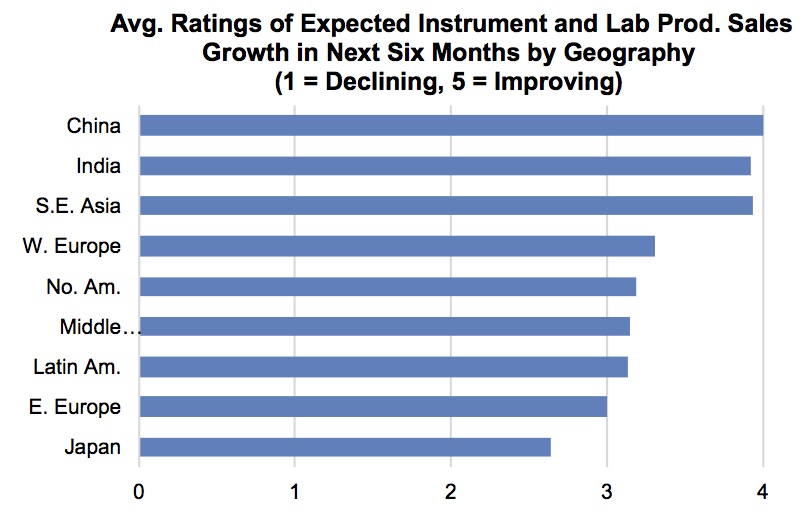

Asked to rate the prospects for their companies’ instrument and lab product sales regionally for the next six months on a scale of 1 to 5, with 1 being “declining growth,” 3 being “stable growth” and 5 being “improving growth,” China and India, as in the fall 2016 survey, were once again the highest rated among the nine regions and countries. As in the fall 2016 survey, China was the only country to receive an average rating of 4 or above.

But China, along with North America and Japan, recorded notable declines in average ratings compared to last fall. Japan’s average rating dropped a full percentage point, while North America was down five-tenths of a percentage point and China was down four-tenths of a percentage point. Surprisingly, no country or region showed a notable upward swing in average rating. The average rating for all categories was 3.5, in line with the majority of respondents’ expectations of overall moderate growth in response to the survey’s initial questions.

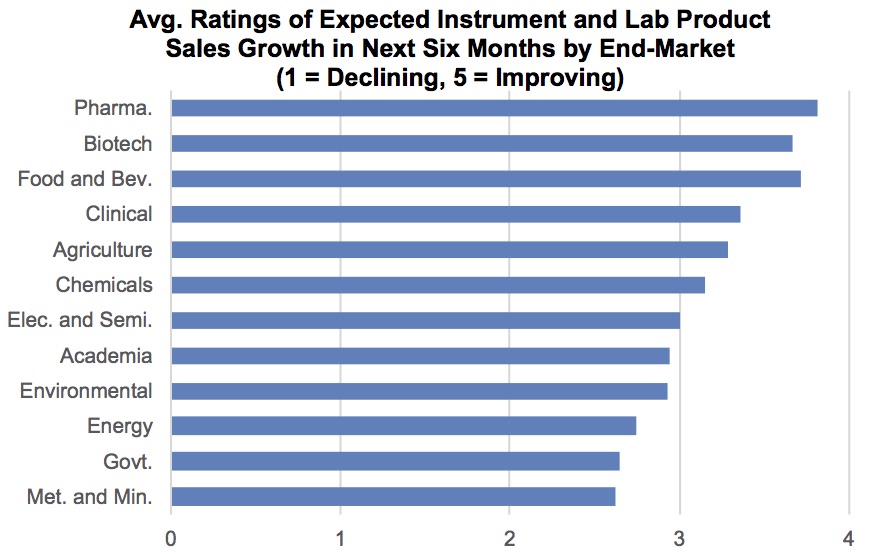

Respondents were also asked to rate on the same scale the prospects for their companies’ instrument and lab product sales for the next 6 months for 12 end-markets. In contrast to the geographic ratings, there were major changes in average ratings compared to last fall.

Biotechnology was the only category from last fall to remain within the top three, yet its average rating declined, falling three-tenths of a percentage point. In fact, it was 1 of 6 end-markets showing a notable decline compared to last fall. Average ratings for the environmental market suffered the steepest decline, dropping seven-tenths of a percentage point. The average ratings for energy and government each fell six-tenths of a percentage point. Even the average rating for the clinical market declined, dropping five-tenths of a percentage point. The only end-market to show an increase in average rating, and a quite dramatic one, was semiconductor and electronics for which the average rating increased a full percentage point to 3.0.

Overall, no end-market received an average rating above 3.8, and five end-markets were rated on average below 3.0. The average rating for all end-markets was 3.1.

Finally, respondents were asked what they believe to be the greatest threat to analytical instrument and lab product instrument sales growth over the next six months. The free text question elicited a range of responses. A number of answers cited uncertainty, ranging from academic and government research outlooks to political and economic stability. Specifically, respondents cited NATFA, Brexit, and political instability in Europe as political and economic threats. A number of respondents cited NIH cuts and budget cuts in general.