First Quarter Financial Results: Illumina, PerkinElmer, QIAGEN, Thermo Fisher Scientific and Waters

Illumina Reveals Strength for New Platform

As the company transitions to its new high-throughput sequencing system, first quarter sales for Illumina grew slightly above company expectations, climbing 4.6% to $598 million. While initial demand for its new NovaSeq system was encouraging, profit margin was negatively impacted by increased investments and higher production costs.

Orders for the new NovaSeq system exceeded company expectations at more than 135 units. Previous HiSeq X customers accounted for roughly one–third of these orders, which included several multi-unit transactions. During the quarter, the company manufactured and installed 25 NovaSeq units, capping capacity expectations.

In spite of these positive developments, total sequencing sales grew only 2% due to lower HiSeq placements and transition to the NovaSeq platform. Consequently, sequencing instrument sales contracted 17%. Despite muted expectations, the company placed more than 10 HiSeq systems, as a result of certain customer capacity requirements. In addition, sales of benchtop systems remained healthy, including continued demand for NextSeq from NIPT customers in China. MiniSeq and MiSeq sales were also sturdy, driven by demand from new-to-sequencing customers, which accounted for roughly 60% of placements for these systems.

Sales of sequencing consumables improved 7%, roughly in line with company consensus. However, unitization rates for HiSeq systems slowed at a slightly higher-than-expected rate as customers ran down existing inventories. Sequencing services revenue grew roughly 10%.

Microarray sales grew 17% to just over $100 million, driven by strong genotyping consumer demand as well as oncology testing applications, especially for commercial molecule diagnostics and translational liquid biopsy. Array sales to consumer and oncology customers grew 40% and 20%, respectively.

Geographically, sales in Asia Pacific climbed 15%, driven by strength in China, for which shipments advanced more than 35%. This growth was partially offset by lower genomics funding in Japan. Sales in the Americas expanded 4%, but declined 2% in Europe.

Illumina adjusted gross margin fell 490 basis points to 66.4% due to lower sales of sequencing instrumentation, product mix and manufacturing ramp up of the NovaSeq. Given the lower margins, and higher R&D and marketing expenses, adjusted operating margin contracted more than six percentage points to 17.6%.

Sales growth is expected to accelerate towards the second half of the year due to increased deliveries and consumable pull-through for NovaSeq. The company maintained its 2017 sales growth outlook of 10%–12% and projected second quarter sales to grow 7%. Currency headwinds are expected to reduce full-year sales growth by 1%.

Diagnostics and New Products Lift PerkinElmer

First quarter financial results for PerkinElmer outshined company expectations, as sales advanced 3.2%, 4% organically, to $514.3 million (see Bottom Line). Currency reduced sales growth by 1%, while acquisitions, net of divestments, added roughly 0.5%.

The company again highlighted its four key business areas (reproductive health, emerging market diagnostics, food and biopharmaceutical services) for which combined sales grew in the high single digits to account for just under 50% of revenues. However, demand in the remaining businesses were relatively muted, as stronger environmental sales were mostly offset by weakness in the core industrial, and academic and government markets.

Discovery & Analytical Solutions (DAS) sales improved 2% organically to account for 70% of revenues. This growth was driven by new products and strong service revenues, which grew in the mid-teens. From a market perspective, biopharmaceutical sales advanced in the mid-single digits, led by strength in OneSource, as well as healthy demand for imaging products and reagents, especially in China. However, radiochemical sales continued to decline.

Following three consecutive quarters of declining sales, environmental sales expanded in the high single digits, led by demand for the new ICP-MS system, as well as increased regulatory measures in emerging markets. Food sales grew in the mid-single digits due to double-digit sales growth in the Perten bacterial testing business.

Industrial sales were flat but grew on a sequential basis. In addition, orders for the industrial market improved.

Academia and government sales contracted in the low single digits, including a mid- to high-single digit decline in the US and lower sales in Asia Pacific. Conversely, European academic and government sales advanced.

Diagnostics sales climbed 8% to represent 30% of revenues. This growth was driven by strength in the newborn screening and infectious disease businesses, as well as more than 20% sales growth in China. The oncology-related business, which primarily consists of NGS workflow solutions, grew in the mid-single digits, with strength in Europe and Asia.

Geographically, organic sales grew in high teens in Asia and low single digits in Europe. Sales in the Americas contracted in the low single digits. Demand in emerging markets remained robust, as combined sales in Brazil, Russia, India and China climbed more than 20% organically.

Adjusted gross profit margin slipped 48 basis points to 48.4% due to acquisitions and divestment. Adjusted operating margin was roughly unchanged at 16.3%, as improved margins in the Diagnostics segment was offset by increased investment in DAS.

The company modestly raised its 2017 sales outlook from $2.19–$2.20 billion to $2.20–$2.22 billion, but maintained its organic sales growth rate of 4%. The company expects roughly $50 million in sales from new products in 2017. Second quarter organic sales are expected to grow 3%–4% to $550–$555 million.

Diagnostics and Forensics Support QIAGEN Growth

QIAGEN’s first quarter organic sales, which advanced 3% to $308.3 million (see Bottom Line), topped company expectations due to timing of forensic orders, as well as robust sales growth for QIAsymphony and QuantiFERON latent TB tests. Acquisitions contributed 2% to revenue growth but were offset by currency headwinds of 2%. Growth was again tapered by declining US HPV sales, which reduced sales growth by 2%.

All financial figures below are based on currency-neutral sales and include acquisitions. Sales of consumables and other related products, which accounted for 89% of revenues, climbed 7%, including double-digit sales growth for QIAsymphony, QuantiFERON and NGS consumables each. Representing the remaining 11% of revenues, instrument sales contracted 3% due to cautious spending by pharmaceutical and academic customers. However, instrument sales grew in both the Molecular Diagnostics and Applied Testing segments. In addition, the company noted a positive uptake for the automated QIAsymphony and GeneReader NGS systems.

Life sciences–related sales grew 8% excluding currency, roughly 5% organically, to account for 54% of revenues. Applied Testing sales grew roughly 21% due to a weak comparison, as well as timing of orders for new human ID forensics products.

Despite lower instrumentation demand, Pharma sales climbed 8% due to strong double-digit sales growth for consumables and related products, as well as contributions from acquisitions.

While Academia sales advanced 3%, growth was primarily supported by acquisitions. Instrumentation demand for this market was particularly weak, especially in Europe.

Molecular Diagnostics sales grew 3%, 6% excluding US HPV revenues. Demand was particularly strong for infectious disease and tuberculosis testing products. Companion diagnostic co-development sales, which accounted for only a small portion of segment revenue, grew 11%. Conversely, the company noted lower HPV sales outside of the US.

Overall, sales climbed 10% in the Asia-Pacific/Japan region to make up 21% of revenues. This increase was driven by strong double-digit growth in South Korea, while Japanese sales advanced in the low single digits. Accounting for 46% of revenue, sales in the Americas expanded 3%, 6% excluding US HPV revenue. Within the Americas, sales grew double digits in Brazil, as well as single digits in the US and Mexico each. Representing 33% of revenue, sales in the Europe/Middle East/Africa region grew 7%, including double-digit sales growth in Turkey and improved demand in Germany and the UK, but a decline in the Middle East due to timing of orders.

QIAGEN adjusted gross margin expanded 100 basis points to 70.6% primarily due to product mix. Adjusted operating margin advanced 250 basis points to 20.7%, driven by restructuring and cost saving measures.

The company maintained its full-year currency-neutral sales growth forecast of 6%–7%, including 5%–6% organic growth. Second quarter sales are projected to grow 5%–6% excluding currency, or 3%–4% organically.

Thermo Fisher Scientific Reports Confident Outset

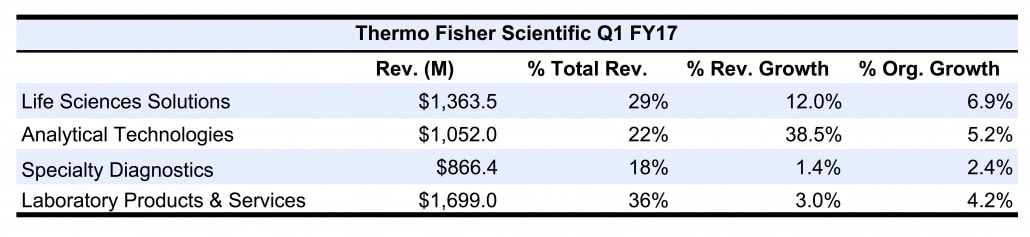

Thermo Fisher Scientific started the year on a strong note as sales climbed 10.9%, 4.2% organically, to $4.77 billion. Acquisitions added 8.0% to sales growth, which included a stronger-than-expected contribution from FEI (see IBO 8/15/16) due to robust cryo-EM demand. Meanwhile, currency headwinds were less impactful than projected, reducing sales growth by only 1.3%. Organic growth also topped expectations, as a result of continued strength in biopharmaceutical markets and demand in China.

All end-market and geographic figures below are based on organic growth. Biopharmaceutical sales climbed roughly 9%, led by continued strength for bioproduction, biosciences, chromatography and MS products. Sales to health care and diagnostics, as well as academic and government customers improved in the low single digits each. Academic and government sales were healthy in Asia Pacific, but grew modestly in the US. Industrial and applied sales advanced 4%, driven by strong food testing and environmental applications. Industrial demand progressed, driven by increased sales growth in the research and safety market channels, and lower-priced instrumentation. Further, orders for long-cycle products from industrial customers grew for the second consecutive quarter.

Life Science Solutions sales climbed 7% with particular strength for bioproduction, bioscience and NGS products and, to a lesser degree, positive sales within the genetic sciences business.

Analytical Technologies sales grew 5%, led by strong demand for both chromatography and MS products, especially from pharmaceutical and applied customers in Asia. The company highlighted demand for the high-end MS Orbitrap product lines, while chromatography sales growth was more uniform across major product lines.

Lab Products and Services sales grew 4%, including strong growth in both the channel and manufacturing lab products businesses. However, biopharma service revenues were negatively impacted by the discontinuation of a large clinical trials study. Sales in the Specialty Diagnostics segment improved 2%.

Geographically, Asia-Pacific sales advanced in the low double digits, including mid-teens sales growth in China, and continued strength in India and South Korea. Sales in North America and Europe advanced in the low single digits and mid-single digits, respectively. Sales to Rest of the World were flat.

Thermo’s adjusted gross margin expanded 110 basis points to 49.3%. Adjusted operating margin progressed 90 basis points to 22.6% due to productivity improvements and increased sales volume. The company initiated several minor restructuring measures during the quarter, including facility consolidation and headcount reduction, to help augment acquisition synergies.

The company raised its 2017 revenue guidance by roughly $110 million to $19.51–$19.71 billion for growth of 7%–8%, including 4.5% growth from acquisitions and currency headwinds of 1.5%. However, the elevated revenue guidance was attributed to new acquisitions and lower projected currency headwinds. The company’s overall organic annual growth forecast of 4% was unchanged.

Waters Boasts Strong Biopharma Demand

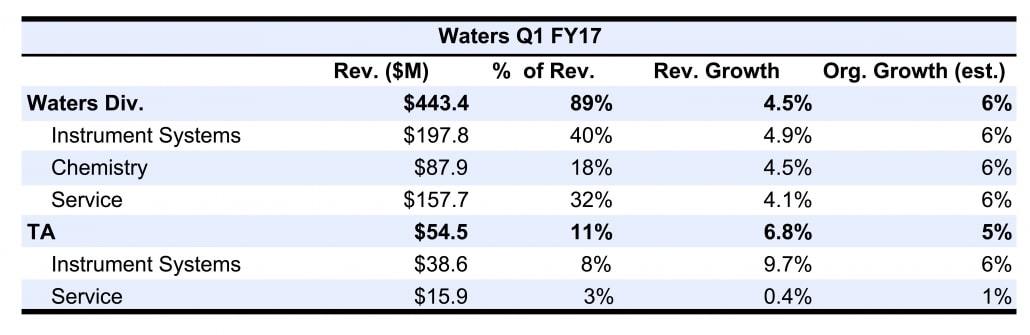

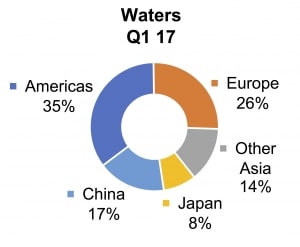

Waters delivered a stronger-than-expected first quarter, as sales advanced 4.8%, 5.9% organically, to $498.0 million. Furthermore, sales were negatively impacted by two fewer selling days, which reduced overall sales growth by 1%, and sales for recurring revenues by 2%. Adjusted for normalized selling days, instrument and recurring revenues grew 6% and 7% organically to account for 47% and 53% of sales, respectively.

Biopharmaceutical demand was again highlighted, as sales for this market climbed 9% organically. Increased large molecule drug development in the Americas and Europe, as well as heightened QC testing in China and India boosted demand from this market. However, US biopharmaceutical sales declined slightly, primarily due to a strong year over year comparison for small molecule applications and slower budget spending early in the quarter.

Industrial-related sales advanced 8% organically, driven by food and fine chemical applications, especially in Asia and Europe. The company also noted improved demand for materials characterization and industrial polymer applications.

Sales in the more volatile academic and government markets declined 11% organically, primarily due to weakness in Europe. However, academic and government sales improved in Asia, and were particularly strong in Latin America due to timing of orders.

Organic sales for the Waters product segment grew 6%, led by strong demand for the ACQUITY Arc and QDa, Alliance HPLC products and Xevo TQ systems. Segment growth was especially strong in China and India, for which sales grew in the 20% range each. However, this was partially offset by lower demand in the US and Japan, for which sales declined 8% and 5% including currency, respectively.

TA sales grew 5% organically, led by higher sales of the new Discovery systems and rheology products. TA sales grew in the strong double digits in Europe and roughly 10% in China, but declined in Japan.

All geographic figures below are based on currency-neutral sales and include modest contributions from acquisitions. Sales in Asia climbed 13%, including 24% sales growth in China and double-digit sales growth in India. However, Japanese sales fell 8% because of a strong comparison. Similarly, US sales, which declined 7%, were negatively impacted by particular strength for small molecule sales in the previous year. Sales in Latin America grew in the upper teens.

European sales advanced 9%, led by positive demand from biopharmaceutical customers, as well as industrial markets, especially for materials characterization and chemical analysis. This growth was partially offset by lower European academic and government funding.

Waters’ gross margin was roughly flat at 57.6%. Adjusted operating margin expanded 60 basis points to 27.1% due to increased sales volume and favorable currency impacts. The company projected a slightly more optimistic 2017 sales guidance, with currency-neutral sales expected to grow in the strong mid-single digits. Second quarter sales are expected to grow at a similar rate. Currency headwinds are projected to reduce full-year 2017 and second sales growth by 2% and 3%, respectively.