First Quarter Results: Biotage, Fluidigm, Horizon Discovery, NanoString Technologies, Oxford Instruments

Biotage Organic Sales Up Close to 10%

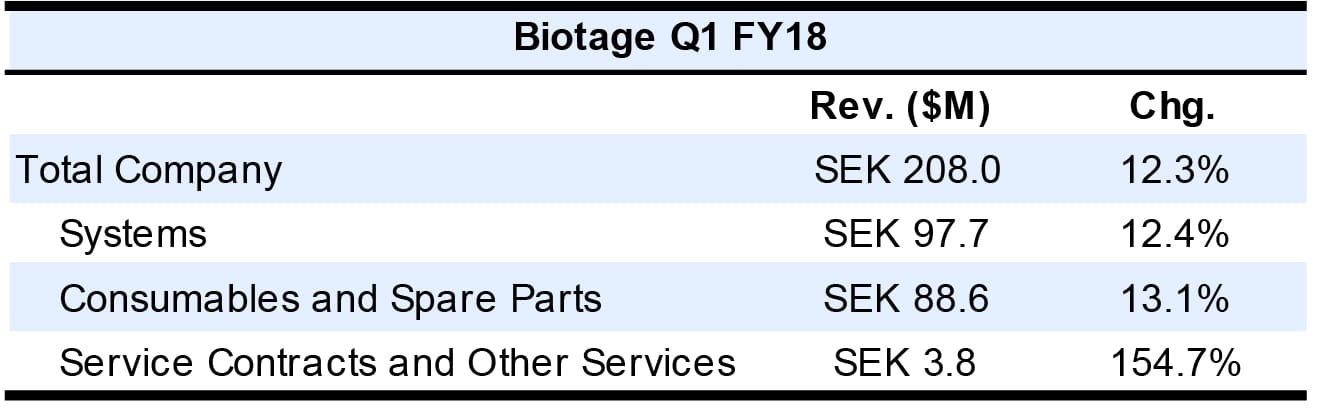

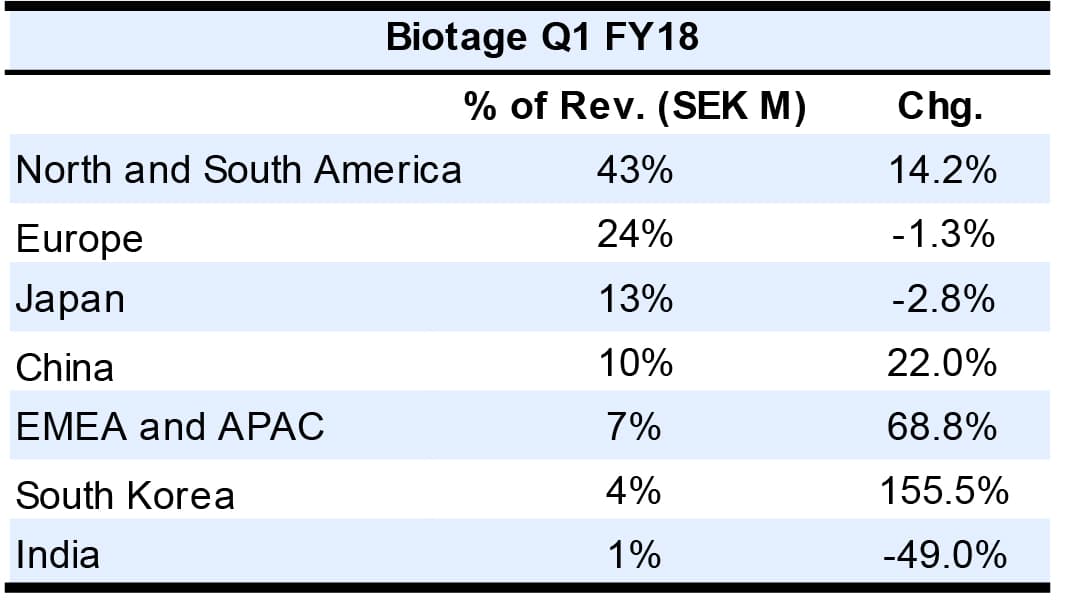

On an organic basis, first quarter sales for Biotage rose 9.8%. (See IBO 4/30/18.) System and Aftermarket sales constituted 48% and 52% of sales, respectively. On a reported basis, including the acquisition of Horizon Technology (see IBO 12/15/17), Analytical Chemistry sales increased 30.0%, including a substantial rise in evaporation product sales. Industrial Products revenue also grew double digits, climbing 30.2%, with particularly strong growth in Europe. In contrast, Organic Chemistry sales grew a scant 1.3%, as sales declined in Europe, Japan and India.

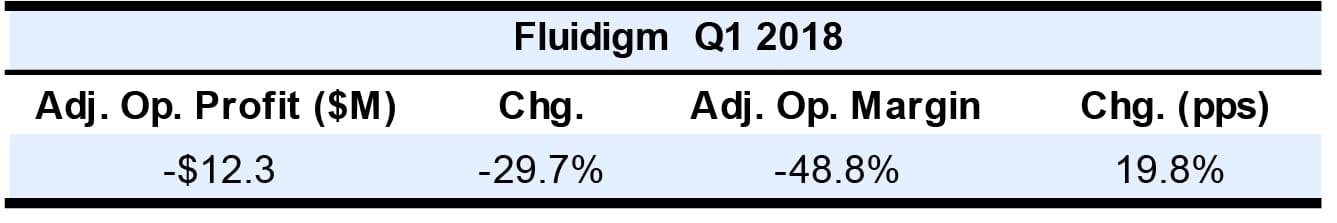

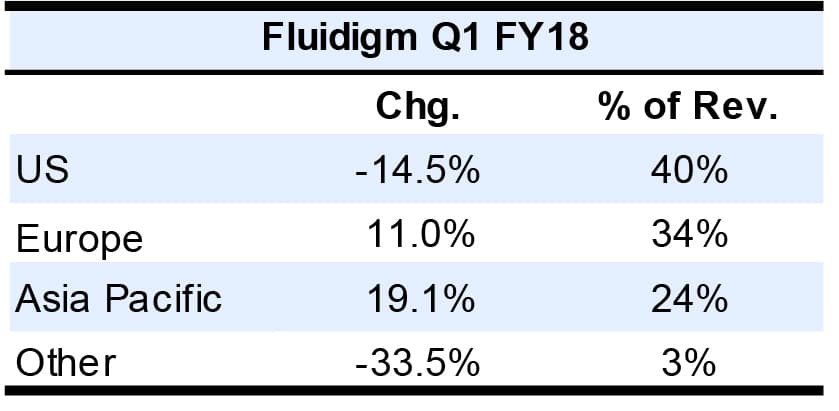

Fluidigm Mass Cytometry Sales Decline

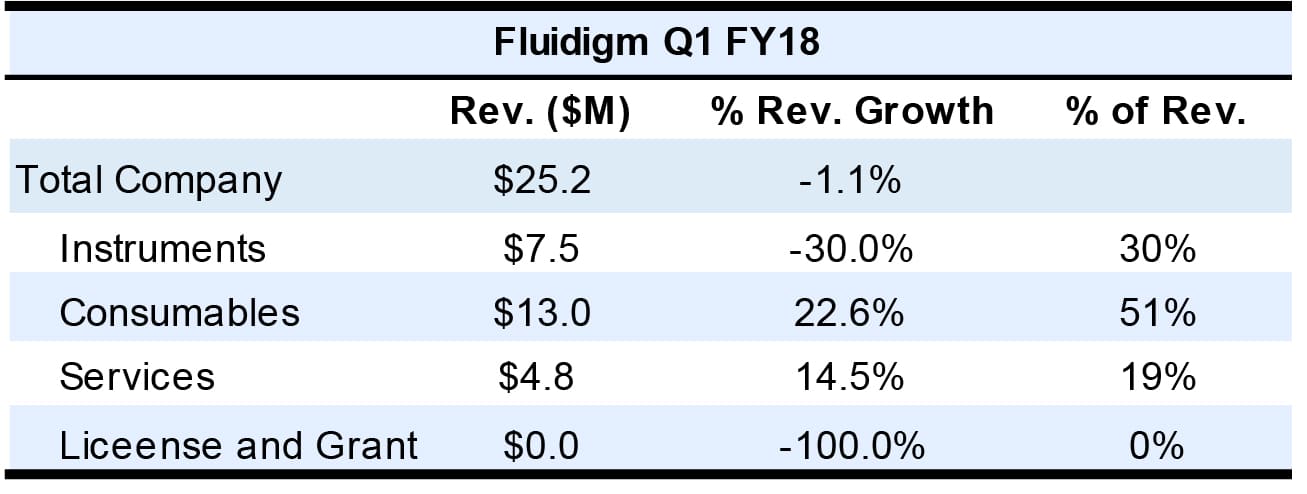

In the first quarter, organic sales for Fluidigm fell around 4% due to slower demand for mass cytometers. (See IBO 5/15/18.) Mass cytometry revenue declined 23.1% to $9.0 million. This included a 34.0% drop in product sales, as instrument sales declined offset by double-digit consumables sales. The company attributed the decline in instrument demand to delayed orders for mass cytometers, as well as the impact of early-adopter sales a year ago.

In contrast, genomics revenue jumped 181% to $16.3 million, led by applied markets. Genomics product sales increased 22.1% to $13.8 million. Although sales of high-throughput genomics products rose, single-cell genomic product revenue declined.

By region, highlights included over 50% increase in organic revenue growth for China, which accounted for 13% of sales. Similarly, Japanese revenue grew 45%. On an organic basis, European sales were up 3%. Fluidigm forecasts second quarter sales of $25–$28 miilion, up 2.5% at the midpoint.

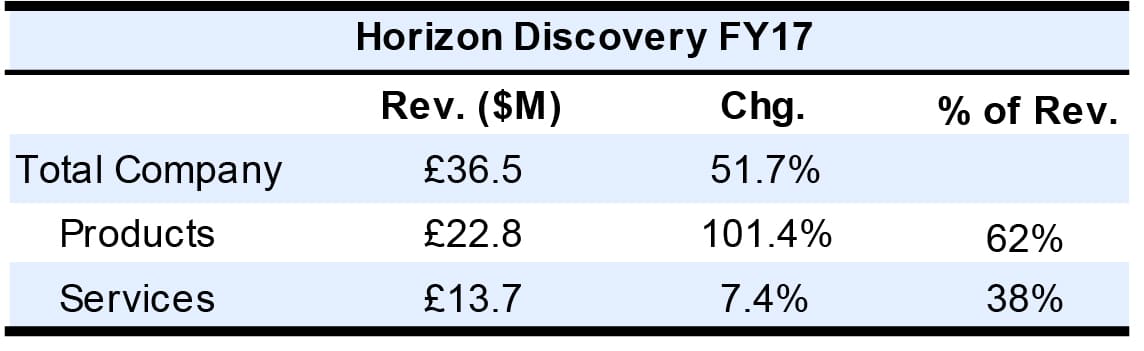

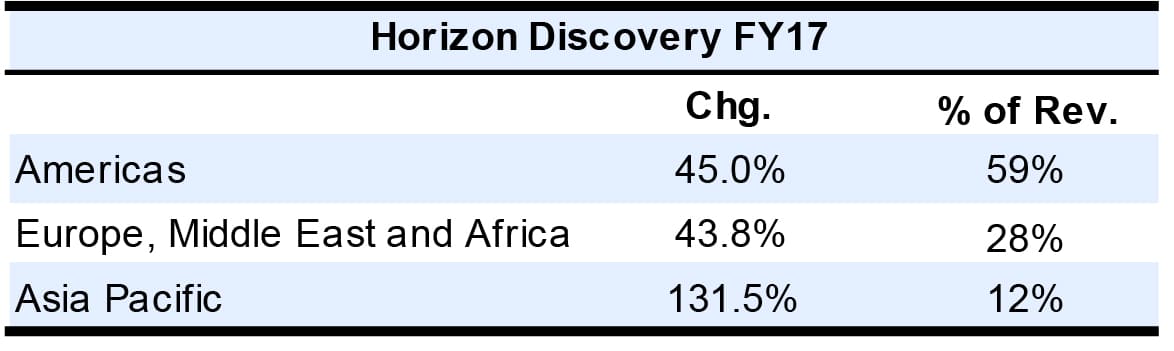

Horizon Discovery Rides High on Acquisition

In constant currency, Horizon Discovery’s fiscal 2017 sales rose 50%, as Product sales grew 101% and Services revenue was up 4%. (See IBO 5/15/18.) Organically, revenues rose 14%, with Product sales up 22.8% and Sales revenue increasing 4%. EBITDA declined from a loss of £4.0 million ($5.1 million at £0.78 = $1) to a £1.1 million ($1.4 million) loss. E-commerce sales increased 67%.

The Products business consists of Research Products and Applied Products. Sales of Research Products jumped 223.1% to £12.6 million ($16.2 million) due to the Dharmacon acquisition (see IBO 7/31/17), to make up approximately half of Products revenue. On an organic basis, Research Products revenue declined 7.7% attributed to a nonrecurring large cell-line agreement. Applied Products sales rose 37.8% to £10.2 million ($13.1 million). The Bioproduction business represented 51% of sales. For the Molecular Reference Standards business, Off-the-Shelf sales remained strong, while OEM revenues fell.

Growth in Services revenue was led by Custom Cell Line Engineering and, within contract testing, molecular screening for target identification and validation.

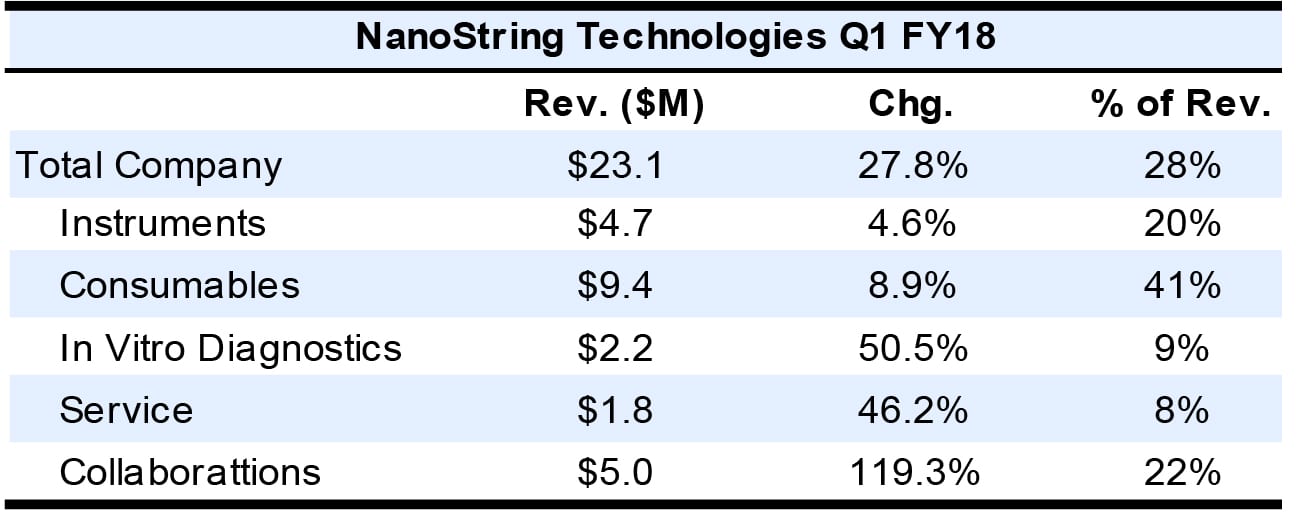

Consumables Growth Leads NanoString Revenues

In the second quarter, NanoString Technologies revenues showed a healthy increase. (See IBO 5/15/18.) Sales of nCount SPRINT systems represented nearly 40% of unit sales. Also showing good growth were sales of the high-throughput dual-use nCounter FLEX systems. By application areas, oncology applications made up 75% of new instrument placements, with immunology and neuroscience representing the remainder.

Total consumables sales rose 14.9% to $11.5 million. In particular, oncology panel sales increased 50%, fueled by immune-oncology applications. Overall, panel revenue was up more than 30% to account for over 70% of sales of life science consumables, which totaled $9.4 million.

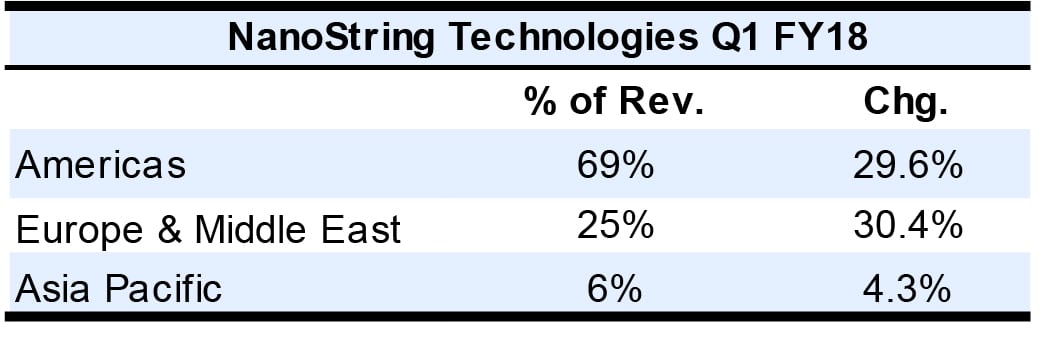

Geographically, within the Americas, US revenues increased 25.4% to $14.8 million. The Americas, Europe and Middle East, and Asia Pacific accounted for 57%, 32% and 11% of instrument revenues, respectively.

Second quarter revenues are expected to decline 26%–29% to $24.5–$25.5 million due to a drop in collaboration revenue. Product and service revenue is forecast to be $18.5–$19.5 million, compared to $18.3 million a year ago. Collaboration revenue is expected be around $6 million.

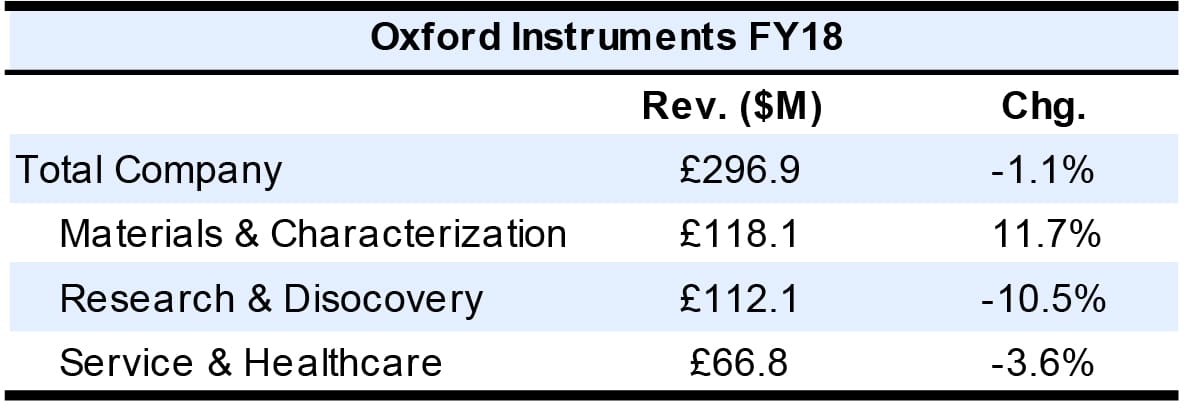

Oxford Instruments Posts Profit

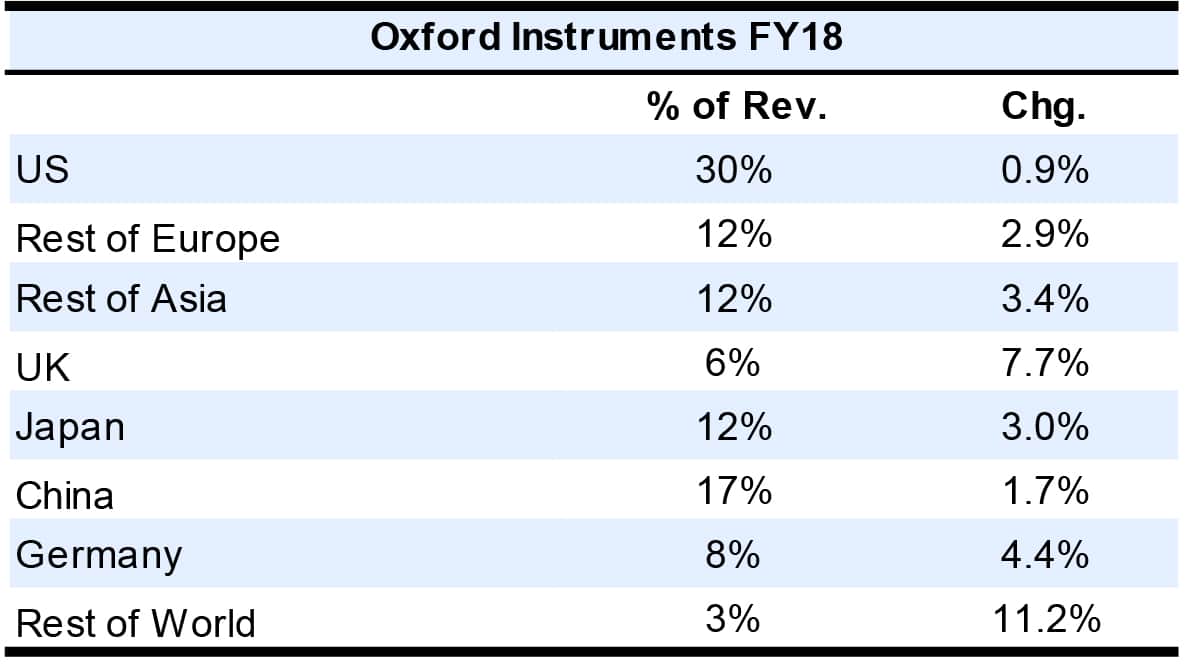

In constant currency, Oxford Instruments’ fiscal 2018 sales ending March 31, were flat. (See IBO 6/15/18.) Orders rose 5.0%, to £134.0 million ($181.1 million at £0.74 = $1) or 5.8% in constant currency.

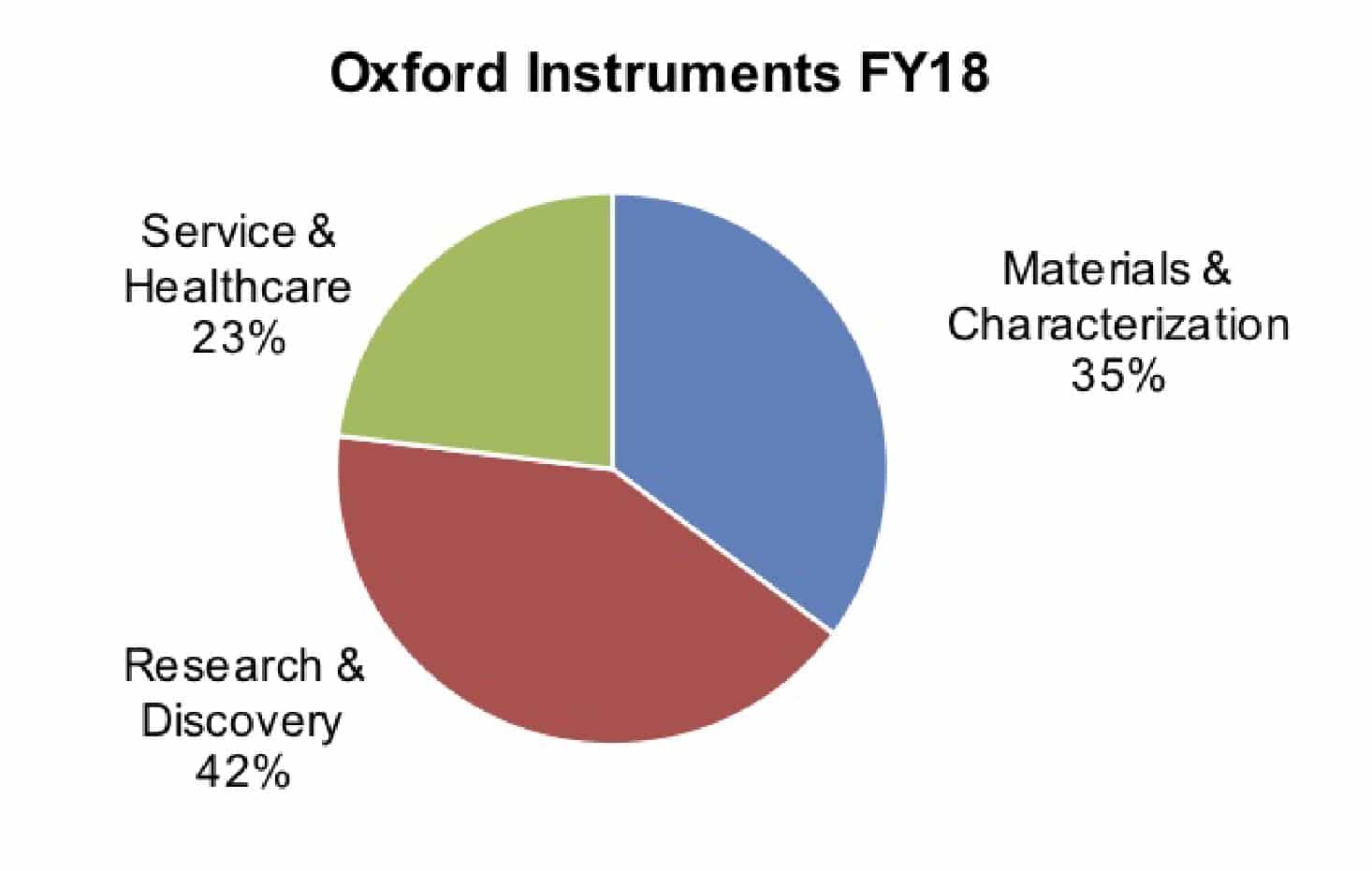

Materials & Characterization (Asylum Research, NanoAnalysis, Plasma Technology) revenue increased 11.7%, and was up 13.2% in constant currency. Semiconductor & Communications accounted for 46% of segment revenue, with Advanced Materials, Environment, Energy, Healthcare & Life Science and Quantum Technologies representing 30%, 10%, 7%, 6% and 1%, of segment sales, respectively. Product sales strength included imaging and analysis products for electron microscopy, as well as SPMs and semiconductor processing systems.

Research & Discovery (Andor Technology, NanoScience & Magnet Resonance, X-ray Technology, minority share in ScientaOmicron) sales fell 10.5% and declined 9.7% on a constant currency basis. Orders were flat. Forty percent of segment sales were for Healthcare & Life Science applications and 20% were for Quantum Technologies applications. Semiconductor & Communications, Advanced Materials, and Research & Fundamental Science respectively accounted for 20%, 13% and 4% of sales. Environment and Energy applications each accounted for 3%. Growth was offset by softer sales growth for Andor optical microscopy systems, NanoScience sales and x-ray tube revenue. Areas of revenue strength included desktop NMR, products for quantum technology applications, and x-ray sources for medical and research markets.

Service & Healthcare revenue declined 3.6% and was down 2.9% in constant currency. Sales growth was led by demand for services. However, sales declined for OI Healthcare’s US business.