Fourth Quarter 2018 Results: Bio-Techne, Hitachi High-Technologies, HORIBA, Illumina, QIAGEN

Bio-Techne Maintains Double-Digit Growth

Bio-Techne fiscal second quarter revenues grew double digits, led by Protein Sciences sales, which rose double digits organically (see Bottom Line). This marks the first time that Bio-Techne’s organic revenue increased in the double digits sequentially. Despite a decrease in basis points, adjusted operating margin increased 260 basis points, excluding the impact of the acquisition of ExosomeDX (see IBO 06/30/18). This increase was driven by strong volume leverage, diverse product sales and solid productivity.

Geographically, Greater China led the way with a reported 30% organic sales increase. This is the first time Greater China experienced over 30% organic growth for two consecutive quarters. One reason for the region’s revenue growth includes PrimeGene’s offerings in cell therapy for hospitals, which accounted for approximately 30% of Chinese sales. In addition, instruments and RUO sales in Greater China increased approximately 50% and 25%, respectively. US sales grew organically in the low teens, while Europe and Japan were the only regions to have less than double-digit revenue growth. Despite Japan’s less than stellar sales growth, APAC, excluding China, grew organically in the mid-teens, thanks to strong sales in South Korea and India.

Protein Sciences’ experienced revenue growth across all major product categories, with most product lines experiencing double-digit sales growth. Highlights included a 30% sales increase for Western blot instruments, 20% sales increase for Biologics iCE and 50% sales increase for Ella. Another highlight was double-digit sales growth for the entire assay product line. Protein Sciences also benefitted from consistent sales of core reagents, especially antibodies and cell and gene therapy products, which grew more than 20%. Excluding lower-margin acquisitions, Protein Sciences’ adjusted operating margin increased 43.5%, a 60-basis point change. The company credited strong volume leverage and operational productivity, which helped offset the lower-margin acquisitions.

Diagnostics and Genomics revenue grew modestly, despite delivering solid sales for both RUO and diagnostics product lines. Other highlights include a low-single digit increase for the ACD product line.

A factor influencing the modest growth was a tough year-over-year comparison. Regarding adjusted operating margin performance, excluding the dilution from Exosome Diagnostics acquisition, Diagnostics and Genomics’ operating margin grew 17.7%, or 180 basis points, thanks to profitable, diverse product sales.

End-market wise, biopharma sales grew approximately 10%, while academic sales rose in the mid-single digits. Bio-Techne did not give a financial forecast for fiscal third quarter 2019.

Clinical Analyzers Sales High for Hitachi High-Technologies’ Science & Medical Systems Segment

Third quarter fiscal 2019 revenues increased, thanks to Hitachi High-Technologies’ three main business segments (Science & Medical Systems, Electronic Device Systems and Industrial Systems) experiencing double-digit increases. Despite decreased sales for its scientific instruments and biotechnology products, the Science & Medical Systems segment sales offset those losses due to the high sales of clinical analyzers in the Asian market.

The company forecasts year-end fiscal 2019 division sales to increase 9% to ¥7,500 billion ($66.5 billion = ¥112.76 = $1).

Europe a Steady, Consistent Region for HORIBA

Q4 2018

HORIBA’s combined revenues for its Scientific (SI), and Process & Environmental Instruments and Systems (P&E) businesses rose 2.4% in the fourth quarter 2018 to ¥14,071 ($124.8 million at 112.76 = $1) to make up 22% of total company sales (see Bottom Line).

Geographically, SI sales in Europe grew the fastest, up 12.1% to ¥1,738 ($15.4 million). Sales in Japan advanced in the high single digits, rising 5.8% to ¥2,102 ($18.6 million). Sales for the regions accounted for 19% and 24% of segment revenue, respectively. In Asia, sales advanced in the lower single digits, only rising 2.9% to ¥2,444 ($21.7 million), though the region accounted for 29% of segment revenue. The Americas was the only region that had a sales decrease, down 20.8%.

Geographically, P&E sales in the Americas, Europe and Japan advanced in the double digits, rising 23.9%, 21.1%, 13.2%, and respectively. Sales in the Americas, Europe and Japan accounted for 13%, 16% and 47% of segment revenue. P&E sales in Japan declined 10.4% to ¥1,426 ($12.6 million).

FY 2018

HORIBA’s combined revenues for its SI and P&E businesses rose 8.2% for the year to ¥47,115 million ($417.8 million at 112.76 = $1), comprising 22% of total company sales (see Bottom Line).

P&E sales were driven by the Americas and Asia. In the case of Asia, the increase in sales was attributed to high demand for water quality and air pollution analyzers, while in the Americas, process measurement equipment drove regional sales. Operating income increased 85.3% to ¥2,027 million ($18.0 million) due to increased sales in Asia. P&E fiscal first-half revenue is forecast to rise 8.1% to ¥10,000 million ($88.7 million) and the full-year sales forecast is expected to rise 3.3% to ¥20,000 million ($177.4 million).

Full-year 2018 SI sales in Europe and Japan advanced in the double digits, while Asian sales rose in the mid-single digits. The increase in segment revenue was attributed to high R&D spending. SI sales in the Americas experienced a slight loss with a 1.8% decline, attributed to HORIBA’s continued investment to establish an industrial presence in the region. As a result of that investment, the operating income for SI decreased 55.6% to ¥221 million ($2.0 million). SI fiscal first-half revenue is forecast to rise 3.7% to ¥13,000 million ($115.3 million) and the full-year forecast anticipate a 27.9% decline to ¥20,000 million ($266.1 million).

Illumina Finishes Strong with Record Sales

Q4 2018

Illumina fourth quarter 2018 revenues grew 11.4% and were led by 12% growth in sequencing and 7% growth in microarray sales, respectively (see IBO 01/31/19).

Sequencing consumable sales grew 16% when adjusting for the timing of a $5 million China tariff-related stocking order for the fourth quarter. Mid-throughput sequencing consumables had a record quarter due to the high sales of NextSeq consumables. The highlight for low-throughput sequencing consumables was the strong demand for both MiSeq and MiniSeq, as well as respectable sales from iSeq consumables.

Sequencing systems sales reached a quarterly revenue record of $159 million, making it the strongest quarter for the product line due to an overall strong sales portfolio, with more than 100 NovaSeq shipments. In addition, NextSeq systems sales set a company record of being the second highest system shipped since a product launch.

Sequencing services sales increased 19.5% to $104 million, led by strong sales to Genomics England. Sequentially, revenue was down $5 million due to oncology collaboration payments that did not repeat in the fourth quarter. In total, combined sequencing revenue grew 12%.

Microarray consumables sales increased 17.1% to 13 million, while microarray services sales declined 21.9%. Microarray systems sales were up $3 million, but declined $5 million sequentially. Combined microarrays revenue increased 7% to $132 million.

Geographically, sales in the US and Europe experienced double-digit growth, while Greater China and APJ (Asia Pacific Japan) revenues increased in the high single digits. Specifically, Greater China grew 28% when adjusting for the effects of tariff-related stock orders in the second and third quarters of 2018. Sequentially, APJ experienced a 21% sales increase.

Illumina expects first quarter total revenues to be down sequentially due to a $50 million sales decline for sequencing systems. This has been a trend for the company for the past four years; however, Illumina expects a year-over-year $466 million sales forecast for sequencing consumables to offset the loss. Sequencing services and other revenues are expected to be flat due to anticipated sales declines for Genomics England, while microarrays sales are forecast to be in the mid- to high-single digits.

FY 2018

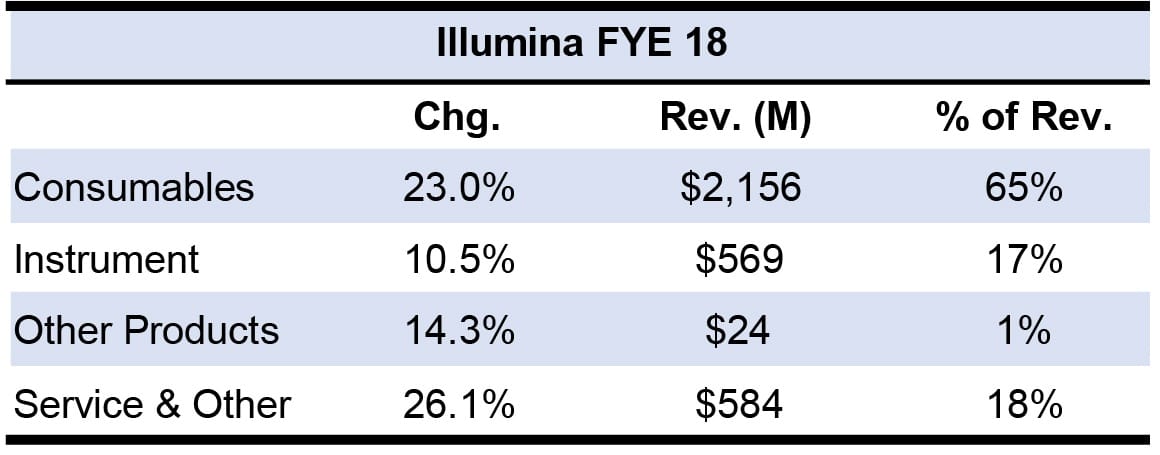

Illumina full-year 2018 revenues grew 21.1% and were led by growth in sequencing and microarray sales, respectively (see IBO 01/31/19).

Sequencing consumables revenue grew 23% thanks to strong sales growth across high-throughput, mid-throughput and low-throughput categories. The high-throughput sequencer HiSeq continued its sales decline as customer demand for NovaSeq increased dramatically.

For the year, sequencing systems sales rose, thanks to 600 NovaSeq systems being shipped, a 110% increase. HiSeq ended the year with approximately 350 units shipped in the first two quarters. The HiSeq upgrade cycle’s strong demand resulted in the product representing 30% of sequencing systems orders. In total, combined sequencing systems increased 21% with strong sales growth across all research, translational and clinical products.

Illumina declared its full-year 2019 revenue growth to be 13%–14%, or $3.77 billion–$3.8 billion, with expectations of an 1% currency headwind. Additionally, the company expects sequencing revenue to grow in the mid-teens and sequencing consumables to grow above 20%. Microarrays revenue growth is anticipated to slow to the low single-digits due to the company’s cautious view of the consumer market. Illumina anticipates sequencing systems sales to grow in mid-single digits, with NovaSeq shipments to be flat or slightly higher than 2018 shipments.

QIAGEN Fourth Quarter Sales Soft, But End the Year Strong

Q4 2018

QIAGEN reported soft fourth quarter 2018 sales growth (see Bottom Line). On a constant currency basis, sales growth was 5%, excluding the approximate three percentage-point currency headwind. QIAGEN missed its constant currency growth target of 6%–7% due to various changes, such as the divestment of the veterinary testing assay portfolio, which caused needed adjustments to a third-party R&D project, and the continuing reduction of third-party service contracts for QIAGEN instruments. All figures mentioned are in constant currency.

Instrument sales advanced 13%, but were partially offset by a 10% decline in service revenue. QIAsymphony experienced high quarterly sales, with more than 120 new placements.

Consumables and related revenue sales were stable, thanks to solid sales across the Molecular Diagnostics, Pharma and Academia customer segments. However, the Applied Testing customer segment only experienced mid-single-digit revenue growth. Revenue growth for consumables increased 4%.

Molecular Diagnostics sales advanced 5% to $194 million, excluding the approximate four percentage-point headwinds from low US HPV sales and the discontinuation of instrument service contracts. Strong sales growth was attributed to double-digit sales for QuantiFERON-TB. Sales were partially offset, however, by a decline in instrument service revenue.

As a whole, the following Life Science customer segments rose 5% on a combined basis: Academia posted the fastest sales growth among the company’s main four customer segments, with a 6% increase to $95 million. Strong sales growth was credited to the double-digit sales growth in instruments and single-digit revenue growth in consumables. Japan was a strong performer among the regions.

Applied Test sales continued to be impacted by the divestment of veterinary testing assays, which resulted in only a 1% increase to $39 million.

Pharma sales rose 5% to $74 million, which was slightly below QIAGEN’s sales target. This was due to a combination of low-single-digit growth in consumables and double-digit growth in instruments.

Geographically, Europe/Middle East/Africa was the best performing region with 13% growth to $143 million. Revenue in France, Italy, Belgium and Turkey grew, while Germany’s sales slackened.

Asia Pacific sales grew 8% to $91 million. This was due to the double-digit growth in Japan, as well as South Korea recovering from the impact of the 2017 tenders for QuantiFERON -TB.

The Americas were the worst performing region, with sales declining 4% to $91 million. An instrument service revenue decline in the Molecular Diagnostics customer segment was largely due to Americas’ overall revenue slump.

FY 2018

Full-year 2018 QIAGEN revenue advanced 5.8%, reaching its full-year revenue growth forecast of 6%–7% (see Bottom Line), due to reaching various product sales targets throughout the year. For example, QuantiFERON-TB sales grew 21% to $223 million, and QIAGEN’s NGS portfolio surpassed its 2018 sales target, advancing to $140 million, a 21% increase. Organically, sales grew 6.7%, excluding business portfolio changes and acquisition contributions. All figures mentioned are in constant currency.

Instrument sales advanced 6% in large part to the company exceeding its placement target for the QIAsymphony at 2,300, and a broad NGS portfolio whose sales grew in the double digits. For 2019, QIAGEN expects 2,500 placements of QIAsymphony. Regarding the NGS portfolio, the company set a sales target of $190 million.

Molecular Diagnostics posted the fastest sales growth among the company’s main four customer segments. Strong sales growth was attributed to the 21% increase for QuantiFERON-TB revenue. With such high sales, QIAGEN set a 2020 sales forecast of $300 million for its QuantiFERON-TB tests.

The following Life Science customer segments grew 4% on a combined basis. Applied Test sales were mostly unchanged for the year, excluding the veterinary testing assay divestment. Both Pharma and Academia sales grew 5%.

Despite having a disappointing fourth quarter 2018, the Americas performed the best geographically for the year advancing 6% to $693 million. Europe/Middle East/Africa sales grew 6% to $490 million, while Asia-Pacific sales advanced 5% to $315 million.

For 2019, QIAGEN expects total company revenues to grow between 7%–8%, with a $30 million sales target for QIAstat-Dx. Currency effects are projected to add a 1% headwind to overall reported sales growth. Academia, Pharma and Applied Testing customer segments are each forecast to advance in the mid-single digits. As for the first quarter, the company expects revenues to grow 5%–6%. In terms of currency impact for the first quarter, the company expects a 4% headwind impact on revenue sales.