General Analytical Techniques: Serving All Markets

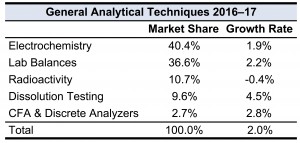

The general analytical techniques (GAT) segment is comprised of a series of basic technologies that have little in common but tend to be slower growing parts of the overall instrumentation market: electrochemistry, lab balances, radioactivity, dissolution testing, and continuous flow analyzers (CFA) and discrete analyzers. The total demand is expected to grow 2.0% and reach $2.2 billion in 2017.

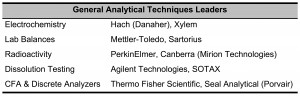

Electrochemistry is the largest individual market, accounting for more than $850 million in demand in 2016. These techniques’ relatively inexpensive price points and scientific importance ensure that the market, though growing at a low rate and experiencing little in the way of technological advancement, will persist for many years to come. The 1.9% growth rate is mostly driven by the burgeoning Asian Pacific and Indian markets.

Lab balances, with over one-third of the market, comprise the second largest segment. The growth projection is 2.2% for 2017, driven by replacement systems in developed regions and new installations in developing areas. Mettler-Toledo dominates the market, accounting for nearly half of revenues, while Sartorius is the second largest vendor, with more than a quarter of total sales.

Demand for radioactivity instrumentation is expected to decline 0.4% in 2017, largely due to an increase in development of techniques that do not require radioactive reagents for life sciences. Canberra, the second largest vendor and formerly the nuclear instrumentation and measurement portion of Areva, was sold to Mirion Technologies in 2016 (see IBO 7/15/2016).

Dissolution testing is a mandatory procedure for the physical evaluation of solid dosage forms of capsules, tablets, ointments and creams, and are sold almost exclusively into regulated pharmaceutical laboratories. The strong growth of the pharmaceutical and biotechnology sector will support the growth of dissolution testing demand, which is expected to be 4.5% in 2017. Agilent Technologies and SOTEX are the leading vendors in this market.

CFA and discrete analyzers are analytical methods used heavily for environmental and food applications. They represent only 2.7% of the GAT market and are expected to grow 2.8%, reaching $58 million in sales for 2017. Water contamination analysis is emerging as one of the premier growth drivers that will add to quality control demand. Thermo Fisher Scientific is the largest vendor with more than a quarter of the market, and Seal Analytical (Porvair) is in second place.

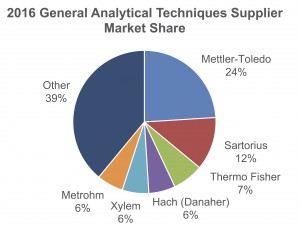

Mettler-Toledo and Sartorius are the top vendors in the overall GAT market, with 24% and 12% of the demand, respectively. Thermo Fisher is next with 7% and competes with the top two vendors in all GAT technologies except dissolution testing.