The IBO 2017 Industry Forecast

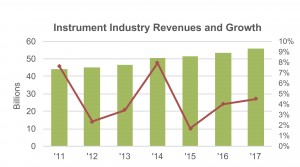

The analytical and life science instrument and laboratory products industry gathered strength in the past year, achieving greater revenues than in 2015, with growth ratcheting up as well. Government and academic funding remained somewhat troubled in 2016, but taken as a whole, new initiatives helped provide growth from this sector. Demand from private organizations was mixed. Pharmaceutical and biotechnology customers continued to increase demand for both life science and materials science tools throughout their workflows from research to production. Low commodities prices had a negative impact on demand in the oil and gas, and metals and mining industries, but semiconductors, electronics and non-traditional energy industry were brighter spots in the industrial markets. The applied markets also gained momentum in 2016. In total, the overall analytical and life science instrument and lab products market, including aftermarket and service, increased 4.0% in 2016, compared with 2015. This falls just shy of IBO‘s July 2016 mid-year forecast of 4.1% (see IBO 7/31/16).

In 2016, the US dollar advanced against its major counterparts, including the euro, Swiss franc and, most notably, the British pound and Mexican peso, which depreciated 16% and 17% against the dollar, respectively. In contrast, Brazil’s real rebounded against the dollar, rising 22%, as did valuations for the Japanese yen and Canadian dollar, which advanced 3% each. In terms of currency impact on the instrument and lab product market for 2016, headwinds were negligible, amounting to just 0.3% compared to 7.0% in the previous year.

Currency valuations will again be difficult to predict in 2017 by reason of political transitions in the US and presumably in Europe. However, given a modestly improved economic growth outlook and proposed interest rate hikes in the US, coupled with anticipated quantitative easing measures in Europe and Japan, the dollar should continue to strengthen in the first half of 2017. As such, IBO expects the US dollar to reach parity with the euro in 2017 and trade above the ¥120 mark against the yen. The longer-term outlook for the US dollar, which may materialize towards the latter part of 2017, is less buoyant. An anticipated rise in the US deficit and debt, slowing corporate profits and a potential shift in monetary policy should cause the dollar to capitulate. Projected currency headwinds for the instrument and lab-product market are anticipated to be 3% in 2017.

Beyond currency, other global events may have an effect on the market. Two events of 2016 that defied conventional wisdom, and are likely to have lasting effects, are the votes taken by the UK to leave the EU and the US presidential election. While Brexit has not led to an immediate collapse of the economy in the UK—as was feared—it has had a significant effect on the value of the pound, and has also brought into focus more lines of fracture within the EU over the debate between austerity and stimulus. The advent of the Trump Administration is also difficult to read, but the clearest signs are a push towards deregulation and lower corporate taxes, which may shift US private spending away from regulatory and environmental testing towards more research. However, it seems unlikely that this will have too great an effect in the current year.

The World Bank’s latest economic forecast, published this month, calls for global GDP to increase 2.7% in 2017, an improvement over 2016. The advanced economies are slated to grow 1.8%, while the emerging and developing markets are expected to increase 4.2%, boosted by modest gains in commodity prices (see Regional Forecast: India Drives Sales Growth in Life Science Markets).

With commodities on the rebound, this should help promote growth in instrument demand not only in developing regions, but for these industries generally. The metals and mining industry can expect more rapid improvement, while the oil and gas market may take longer to show stronger demand. Other industries that depend on raw materials should not be too greatly affected by rising prices, so instrument demand from the automotive, chemical and polymer industries should remain on a modest growth trajectory (see End-Market Forecast: Life Science Leads the Way).

The life science sector continues to expand as well and will be one of the primary engines of growth for instrument demand. Of particular note is the continued migration of instrumentation from the pharmaceutical and biotech sector to more applied markets in clinical labs and food safety testing. In total, IBO’s forecast for 2017 is for instrument and lab product demand to increase 4.5%, with the industry accelerating out of 2016.