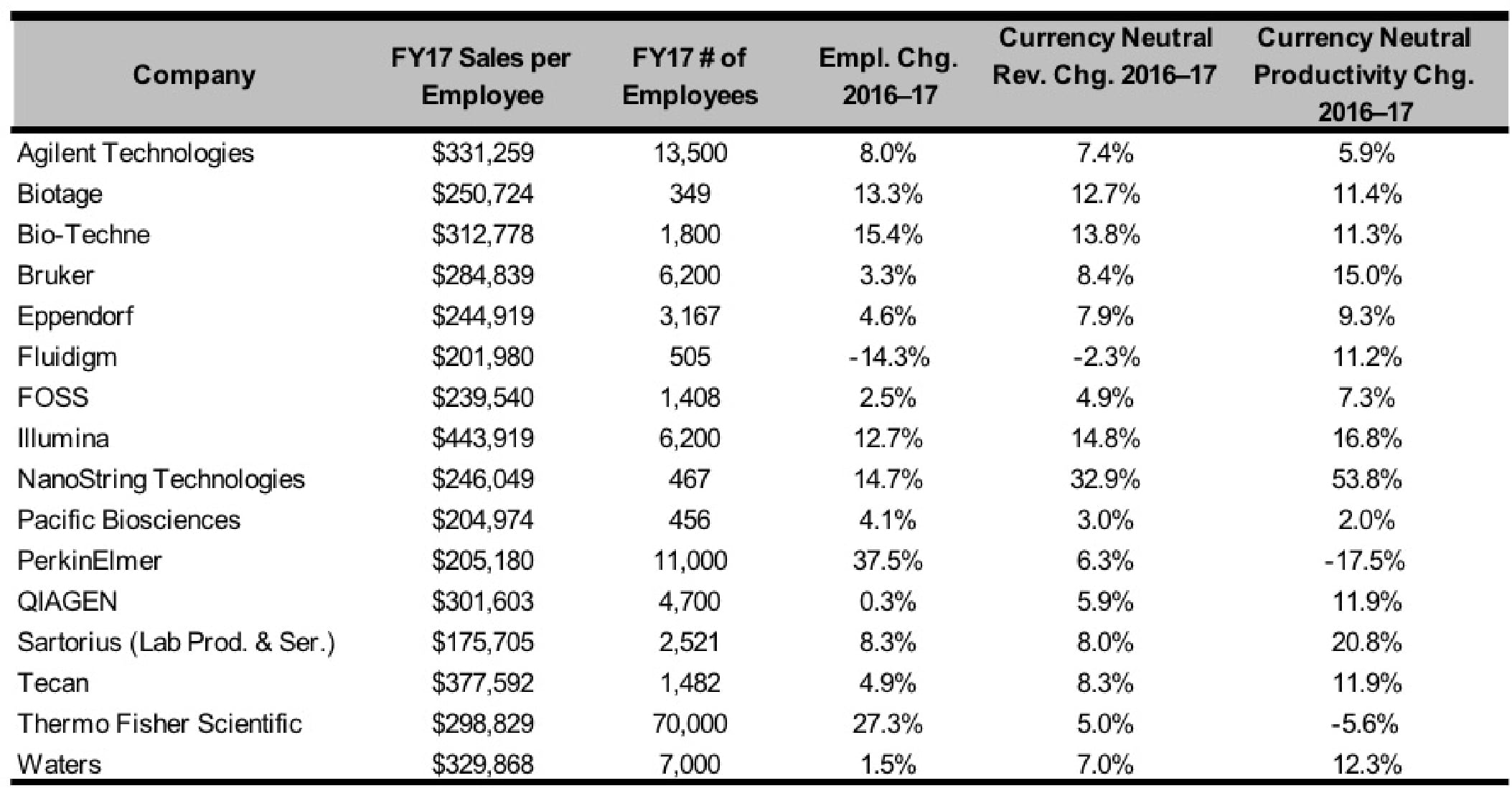

IBO Productivity Review: Illumina Leads the Pack

The productivity, measured as currency-neutral sales per employee, of selected analytical instrument and lab product companies/businesses rose 19.1% in fiscal 2017 to an average of $317,205. Six of the 16 companies recorded sales per employee of over $300,000. However, the seemingly dramatic increase was affected by several factors, including acquisitions and skyrocketing growth for one company. Excluding NanoString Technologies, whose sales grew 33% in 2017, average sales per employees for the remaining 15 companies tracked by IBO (see table below) were flat at -0.2%. Average sales per employee for the table, excluding NanoString, were $280,247. In addition, PerkinElmer and Thermo Fisher Scientific each completed two major acquisitions in 2017, EUROIMMUN (see IBO 6/30/17) and Patheon (see IBO 5/15/17), respectively, affecting their employee-to-sales ratio.

Click to enlarge

The Acquirers

Thermo Fisher’s purchase of contract research and manufacturing organization Patheon added approximately 9,000 employees. However, the acquisition closed in August 2017 so only a portion of Patheon’s sales were included in Thermo Fisher’s full-year revenues. As a result, sales per employee for the company fell 5.6% to $298,829 sales per employee. However, calculated on a pro forma basis (as if Thermo Fisher had owned Patheon for the whole year), sales per employee totaled $316,342.

In addition to growing through acquisition, Thermo Fisher is investing in emerging markets. Its Chinese workforce accounts for 6% of the company’s total employee base and includes 2,400 commercial employees. China accounts for 11% of Thermo Fisher’s revenues or $2.2 billion last year. This results in an impressive $488,889 per employee. The sales per employee in China is at $150,000, with Indian sales at approximately $300 million and 2,000 employees.

PerkinElmer closed its purchase of EUROIMMUN in December 2017. Thus, in 2017, PerkinElmer added EUROIMMUN’s 2,400 employees but only a small portion of the acquired company’s revenues were counted for the fiscal year. Consequently, the company’s productivity declined 17.5% to $205,180. However, calculated on a pro forma basis, sales per employee totaled $232,961. In total, the company reported a reduction in headcount of 147 in FY17, less than 1% of its workforce, compared to 94 in 2016.

The Gainers

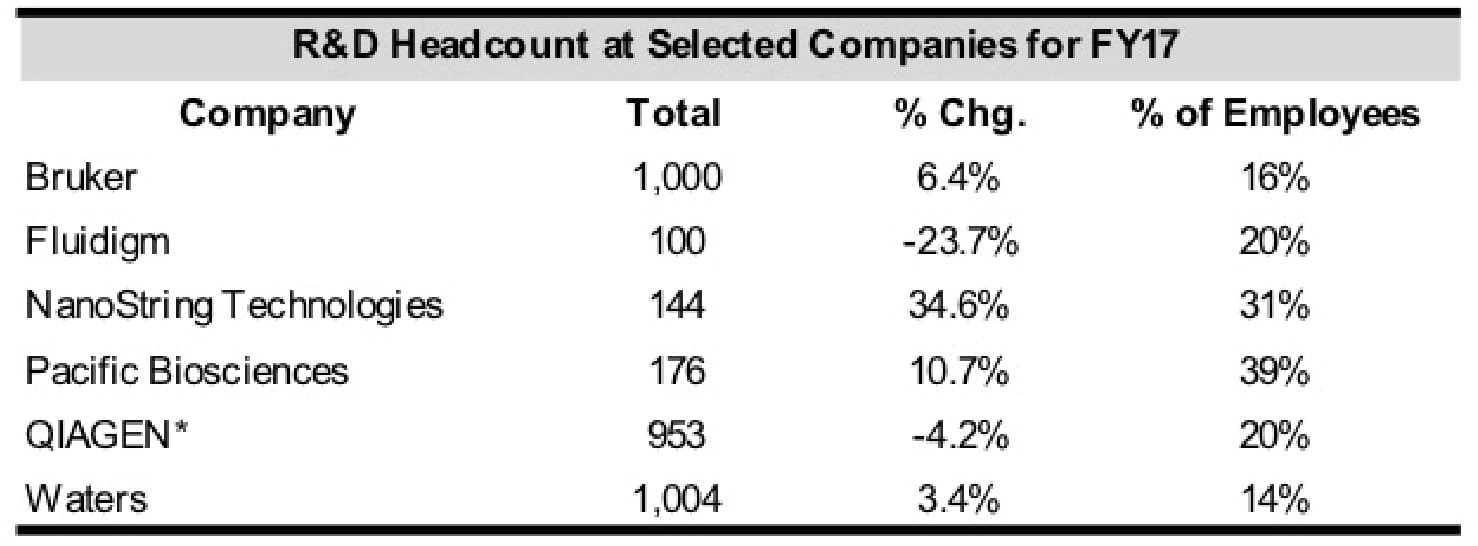

NanoString Technologies and Sartorius’ Lab Products & Services Division showed the largest percentage jumps in productivity in 2017 of the businesses examined in the table. For NanoString, its skyrocketing sales growth, including a sizable increase in collaboration revenue, was matched by only a 14.7% increase in its workforce, including increasing its R&D personnel by other a third (see table below).

Click to enlarge

Similarly, Sartorius Lab Products & Services recorded an increase in productivity of over 20%. The boost was assisted by the company’s March 2017 purchase of Essen BioScience (see IBO 3/15/17), which added $60 million in revenues and approximately 178 employees, including 39 R&D employees. Thus, the business’ productivity figures benefited last year from Essen BioScience’s higher sales per employee of around $337,079. Nonetheless, Sartorius Lab Products & Services has the lowest sales per employee among the companies in the table at less than $200,000.

The Hirers

In addition to Sartorius Lab Products & Services, as well as PerkinElmer and Thermo Fisher Scientific, which all completed acquisition during 2017, four other companies recorded workforce increases that surpassed sales growth last fiscal year.

Agilent Technologies added 1,000 employees, an 8.0% increase. The company completed three acquisition during fiscal 2017 but its two largest acquisitions (see IBO 12/31/16, IBO 7/15/17) added a total of only 142 employees. This suggests that most of the company’s new employees were direct hires. Posting the largest percentage increase among the company’s business units was Agilent CrossLab, whose employee count rose 18.4% to 4,500. Also boosting its headcount was Diagnostics and Genomics Group, where total headcount rose 15.8% to 2,200. In contrast, headcount for the Life Sciences and Applied Markets Group declined 2.3% to 4,200.

In China, sales accounted for 20% of the company’s total revenues in FY17, and with an employee base of over 1,700 employees, the result is a strong $526,118 in sales per employee for the country.

Headcount grew slightly faster than sales for Bio-Techne in fiscal 2017. The company noted on its quarterly conference calls during the fiscal year investments in sales and marketing in both Europe and China. In its fiscal third quarter 2017 call, the company disclosed a 200-person workforce for sales and marketing. The company also highlighted the addition to the business of new employees support the its newest business Advanced Cell Diagnostics (ACD) (see IBO 7/15/16). Completed in fiscal 2017, ACD contributed 100 employees to the total of 240 new hires last fiscal year. With $25 million in annual revenues, ACD’s sales per employee were $250,000.

Biotage’s percentage growth in employees also slightly edged out its sales growth in 2017 as the company added personnel in all its regional businesses except France and Germany. The company has announced an expansion in its regional presence with a new office in South Korea opened in 2016. Last year, Biotage more than doubled its staff at this office from 2 to 5. The company also boosted personnel in its Chinese operations from 13 to 18 with resulting sales of SEK 64.3 ($7.5 million at SEK 8.55 = $1), or $417,804 in sales per employee in US dollars.

Similarly, Pacific Biosciences’ headcount showed a minor percentage increase compared to sales growth. Among the biggest changes were a 10.7% increase in R&D employees to make up 39% of total employees. Thus, 17 of the the company’s 18 new hires were in R&D as the company, offset by reductions in other functions.

The Outliers

Illumina stood out in the table, for as its employee count grew double digits, sales grew even faster. The company has the highest sales per employee among businesses in the table at $443,919, far surpassing the next largest sales per employee of $377,592 per employee for Tecan. Illumina’s advantage is related to its premium priced consumables, a growing testing service business and overall fast sales growth. As the company disclosed last year on a quarterly conference call, headcount additions have been made in its sales force for benchtop instruments as well as investments in China.

In contrast, Fluidigm was an outlier in that it was the only company in the table to record a decline in employees numbers and sales growth. However, employee numbers declined faster than sales, leading to double-digit growth in productivity. Among the areas with the biggest declines in personnel were R&D with a 23.7% decline and sales, technical support, and marketing headcount with a 17.7% decrease.