Contract Testing Labs Deliver Strong Revenues

After experiencing negative impacts due to sluggish oil, gas and mineral markets in 2015 and working on recovering revenues in 2016 (see IBO 7/15/17), publicly held contract testing labs ALS, Eurofins and SGS were back on track in 2017 to deliver strong revenues across their business segments.

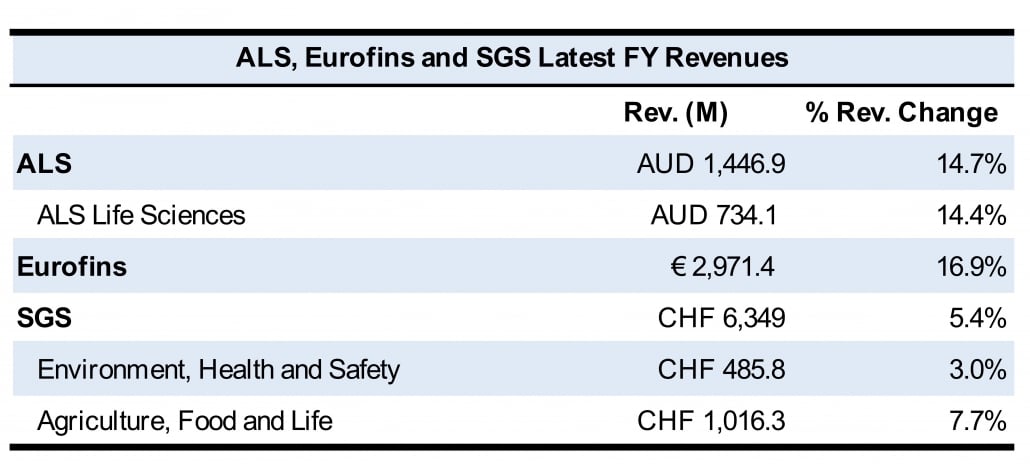

Through acquiring companies, making divestments and investing in startups, ALS, Eurofins and SGS generated significant gains in revenue last year, especially in the environmental, food and agriculture testing segments. ALS and Eurofins’ revenues increased in the double digits, while SGS revenues rose less than 10%. Nonetheless, revenues for ALS, Eurofins and SGS are on an upward trajectory, as each fo the three testing companies are in the middle of a specific multi-year strategic growth plans.

Contract testing labs have a global presence and offer broad testing services, which establish them as an important customer base for analytical instrumentation and lab product companies. Through acquisitions, consolidations and operational changes, the business activities of contract testing labs are influential in deciding on the purchase, utilization and application of analytical instruments and lab products.

ALS

Australian firm ALS provides testing services in three main segments: Life Sciences, Commodities and Industrial. In March, the company decided to exit its Oil and Gas segment due to continued underperformance in the sector. With over 300 labs in 70 countries in Africa, Asia, Australia, Europe and the Americas, ALS operates in numerous industries, providing testing and inspection services for the mining, natural resources, environmental, food, pharmaceutical and industrial end-markets.

FY18 ending March 31 proved to be a strong year for ALS, with revenues jumping 14.7% to AUD 1.5 billion ($1.1 billion at AUD 1.36 = $1), and underlying net profit spiking 21.1% to AUD 142.2 million ($104.5 million). ALS acquired numerous companies in FY18, specifically in the food, pharmaceutical and tribology testing sectors, including Marshfield Food Services in the US, OILCHECK in Brazil and Mikrolab in the Nordic region.

All of ALS’s segments delivered healthy results in FY18. Commodities revenue grew the most, up 21.5% to total AUD 518.9 million ($381.3 million), while Industrial sales improved a nominal 0.6% with revenues of AUD 193.9 million ($142.5 million). The Life Sciences segment brought in the largest share of revenues, which are discussed below.

ALS Life Sciences

The company’s Life Sciences segment conducts testing in environmental, food and pharmaceutical, and consumer product sectors, focusing on microbiological, physical and chemical testing services. In FY18, Life Science revenue grew a robust 14.4%, bringing in revenues of AUD 734.1 ($539.4 million), marking it as the best performing segment.

Food and pharmaceutical testing revenues increased in all regions. ALS plans to continue acquiring food testing companies, specifically in the Americas and Europe, in FY19.

Segment revenues increased in all regions. However, even though Europe delivered a 25% increase in revenues, the segment reported a decline in contribution margin in the region due to acquisition completion costs brought upon by the integration of ALcontrol in the UK, which was acquired in December 2016. Asia and Australia delivered strong growth, especially in the environmental testing sector.

Eurofins

Based in Luxembourg, Eurofins provides testing services for a variety of sectors, such as the agriculture, biopharmaceutical, clinical diagnostic, environment, food and genomic markets. Eurofins has over 400 labs across 44 countries, and a portfolio of more than 150,000 analytical methods. The lab testing company performs over 360 million tests each year.

One of the fastest growing public European companies, Eurofins’ sales have grown by a CAGR of 36% since its IPO on the French stock exchange in 1997, totaling €2.97 billion ($3.5 billion at €0.86 = $1) in FY17, a 16.9% increase. Of this, 6% was organic growth. Capital expenditures for FY17 grew 9.7% to total €213 million ($247.3 million), with the ratio of net capital expenditures and sales having dropped 50 basis points to 7.2% of FY17 revenues. This was mostly due to the sale of a facility that had been obtained in an acquisition from years before. Capital expenditures in FY17 included the addition of 570,487 ft2(53,000 m2) state-of-the-art lab space, the establishment of 30 startup labs, and continued development and implementation of new IT solutions.

Geographically, North America continued to represent the largest market for Eurofins at €902.8 million ($1.0 billion), 30% of revenues, jumping 12.3%. The growth was largely driven by biopharma services, which was bolstered by the US FDA approving a record number of novel drugs. France remained the company’s second largest market, accounting for 23% of sales and bringing in FY17 revenues of €677.8 million ($787.1 million), an 8.3% increase. While revenues grew, organic growth was below average in France, mostly due to total lab spend being capped by French health authorities. However, this limitation was offset by demand for food, microbiology, environment and genomics services, with the latter having the fastest organic growth. German revenues spiked 22.6% to €342.5 million ($397.1 million), thanks to the vigorous food testing market as well as the biopharma sector, which brought in the greatest organic growth in the region.

Continuing its expansion in Asia Pacific, Eurofins reported revenues of €272.0 million ($315.8 million) in the region, a 19% jump. During FY17, Eurofins further expanded its footprint, establishing its market presence in Argentina, Estonia, Lithuania, Slovenia and South Korea, which boosts its portfolio in Central and Eastern Europe, and sets the stage for future growth in Latin America.

Acquisitions and Startups

Eurofins acquired 60 companies in FY17, up over 100% from the 27 acquisitions it made in FY16. Significant acquisitions include environmental testing labs such as Ahma Ymparisto, Finland’s second-largest environmental testing lab, and Nab Labs Group, another large Finnish environmental testing lab; VBM Laboratoriet, a leading environmental testing lab in Denmark; the analytical business of Finlands Ramboll, made up of five testing labs ; and Spectro Analytical Labs in India, which serves as an entry into the environmental testing market in the region.

Other acquisitions completed in FY17 included Canadian company Alphora Research, a contract R&D and manufacturing organization; Italy’s Genoma, a leading genetic testing provider in the country; California-based DiscoverX, which provides drug discovery products and services; and LGC Forensics, the largest forensic science services lab in the UK. In December, Eurofins also completed the acquisition of EAG Laboratories, which provides testing, inspection and certification, for $780 million, the largest acquisition in the company’s history. The 60 acquisitions represent revenues of approximately €700 million ($812.8 million).

As part of Eurofins’ startup program, the company established 30 startups in FY17, a record number for Eurofins, up 36.4%. Startups, along with businesses in the process of being restructured or reorganized, brought in revenues of €258 million ($299.6 million), accounting for 8.7% of Eurofin’s total revenues, a 21.6% decrease.

Infrastructure

As previously mentioned, Eurofins added 570,487 ft2 (53,000 m2) of lab space in FY17, and has planned to construct an additional approximately 1,065,627 ft2 (99,000 m2) of lab space in 2018 and an extra 968,751 ft2 (90,000 m2) in 2019. During the year, the company opened a new facility in Chile for its Agriscience Services segment and relocated its Chinese food testing facility.

New facilities with construction plans already underway include a new space for biopharmaceutical testing as well as global data centers. The company also has major infrastructure plans underway in India, as it is developing a new bioanalysis lab, and an expansion of its chemistry and agro chemical services.

SGS

SGS is a leading inspection, verification, testing and certification company, with 2,400 offices and labs worldwide. It provides services for a variety of industries, such as life science, agriculture and food, energy, chemical, and oil and gas. In FY17, the Swiss company reported revenues of CHF 6.3 billion ($6.3 billion at CHF 0.99 = $1), a 5.4% increase in constant currency, with the Consumer and Retail, Agriculture, Food and Life, and Transportation segments driving much of the growth. Organic growth in FY17 was 4.2%, with acquisitions contributing 1.2% growth.

Environment, Health and Safety

One of the key segments for SGS, Environment, Health and Safety grew 3.0% in FY17 to reach revenues of CHF 485.8 million ($489.0 million), of which 1.3% was organic. The main driver for growth was the lab services and Health and Safety services, which delivered strong results in Europe, Northeast Asia and Asia Pacific. Adjusted operating margin for the segment dropped 15.3% to 10.0%, largely due to a large, one-time project’s completion in 2016, a sluggish South American market and difficult conditions in Angola.

In North America, Accutest, acquired by SGS in 2016, completed non-profitable contracts and shut down numerous lab sites, which impacted the segment for a short period. China and Taiwan delivered robust growth, particularly for dioxin testing, and India and Australia bolstered growth in the Southeast/Asia Pacific region.

Capital additions in the Environment, Health and Safety segment totaled CHF 22 million ($22.1 million) in FY17, a 7.1% increase.

Agriculture, Food and Life

SGS’s Agriculture, Food and Life segment is one of its most important and well performing. In FY17, the segment brought in revenues of CHF 1.0 billion ($1.0 billion), rising 7.7%, of which 6.7% was organic growth. Adjusted operating margin for the segment grew two basis points to 16.0%, driven mostly by incremental growth in Food and Life, which was partially offset by investments into digital projects. The company’s Food services revenue grew in the double digits due to recent investments in lab infrastructure and progress in food certification services. The Seed and Crop business also performed well, thanks to SGS’s recent investments into precision agriculture.

The company’s efforts in its Life segment continued to grow, with revenue growing in the double digits, mostly driven by Asia and Europe. Clinical Research service revenues also increased in the double digits, with the early development clinical segment gaining momentum with the company’s diversification into viral disease testing.

New acquisitions added to the segment include Morocco-based Laboratoire LCA, which performs analytical services like soil fertility testing; independent Canadian microbiology and food chemistry services lab, ILC Micro-Chem; Central Illinois Grain Inspection, which is licensed by the USDA; and another Canadian lab, BioVision Seed Research, which conducts seed, grain and soil testing.

Capital additions in the Agriculture, Food and Life segment totaled CHF 54 million ($54.5 million) in FY17, jumping 18.0%.