IBO Sales Indexes’ Organic Growth Slows in 2016

IBO’s Life Science and Analytical Instrument Indexes (LSA Indexes) track quarterly sales and operating profit margins for 22 major publicly held instrument and laboratory product companies or businesses. Despite a declining quarterly growth progression due to waning European academic spending and a stronger year-over-year growth comparison, demand was healthy for a majority of publicly held instrument and lab product companies in 2016.

LSA Index growth was driven by sales of LC, MS and NGS products for biopharmaceutical and applied applications, as well as significant growth in China. Life science instrument growth was also sturdy in 2016, but was partially hindered by lower high-throughput instrumentation demand for Illumina. Nevertheless, the company’s sequencing utilization rates and service revenues accelerated for the year. In contrast, industrial market remained challenged due to weak oil prices, and delayed research funding for certain companies in the US and Europe.

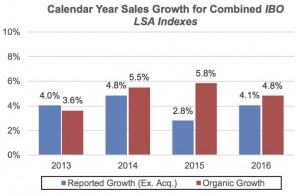

As such, combined calendar year 2016 sales for the LSA Indexes grew 4.9% organically, compared to 5.8% in 2015. Quarterly estimates were calculated for Oxford Instruments, whose results were not announced before publication. All sales figures below are organic.

Biopharmaceutical Markets

Despite modest slowing in the fourth quarter 2016, biopharmaceutical markets for the LSA Indexes remained robust, climbing 8.6% in 2016. Growth was highlighted by increased QC applications for biologics development, expanding regulatory measures as well as new products. LC and MS demand, including related aftermarket products, were particularly strong in these markets, especially for Thermo Fisher Scientific, Waters and Agilent Technologies, for which biopharmaceutical sales climbed 9%, 10% and 13%, respectively. Robust sales growth for bioproduction products for Thermo Fisher and Merck KGaA Life Science (Merck LS) further contributed to market strength.

Applied Markets

Applied Markets for the LSA Indexes grew 5.4% due to significant strength in food testing, especially in China. Food sales for Agilent and PerkinElmer jumped 13% each, and were also solid for Thermo Fisher and Waters. QIAGEN, Shimadzu Analytical & Measuring Instruments (AMI) and Tecan Life Sciences recorded steady demand for food testing and forensics applications. Environmental sales for the LSA Indexes were less dynamic as demand slowed in the second half of the year, with the exception of China.

Sales for clinical research applications elevated growth for Illumina, which reported strength in microarray sales. In addition, Waters recorded higher MS sales to health care customer despite weakness in the fourth quarter of 2016. However, Bruker was negatively impacted by slower MS sales in China.

Academic and Government Markets

The projected sales growth in academic and government markets by several companies failed to materialized in 2016 due to weakness in Europe and delayed NIH funding in the US. As a result, academic and government sales growth for the LSA Indexes was roughly flat in 2016. Academic and government sales for Bruker, Merck LS, PerkinElmer and Waters each declined in the low single digits, and were flat for Agilent. However, academic and government funding in Asia remained healthy.

Industrial Markets

Industrial sales for the LSA Indexes trended lower again in 2016, declining 2.8%. A majority of companies in the LSA Indexes were negatively impacted by delayed equipment purchases due to challenges in the oil markets, including declining refining rates. Several companies expressed cautious optimism that demand for this market is expected to improve in 2017 due to rising orders from chemical customers late in the year.

Geographic Markets

Driven by demand in China and India, total sales in Asia for the LSA Indexes maintained strength, advancing 11.0%. Agilent, Bruker, Fluidigm, PerkinElmer, Thermo Fisher and Waters each reported more than 15% sales growth in China due to increased biopharmaceutical, environmental and food testing applications. Japanese sales for the LSA Indexes were mixed, as sales for the region grew in the low single digits for Agilent, Thermo Fisher and Waters each, but declined for Bruker, Fluidigm and PerkinElmer. LSA Index sales in the Americas and Europe grew roughly 2.7% and 3.3%, respectively due to strength in biopharmaceutical markets and increased food testing applications.

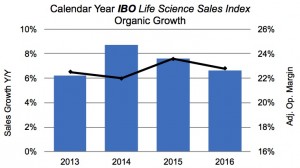

Life Science Sales Index

Full-year 2016 IBO Life Science Index sales advanced 6.6% organically to $14,686 million, compared to 7.6% in 2015. Growth was driven by demand from biopharmaceutical markets for research, process and production applications. NGS-related sales were also strong, especially for sample preparation, services and sequencing consumables. Adjusted operating margin slipped 80 basis points to 22.8%.

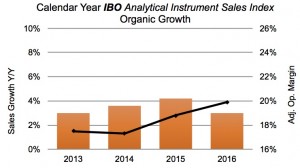

Analytical Instrument Sales Index

Full-year 2016 sales for the IBO Analytical Instrument Index grew 3.0% organically to $15,020 million, compared to 4.2% in 2015. A number of companies highlighted demand for MS, LC and lab automation products from biopharmaceutics and applied customers. This growth was partially offset by delayed European academic funding and weak industrial markets. Adjusted operating margin expanded 110 basis points to 19.9% driven by restructuring activity and cost control measures.

Reported IBO Indexes’ sales growth excludes acquisitions and are based on constant exchange rates for international companies when converted into US dollars.

IBO Life Science Index businesses: Becton, Dickinson’s (BD Biosciences); Bio-Rad Laboratories (Life Science); Biotage; Bio-Techne (Biotechnology, ProteinSimple); Brooks Automation (Life Science Systems Products); Fluidigm (Product); Illumina; Merck KGaA (Life Science); NanoString Technologies; Pacific Biosciences (Products, Services); QIAGEN (Life Sciences); Tecan (Life Sciences) and Thermo Fisher Scientific (Life Science Solutions).

IBO Analytical Instrument Index businesses: Agilent Technologies (Life Sciences and Applied Markets, Agilent Crosslab); Bruker (Scientific Instruments); HORIBA (Process and Environmental Instruments & Systems, Scientific Instruments & Systems); Oxford Instruments; PerkinElmer (Discovery & Analytical Solutions); Shimadzu (Analytical and Measuring Instruments); Spectris (Materials Analysis); Thermo Fisher Scientific (Analytical Technologies); Waters.