Fourth Quarter 2016 and FY16 Results: Bio-Rad Laboratories, Biotage, Danaher, Fluidigm, HORIBA, NanoString Technologies, Pacific Biosciences, Tecan

Timing Curbs Bio-Rad LS Growth

Q4 2016

Fourth quarter 2016 sales for Bio-Rad Laboratories’ Life Science (LS) segment declined 5.2%, 4.3% excluding currency, to $206.8 million to account for 36% of revenues. The expected decline was due to completed backlog orders and timing of process media sales in the previous year. However, this decline was partially offset by higher sales of Droplet Digital PCR and food safety products. Given the strong comparison, LS sales declined in most geographic regions, including China. Reported LS operating loss widened dramatically to $19.2 million but included substantial restructuring, impairment and other one-time charges.

2016

Full-year 2016 LS sales grew 5.1%, 6.5% excluding currency, to a record $730.7 million to account for 35% of revenues. Sales were strong for Droplet Digital PCR and process media products, and grew steadily for gene expression, Western Blot reagents and food safety products. Geographically, currency-neutral sales grew in all regions, led by North America and Asia Pacific, especially China. Despite plans to release a new product related to the acquisition of GnuBIO (see IBO 4/15/14), the company recorded impairment and in-process R&D charges of $59.9 million due to the delayed R&D development. For 2017, LS sales are projected to grow 4.5%–5.0%. The acquisition of RainDance Technologies (see IBO 2/15/17) is estimated to add $20 million in sales.

Biotage Q4 2016 Organic Growth Slows

Q4 2016

Boosted by currency, fourth quarter 2016 sales for Biotage advanced 6.3% to SEK 179.1 million ($19.8 million = SEK 9.05 = $1). However, sales growth was limited to 0.9% excluding currency. Operating margin expanded 140 basis points to 13.4%.

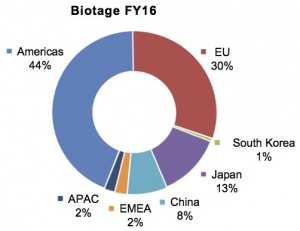

2016

Full-year 2016 sales climbed 9.4%, 7.8% excluding currency, to SEK 667.9 ($78.0 million at SEK 8.56 = $1). Growth was driven by Organic Chemistry sales, which benefited from healthy uptake of the new V-10 Touch evaporation system. Stronger-than-expected sales for the purification system Isolera also contributed to this growth. Consumables sales within the Analytical Chemistry business remained positive, driven by strong growth in the US. Geographically, sales in China were accentuated, climbing 28% due to strong system revenues.

Biopharma Markets Lift Danaher Sales

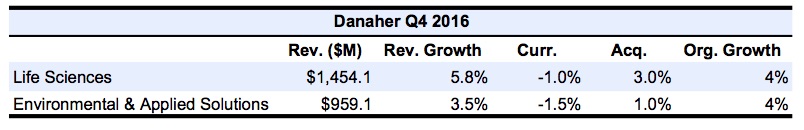

Q4 2016

Fourth quarter 2016 sales for Danaher’s Life Sciences segment expanded 5.8%, 4% organically, to account for 32% of company revenues. Segment growth was driven by demand for MS products from biopharmaceutical customers, especially in China and India. As such, sales for the SCIEX business grew in the mid-single digits organically. Strong service revenues, which climbed double digits, as well as healthy demand from food and environmental markets, further contributed to SCIEX growth. Geographically, SCIEX sales advanced at a sturdy pace in both China and Western Europe.

Sales for the Beckman Coulter Life Sciences (BCLS) business grew in the low single digits organically, driven by demand for flow cytometry and particle counting products. Sales for the CytoFLEX system maintained strength, helping deliver higher BCLS sales growth in North America. BCLS sales in China delivered another quarter of double-digit sales growth, but were partially offset by lower demand in Latin America.

Despite weakness in Japan, Leica Microsystems sales grew in the low single digits organically, driven by demand in North America and China.

Sales for the acquired Pall business (see IBO 5/15/15) grew in the mid-single digits organically, driven by demand for single-use technologies within Pall Life Sciences. Meanwhile, Pall Industrial sales improved in the low single digits, as higher demand from microelectronics and aerospace markets was partially offset by weakness in the Process Technologies business.

Fourth quarter sales for Danaher’s Environmental & Applied Solutions segment grew 3.5%, 4% organically, to $959.1 million to make up 21% of revenues. Sales for the water quality platforms grew in the low single digits organically. Hach sales improved in the low single digits organically, as demand from municipal and industrial customers in the US offset lower project activity in Eastern Europe and China. However, Hach orders grew at a faster pace, rising in the mid-single digits due to improved bookings in the US and Western Europe.

2016

Full-year 2016 sales for the Danaher’s Life Sciences segment advanced 3.5% organically to $5.37 billion to make up 32% of company revenues. Organic MS sales grew roughly in the mid-single digits, led by demand from biopharmaceutical customers and strong services revenues. However, this growth was partially hampered by weakness in Japan and slower demand from clinical customers in North America. Microscopy sales were flat, while sales of flow cytometry and particle counting products improved in the low single digits. Pall Life Sciences sales benefited from higher demand for single-use technologies in bioproduction.

Full-year Environmental & Applied Solutions grew 3% organically to $3.69 billion to make up 22% of revenues. Price increases contributed 1.0% to organic sales growth. Sales in the water quality businesses grew at a low single-digit pace as in the fourth quarter 2016.

Fluidigm Closes Out Disappointing Year

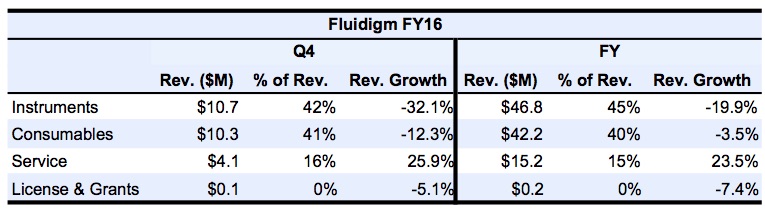

Q4 2016

Fourth quarter 2016 sales for Fluidigm fell 18.4% to $25.1 million due to weak instrumentation demand across most platforms and lower consumables sales. Like third quarter 2016, sales growth was negatively impacted by competitive challenges and weak academic demand, especially in Europe.

Notwithstanding the sharp year-over-year decline, sales stabilized from the previous quarter, advancing 13.0% on a sequential basis. In addition, the company noted increased interest for mass cytometry products from biopharmaceutical customers, sustained demand in China and strong Service revenue, which climbed 25.9%.

Product sales tumbled 23.7% to account for 84% of revenues. Genomics and mass cytometry–related sales declined 26.3% and 19.6% to make up 59% and 41% of Product revenue, respectively. Instrument demand was particularly weak for Helios and, to a lesser extent, the sample preparation C1 system. However, the company reported positive interest in the new imaging mass cytometry system, which was released on a limited basis towards the end of the quarter. Consumables revenue also contracted, as higher sales of mass cytometry products, which grew 33%, were more than offset by lower demand for Integrated Fluidic Circuits (IFCs). Sequentially, instrument and consumables sales advanced 16% each due to increased demand for mass cytometry products.

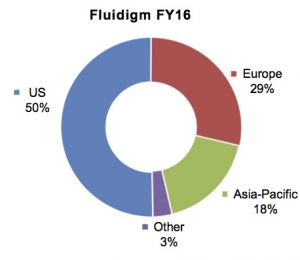

Geographically, sales in the US, Europe and Other regions contracted 4%, 37% and 79% to make up 52%, 27% and 1% of revenues, respectively. Accounting for 19% of revenues, sales in Asia-Pacific climbed 8%, including 77% growth in China.

Adjusted Product gross margin contracted 278 basis points to 65.5% due to product mix and lower production volume. Adjusted operating loss widened 36.0% to $14.8 million.

2016

Full-year 2016 sales contracted 8.9% to $104.4 million, driven by a significant decline in genomic instrumentation sales in the second half of the year, as well as lower consumables utilization. Alternatively, Service revenue grew 23.5%.

Product revenue sank 12.9% to account for 85% of sales. This decline was primarily attributed to lower demand for C1 and Access Array products. As a result, genomics sales fell 19.3% to account for 68% of Product revenue. Accounting for 32% of Product revenue, mass cytometry sales improved 4.7%, including a 40% increase in consumables revenue.

Following an internal business review, the company modified its list of installed systems, excluding units sold past an 18-month period for which no consumables purchases were recorded. As a result, the company’s active installed base was reduced by 515 systems to roughly 1,340. A majority of those inactive systems were Access Arrays platforms, as customers transitioned to the Juno system.

The decline in C1 systems mostly impacted sales in Europe, which declined 19.1%. Sales in the US and Other region contracted 5.0% and 35.5%, respectively. However, sales in Asia-Pacific advanced 8.9%, as strength in China offset lower Japanese sales.

Adjusted Product gross margin dove 247 basis points to 66.4%. Adjusted operating loss widened 44.5% to $61.9 million. The company initiated cost saving measures, including headcount reductions in the first quarter, which is expected to lower operating expenses by $8 million in 2017. First quarter sales are expected to be stable, representing flat growth on a sequential basis but a decline of roughly 13% year over year.

HORIBA Ends Year on a High Note

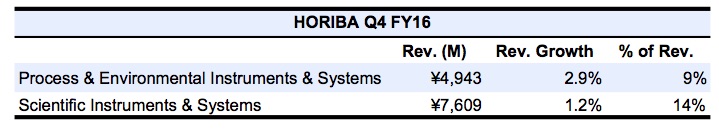

Q4 2016

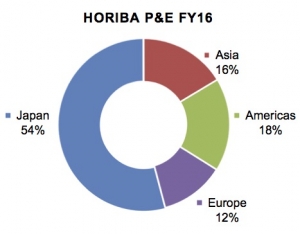

Fourth quarter 2016 sales for HORIBA’s Process and Environmental Instruments & Systems (P&E) sales expanded 2.9%, roughly 9% excluding currency, to ¥4.94 billion ($45.2 million at ¥ 109.46 = $1). Growth was led by higher sales of stack-gas analyzers in Asia.

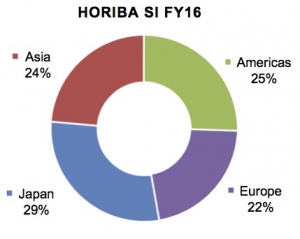

HORIBA’s Scientific Instruments & Systems (SI) sales grew 1.2% to ¥7.61 billion ($69.5 million) to account for 14% of company revenues. Excluding currency, sales climbed nearly 10% driven by demand in the Americas and Europe but partially offset by weakness in Asia.

2016

Full-year 2016 P&E sales improved 0.3%, roughly 6% excluding currency, to ¥16.75 billion ($154.0 million at ¥ 108.76 = $1) to account for 10% of revenues. The company highlighted demand for process measurement equipment products in the Americas. Segment operating margin contracted 132 basis points to 9.2%. The company projected 2017 P&E sales to grow 7% to ¥18.0 billion ($164 million at ¥110.00 = $1).

SI’s full-year 2016 revenue declined 3.8% to ¥25.7 billion ($236.6 million) to account for 15% of revenues. Excluding currency, sales advanced roughly 5%. Segment operating margin slipped 81 basis points to 3.7%. SI sales are estimated to grow 1% in 2017 to ¥26.0 billion ($236 million).

NanoString Growth Slows

Q4 2016

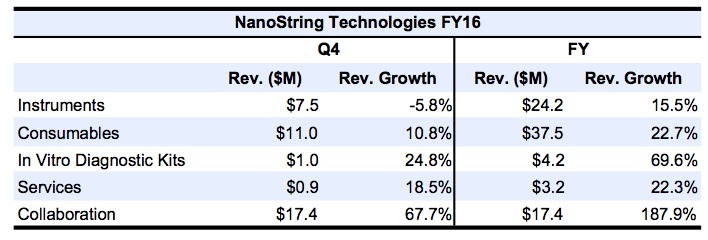

Fourth quarter 2016 sales for NanoString Technologies grew 13.1% to $25.2 million. However, this growth was largely attributed to collaboration revenue, which climbed 67.7% to account for 19% of sales. Product and Service revenue, which improved 4.9% to account for 81% of revenues, was slightly below company expectations due to weaker demand for both instruments and consumables from academic customers. Instrument sales declined 5.8% due to funding delays for academic customers, as well as growing competition for genomics-related products. The company also noted that its commercial channels were inadequately supported, resulting in lower instrumentation sales productivity. Life science consumables sales advanced 10.8%, led by demand for PanCancer Immune Profiling panels. Sales of IVD kits expanded 24.8%. Operating loss widened 30.2% to $9.9 million due to increased R&D investments.

2016

Full-year sales for NanoString climbed 38.0% to $86.5 million, including collaborative revenues of $17.4 million, which nearly tripled compared to the previous year. Product and service sales jumped 22.1% to account for 80% of revenues. While the number of systems sold jumped roughly 40% to 160 units, instrument sales grew disproportionately, rising 16% due to higher placements of the lower-priced SPRINT system. The company shipped 60 SPRINT systems for the year.

Including contractual revenues, sales in the Americas, Europe/ Middle East and Asia Pacific climbed 46.2%, 24.9% and 16.2% to make up 70%, 21% and 9% of revenues, respectively. Operating loss was unchanged at $41.2 million. The company projected 2017 sales to growth 16%–21% to $100–$105 million, including collaboration sales of $19–$20 million. Product and service revenues are expected to grow at similar rate as in 2016.

Rising Momentum for Pacific Biosciences

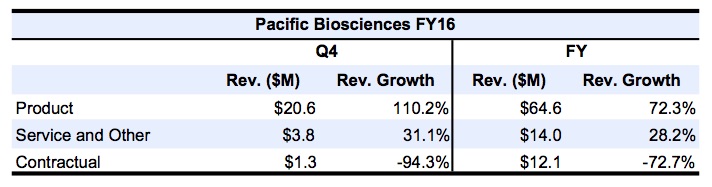

Q4 2016

Excluding contractual revenue, fourth quarter 2016 product and service sales for Pacific Biosciences jumped 92.2% to $24.4 million. Instrument sales soared 151% to $13.1 million, driven by increased Sequel system placements. Instrument bookings also improved on a sequential basis, as orders climbed from 20 units in the third quarter 2016 to 30. The company noted stronger interest from sequencing companies following the addition of new functions to its sample loading feature. Consequently, GrandOmics ordered 5 systems in the quarter, while Novogene place a 10-system order in January.

Consumables revenue climbed 64% to $7.5 million, as demand for Sequel consumables ramped up. Service and other revenue expanded 31% to $3.8 million.

Contractual revenue amounted to $1.3 million, representing the final amortized payment from Roche, compared to $23.6 million recorded in the previous year from both milestone and amortized payments.

Product and service gross margin jumped from 23% to 41% due to increased system placements. Operating loss was significantly higher at $17.9 million due to lower contractual revenues.

2016

Full-year 2016 product and service sales for Pacific Biosciences climbed 62.4% to $78.6 million. Instrument sales more than doubled to $41.0 million, as the company ended the year with an installed base of more than 110 Sequel systems. Consumables sales advanced 26% to $23.7 million, while service and other revenue improved 28% to $14.0 million. Contractual revenue declined 73% to $12.1 million. Overall, sales in North America, Europe and Asia accounted for 56%, 22% and 22% of revenues, respectively. Reported 2017 sales are expected to climb 21%–38%, including product and service revenue growth of 40%–60% and zero contractual revenue.

New Systems Elevate Tecan

H2 2016

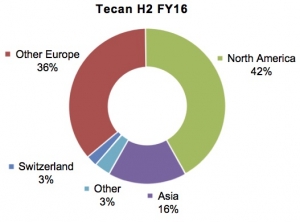

For the second half of 2016, Tecan sales advanced 12.7%, 7.3% organically, to CHF 271.0 million ($273.7 million at CHF 0.99 = $1). Currency and acquisitions added 0.5% and 4.9% to sales growth, respectively.

Organic sales growth for the Life Sciences Business (LSB) accelerated in the second half of the year, climbing 7.5% due to continued adoption of its new Fluent liquid handling platform and Spark line of microplate readers. Increased demand for services, consumables and reagents also contributed to segment growth.

Partnering Business sales advanced 7.0% organically, driven by increased production and placements for one of its customers, Ortho Clinical Diagnostics’ automated analyzer. Component sales were similarly strong, led by demand in China and from NGS customers. Segment operating margin slipped 166 basis points to 11.9% due to acquisition-related costs following the purchase of Sias (see IBO 10/31/15).

All sales figures below are expressed in local currency but include acquisitions. Sales in Asia and North America climbed 24.5% and 14.0% to account for 16% and 42% of Tecan sales, respectively. European sales slipped 0.5% to make up 38%. Sales in Other regions jumped 87.1% to represent 3%.

Tecan orders declined 2.8% organically to CHF 252.6 ($255.2 million) due to timing of a large order within the Partnering Business. Operating margin fell 243 basis points to 14.9% as a result of acquisitions and higher sales of new instrumentation, which carry lower gross margins.

2016

Tecan 2016 sales climbed 15.0%, 8.2% organically, to CHF 506.2 million ($511.3 million at CHF 0.99 = $1). The company achieved record annual sales due to strong demand for new instrumentation, higher recurring revenues and robust growth in China. Currency and acquisitions further contributed to sales growth, adding 1.5% and 5.3%, respectively.

LSB sales grew 6.8% organically, driven by demand for the new Fluent and Spark systems. Sales of plastic consumables, primarily pipette tips and microplates, were also healthy. Segment growth further benefited from expanded operations in China, including strong demand from diagnostics customers in the region. LSB operating margin contracted 165 basis points to 16.3% due to product mix.

Organic sales for the Partnering Business advanced 10.1% due to higher production volume for Ortho Clinical Diagnostics’ ORTHO VISION Analyzer and strong components sales. Segment operating margin declined 118 basis points to 14.9% due to the acquisition.

In local currency but including acquisitions, Tecan sales in Asia, Europe, North America and Other climbed 27.0%, 12.8%, 7.6% and 52.3% to make up 16%, 43%, 39% and 3% of revenues, respectively. The company highlighted sales growth in China, which soared roughly 50% including acquisitions to account for 10% of revenues. Orders improved 1.8% organically to CHF 503.2 ($508.3 million), as strong LSB order growth was partially offset by a missed order within the Partnering Business. Despite higher pricing, Tecan gross margin contracted 160 basis points to 47.3% due to the acquisitions and product mix.

The company projected 2017 sales to grow at least 6% in local currency, which should equate to roughly a minimum of 3% growth organically.