IBO Stocks Mixed In An Uncertain Market

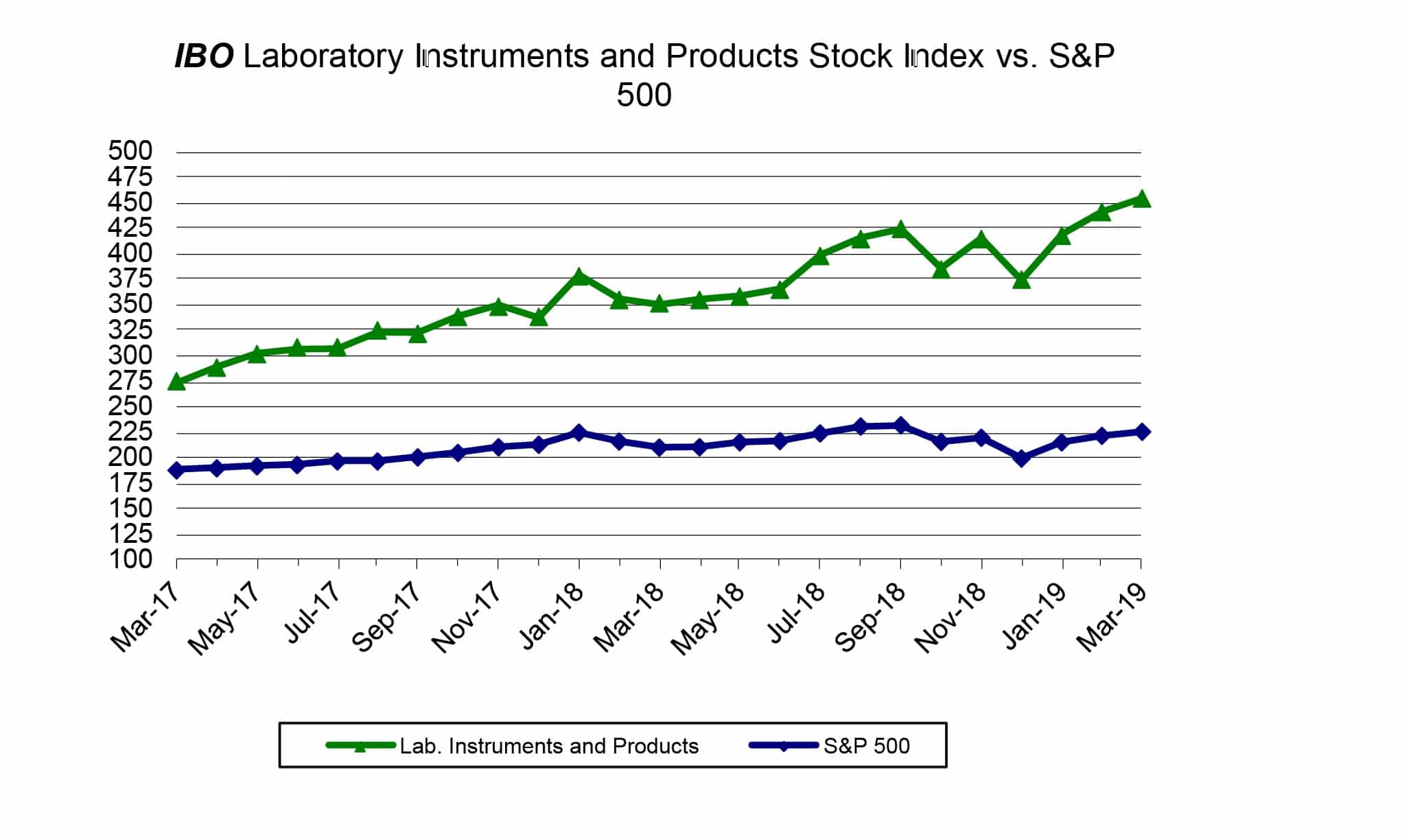

The US market ended both the month and first quarter with gains, advancing 0.3%. The S&P 500 closed with its best showing since 2009 and its best start to a year since 1998. In addition, March 8 marked the 10th anniversary of the current bull market. Despite the US market ending March on a high note, the state of the economy had a tone of uncertainty throughout the month, with inconsistent behavior throughout the market that could not give investors a clear picture of what was to come for the remainder of the year.

The US-China tariff issue did not reach a conclusion with a trade agreement on March 1 as originally planned. The latest development occurred on March 18, when both parties pushed back their summit meeting to sign a trade agreement to June.

The labor market continued to be a relatively strong economic indicator, yet showed signs of decline. For example, on March 8, the Bureau of Labor Statistics reported that February was the worst month for job creation since September 2017, with only 20,000 jobs created, despite a Dow Jones survey projecting an expectation of 180,000 new jobs. This decline was somewhat offset by increases in wages which rose 3.4%, its strongest pace since April 2019, and the unemployment rate declining to 3.8%.

Another concern investors had was the Federal Reserve’s wait-and-see approach to monetary policy. Despite a March 20 announcement that the Fed would hold off on raising interest rate hikes and keep the rates between 2.25%–2.5%, the announcement divided investors who either saw it as a tactic to prolong the current bullish market or a sign that the US economy would continue to slow throughout the year.

The Commerce Department announced on March 28, that the GDP grew 2.2% in the fourth quarter of 2018, a downgrade from the projected 2.6% and the third quarter 2018 figure of 3.4%. Financial analysts attributed the decrease in the GDP due to low spending from consumers, state and local governments and reduced business investment.

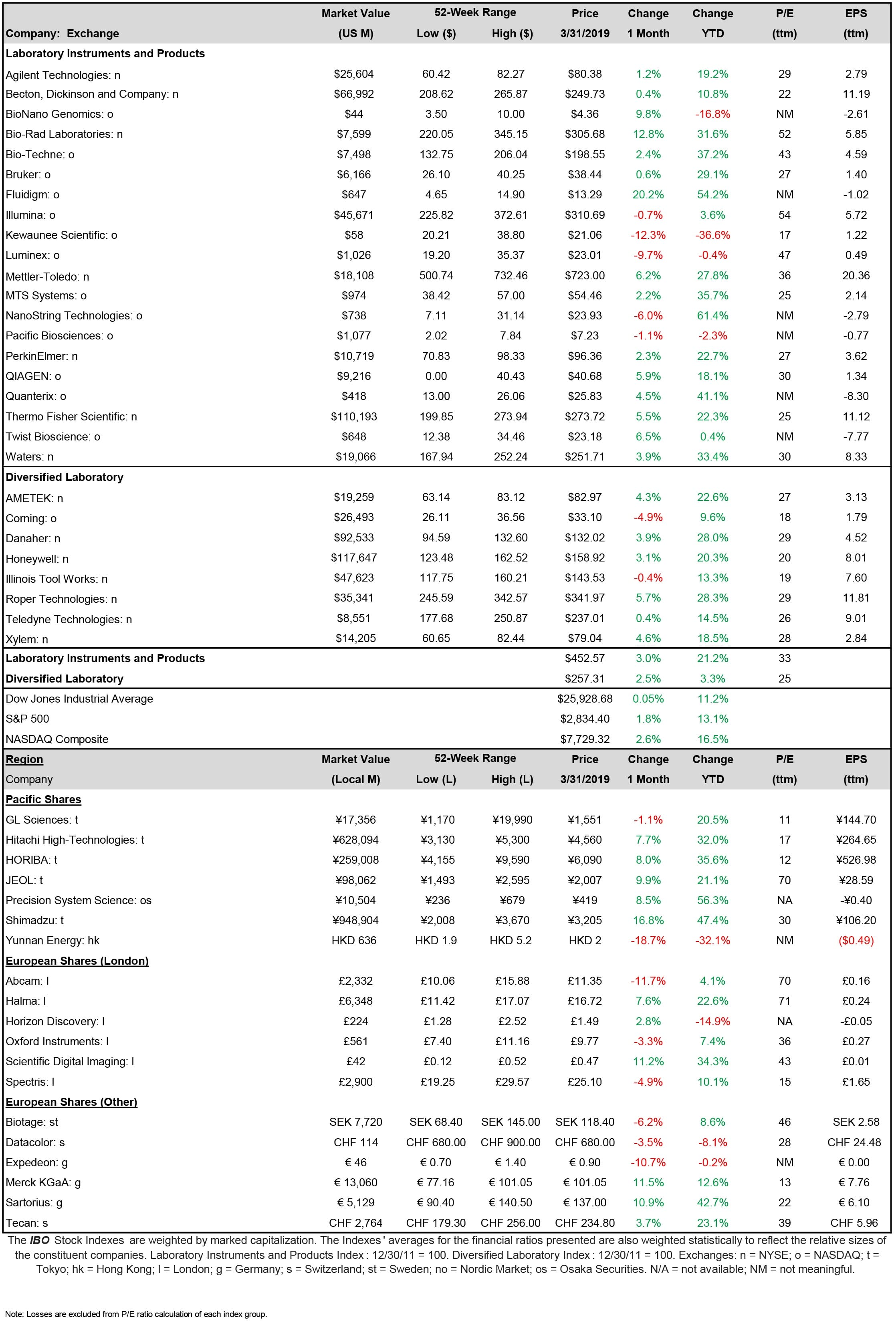

For March, the Dow Jones Industrial Average, S&P 500 and NASDAQ all had gains, rising 0.05%, 1.8% and 2.6%, respectively.

Laboratory Instruments and Products Stock Index

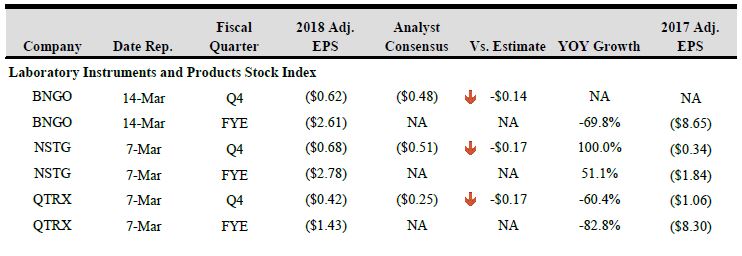

The Index advanced 3.0% to $452.57 this month and is up 21.2% for the year. The Index’s performance was mixed, with most companies trading higher this month. The top performing company for the month was Fluidigm, which jumped 20.2%. The worst performing company for the month was Kewaunee Scientific, declining 12.3%.

In other news, three Index companies undertook new securities offerings. Fluidigm announced on March 18 a mixed shelf offering of securities to raise an unspecified amount. On March 20, Quanterix announced the filing of a prospectus for $200 million worth of mixed shelf offering of securities. Quanterix did not provide specific share prices for each security being offered. NanoString Technologies announced on March 19 the public offering of 4.5 million shares of common stock priced at $23 per share. The company’s stocks slipped 11% on the day of the announcement. The stock offering closed on March 25 with a total of 5.2 million shares of common stock sold, resulting in $68.3 million of net proceeds.

In addition, BioNano Genomics entered into financing agreements on March 14 totaling $41.5 million in debt and equity commitments from affiliates of Innovatus Capital Partners, East West Bank and Aspire Capital Fund.

On March 11, Kewaunee Scientific’s stock slipped 6% after the announcement of David Rausch’ resignation as the president, CEO and director. Thomas D. Hull, who served as CFO since 2015, has been appointed as his successor.

In rating news, on March 1, Deutsche Bank gave Bio-Rad Laboratories a “buy” rating and raised its price target from $330 to $350, a 9.1% upside from the March 1 price of $320.92. On the same day, Barclays gave the company an “overweight” rating and raised its price target from $315 to $340, a 5.9% upside from the March 1 price of $320.92.

Thermo Fisher Scientific had various rating news throughout the month. On March 18, Barclays gave the company an “overweight” rating and raised its price target from $295 to $300, a 14.5% increase compared to its March 18 price of $261.97. On March 22, Deutsche Bank gave Thermo Fisher a “buy” rating and raised its price target from $275 to $300, up 12.9% March 22 price of $265.63. Lastly, on March 25, UBS Group gave the company a “buy” rating and raised the price target to $305, a 14.2% upside from the March 25 price of $267.05.

On March 26, Cowen gave Agilent Technologies an “outperform” rating and raised its price target from $80 to $90, up 11.6% the March 26 price of $80.63.

Although they reported financial results this month, the following companies did not provide EPS guidance: BioNano Genomics, NanoString Technologies and Quanterix.

Diversified Laboratory Index

In March, the Index increased 2.5% to $257.31 and is up 3.3% for the year. All companies in the Index except Corning and Illinois Tool Works experienced monthly gains. Corning and Illinois Tool Works declined 4.9% and 0.4%, respectively. Roper Technologies experienced the highest gains in share price, rising 5.7%, while Teledyne Technologies experienced the smallest, rising only 0.4%.

On March 1, Danaher announced the closing of the concurrent offerings of its 12.1 million common stock offering at the price of $123.00 per share and its 1.65 million shares of 4.75% Series A Mandatory Convertible Preferred Stock at the price of $1,000 per share. The net proceeds were approximately $1.44 billion and $1.60 billion, respectively. Danaher will use the proceeds to fund a portion of the pending acquisition of the Biopharma business of GE Life Sciences (See IBO 2/28/19). On March 8, Danaher declared a $0.17 dividend, a 6.3% increase from the prior dividend of $0.16.

International Stocks

For the month, the Asia Pacific markets were mixed with three indexes having positive gains and the remaining three indexes experiencing declines. India’s Sensex experienced the largest gain, rising 7.23%, while Japan’s Nikkei 225 was one of region’s worst performing indexes, sliding 1.84%.

Prices for the Asia Pacific region companies in the IBO Stock Table were mixed, with most companies experiencing monthly gains. Shimadzu was the only company to rise in the double digits, increasing 16.8%. The two companies with monthly declines were GL Sciences and Yunnan Energy, decreasing 1.1% and 18.7%, respectively.

European equity markets were mostly positive in March. Italy’s FTSE MIB Index and London’s FTSE 100 expanded 2.86% and 2.43%, respectively. Germany’s DAX and Spain’s IBEX 35 experienced monthly declines, sliding 0.65% and 0.30%, respectively.

Prices for the European stocks in the IBO Stock Table were mixed in March with 6 companies showing gains and 6 experiencing monthly declines. Scientific Digital Imaging, Merck KGaA and Sartorius were the only companies to grow in the double digits, increasing 11.2%, 11.5% and 10.9%, respectively. In contrast, Expedeon and Abcam were the biggest losers, declining 10.7% and 11.7%, respectively.

Abcam reported its first-half financial results on March 4. Adjusted diluted EPS increased 5.2% to 16.3 pence ($0.21) as the company continued to show broad-based demand across all product categories. Merck KGaA announced both fourth quarter 2018 and full-year 2018 results on March 7, posting a fourth quarter adjusted EPS increase of 141.6% to €5.63 ($6.39) and a full-year adjusted EPS rise of 29.5% to €7.76 ($9.12). Tecan reported full-year 2018 results on March 11. Diluted EPS increased by 6.6% to CHF 5.96 ($6.08) as the company posted high-single-digit revenues (see Bottom Line).

In ratings news, on March 22, Deutsche Bank reaffirmed Halma’s “buy” rating while, on the same day, UBS Group reaffirmed its “sell” rating of the same company. Also, Goldman Sachs Group downgraded Spectris to a “sell” rating and lowered the price target from 2,600 pence ($33.97) to 2,200 pence ($28.75).