Materials Characterization: Hitchhiking Oil Prices

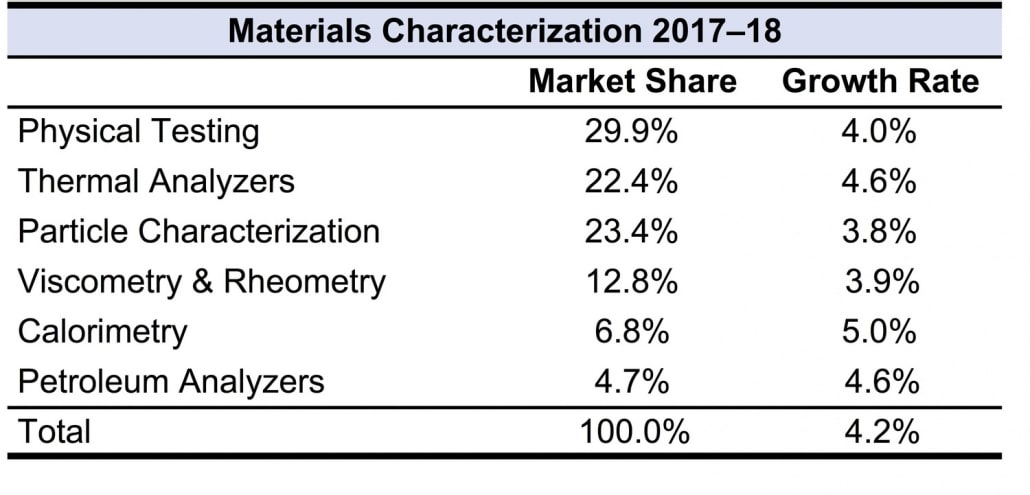

The market for materials characterization technologies picked up in 2017, benefitting from pent-up demand in the industrial sector. Its moderate growth rate is expected to continue this year, in line with the expected rise of global oil prices through 2018. Rising oil prices will encourage oil producers to increase their output, especially in North America, translating into higher demand for analytical testing products such as petroleum analyzers, viscometers and calorimeters.

The growth in demand for physical testing instrumentation is driven by applications in product development and QC by automotive manufacturers. The increasing use of aluminum, carbon fiber composites and additive manufacturing in automotive production is expected to bolster demand for these techniques in 2018.

Following solid sales growth this past year, demand for thermal analyzers are set to have another good year, driven by the pharmaceuticals, chemicals and applied markets. Sales growth for this technology may be offset by diminished demand from polymers/plastics applications, however, due to adverse effects on spending from higher oil prices. A similar pattern will likely affect sales growth for viscometers. Meanwhile, demand for particle characterization products is hedged across many diverse industries, which will keep its growth rate moderate and stable.

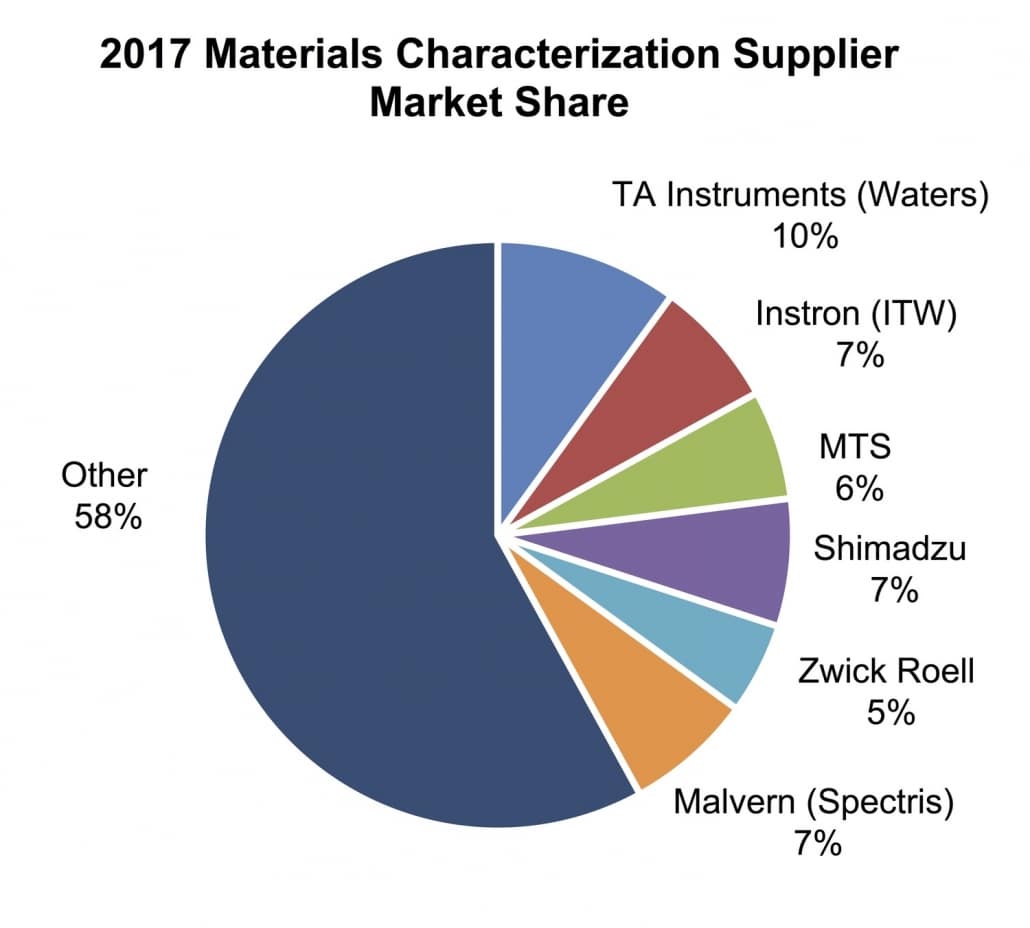

There is no dominant player in the materials characterization market as no company owns more than a tenth of the total market size. This is the result of each company’s specialization in only one or two segments. For example, Instron (Illinois Tool Works) and MTS Systems participate solely in the physical testing segment, while TA Instruments focuses its business operations on thermal analyzers, and viscometers and rheometers. The competitive landscape is unlikely to change much in the foreseeable future, as there is no strong indication that suppliers are looking to substantially diversify their product portfolios beyond their current offerings.