Second Quarter Results: Bio-Rad Laboratories, Bio-Techne, Hitachi High-Technologies, QIAGEN, Spectris, Tecan

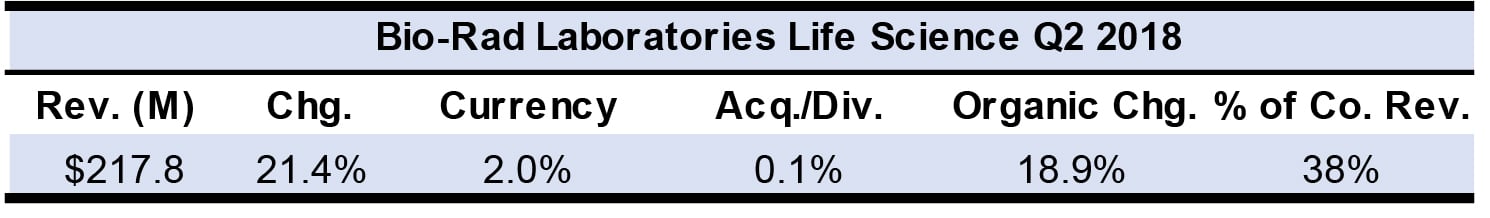

Bio-Rad Life Science Revenues Up Over 20%

Sales for Bio-Rad Laboratories’ Life Science segment increased double digits on an organic basis (see IBO 8/15/18). Highlights were the Droplet Digital PCR, gene expression, cell biology, protein quantitation and food science sales. Process chromatography sales grew on an easy year-over-year comparison. Life Science revenue rose 14% on a currency neutral basis excluding process media sales.

Click to enlarge

Excluding currency, sales grew double digits in North America, Europe and Asia. The US, Europe and China led regional sales growth.

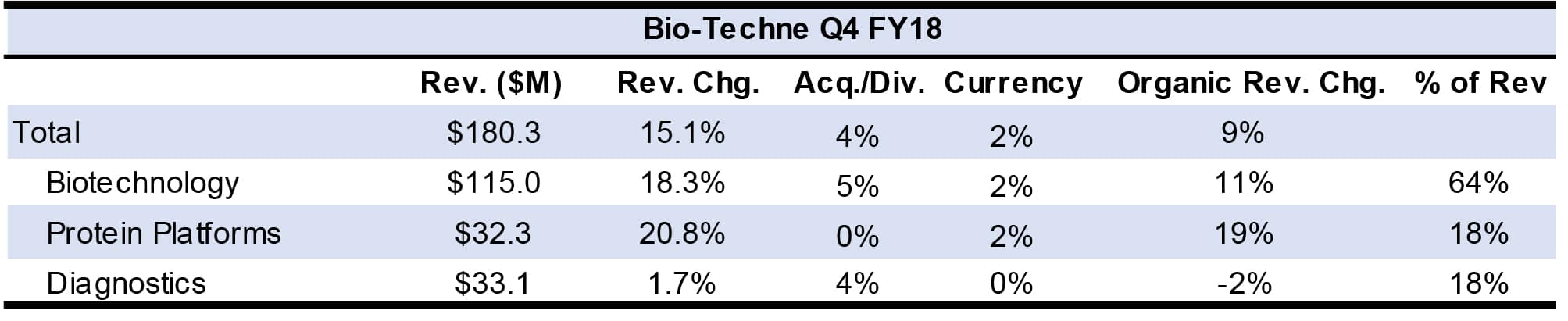

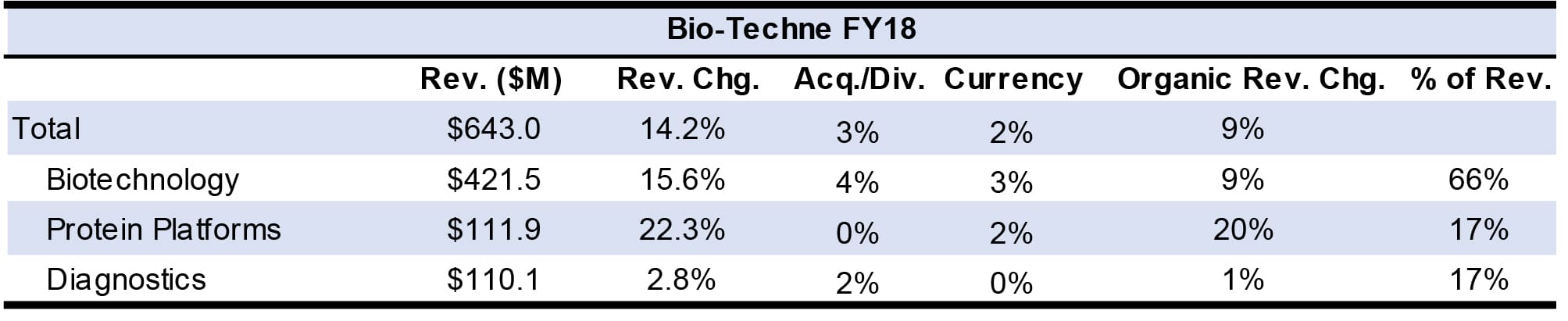

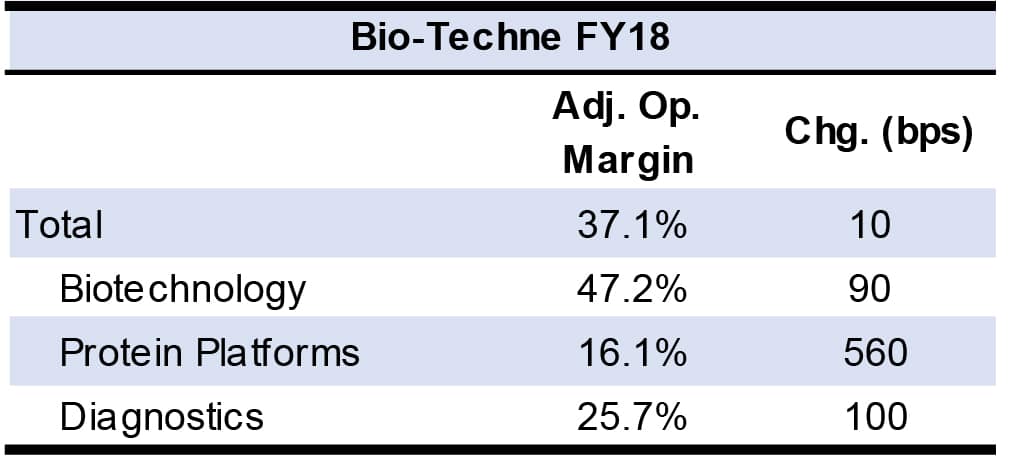

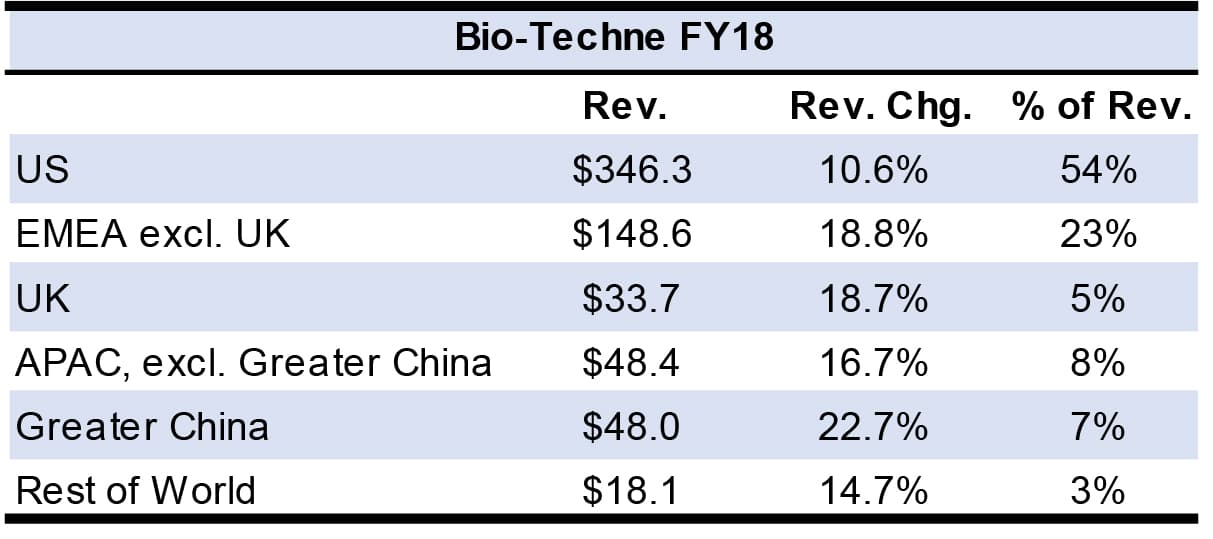

Bio-Techne’s Protein Platforms Division Leads Sales Growth

Bio-Techne fiscal fourth quarter and 2018 revenues each grew double digits, with the company reporting its best fiscal year organic revenue growth in five years (see IBO 8/31/18).

Click to enlarge

Click to enlarge

Biopharma sales were up high single digits in both the US and Europe in the quarter. In the same period, academic sales rose in the low teens in the US and mid-teens in Europe. For the year, the company reported strong growth in the US academic market and high single digits sales growth in pharma.

Biotechnology division sales were driven by a broad range of products, including sales of proteins, antibodies and assays. Annual product highlights included solid sales for the Human XL Cytokine Discovery Luminex assay. ACD research-only sales rose over 30% for both the quarter and the year.

Click to enlarge

Within the Protein Platforms division, iCE instruments sales to new customers increased over 25% in the fiscal fourth quarter. Sales of the Simple Western platform grew over 30% for the quarter and more than 25% for the fiscal year to 1,100 units. Simple Plex products sales increased 60% for the quarter and 80% for the year.

Click to enlarge

Fiscal and quarterly Diagnostic revenue growth was affected by timing of OEM orders. For the year, highlights were sales of hematology controls, point-of-care diagnostics kits and reagents manufacturing.

Fiscal 2019 sales are expected to rise in high single digits on an organic basis. The company estimates $30 million in revenue in fiscal 2018 from its acquisition of Exosome Diagnostics, which is also expected to be profitable. The company estimates Protein Platforms sales growth of around 15%.

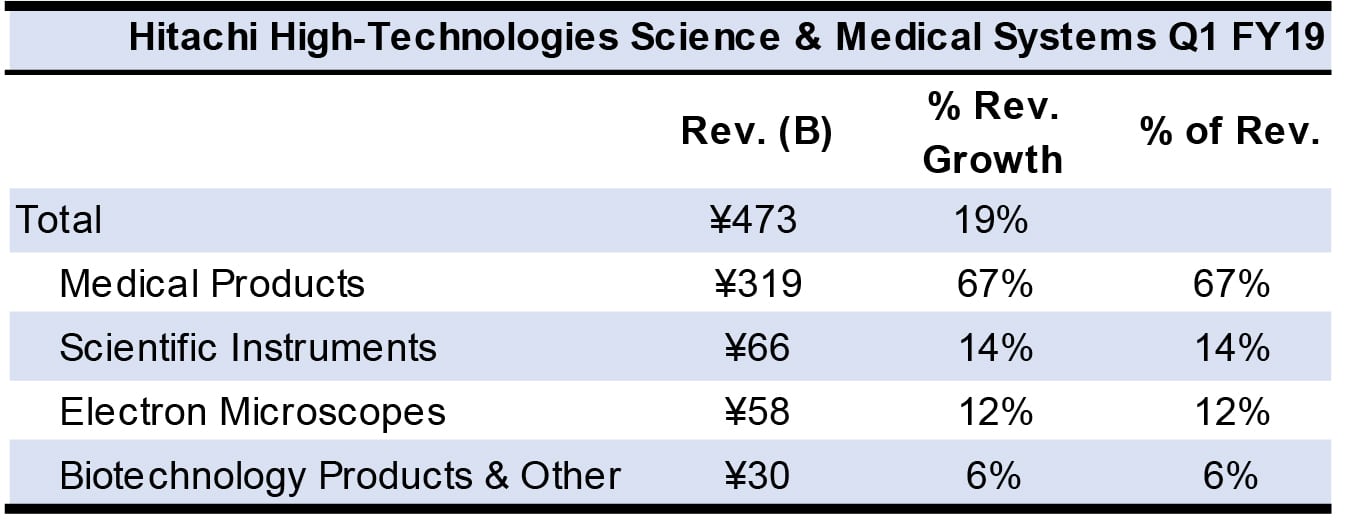

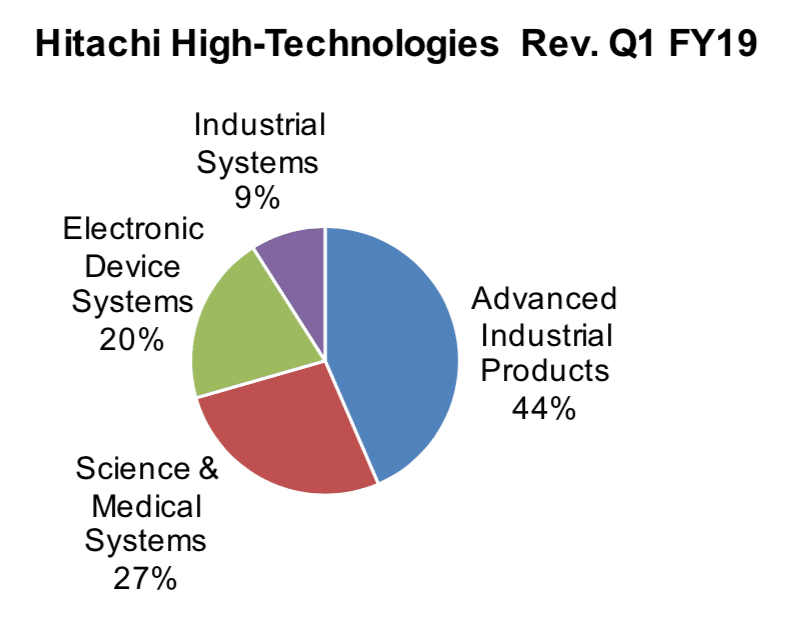

Microscopy Sales Fall for Hitachi High-Technologies Science & Medical Systems

Fiscal first quarter 2019 revenues increased despite a decrease in electron microscopy sales (see IBO 7/31/18). However, the company reported demand for the systems from Asian semiconductor and materials manufacturers. Other segment highlights included demand related to rechargeable batteries and RoHS compliance.

Click to enlarge

The company forecasts first-half 2019 division sales to increase 13.9% to ¥998 billion ($915 million = ¥109.08 = $1).

Click to enlarge

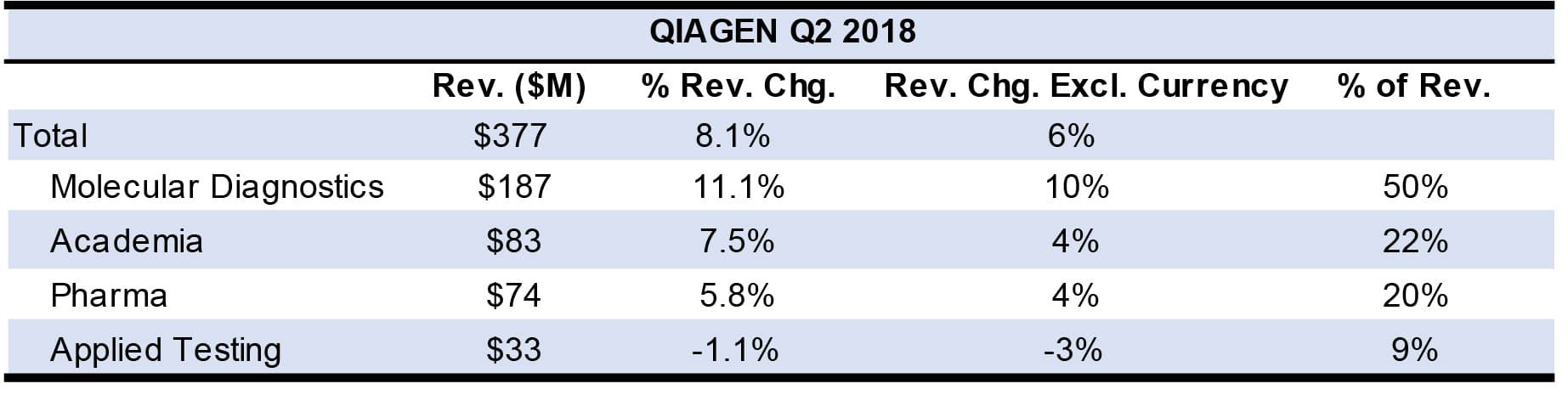

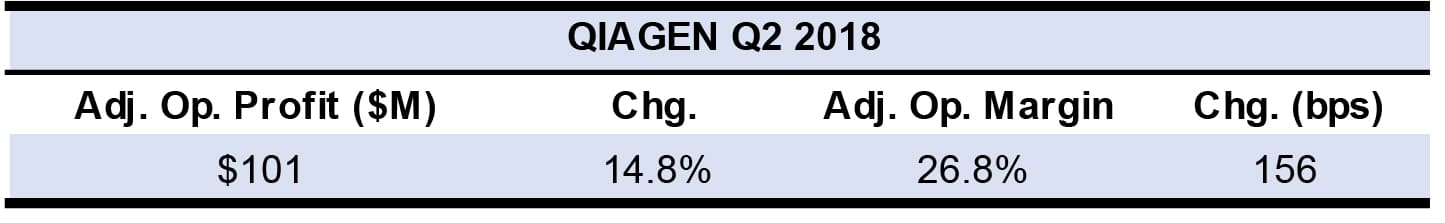

QIAGEN Reports Double-Digit Molecular Diagnostics Growth

QIAGEN reported healthy second quarter sales growth. Instrument sales growth was impacted by lower third-party service revenues as the company reduces service for third-party providers (see IBO 7/31/18).

Click to enlarge

Molecular Diagnostics posted the fastest sales growth among the company’s four customer segments. Strong sales growth was reported for the QuantiFERON-TB test and QIAsymphony consumables. In addition, companion diagnostic agreement revenue rose 81% in constant exchange rates to $14 million.

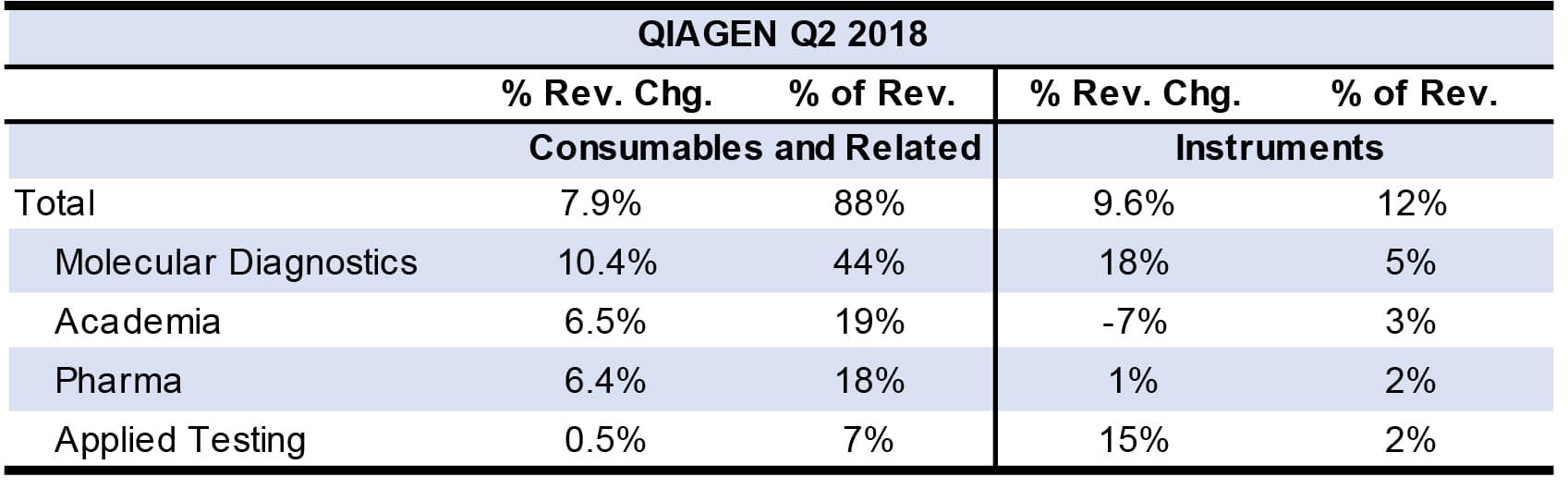

Click to enlarge

Sales to Pharma and Academia customers also increased, with Pharma sales growing the fastest in the Americas. In contrast, Applied Test sales decreased due to the year-over-year comparison and the exit from its veterinary testing portfolio. Excluding the divestment, Applied Test revenues grew in the low single digits.

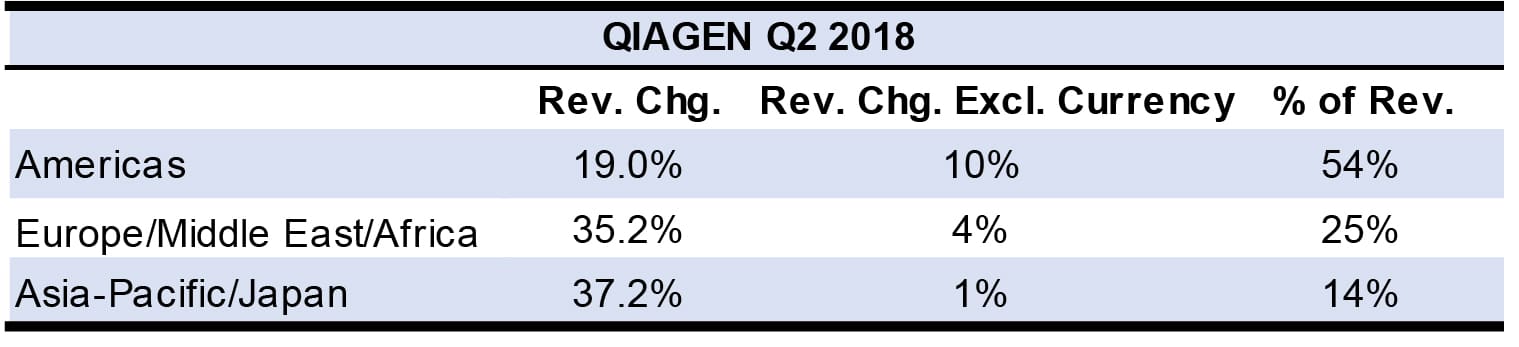

Click to enlarge

By region, in the Americas, the company highlighted double digit constant currency sales growth for the US, Brazil and Mexico, led by Molecular Diagnostics sales. In Europe/Middle East/Africa, sales in France and Germany declined slightly. Asia-Pacific sales growth was affected by last year’s South Korean tenders for QuantiFERON-TB. Excluding this, Asia-Pacific sales were up 5% in constant currency.

Click to enlarge

For the year, the company expects companion diagnostics revenue to increase 20% on average. QIA-state sales to new customers are expected to total $7 million for the year.

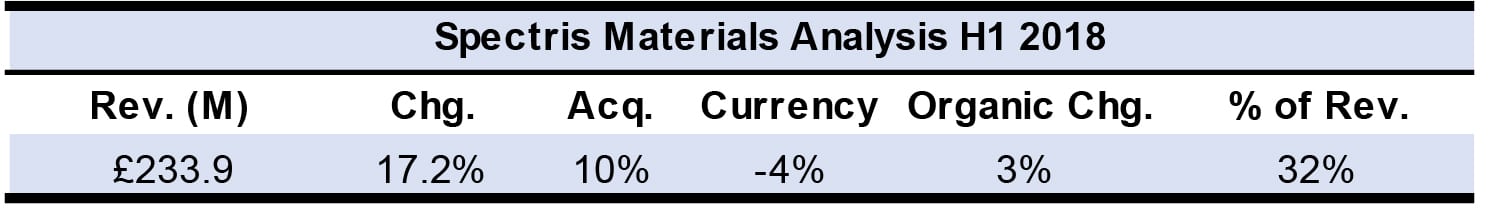

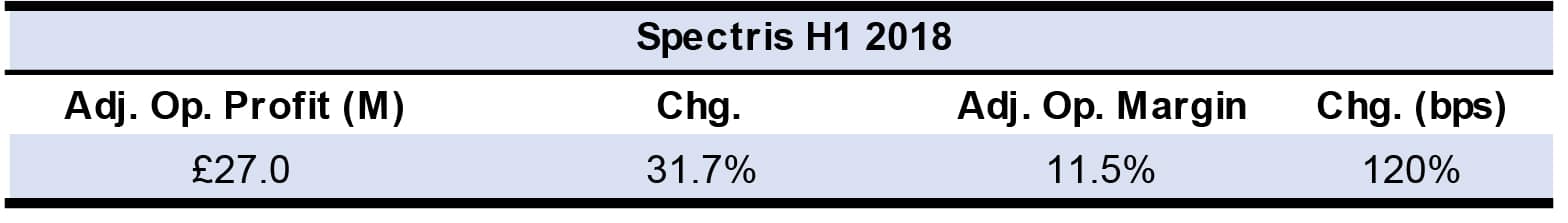

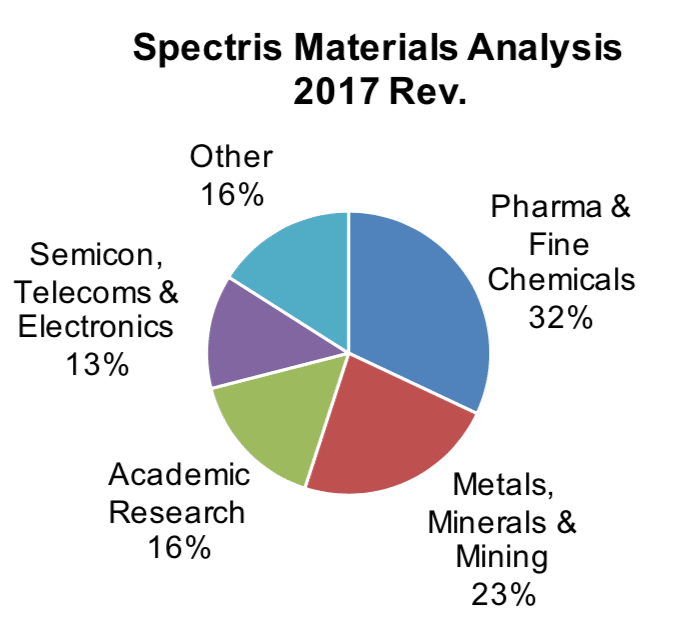

Spectris Materials Analysis Benefits from Acquisition

Click to enlarge

The Materials Analysis business revenue increases boosted by a double-digit percentage growth contribution from the purchase of Concept Life Sciences (see IBO 1/31/18).

Click to enlarge

Organic sales growth was led by pharmaceutical and fine chemicals end-markets, with particular strength in North America, as well as good growth in Germany and Italy. Semiconductor and electronics revenue remained strong, led by Asia and Particle Measuring Systems sales to semiconductor fabrication plants.

Click to enlarge

Sales to the metals, minerals and mining industries rose, reversing the trend from a year ago, despite a decline in metals sales in Asia and North America. Academic sales also rebound with strong growth in China.

Click to enlarge

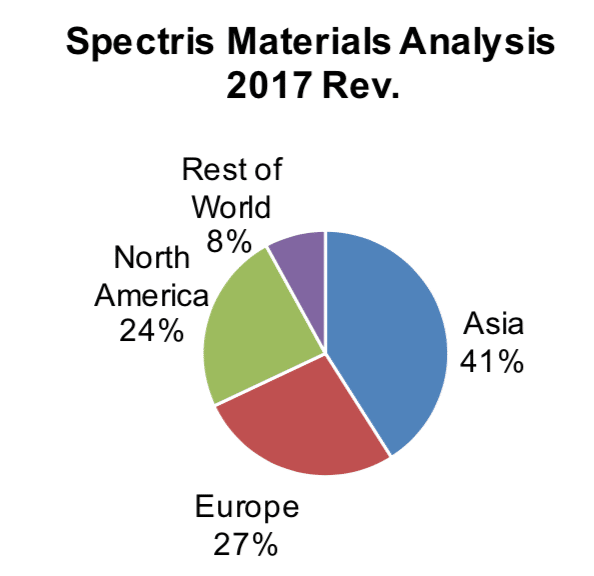

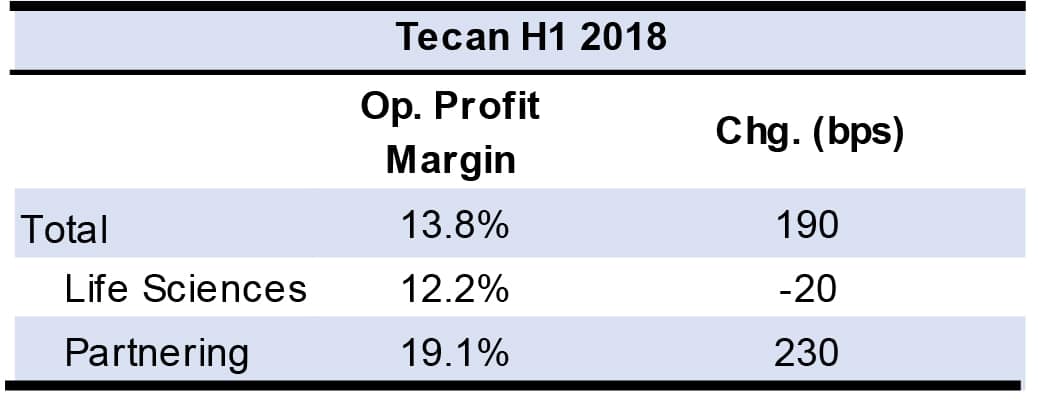

OEM Business Fuels Tecan Sales

Click to enlarge

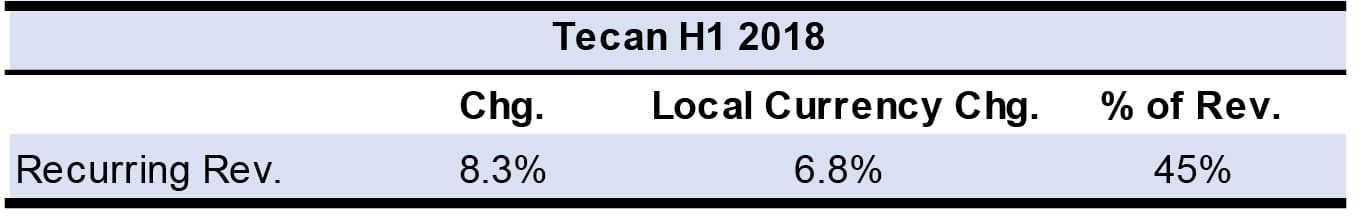

Tecan’s first-half sales were led by its Partnering (OEM) business, with over five projects in development (see IBO 8/31/18). The company attributes the comparative slower sales growth in the Life Sciences business to a difficult year-over-year comparison and noted strong demand for the new Fluent Gx platform. Life Sciences orders grew double-digits. Total company orders in the first half rose 2.8%, or 1.3% in local currencies.

Click to enlarge

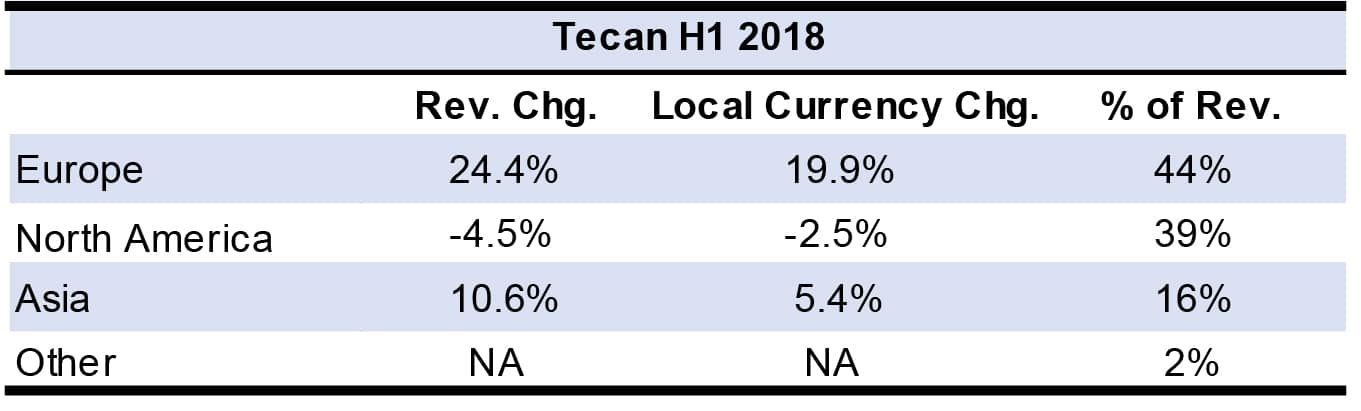

Geographically, Partnering sales grew 40% in Europe during the first half, with an easy year-over-year comparison. North America revenue growth benefited from Fluent and Fluent Gx demand as well component sales.

Click to enlarge

Click to enlarge