The Growing Potential of the Cell and Gene Therapy Market in 2020

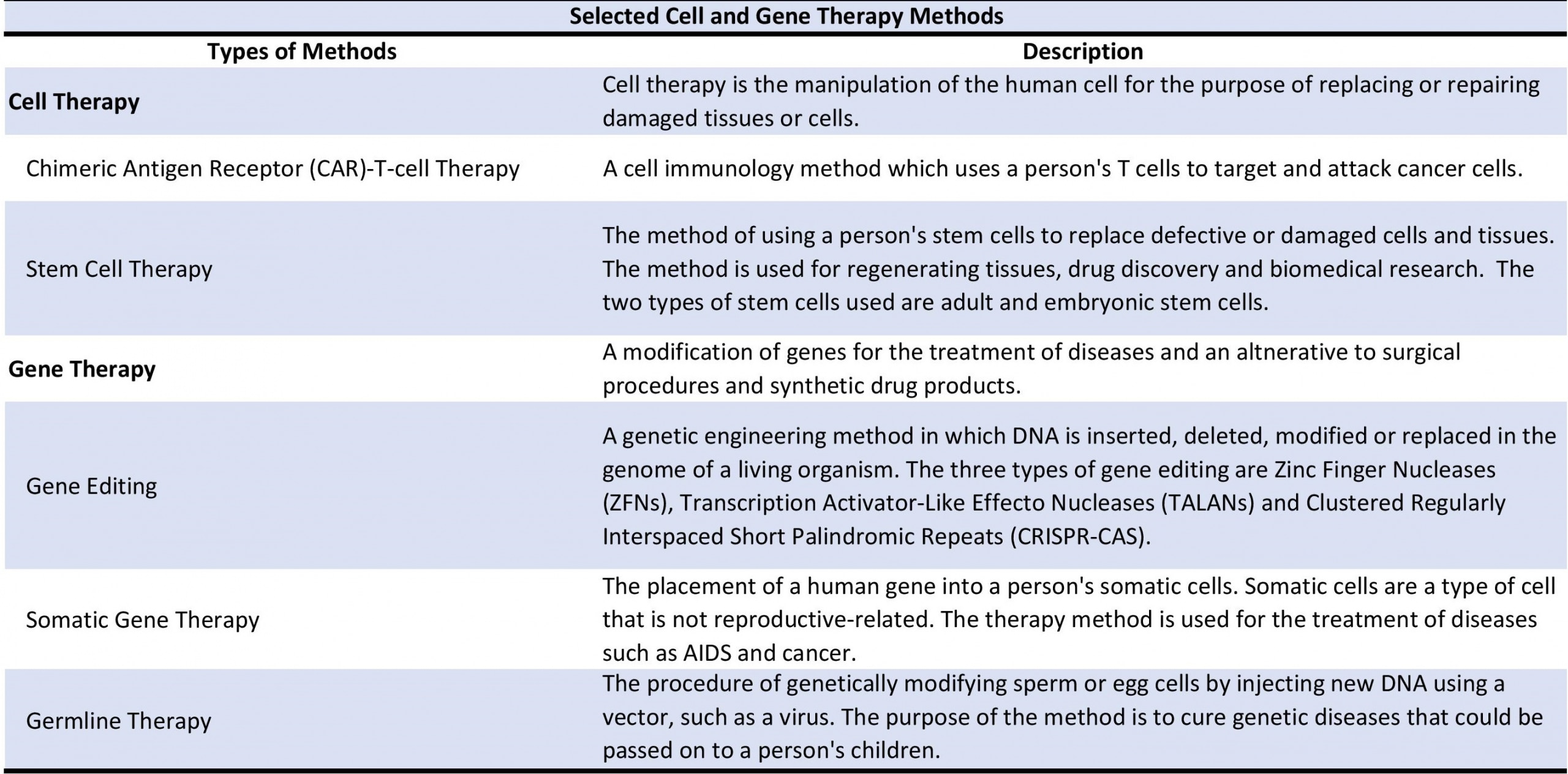

The development of cell and gene therapies has become an essential component of cancer and genetic disease research and treatment. Consequently, regulatory approvals for cell and gene therapy have begun to increase globally. As a result, cell and gene therapy research has expanded into other areas of medicine, such as treatments for autoimmune and dermatological diseases.

In April 2020, Kalorama Information released “Cell and Gene Therapy Markets.” The report gives an overview of the current market situation for the sector. Specifically, the report details market outlook, R&D trends, selected product developments and more for both the overall market and five branches of medicines—dermatology, oncology, ophthalmology, the study of cardiovascular and blood, and the study of musculoskeletal conditions—that are developing treatments and drugs based on cell and gene therapy.

The report also devotes a section to summarize the development of drugs and treatments for various genetic diseases. Additionally, the report highlights the leading companies offering cell and gene therapy products as well as describes the impact that government policies have on the market. Kalorama utilized primary resources, including interviews and email correspondence, and secondary resources, such as company reports and research journals.

According to the report, in 2020, sales of cell and gene therapies are estimated to reach $3.8 billion and are projected to total $12.9 billion by 2025 and $29.9 billion by 2030. The cell therapy market accounts for most of these sales, yet usage of gene therapy is projected to increase in the coming years. Oncology and genetic disorder treatments are expected to account for most cell and gene therapy sales. The study of cardiovascular and blood studies and oncology are forecast to be the two fastest-growing markets of the five disease areas listed above, with sales for both rising in the double digits by 2030.

Cardiovascular and blood diseases are one of the top causes of death globally. As a result, regulatory approvals in the US and Europe have engendered demand for treatments and drugs for these medical conditions. Blood disorders are the primary revenue driver for the cell and gene therapy market, with stem cells being the most used method for research. However, gene therapy is projected to rise in popularity in the coming years. Leading providers of cell and gene therapies include Alnylam Pharmaceuticals, Mitsubishi Tanabe, AnGEs and BioCardio.

Drug development and treatments in the oncology sector have also grown in demand due to more than 100 different cancer types affecting the global population. Geographically, the US is the largest market. By cancer type, blood cancer is considered to be a focus of most research and drug development. For oncology, cell therapy, especially cell immunotherapy, is projected to be the primary revenue driver for the cell and gene therapy oncology market by 2030. Top providers in this market include Gilead Sciences, Novartis and others.

Despite a bright outlook, the report highlights some of the challenges the cell and gene therapy market is currently facing. Overall, cell and gene therapy companies face difficulties such as tight timelines, employment recruitment, and a lack of optimized scientific instrumentation and lab products for manufacturing. Regarding staffing, companies have struggled with finding personnel that specializes in specific techniques and have resorted to hiring from other industries. Another hindrance has been the struggle to streamline shipping logistics for treatments.

Mergers and acquisitions have been an essential component of sales growth for the cell and gene therapy market. Realizing the potential of the cell and gene therapy market, pharmaceutical and biotechnology companies have started begun to acquire smaller companies.

This activity has further stimulated demand for solutions for cell and gene therapy research and manufacturing. Consequently, laboratory tool companies are expanding their expertise in the field through internal investments and acquisitions. In 2019, Bio-Techne, a maker of life science research consumables, acquired B-MoGen Biotechnologies for an undisclosed amount to diversify its gene editing and delivery portfolio (see IBO 6/17/19). Also in 2019, Thermo Fisher Scientific purchased viral vector manufacturer, Brammer Bio for $1.7 billion due to Brammer’s specialization in enabling bioprocessing and gene transfer (see IBO 3/31/19). Additionally, in 2019, a pharmaceutical company, Bristol-Myers Squibb (BMS), purchased Celgene, a biotechnology company that specializes in developing medicines for cancer and inflammatory disorders.