The Impact of the Scientific Instruments Market on Water Testing

The water quality analysis and testing market’s role in improving water waste infrastructure on a global scale has shined a light on various issues related to the natural element. Access to clean water, government regulations addressing water pollution, extreme weather occurrences, and the attempt to update different regions’ aging water infrastructure are some of the issues impacting water testing. The scientific instrument industry plays a crucial role in water quality analysis and testing, with companies offering analytical techniques and products that aid this end-market’s various goals

In November 2019, Strategic Directions International (SDi) released the “Water Testing Instruments 2019: Environmental & Industrial Monitoring” report, which outlines the market conditions for water testing instrumentation used for environmental and industrial testing in 2019. The report summarizes the market developments and end-market and regional demand for both the overall market and five technologies in particular: atomic spectroscopy, chromatography & mass spectrometer (MS), electrochemistry, molecular spectroscopy and process analyzers. The report highlights the leading vendors offering these technologies, which include Agilent Technologies, Danaher (Hach), Shimadzu, Thermo Fisher Scientific and Xylem. Also, the report outlines the potential opportunities for the water testing instrumentation market. For the report, SDi utilized primary sources, including interviews, and secondary resources, such as industry publications and other internet resources.

According to the report, in 2018, the water testing instrumentation market was valued at $3.7 billion and is forecast to reach low single-digit sales growth to more than $4.5 billion by 2023. Chromatography & MS instrumentation is potentially growth driver due to the technologies’ use for water analysis applications, such as detecting and quantifying potential-containments research and trace-level analysis. Additionally, the report discusses the LC/MS instrument sector’s role in boosting the chromatography & MS market as this technology contributes to the growing demand for wastewater reuse and water pollutants research, such as Per- and Polyfluoroalkyl Substances (PFAS) studies.

Geographically, in 2018, the US & Canada and Europe were the two largest regional markets for water testing instrumentation. Nevertheless, the report projects China will drive revenue growth because of the country’s enacting government regulations that tackle water pollution due to rapid industrialization. Also, the country’s project of transferring water from the southern to the northern region is a potential reason.

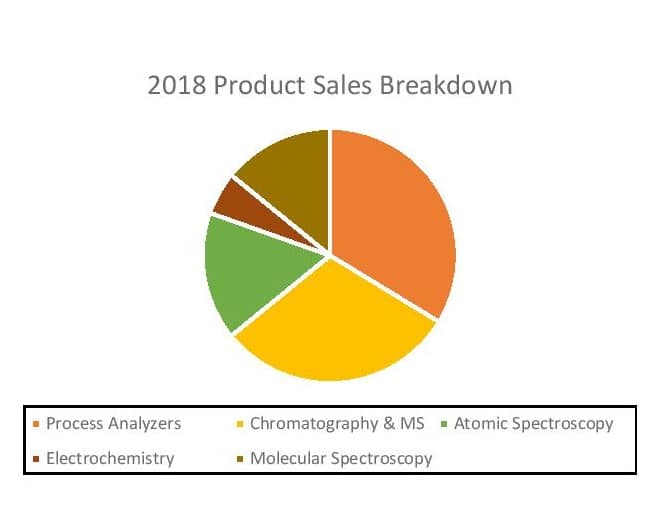

In 2018, sales-wise, chromatography & MS, molecular spectroscopy and process analyzers were the highest-selling analytical technologies in the water testing instrumentation market among the five profiled. The report expects that out of these three, chromatography & MS, and process analyzers will continue to be fast-growing sectors, along with atomic spectroscopy. Chromatography & MS sales are forecast to increase in the mid-single digits from 2018 to 2023, while atomic spectroscopy and process analyzers demand is expected to rise in the low single digits. Additionally, because of GC/MS and HLPC’s reliance on aftermarket products, the chromatography & MS market is anticipated to experience a significant increase.

Drivers of the chromatography & MS market include regional demand and the prominence of particular techniques. Within the chromatography & MS sector, the report forecasts local demand from China and Other Asia Pacific countries to increase significantly. Also, the LC/MS instruments sector is projected to be the main growth driver in the overall chromatography & MS market. In 2018, Agilent, Thermo Fisher, and Waters were the top suppliers for this technology sector. Earlier this year, Thermo Fisher launched an automated solution for solid phase extraction prior to water analysis for PFAS in drinking water.

Like the chromatography & MS sectors, the atomic spectroscopy sector is expected to have a significant market presence in China and Other Asia Pacific nations. One reason is the increasing demand is low price points and applications in metal-containment detection, a growing concern for these regions. Inductively coupled plasma spectroscopy (ICP) and ICP-MS systems are projected to be the most in-demand technologies in the atomic spectroscopy sector, with ICP revenue rising in the high single digits and ICP-MS sales reaching low single-digit growth. Agilent, PerkinElmer, and Thermo Fisher were the top suppliers in 2018. Agilent further invested in the water testing instrument market through the introduction of its Agilent 7800 ICP-MS in November 2018, which is geared towards the environmental laboratory end-market for water analysis applications.

Demand for process analyzers for water analysis is anticipated to grow thanks in part to the need for process electrochemistry technologies, which accounted for the most sales in the process analyzers sector in 2018. However, the report predicts that process total organic nitrogen/total nitrogen (TON/TN) and turbidity/colorimetric process analyzers will be the fastest-growing technologies in this segment. Demand for both technologies is expected to rise due to their water-containment monitoring features utilized for wastewater recycling and reuse research. Geographically, China, and the Other Asia Pacific countries are expected to be the main growth drivers due to both regions’ investment in water infrastructure expansion. In 2018, the top process analyzer suppliers were Danaher (Hach), Endress+Hauser and Xylem. In May 2018, Hach established a three-year partnership with water, waste and energy management company Veolia. Hach became the leading supplier of water analysis instruments for Veolia’s water testing and analysis division.

In conclusion, the water testing instrumentation sector is projected to meaningfully contribute to the overall analytical and scientific instrument market through 2023, the latest year covered in the report. Additionally, as the report touches on, these technologies play a part in aiding in improving water infrastructure and the environmental status of multiple regions.