NIH Disease Categories Receive Significant Funding Boosts

In May, the NIH released data regarding the annual funding levels classified by disease and condition research based on funding mechanisms, such as grants and contracts. The information came as part of the NIH’s efforts to provide more transparency and improved consistency when reporting its funded research. The new transparency process was implemented in 2008 through the Research, Condition and Disease Categorization (RCDC) system, which mines data to eliminate variability in order to accurately match NIH projects to categories.

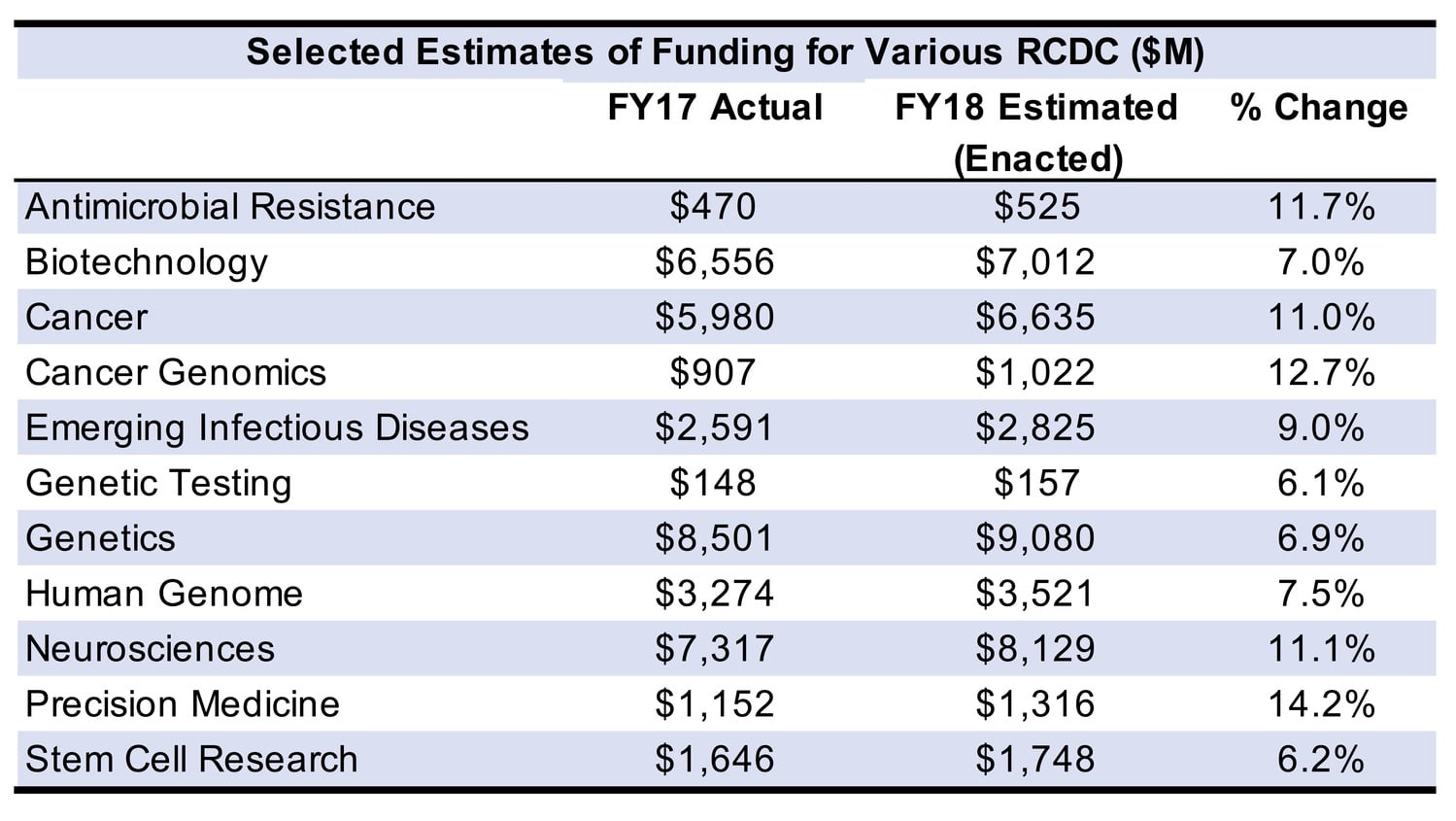

The research projects are not mutually exclusive, meaning that a single research project may be counted in numerous categories. As the NIH does not explicitly budget by categories of disease and condition, the figures below are estimates that reflect changes in science, actual funded research projects and the NIH budget. The selected project categories in the table below are among the categories in which scientific instrumentation (as defined by the categories found in SDi’s Global Report) is most widely used for R&D.

NIH funding has been increasing since 2003, albeit at a sluggish pace. Though funding spiked 16.5% in 2003 to $27.167 billion, it remained largely flat for the next decade, nominally increasing and decreasing until 2016, when it grew at the highest rate since 2003 at 6.6% to $32.311 billion. Funding received an additional bump of 6.2% in 2017 and a further 8.7% in 2018 to total $37.311 billion. The funding increase in 2018 proved beneficial to multiple NIH research projects, which experienced healthy surges in their funding.

As per the selected project categories, the highest funded categories of projects in FY18 were genetics, neurosciences, biotechnology, cancer and emerging infectious diseases. By percentage, precision medicine funding grew the fastest, followed by cancer genomics, antimicrobial resistance, neurosciences and cancer.

The vast majority of NIH projects took place in academic institutions across the US, but numerous projects funded by the NIH were conducted in other countries as well, including Australia, Canada, China, Iceland, Peru, South Africa, Switzerland and Uganda. Many companies also received research funding from the NIH for developing various products to study diseases and infections, establish databases and understand complex biological structures.

Since FY14, funding for antimicrobial resistance projects has grown at the fastest pace, surging 89.5% from $277 million to $545 million in FY18. Precision medicine project funding has also increased, climbing an impressive 67.7% since FY16, when precision medicine projects began to be categorized or reported by the RCDC. NIH funding for projects addressing emerging infectious diseases have increased 46.4% since FY14, with neurosciences project funding following close behind, increasing 45.7%.

Innovations in genomics helped propel NIH funding for gene-based projects, with human genome projects’ funding having jumped 30.4% since FY14. Funding for genetics projects have grown 24.0% during the same time period. However, funding for genetic testing projects have decreased 32.0% since FY14, from $231 million to $157 million in FY18.

Stem cell research funding have risen 25.7% since FY14, while funding for general cancer research projects has received a 23.1% boost. Funding growth for cancer genomics projects was a bit slower growing having risen 18.7%, but this growth only began to be recorded in FY16. Similar to precision medicine project funding, the RCDC did not categorize or report projects as cancer genomics until then. Biotechnology projects have experienced a 19.1% increase in NIH funding since FY14.