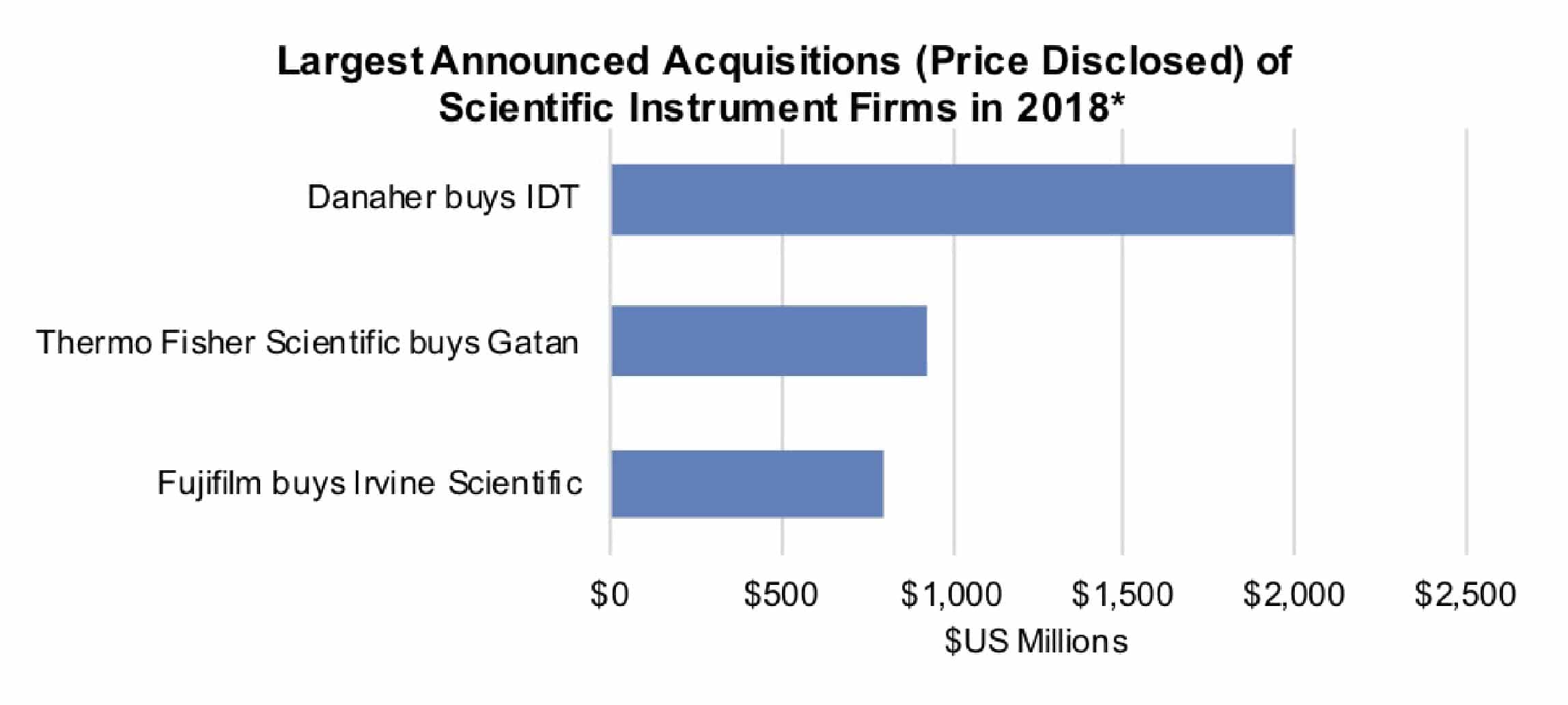

Robust M&A for Lab Instrument Companies in 2018

At the half-way point of 2017, scientific tools companies are active on the M&A front. The largest deal announced so far this year was Danaher’s $2 billion purchase of Integrated DNA Technologies (IDT). IDT supplies oligonucleotides for genomic research, diagnostic testing and drug development. Another company known for its industry changing deals is Thermo Fisher Scientific. After the $7.2 billion purchase of contract development and manufacturing organization Patheon last year, the company has pursued technology purchases in 2018, buying IntegenX and Gatan to supplement their forensics and electron microscopy businesses, respectively.

*As of July 17

Two scientific instruments firms that have been especially busy so far this year in the M&A market are Agilent Technologies and Bruker. The companies’ acquisitions build upon existing technology franchises serving fast growing markets. In fact, so far this year, Agilent has announced 6 new purchases and Bruker has announced 5.

Agilent Technologies’ purchases represent investments in instrumentation, consumables and software. Extending its current offerings for the cell analysis and NGS markets, the company acquired Luxcel, a provider of kits for cell analysis, and Advanced Analytical Technologies, which makes fragment analysis systems used in NGS library preparation. Additionally for the the NGS market, Agilent acquired the remaining 52% share of NGS chemistry firm Lasergen that it did not already own. Also enlarging the Agilent’s consumables offerings was the recently announced purchase of ProZyme, whose glycan analysis kits are used as part of MS workflows for biologics testing. Recurring revenue was also the centerpiece of Agilent’s purchase of ULTA Scientific Assets, a provider of standards and reference materials. The company further added to its software expertise with the purchase of Genohm for laboratory data management, and also invested overseas, buying its South Korean distributor Young In Scientific.

Bruker’s acquisitions largely target the surface science market, where the company has steadily built up its AFM and super-resolution microscopy businesses. Bruker’s announced purchases of Anasys and JPK supplement the company’s AFM offerings for markets ranging from cell analysis to materials characterization. The company’s purchases of IRM2, Sierra Sensors sand Lactotronics added product lines for tissue imaging, surface plasmon resonance and dairy testing, respectively.