Steady Demand in the Industrial Market for Analytical and Scientific Instrumentation

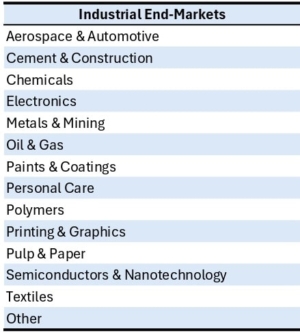

One can look at the inventions of the semiconductor and the battery to show why the industrial end-market plays a pivotal role in advancing technology. However, manufacturers of semiconductors, batteries, chemical products, plastics and other products would be unable to make advancements without the assistance of analytical technologies. Due to its importance to society and ability to weather macroeconomic challenges, the industrial end-market (see table) has been a stable market for the analytical instrument industry.

In July 2024, SDi, a market research and intelligence firm, released “Industrial Market Opportunities for Analytical Instrumentation 2024,” which reviews the market conditions for analytical instrumentation used by the industrial end-market. Furthermore, the report provides an overview of industrial market sectors and the laboratory technologies used by them. Also, for both the overall market and each analytical technology category highlighted in the report, SDi provides forecasts by region, analytical technique, product type, sector, region and more.

The laboratory technologies emphasized in the report are atomic spectroscopy, chromatography, lab automation, lab equipment, mass spectrometry (MS), materials characterization, molecular spectroscopy and surface science. The report also highlights the top vendors for each of the respective technologies. Significant companies cited are Agilent Technologies, Bruker, Shimadzu, Thermo Fisher Scientific and ZEISS. SDi utilized secondary resources such as financial reports, industry publications, website information, etc.

According to the report, in 2023, the laboratory instrumentation market for the industrial end-market was valued at $13.5 billion and is forecast to grow low single-digit CAGR through 2028. Also, in 2023, atomic spectroscopy, materials characterization and surface science accounted for the industrial market’s most significant analytical technology segments. Of the three, SDi forecasts atomic spectroscopy to be the primary growth driver by 2028, predicting a mid-single-digit increase in demand from 2023 to 2028.

Atomic Spectroscopy

Among the technology categories covered in the report, atomic spectroscopy is estimated to be the main growth driver in the industrial end-market. The atomic spectroscopy market is forecast to show a CAGR in the high single digits through 2028 because of the need in the environmental monitoring sector. Within the atomic spectroscopy market, XRF technology is one of the primary growth drivers, partly due to its utilization in the metals, minerals and other materials sector.

The top vendors of atomic spectroscopy systems are AMETEK, Bruker and Thermo Fisher. For instance, AMETEK is a leading provider of various x-ray products. In addition, Bruker is a large supplier of x-ray fluorescence (XRF) and x-ray diffraction (XRD) systems. Lastly, Thermo Fisher also has a strong market presence in the atomic spectroscopy market.