Bioprocessing Analytical Technologies: Enabling Biopharma Production

The bioprocessing analytical technology sector is critical to the biopharmaceutical industry and becoming more so as continuous and single-use solutions are becoming widely adopted and the number of biotherapeutics coming to market increases. These technology solutions include custom-built and highly specialized bioprocessing technologies.

In August 2023, Strategic Directions International (SDi) released the “SDi Bioprocessing Markets and Forecast, 2023” report. The report reviews the market conditions for bioprocessing analytical technologies in the broader pharmaceutical and biotech end-market. Additionally, the report provides an overview of the laboratory technologies used for bioprocessing and a summary of recent business activities and trends.

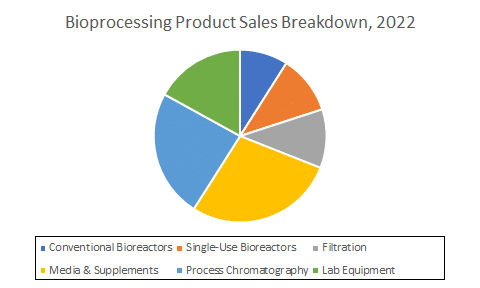

The laboratory technologies covered in the report are cell culture media & supplements, conventional bioreactors, filtration & concentration equipment, lab equipment, process chromatography systems, single-use bioreactors (SUBs), and single-use chromatography & membrane adsorbers. The report also highlights the leading vendors for each respective technology. Notable companies mentioned are Danaher, MilliporeSigma, Sartorius and Thermo Fisher Scientific. SDi utilized secondary resources for the report, such as company financial documents, industry publications, internet data and other credible resources.

According to the report, in 2022, analytical instrument bioprocessing demand was valued at over $8 billion. In addition, SDi predicts the bioprocessing market will achieve a high single-digit increase in demand through 2027. Media & supplements, process chromatography and lab equipment were the largest technology segments for the bioprocessing market. However, through 2027, the report predicts that SUBs will be the main growth driver with high single-digit growth. Following SUBs, media & supplements and process chromatography are both forecasted to increase at a high single-digit rate over the next five years.

SDi also provides market forecasts by region and product types, such as instruments and aftermarket products for the six analytical technologies used in bioprocessing In the report. Regarding forecasts by region, SDi stated Europe and the US & Canada were the dominant markets in the bioprocessing industry. However, along with the US & Canada, the report forecasts select Asia Pacific countries to achieve significant growth through 2027 as well.

Single-use Bioreactors

According to the report, SDi expects SUBs to be in high demand due to the different instrument formats that are used for various applications. For example, to decrease the risk of cross-contamination, SUBs were heavily utilized for COVID-19-related vaccine production. As a result, biopharma and contract manufacturers have increased their investments in SUBs. For instance, on October 5, Thermo Fisher, which both sells SUBs and uses them as part of its contract manufacturing business, announced it would expand its St. Louis, Missouri manufacturing site for producing biologics. At the facility, Thermo Fisher will implement its DynaDrive SUB.

By technique, the most in-demand instrument among SUB technologies are benchtop-scale instruments, with a high single-digit prediction over the next five years. In 2022, the top vendors for SUBs were Cytiva (Danaher), Sartorius and Thermo Fisher Scientific.

Regionally, the report projects the US & Canada will be the fastest growing region for the SUB market, with growth rising double digits through 2027. SDi also expects the US & Canada will generate the most revenues through 2027.

Conclusion

According to SDi, within the biopharmaceutical industry, the analytical techniques serving the bioprocessing sector will be critical factors in future drug development and manufacturing. Due to these instruments’ role in developing treatments for the COVID-19 virus, vendors such as Eppendorf, Repligen and Thermo Fisher Scientific have continued investing in manufacturing bioprocessing-related systems to meet demand in the biopharmaceutical market. Supporting these companies’ investment is the rise in single-use technology.