The Lab Instrumentation Market and the Biopharmaceutical Industry: An Essential Partnership in Drug Development

The biopharmaceutical industry plays a critical role in ensuring people’s health and treating diseases. The advent of the COVID-19 pandemic in 2020 tested the biopharmaceutical industry’s capabilities as new vaccines and therapies were urgently required to counteract the virus’s spread. Aiding the biopharmaceutical industry in this goal as well as its overall R&D efforts is the analytical instrument industry.

In October 2021, Strategic Directions International (SDi) released the “Lab Instrumentation Markets for Pharmaceuticals, Biopharmaceuticals, & CROs” report. The report summarizes the market conditions in 2020 for analytical instrumentation utilized by the biopharmaceutical industry, including the CRO sector. In addition, the report provides a history of market demand, potential market opportunities and threats, and an overview of the laboratory technologies used in biopharmaceutical labs worldwide.

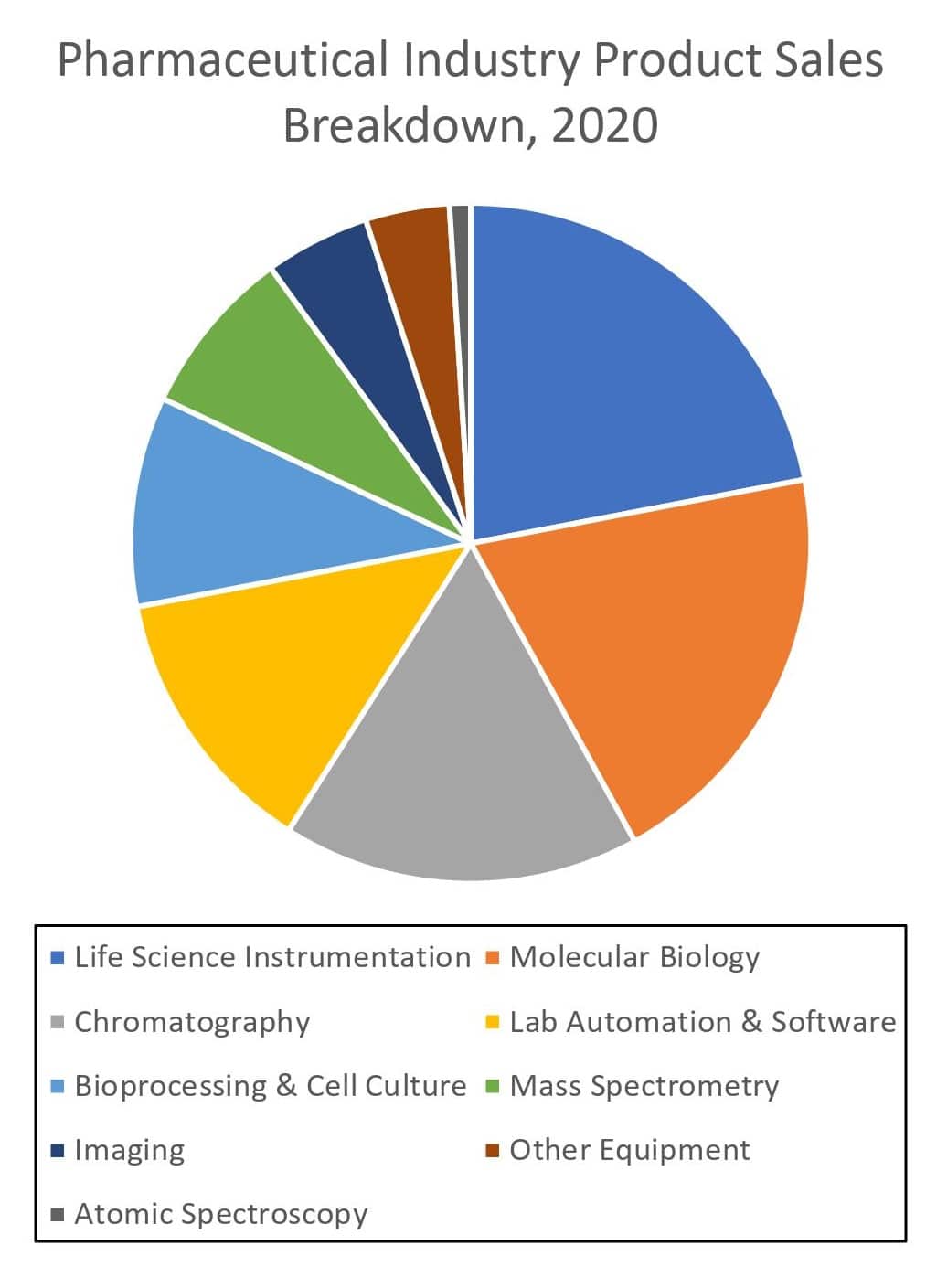

The laboratory technologies highlighted in the report are life science instrumentation, molecular biology, chromatography, mass spectrometry (MS), lab automation & software, atomic spectroscopy, bioprocessing & cell culture, imaging instrumentation and other techniques. The report details the leading vendors for each of the respective technologies. Notable companies mentioned are Agilent Technologies, Danaher, MilliporeSigma, Thermo Fisher Scientific and Waters. SDi used secondary resources for the report, such as annual and quarterly financial reports, government data, industry publications and other credible resources.

According to the report, in 2020, the laboratory instrumentation market for biopharmaceutical laboratories was valued at $22 billion and is predicted to achieve high single-digit growth through 2025. Life science instrumentation, molecular biology and chromatography were the largest analytical technology segments for the pharmaceutical, biopharmaceutical and CROs end-market in 2020. However, through 2025, the report forecasts that molecular biology instrumentation will be the main growth driver with high single-digit growth. As with molecular biology, atomic spectroscopy and MS are also expected to grow at a high single-digit rate over the next five years.

SDi also provides market forecasts by region, therapeutic type, application and sector for the overall analytical instrumentation market for the biopharmaceutical industry and for the nine laboratory technologies categorized in the report. For instance, in 2020, the US & Canada and Europe were the most prominent regional markets for the analytical instrumentation demand in the pharmaceutical industry. However, the report anticipates China to be the fastest-growing region through 2025 due to the strong demand for life science instrumentation and its government increasing tax incentives for private sector investment in basic research.

Molecular Biology Instrumentation

The fast growth expected for molecular biology instrumentation demand will be helped by the breakthroughs made in vaccine development related to the pandemic. The success of mRNA vaccines for COVID-19 has hastened mRNA vaccine research. Molecular biology instrumentation played a vital role in helping to develop mRNA vaccines for the coronavirus. For instance, on November 16, regulators in India approved a DNA-based COVID-19 vaccine that uses nucleic acid technology. It has also invigorated the development of mRNA for other diseases, as well as vaccine development in general.

By technique, CRISPR/Cas9 and NGS library preparation solutions are projected to be the most in-demand instruments among molecular biology techniques with double-digit growth over five years.

Regionally, the report also forecasts demand for molecular biology instrumentation to grow in China, showing the highest demand through 2025 growing double digits. However, the report expects the US & Canada will generate the most revenues through 2025. Lastly, in 2020, the top vendors of molecular biology instrumentation were Illumina, QIAGEN and Thermo Fisher Scientific.

Conclusion

According to SDi, the biopharmaceutical industry’s demand for analytical instrumentation will grow exponentially and make up the lion’s share of the overall analytical and scientific instrumentation market through 2025. SDi notes the continued importance of the analytical techniques highlighted in the report to workflow efficiency and test accuracy in areas such as drug development, clinical trials, QA/QC and more. However, the report hints at supply chain disruptions, drug pricing regulations and other factors that could affect the sector’s performance during the next five years. Nevertheless, the technologies used in the biopharmaceutical industry are expected to contribute to streamlining R&D and the production of therapeutic drugs and other treatments.