Ambiguity for the Analytical and Scientific Instrumentation Industry in Europe

The analytical and scientific instrument market in Europe is a compelling situation. According to IBO’s publisher Strategic Directions International (SDi) and part of Science and Medicine Group, prior to the COVID-19 pandemic, the industry’s recent performance in the region has been modest with periods of both enthusiastic and tepid demand. Despite the region’s strong presence in end-markets such as food, academic, and oil and energy, socio-political events in Europe, such as Brexit, have caused disruptions in capital spending for local companies and institutions.

In May 2019, Strategic Directions International (SDi) released “The 2019 Analytical & Life Science Instrumentation Market in Europe,” which centers around a survey sent to 232 respondents in Europe as well as provides forecasts of how the analytical and scientific instrumentation market fared in 2018 and a forecast for 2019. The European areas covered in the report are Eastern Europe, Scandinavia, Western Europe, DACH (Germany, Austria and Switzerland), and the UK and Ireland.

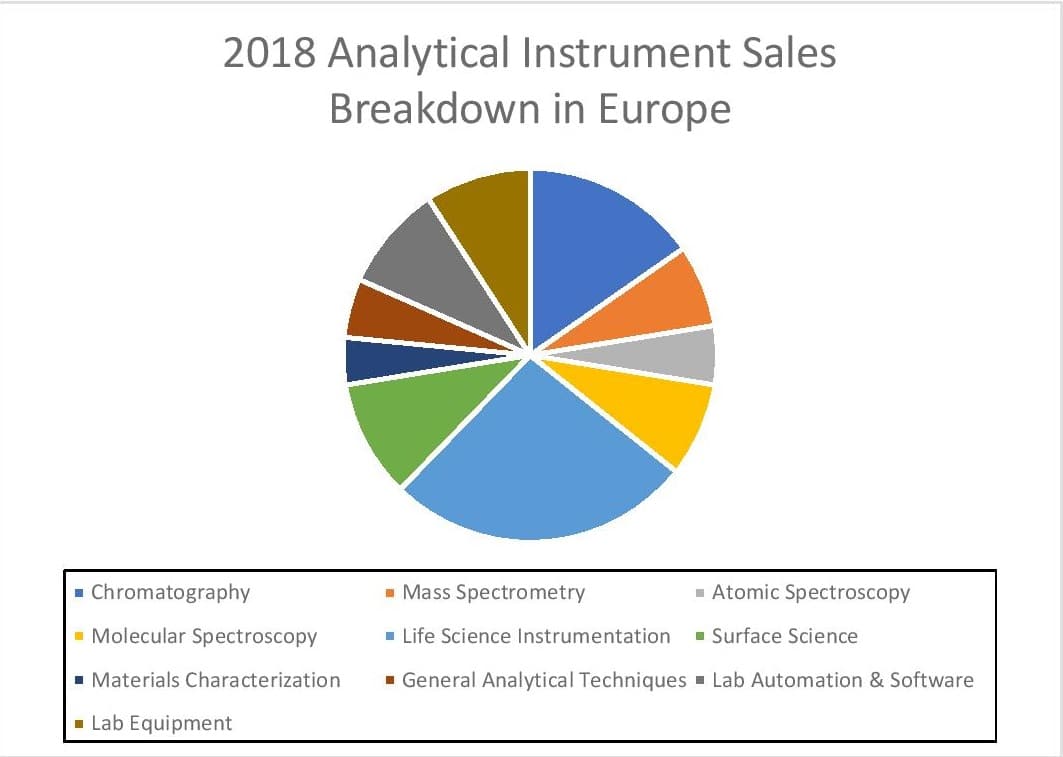

The report categorizes instrumentation into 10 technology sectors: chromatography, mass spectrometry (MS), atomic spectroscopy, molecular spectroscopy, life science instrumentation, surface science, materials characterization, general analytical techniques, lab automation, and software and lab equipment. According to the survey, Agilent Technologies, PerkinElmer, Shimadzu and Thermo Fisher Scientific are the leading vendors for analytical and scientific instrumentation in Europe.

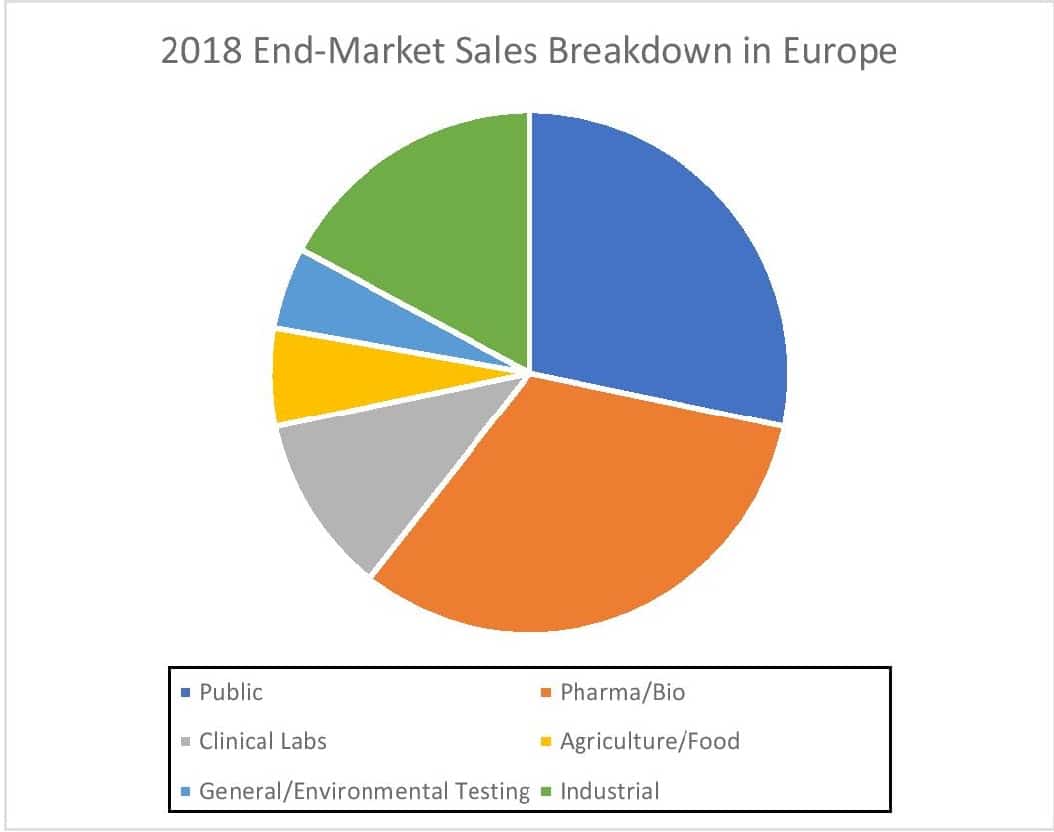

According to the report, in 2018, the analytical and scientific instrumentation market in Europe was worth over $20 billion. Industry-wise, Europe has a significant presence in the academia, pharmaceutical/biotech, food, and oil and gas industry, which drives demand for lab testing.

As detailed in the report, chromatography and life science instrumentation accounted for the largest percentage of sales in 2018. Within the chromatography market, analytical HPLC and gas chromatography technologies had the highest share. PCR and nucleic acid preparation products accounted for most life science instrumentation market sales.

On a geographical basis, Western Europe made up the lion’s share of lab instrumentation sales in the pharmaceutical/biotech, clinical, chemical and other end-markets. However, due to Russia being the largest oil producer on the continent, the country plays a particularly important role in the oil and gas industry and its instrumentation demand.

Since the report’s release last spring the COVID-19 pandemic has dramatically altered the landscape for instrument demand with many industries curtailing R&D and production activities and academic and government labs shutting down. As a result, the epidemic has created uncertainty for the lab tool industry on a global scale as well as in Europe. Since Europe has a history of varying growth in demand for scientific instrumentation, it will be interesting to see how the pandemic affects sales in the region.