Analytical Instruments and the Chinese Market

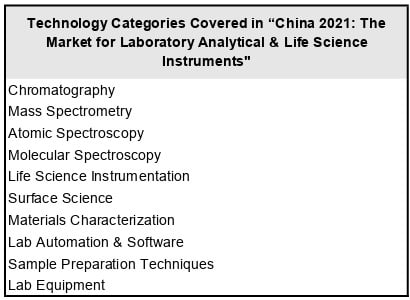

In a recently published report, Strategic Directions International (SDi), IBO’s publisher, provides an overview of the fast-growing Chinese analytical instrument and lab product market. The report, “China 2021: The Market for Laboratory Analytical & Life Science Instruments,” includes forecast and market segmentation details for ten categories of laboratory technologies (see below).

China’s investment in R&D, such as in precision medicine and pharmaceuticals, and quality of life, including food and environmental safety, have driven an exceptional increase in the purchase of analytical instruments for more than a decade. In 2020, market demand totaled more than $8 billion.

Despite the COVID-19 crisis, which took a toll on laboratory tool sales in the first two quarters of last year as a result of widespread lab shutdowns, in recent quarters demand has strengthened. Chinese revenues for LC/MS and materials characterization solutions supplier Waters grew 109% in constant currency in the first quarter of 2021 to $102.9 million, compared with a 45% slump in the first quarter of 2020. Broad-based instrument company Shimadzu Analytical & Measuring Instruments’ revenues also bounced back, growing 20.1% to ¥57,563 million ($543 million) in the company’s fiscal fourth quarter (ending March 31, 2021), compared to a 9% decline in its fiscal fourth quarter 2020. For both companies, sales in the food and pharmaceutical markets drove growth in revenues, and both companies benefited from favorable year-over-year sales comparisons.

According to the report, over the five-year period ending in 2025, demand for lab tools in China will be led by lab equipment (which, unlike analytical instruments, do not take a measurement of a sample) and mass spectrometry (MS). The pharmaceutical/biotech (pharma/bio) market accounts for the majority of demand for both MS and lab equipment in China, and its current development reflects the fastest growing product categories of each technology segment. Among lab equipment products, demand for bioreactors and fermenters are expected to grow the fastest from 2020 to 2025 as China expands its biotech research and manufacturing industry. In MS, triple quadrupole LC/MS will experience the fastest growth due to its use throughout biopharmaceutical R&D and QA/QC.

Aspects of China’s pharma/bio end-market include rapidly growing domestic firms that are investing in R&D to develop proprietary drugs, rather than generics only. ChinaDaily.com reported that fixed asset investments in the domestic pharmaceutical industry grew 8.4% in 2019. The country’s National Medical Products Administration approved 52 new drugs (first-time approvals in China) in 2019, 11 of which were developed by the domestic pharmaceutical industry and marked first-time approvals in any country, according to DIA Global Forum. Growth of the industry is also indicated by more foreign partnerships. In 2019, Chinese pharmaceutical companies signed 271 licensing agreements with foreign multinationals.

A major part of the country’s pharma/bio market are contract research organizations (CROs), both foreign-owned and domestic. Among the recently announced investments by this sector are US-based CRO PPD’s new 67,000 ft2 (6,224 m2) facility in Suzhou New District, Jiangsu Province. Scheduled to open this year, the site will house LC/MS systems and flow cytometers, among many other laboratory instruments, for applications such as pharmacokinetic/pharmacodynamic (PK/PD) assays, biomarker analysis and vaccine development. Chinese CRO Frontage Laboratories announced last year the addition of more than 215,000 ft2 (19,974 m2) of space to its site at Wusongjiang Industrial Park, Wuzhong Economic and Technological Development Zone, Suzhou. The addition will be devoted to drug metabolism and pharmacokinetic and toxicology studies.

The pharma/bio end-market also makes up the majority of demand for life science instrumentation in China. In the report, the life science category includes 12 technologies, such as sequencers and flow cytometers. Life science instrument demand is also being driven by government investments in national and local research projects and academia, as the country looks to shift away from an economy primarily based on manufacturing. In 2020, the National Bureau of Statistics reported that China’s overall R&D spending rose 10.3% to $378 billion. The latest Five-Year Plan (2021–2025) calls for 7% annual increases, with basic research spending representing 8% of all R&D funding by 2025.

The outlook for China’s analytical instrument and lab products market remains strong and underpins the country’s commitment to investments in science and R&D. All technology categories in SDi’s report will show market growth till 2025 indicating the market’s broad-based appeal.