The IBO 2017 Mid-year Forecast

In January, IBO published its annual forecast, detailing our estimates for growth in the life science and analytical instrumentation and lab products industry for 2017 (see IBO 1/15/17). While that forecast incorporated the knowledge we had at that time, it also rested on certain assumptions, some of which have not withstood the test of time. Obviously, the first six months of the year have also brought unforeseen events that have a bearing on the industry and its future prospects. Consequently, it is our customary practice to provide a mid-year update to the forecast, integrating the new information that has come to light. Economic and business data combined with released results from industry participants have been folded into the market model, producing our current view of the marketplace. In brief, the forecast has been adjusted upwards, but the primary contributor to this is the depreciation of the dollar against other major currencies, so that exchange effects are providing less of a headwind than projected in January.

Economic Environment

As expected, commodities prices have rebounded from the rock bottom reached in 2016. Iron, steel and aluminum have all significantly increased in value. Oil prices have also recovered from lows of around $30 per barrel to the $45–$55 range through most of 2017. Although these industrial markets are not experiencing strong growth, the situation has improved enormously. Regionally, this has also resulted in stronger markets in Latin America and the Rest of World, where commodities extraction is concentrated.

Also as expected, Brexit-fever was not particularly contagious. The EU has strengthened politically and further fracturing appears unlikely in the near term. While the ultimate fate of the UK remains just as unclear as it was at the beginning of the year, the outlook remains ultimately pessimistic. Looking further forward, Horizon 2020 funding is coming toward its close, but the early word from the review committee appears to indicate that future EU investment in R&D will be strengthened, with a subsequent program being double the size of Horizon 2020.

In the US, the Trump Administration has been unable to pass significant legislation. Tax reform and budget cuts, if passed, are unlikely to have any major effect in 2017, but the remaining instability and uncertainty are having a deleterious effect on the market for analytical instruments. In Japan, Prime Minister Abe’s popularity has plummeted due to scandal, but his economic policies continue to provide slow and steady growth.

The International Monetary Fund’s (IMF) April version of its “World Economic Outlook” projected GDP global growth of 3.5%, while US GDP growth was estimated to be 2.3%. The more recent June publication reaffirms the IMF’s global GDP growth forecast of 3.5% due to the expected growth performance of the leading advanced countries and continued stagnation of the remaining countries. However, US GDP growth has been revised downwards to 2.1%. This is in large part due to the fact that, while fiscal policy is now understood to be less expansionary than previously expected. Also in the most recent publication, the forecasted growth rates for “advanced economies” and “emerging and developing economies” are expected to be 2.0% and 4.6%, respectively.

Across the Pacific, Japan and its robust economy are predicted to take a slight turn for the better. With a previously forecasted GDP growth rate of 1.2%, Japan is now expected to achieve growth of 1.3%. China’s growth projections are now also more favorable, sitting at 6.7%, a slight advance over the previous projection of 6.6%.

Even though India’s growth projection has not been altered, the country’s staggering 7.2% growth rate, along with a strong first quarter performance, places the country just above China in terms of growth. These two countries once again have most favorable expectations for economic growth in 2017.

In Europe, the Euro area has also improved, with forecasted growth of 1.9% compared to a previously forecasted growth rate of 1.7%.

Currency exchange rates over the past few months have also affected the IMF’s updated view of the global economy. As of the end of June, the US dollar depreciated by nearly 3.5% since March, while the Euro has advanced by more than 3%. The pound has also gained, but nowhere near pre-Brexit levels. The yen has grown stronger, but the greatest advance has come from the Mexican peso. Conversely, the Brazilian real and the Canadian dollar have lost ground against the dollar over the past few months.

Updated Industry Forecast

Taking into account the financial results released by industry participants and the foregoing economic trends, the original IBO estimate for 2017 growth in demand for the analytical and life science instrumentation and lab products industry has been revised upward from 4.5% to 4.8%. As has already been mentioned, organic growth remains moderate, while the depreciating dollar has been the most influential factor in this adjustment.

Consequently, while the US and Canadian market has been adjusted downward slightly, all remaining geographic segments are now forecast to experience higher growth. Despite economic distress in Brazil and Venezuela, the stronger peso and higher commodities prices have lifted the forecast for Latin America the most, from 2.3% to 3.3%. India and Europe also required positive adjustments of nearly a percent.

Growth in China has also been edged upwards, although India is still forecast to achieve the greatest growth for the year. In Japan, weakness in government support is more than being made up for by stronger R&D spending by industry, particularly chemicals and pharmaceuticals. Japanese growth is now estimated to be nearly 3% for the year.

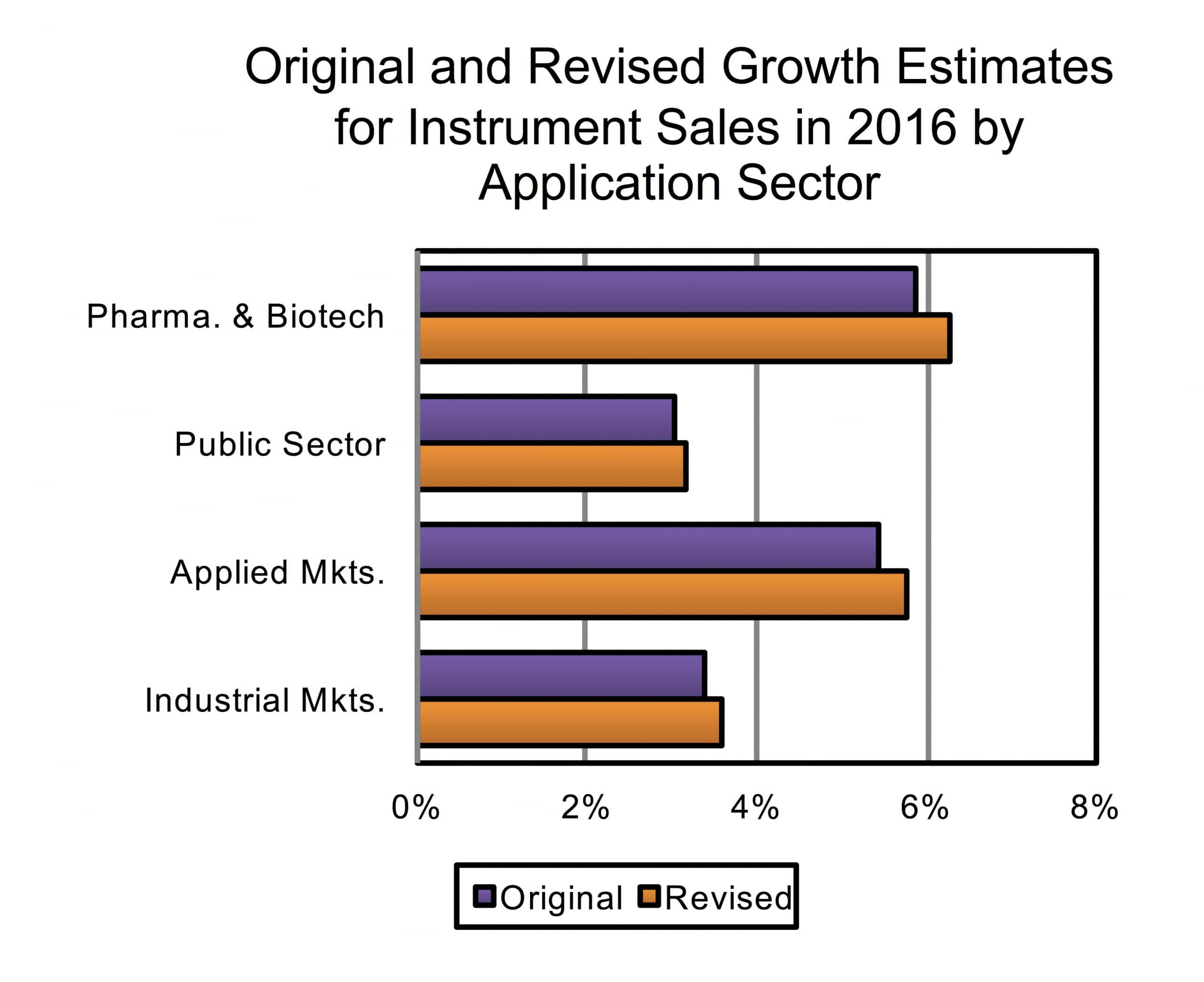

The forecasts for all of the application sectors have been updated upwards, although to differing degrees. The pharmaceutical and biotechnology segment advanced the most, with the forecast increasing from 5.9% to 6.3%—life science applications continue to have the healthiest prospects. The outlook for public sector spending has not changed significantly, with our estimate climbing 0.1%. Growth in the applied and industrial markets were both revised upward by 0.3%, although the applied markets have the greater overall growth forecast for the year.