IBO Stock Indexes Remain Steady in July

The US equity markets remained stable as the first half came to a close in July. On July 28, the US Bureau of Economic Analysis released an estimate for US GDP growth, showing a 2.6% increase, boosted by consumer spending and exceeding the first quarter’s 1.4% growth. Inflation slowed to 1.4% in the second quarter, but the US Federal Reserve missed its revised inflation target of 1.5%. Interest rates have been kept steady by the US Federal Reserve, sitting at 1.25%. The Federal Reserve expects to raise interest rates by a quarter of a percent to 1.5% sometime in 2017 and to a healthy 2% in 2018.

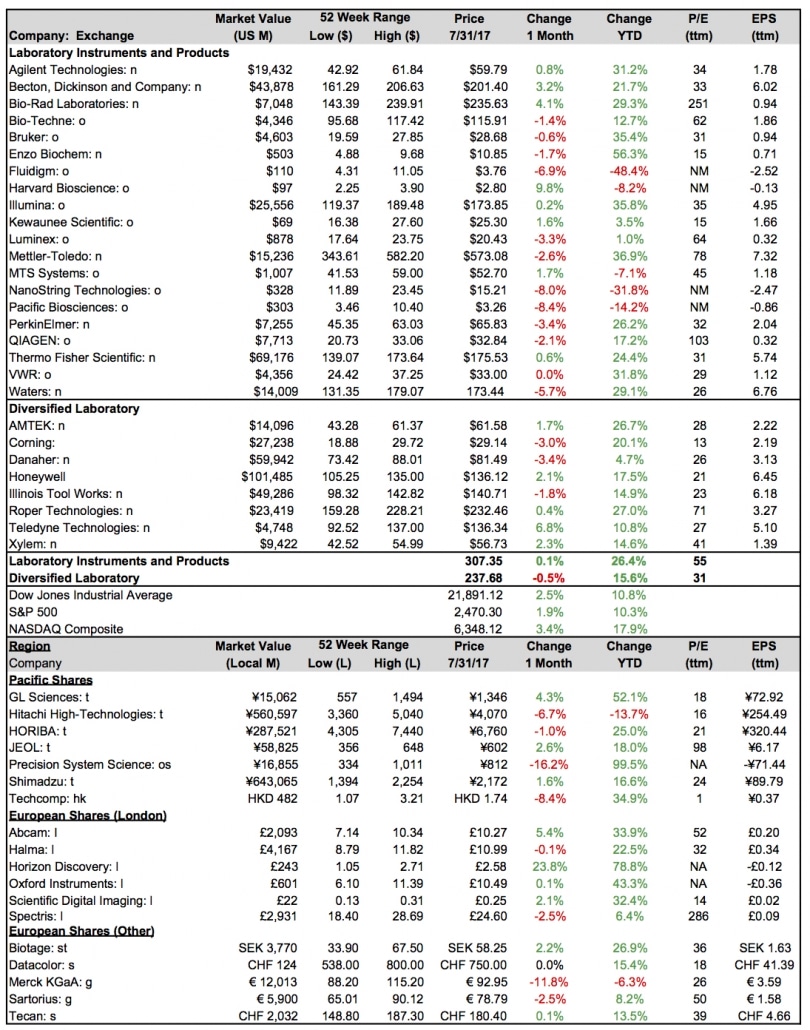

In July, the Dow Jones Industrial Average closed at 21,891.12, a 2.5% increase from the previous month and a 10.8% increase year to date. The Dow climbed nearly 61 points on July 31, backed by a strong earnings season. Conversely, the S&P 500 closed lower at 2,470.30, a 0.07% decrease due to sluggish performance in the material and information technology industries. Similarly, the NASDAQ posted a 0.42% loss for the month, closing at 6,348.12.

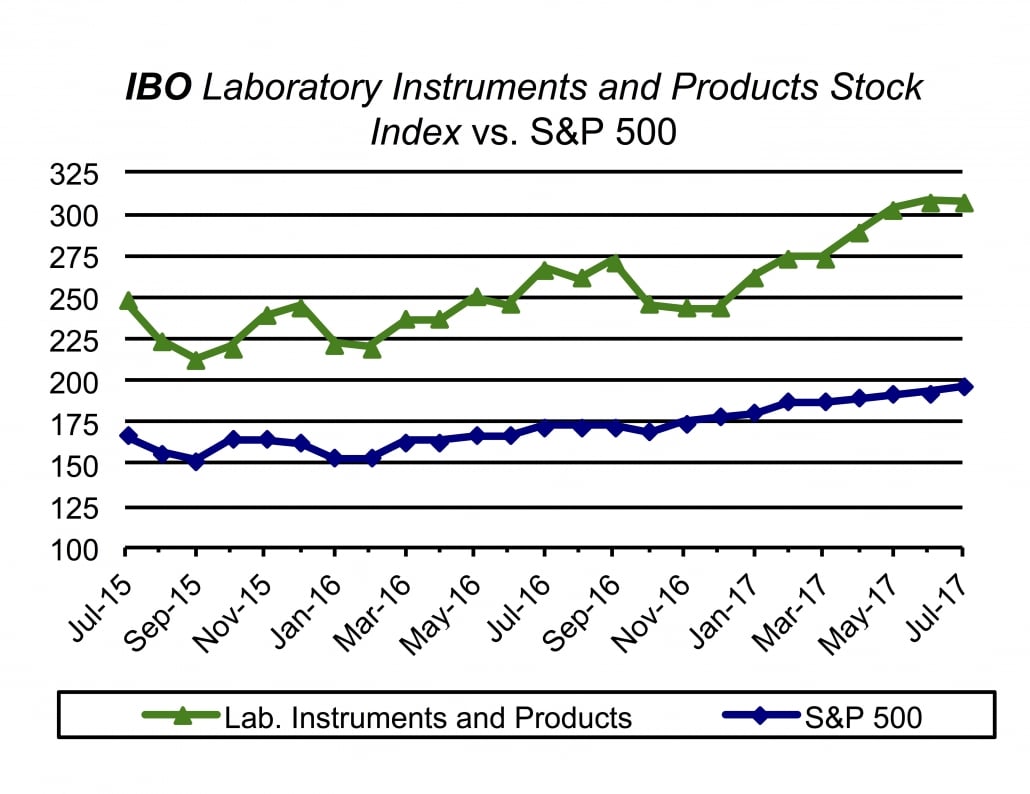

Laboratory Instruments and Products Stock Index

For the month, the Index rose by just 0.1% to 307.31, but is up 26.4% for the year. Less than half the companies in the Index finished in positive territory. Pacific Biosciences suffered the most with an 8.4% decrease. Harvard Bioscience, on the other hand, experienced the largest increase in the Index, jumping 9.8% for the month.

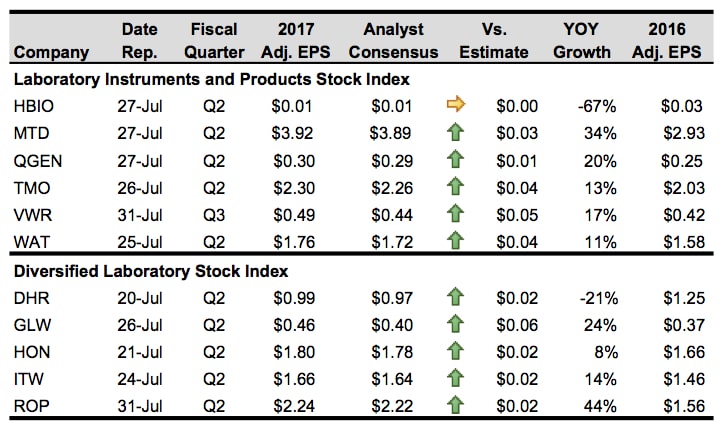

Harvard Bioscience’s second quarter results, released on July 27, showed a 4% decrease in revenues (see Bottom Line). However, the company’s reported adjusted EPS of $0.01 met analysts’ expectations. For the full year, Harvard Bioscience upgraded its forecast to $0.13–$0.15 adjusted EPS versus the previously projected $0.15–$0.17.

On July 27, Mettler-Toledo reported adjusted EPS per share of $3.92 for the second quarter, an increase of 22%. The reported EPS exceeded analysts’ expectations of $3.89 adjusted EPS due to the company’s better-than-expected sales and earnings performance. On the same day, Jefferies Group reiterated its “hold” rating for the company’s stock, setting its target price at $550. For the third quarter, Mettler-Toledo expects its adjusted EPS to range between $4.25 and $4.30, signifying a 9%–11% increase. The company raised its full-year adjusted EPS guidance to $17.25–$17.35, compared to previous guidance of $16.95–$17.15. The new adjusted EPS guidance would signify a 17% increase.

Thermo Fisher Scientific reported its second quarter results on July 26. The company posted an adjusted EPS of $2.30, topping analysts’ consensus of $2.27. The company raised its adjusted EPS guidance for the full-year 2017 to $9.15–$9.28, versus the previously projected range of $9.12–$9.28, signaling an 11%–12% increase. In response to Thermo Fisher’s plan to acquire Patheon, (see IBO 5/15/17), the company’s stock price has risen over 5.7% since mid-May. On July 24, the company issued €2.6 billion ($3 billion) of senior notes, in part to finance the $7.2 billion acquisition. On July 21, Bank of America reiterated its “buy” rating and raised the stock’s target price from $200 to $210.

On July 25, Waters reported 11% growth in its second quarter adjusted EPS to $1.76 per share. The company predicts its third quarter adjusted EPS will reach $1.73 and its full-year adjusted EPS to finish at $7.37.

QIAGEN reported its second quarter results on July 27, slightly outperforming analysts’ adjusted EPS prediction of $0.29 with a roughly 3% higher adjusted EPS of $0.30. The company projects third quarter adjusted EPS to range from $0.32 to $0.33. Due to the negative movements of the US dollar, adjusted EPS for the third quarter is expected to face an unfavorable change of $0.01 per share.

Diversified Instrumentation Stock Index

The Index dipped slightly in July, dropping half a percent to 237.68, while still maintaining a healthy 15.6% increase year to date. The Index’s biggest contributor by market capitaliation, Honeywell, grew 2.1% after a better-than-expected second quarter (see Bottom Line). Teledyne Technologies advanced the most for the month, rising 6.8% to hit a 52-week high. In contrast Danaher sustained the largest decrease within the Index, sinking 3.4% for the month.

Also exceeding quarterly expectations, Corning reported its second quarter results on July 26, including a 5.8% increase in operating profit, which trickled down to $0.46 per share adjusted EPS, beating analysts’ $0.40 estimate. Furthermore, adjusted EPS of $0.46 per share was up 24%. These positive figures suggest a similar result for the the year, for which the company expects $1.73 adjusted EPS.

On July 20, Danaher reported second quarter adjusted EPS of $0.99, surpassing analysts’ estimates of $0.97. Additionally, on July 21, Citigroup upgraded Danaher to a “buy” rating, setting a target price to $96. The company anticipates its core growth rate to improve for the second half of the year due to its enhanced order trends and recent acquisitions. The company expects third quarter adjusted EPS to range from $0.92 to $0.96 and $3.90–$3.97 for the full year.

On July 21, Honeywell reported second quarter adjusted EPS of $1.80, outdoing the analysts’ estimated adjusted EPS per share of $1.78. The company anticipates a positive remainder of the year and raised its adjusted EPS outlook to $7.00–$7.10.

Roper Technologies reported its second quarter results on July 31, posting positive earnings figures, which ultimately lifted its stock price. It reported an adjusted EPS of $2.24, outshining analysts’ estimates of $2.22. The company raised its outlook for the third quarter, along with the remainder of the year. Roper expects an adjusted EPS of $2.24–$2.30 for the third quarter and $9.12–$9.30 for 2017, an upgrade from the previous estimation of $8.98–$9.28.

International

In July, most of the Asia Pacific markets performed above expectations, led by Hong Kong’s Hang Seng, which expanded more than 6%. Similarly, India’s Sensex 30 advanced over 5% for the month for a year-over-year increase of more than 16%. In Europe, more than half of the market indexes recorded negative gains for the month, with Italy’s stock market collapsing nearly 16% and Sweden’s OMX Stockholm sliding over 3%.

Prices for the Pacific Rim companies in the IBO Stock Table faced more losses than gains, as Precision System Science saw the biggest loss for the month, dropping 16.2% due to continued losses in revenues and earnings. GL Sciences, however, jumped 4.3% to advance 52% year to date.

Hitachi High-Technologies reported its fiscal first quarter results on July 27, exceeding the previous year’s results but falling behind in earnings. It reported an EPS loss of ¥85.19 ($0.77), a decrease of over 10%. The company estimates its dividend payout for the fiscal second quarter to be ¥35 ($0.32) per share, with a fiscal fourth quarter payout of ¥40 ($0.36) per share, totaling ¥75 ($0.68) per share annually.

European shares performed positively, with Horizon Discovery vaulting nearly 24% to hit a 52-week high in response to its proposed acquisition of Dharmacon (see Executive Briefing).

Prices for other European companies in the IBO Stock Table mostly traded higher, except for a few companies including Spectris, which tumbled 2.5% due to a decrease in half-year earnings, and Merck KGaA, which slid down nearly 12%.

Biotage inched up nearly 2% for the month as it reported its half-year and second quarter results on July 18. Second quarter EPS reached $0.38 while second half EPS was $0.74.

On July 25, Spectris released its 2017 half-year results, reporting an adjusted EPS of 42.3 pence ($0.56), a 2% decrease. The company proceeded to increase its dividend per share by 6%, such that the company expects to pay out 54.8 pence ($0.72) for fiscal year 2017 and 57.9 pence ($0.77) for fiscal 2018.

Sartorius reported its second quarter results on July 21. The company reported an EPS of €0.53 ($0.63), a 10% increase. The company projects 2017 sales to grow 12%–16%.

In a pre-year-end report issued on July 27, Abcam’s estimates fiscal 2017 revenues to have grown nearly 27%, with a gross margin of 70%. The company estimated product revenue is expected to have increased over 25%, in line with the full-year guidance of 23%–27%. Abcam also announced that its Chinese catalog revenues were up 29%.