Atomic Spectroscopy: Gathering Strength

The atomic spectroscopy category collects a number of technologies primarily intended to provide the elemental composition of samples, using light spectroscopy to detect characteristic signatures of the different atomic structures. Total market demand for atomic spectroscopy reached $3.8 billion in 2017, growing at a rate of 3.9%. Growth will accelerate slightly in 2018 to 4.5%, producing total revenues of $4.1 billion.

Industrial applications in chemicals, as well as metals and mining have recovered, helping to spur additional growth in the market for these instruments. As expected, oil and gas demand remains quite weak but is beginning to recover. Common applications for many of these instruments are environmental testing. This market remains stable and growing, particularly in developing nations that are continuing to adopt regulations and stiffer testing regimens.

The individual segments of the atomic spectroscopy market are forecast to achieve sales growth in the low- to mid-single digits in 2018, with ICP-MS having the fastest growth potential due to its extraordinary sensitivity and the ability to perform speciation analysis, which can be important to users in food, pharmaceutical, and environmental laboratories. Demand is strong for other segments including X-Ray Diffraction (XRD) and Total Organic Carbon (TOC). Organic and inorganic elemental analyzer generally have less sales growth potential, losing out to more general purpose techniques, except for very specific applications.

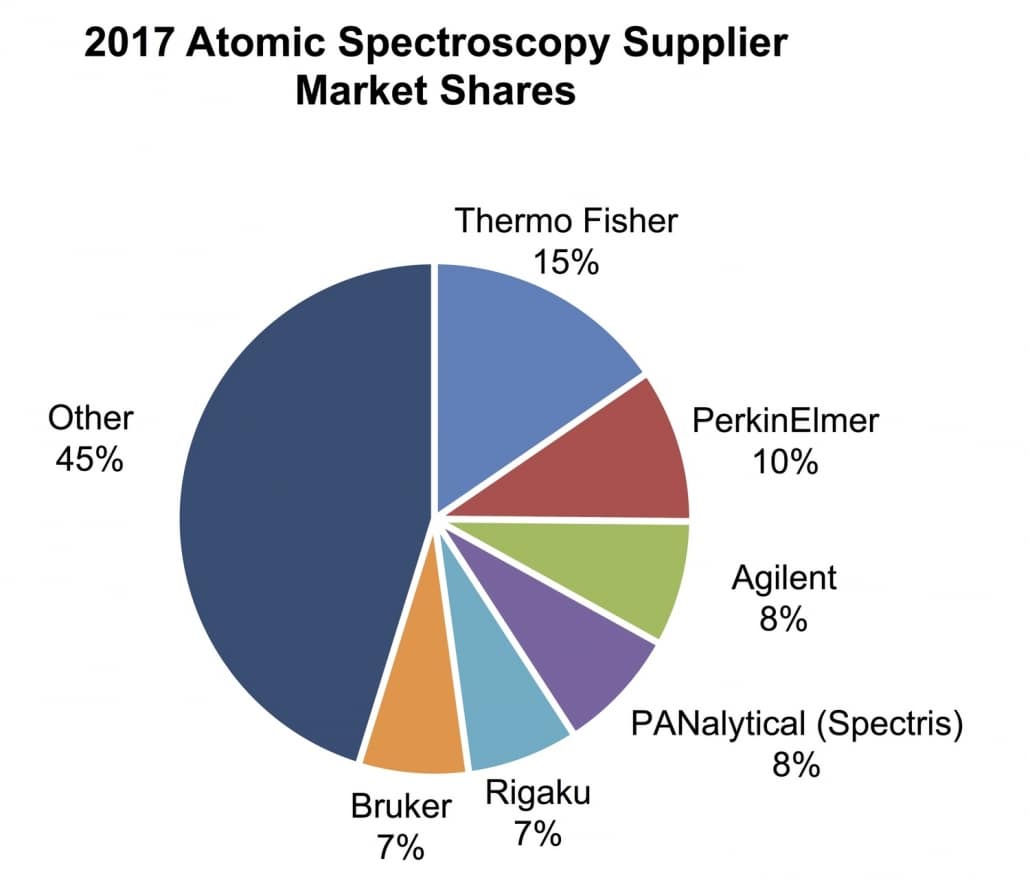

Addressing the market broadly across almost all of the segments, Thermo Fisher Scientific maintains its leading position in this market with the largest share. PerkinElmer follows, with particular strength in broad-based environmental techniques such as atomic absorption (AA) and Inductively Coupled Plasma spectrometry (ICP). Agilent holds the third position and has been building on its strength in ICP-MS and AA.

The following three companies, PANalytical (Spectris), Rigaku and Bruker, are primarily involved in the two x-ray-based technologies, X-ray Fluorescence (XRF) and XRD. As of the beginning of last year, PANalytical merged with Malvern Instruments to bring together the two major components of Spectris’ Materials Analysis business.