Laboratory Automation: Software Fuels Demand

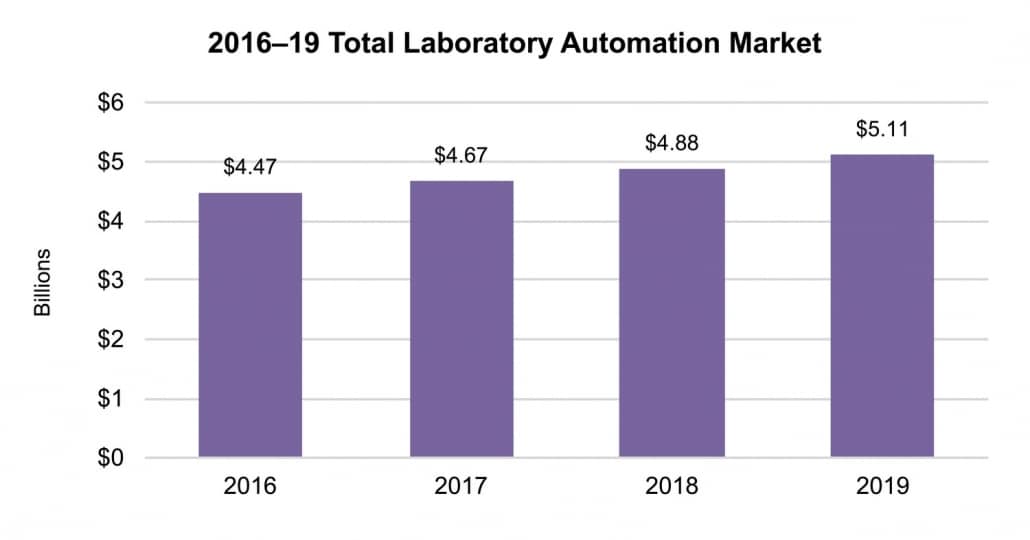

Lab automation technologies are intended to automate and document repetitive laboratory procedures. Therefore, they serve to increase the efficiency, accuracy and pace of work done in the lab. The total market for lab automation reached $4.7 billion in 2017, growing at a rate of 4.3%, with growth for the coming year estimated to increase to 4.5%. It is expected that the market will surpass $5.1 billion in 2018.

The biopharmaceutical sector accounts for more than half of the market for lab automation technologies. The pharmaceutical and biotechnology sectors, as well as CROs depend on automated processes and software solutions to increase productivity. The need for high-throughput analysis, sample tracking and data analysis has driven the growth in demand in many segments. Some technologies, like liquid handling, and multiplex and high-throughput ELISA, play an important role in the applied sector, particularly in hospital and clinical laboratories where large quantities of samples need to be processed in a short time. The increase in diagnostics testing for infectious diseases, cancer, respiratory ailments and gastrointestinal pathogenesis will fuel sales growth of these technologies in 2018.

Informatics and LIMS will record the fastest growing demand among lab automation technologies in 2018. The need for regulatory compliance, desire to increase accessibility of data, validation requirements, optimization of processes and interest in automating QA/QC in the biopharmaceutical and applied sectors are driving sales growth for these products.

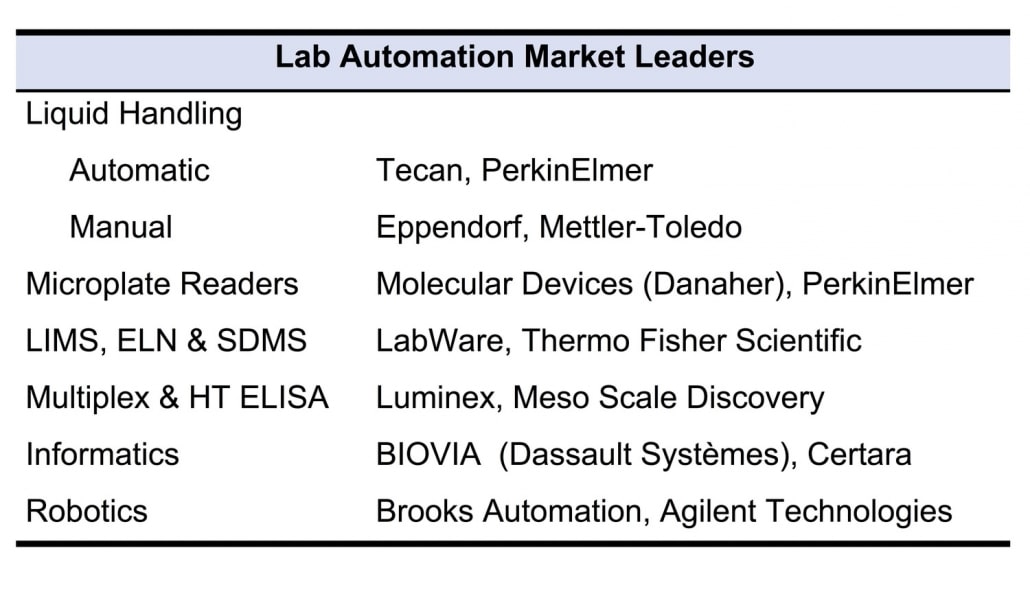

Tecan is the market leader in lab automation, accounting for almost a tenth of the total lab automation market. The company is a leader in liquid handling, but also has offerings in the microplate reader and robotics markets. Thermo Fisher Scientific sells instruments in all six categories and is one of the leaders in LIMS. PerkinElmer shares the third place in market share with Danaher, with the former manufacturing instruments in all categories except multiplex and high-throughput ELISA, while the latter is established in the liquid handling and robotics markets.