Beyond the Hype: Survey Examines Scientists’ Opinions on Impact of New Technologies

Pure pomp or proven performance? In today’s digital age when everything is touted as the greatest thing ever, it can be difficult to separate hype from actuality. With so many advanced innovations in life science over the last decade, it seems as though each new technology is framed as being a game-changer in the industry. IBO asked the people working at the forefront of these technologies—scientists—their opinions on some of the most recent technological advancements to enjoy wide publicity in order to get a grasp on the perception beyond the press reels.

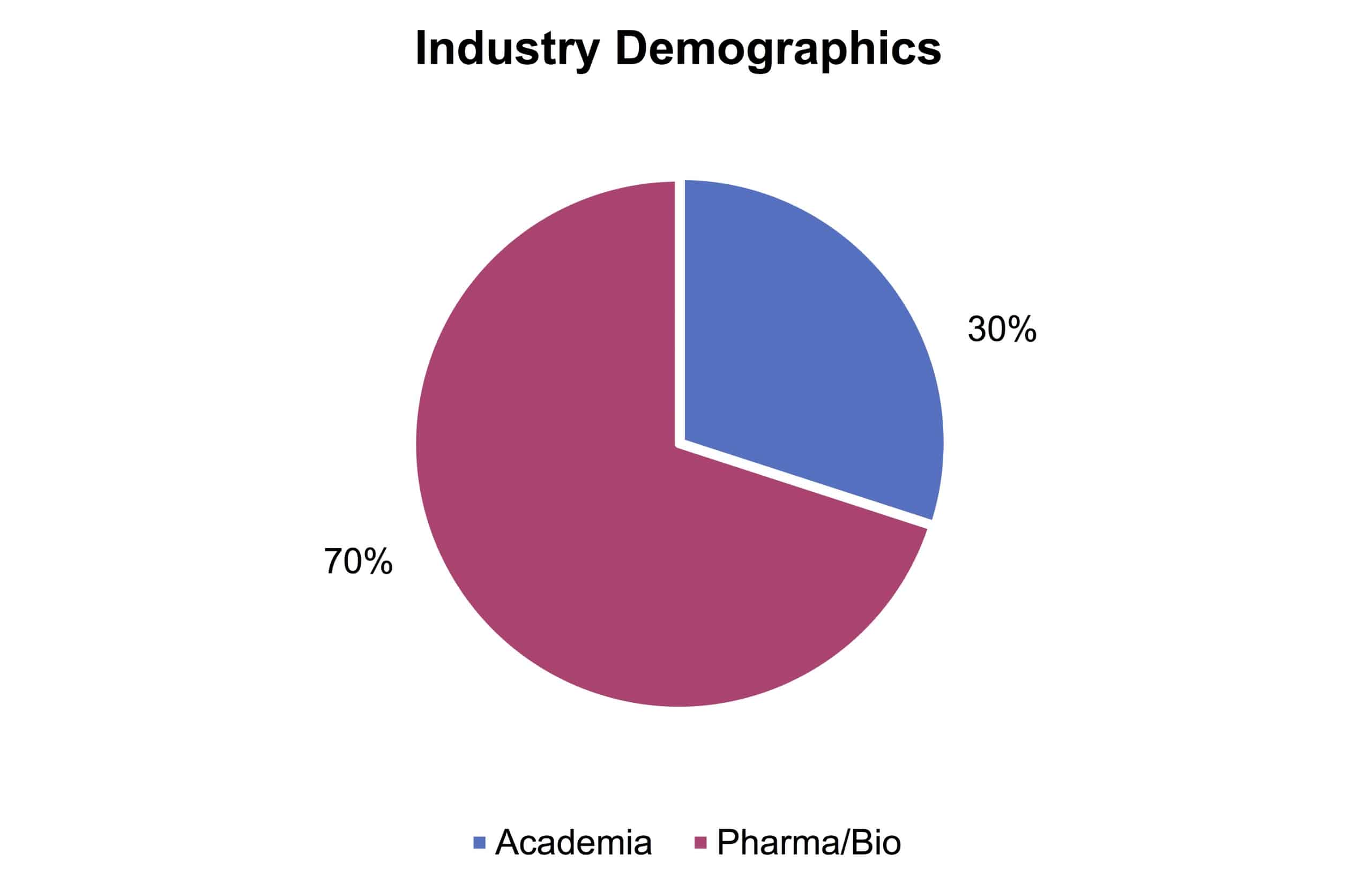

In a survey of 168 US-based scientists in academia and the pharmaceutical/biotechnology industry conducted in late August by BioInformatics LLC’s Science Advisory Board, respondents indicated the technologies that they were most and least skeptical about, from a choice of bioinformatics, CRISPR, NGS, single-cell analysis and synthetic biology. Respondents were largely principal investigators, staff scientists, lab manager/director/supervisors, professors and department heads.

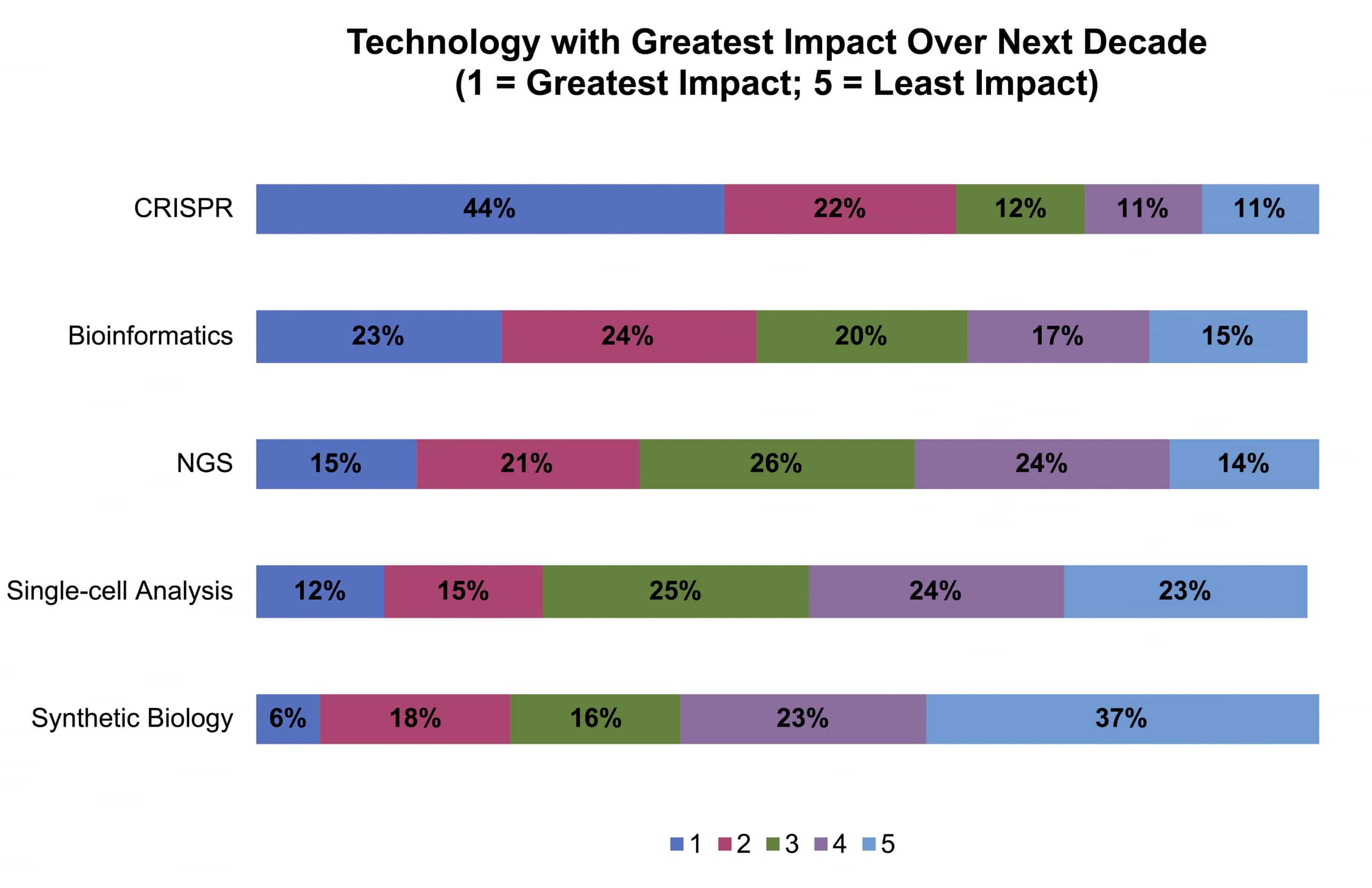

A vast majority of respondents believe that, of the five technologies, CRISPR will have the greatest impact on life science research over the next 10 years. By segment, 27% of academic respondents and 44% of pharma/biotech respondents cited CRISPR as the technology with the greatest potential. Synthetic biology was the least likely to have a major impact on life science, with 12% and 5% of academic and pharma/biotech respondents, respectively, ranking it the lowest.

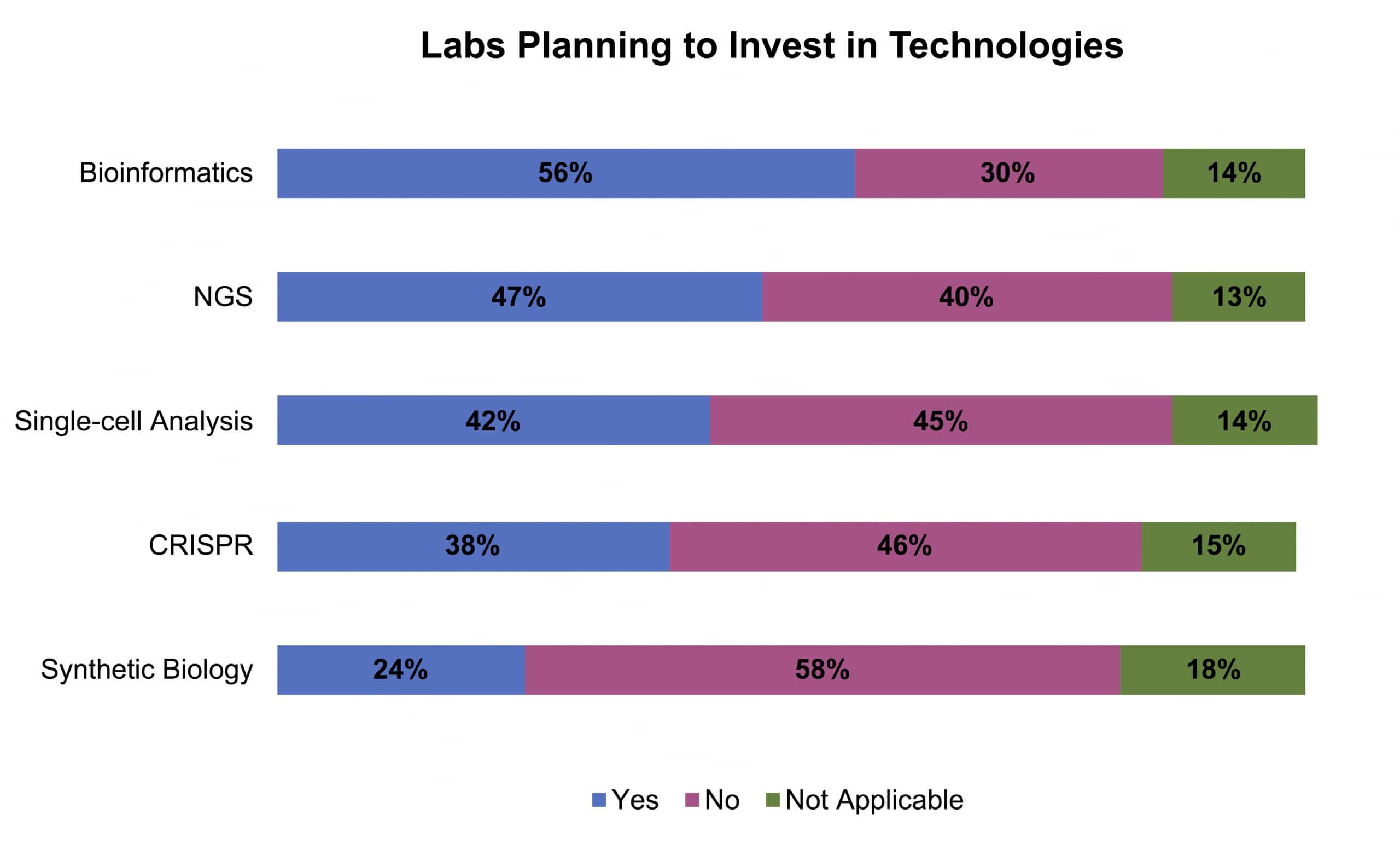

Even though they indicated CRISPR as being the most influential technology, when it comes to investing in these technologies, 56% of labs surveyed have already invested in bioinformatics and 39% have purchased NGS products. Most labs, or 47% of respondents, plan on continuing to invest in NGS, with 42% of respondents continuing to invest in single-cell sequencing. Thirty-eight percent of respondents already invest in CRISPR and 46% would like to invest in CRISPR, with the majority of these respondents from the pharma/biotech sector.

Exactly 100 respondents indicated that they would like to invest in bioinformatics, with 53% of academic respondents and 62% of pharma/biotech respondents interested in the technology. Again, synthetic biology scored the lowest, being the least likely technology for new investments in the future.

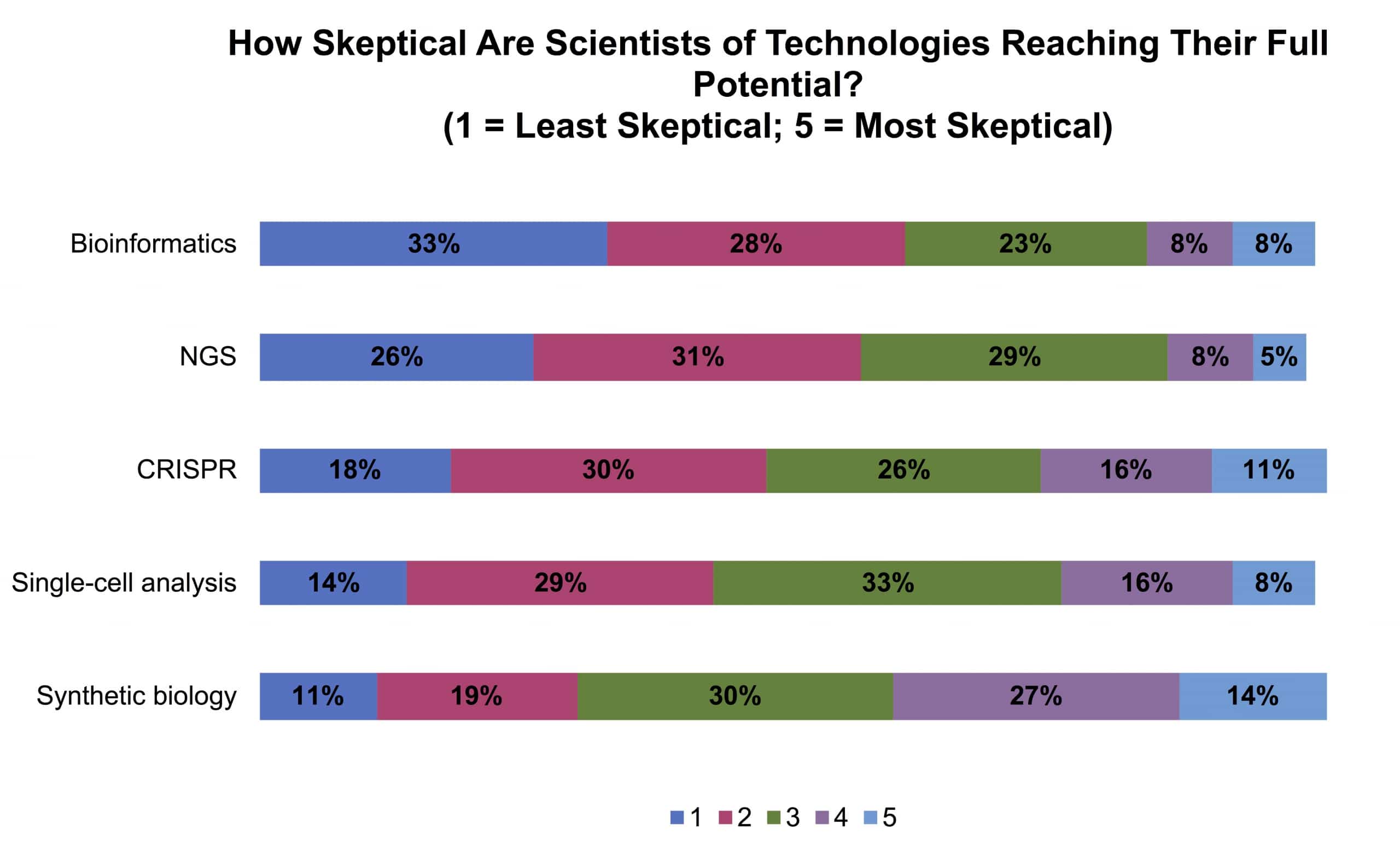

Keeping with this general trend, scientists also believe that synthetic biology is the least likely technology to deliver on its full potential. On a scale of 1 to 5, with 1 being least skeptical and 5 being most skeptical, 71% of respondents scored synthetic biology as a 3, 4 or 5. This was true for both the academic and pharma/biotech sectors. In contrast, bioinformatics was indicated as the technology most likely to deliver on its potential, with 61% of respondents scoring bioinformatics at a 1 or 2. More than half of both academic and pharma/biotech respondents each expressed a low skepticism for bioinformatics.

Respondents were also confident in NGS, with 57% rating NGS as a 1 or 2. By segment, 52% of academic respondents and 58% of pharma/biotech respondents indicated NGS as being low on the skepticism scale. Interestingly, as influential as scientists believe CRISPR to be, 53% of respondents scored CRISPR as a 3, 4 or 5, indicating 39% of all scientists surveyed are skeptical of the promises of CRISPR. Of this, 47% were academic respondents and 53% were pharma/biotech respondents.

In regards to brand recognition, Illumina was undisputedly the company most associated with NGS, while Thermo Fisher Scientific was cited as the company most associated with bioinformatics. Editas Medicine, Invitrogen (Thermo Fisher), Sigma (MilliporeSigma) and Thermo Fisher were most associated with CRISPR. Thermo Fisher, Fluidigm and 10X Genomics were most commonly associated with single-cell analysis. Thermo Fisher was also most associated with synthetic biology, with Gingko Bioworks and Integrated DNA Technologies also being mentioned most frequently.

The survey results indicate that labs are willing and open to investing in innovations in bioinformatics, and generally believe in the potential of NGS. Planned investments in synthetic biology are slim compared to other new technologies, and most scientists surveyed do not see it as an influential technology compared to others. Though respondents view CRISPR as the technology most likely to change the game in life science, it is interesting to note the large group of scientists who, although they admit CRISPR’s vast impact, do not necessarily believe that it will live up to its hype.