Lab Instrument Sales in China Collapse

The Chinese market for laboratory instruments suffered in 2023, as the country’s economic environment, end of stimulus funding, tariffs, political tensions with the US and local competition hurt sales for many multinational instrumentation companies. The unprecedented situation was made evident by the financial results of some of the world’s largest analytical instrument and consumable providers, including dedicated life science instrumentation and consumables suppliers 10x Genomics, Bio-Techne and Illumina, and more board-based suppliers Agilent Technologies and Waters which serve the life science market as well as the industrial (e.g., chemicals) and applied markets (e.g. food safety).

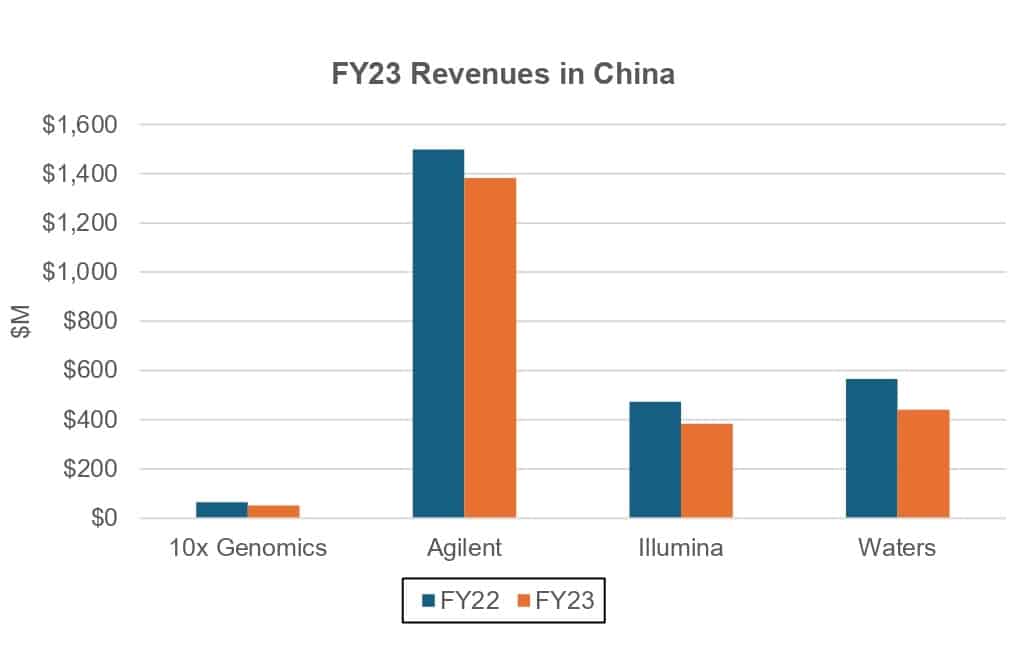

After gaining 18% in fiscal 2022 (ending October 31, 2022), Agilent’s fiscal 2023 China sales fell 8% to account for 20% of total company sales. Waters’ Chinese sales also showed a rapid reversal in 2023, falling 22% to $441 million, or 15% of total sales, following 8% growth in 2022. Illumina recorded a 6% sales decline in 2022, and continued to sink in 2023, dropping 19% to represent 9% of company sales. Similarly, 10x Genomics posted a decline both years, with a 17% drop in 2022 and a 21% decrease in 2023 to make up 8% of company sales.

Second-Half Sales Declines

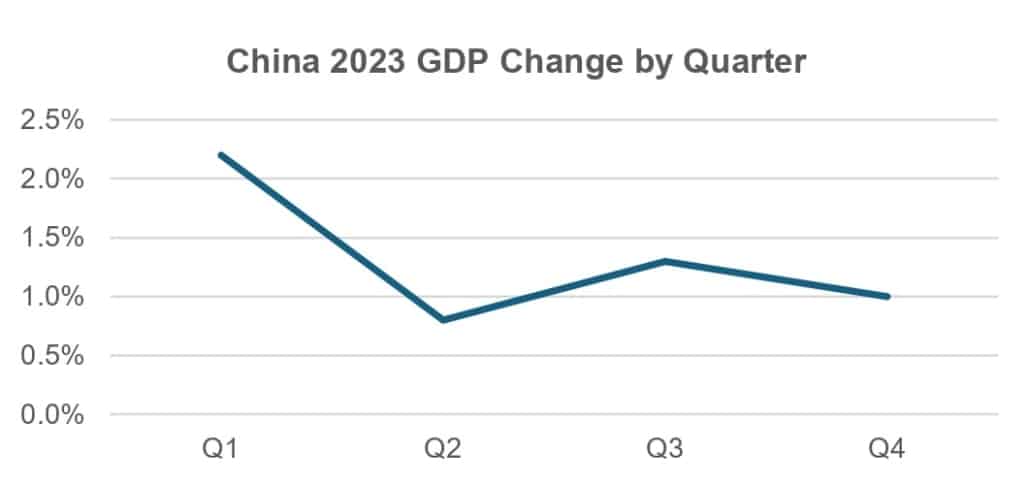

Sales weakness accelerated as the year progressed for a number of companies. Waters’ sales declined 11% in the first half of last year and dropped 31% in the second half, a 20 percentage point difference. The gap between Bio-Techne’s calendar year first-half and second-half performance showed a 15 percentage point difference, with sales down 4% and 19%, respectively. 10x Genomics’ sales sank 16% in the first six months of 2023 before falling 26% in the second half.

Calendar-year 2023 third quarter sales were especially hard hit. An adverse performance was notable for Agilent, Illumina and Waters with quarterly sales plummeting 31%, 26% and 27%, respectively. However, comparisons were a factor as each company enjoyed strong calendar-year 2022 third quarter sales growth of 44%, 9% and 21%, respectively.

The situation for instrumentation demand in China last year reflected above all else the weakness of China’s pharma market as the year progressed. For Waters, sales to the Chinese pharma market declined more than 30% in the third quarter 2023 and were down 45% in the fourth quarter. Discussing its results for the fourth quarter, Agilent commented that sales related to small molecule drug sales in China fell around 14% in calendar-year 2023.

But the situation was not confined to the pharma market. Describing the market environment, Udit Batra, PhD, Waters President and CEO, told investors on the company’s third quarter 2023 conference call, “Market challenges in China have now broadened beyond pharma and impacted both our industrial and academic and government end-market results in the quarter.” These declines accelerated from the third to fourth quarter with Waters’ third quarter industrial sales down low teens before falling around 20% in the fourth quarter. Waters’ academic and government revenue in China dropped more than 30% in the third quarter and declined nearly 40% the following quarter. Agilent also described a situation of slower sales in the second half of the calendar-year 2023 for China versus the rest of the world for its academic and government and food end-markets.

Several companies tied the sharp drop in Chinese revenue directly to previous stimulus programs that had driven academic and government sales. 10x Genomics, which sells primarily to the academic market in the country, suggested its sales decreases are related to that market. In its calendar-year third quarter 2023 call, Bio-Techne President and CEO Charles Kummeth remarked, “The funding challenges we highlighted in the last earnings call persisted in the quarter, as Chinese government funding for life sciences R&D at hospitals and academic institutions is significantly lower than last year.”

Local competition also played a role. Illumina CFO Joydeep Goswami told investors on the company’s third quarter 2023 financial call, “Greater China revenue of $98 million represented a 26% decrease year over year or 25% on a constant currency basis, reflecting continued macroeconomic and geopolitical challenges as well as local competition in mid-throughput.” Waters also referred to competition as a factor affecting Chinese sales in its annual report.

China Science and Technology Funding

China has been a strong market for laboratory instrumentation as the government has poured money into growing major labs, producing scientific publications and promoting economic development. In addition, programs designed to improve food safety and environment protection have boosted testing regulations, resulting in more stringent detection limits and greater testing volume.

Government funding increases for both basic and applied research have upped spending. According to a June 2022 report by Georgetown University’s Center for Security and Emerging Technology, China has 469 State Key Labs (SKLs). Different ministries control different SKLs, which are focused on areas such as biology, chemistry, earth sciences, engineering, IT, materials science and physics. The ministries with the highest number of SKLs are the Ministry of Education and Chinese Academy of Science.

According to the Nature Index, which covers the period between November 1, 2022 and October 31, 2023, China led the world in the number of chemistry publications, earth & environmental sciences publications, and physical science publications. The country was number two in the number of biological science publications and health sciences publications. By institution, the Chinese Academy of Sciences (CAS) accounted for the highest number of publications worldwide.

2024 Outlook

Analytical instrument companies expect 2024 sales in China to improve as the year progresses. Some have already begun to see sequential improvement. Agilent which expects Chinese sales to post a mid-single-digit decline for its fiscal year 2024, with the calendar year first quarter 2024 growth in the similar range as the calendar fourth year quarter’s 9% decline. Agilent CEO Mike McMullen told investors on the company’s most recent investor call: “So what we’re seeing, what we’re forecasting, what we’re hearing from our teams is that our customers don’t expect any significant near-term improvements but don’t expect any significant near-term deterioration either.”

Waters forecasts 2024 sales in China to be down in the mid- to high teens. First quarter sales are expected to decline around 40% due in part to a tough year-over-year comparison. But the company remains optimistic. “We generally feel, barring maybe one or two smaller issues, most of these issues [in China] are cyclical rather than structural; for example, CDMOs struggling with overcapacity, as well as geopolitical challenges or branded generics pulling back spend because of anti-corruption campaigns or industrial business, especially food and environmental, [and] slowing down because of government pulling back reimbursement,” said Waters CFO Amol Chaubal on the company’s fourth quarter 2023 conference call.

10x Genomics sees a similar trajectory. The company expects flat sales in the first quarter revenue and sales for the year to each decline. Illumina did not provide a forecast.

Although the situation is expected to improve for sales of analytical instrumentation in China this year, and the situation does not appear to be getting worse, there is still general uncertainty regarding microeconomic and political events as well as China’s policy decisions. This uncertainty leaves instrument companies in a wait-and-see mode.